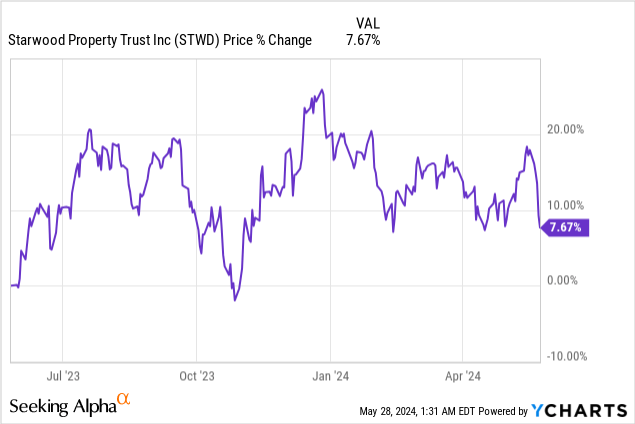

Starwood Property Trust (NYSE:STWD) is a strong choice for dividend investors in the commercial real estate market: Starwood Property supported its dividend with distributable earnings in the first fiscal quarter and the company has considerable access to liquidity which could make the REIT a net buyer of commercial mortgage assets in the future. Starwood Property has suffered a valuation decline last week as redemption issues affecting the non-traded Starwood Real Estate Income Trust were reported last week, which reinserted fears and concerns about the state of commercial real estate into the market. I believe redemption limitations are an isolated problem that doesn’t affect Starwood Property’s publicly traded shares. The REIT also has relatively little exposure to challenged U.S. office loans, which makes Starwood Property one of the safest choices in the CRE market, in my opinion.

Previous rating

I rated shares of Starwood Property a strong buy in early March due to the REIT’s well-performing loan portfolio and high dividend yield: Collect A 9.4% Yield On Autopilot. Additionally, shares of Starwood Property are priced below book value, again which, I believe, is unfair considering that the REIT has no distribution coverage issues and a very well-structured portfolio. I believe the risk profile remains widely skewed to the upside here, especially now investors are overreacting to the SREIT issue.

Diversified portfolio, liquidity access and SREIT troubles

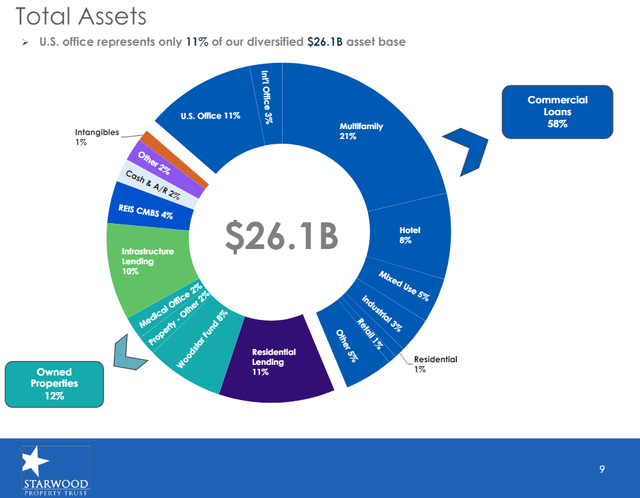

Starwood Property is a well-run, highly diversified mortgage REIT with a relatively low amount of investments in the challenged U.S. office market. U.S. offices represented only about 11% of all investment assets on Starwood Property’s balance sheet at the end of the March quarter and the REIT remained overall well-diversified with investments in commercial and residential lending (the biggest segment, responsible for 69% of assets), infrastructure lending, owned properties and real estate investing and servicing.

Starwood Property

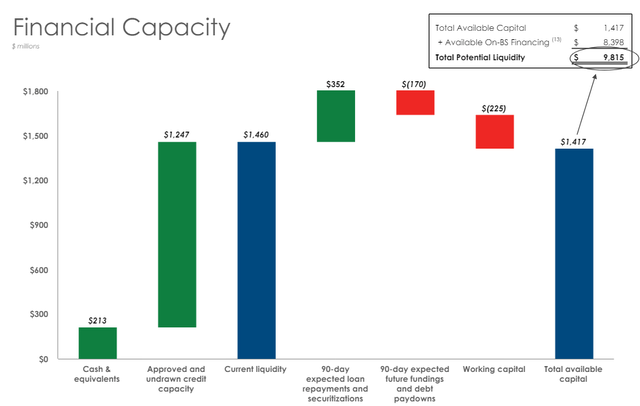

Starwood Property’s core strength is that it is the largest commercial REIT in the U.S. and therefore has access to a ton of liquidity which the company could deploy to grow its distributable earnings, especially in times of distress. Starwood Property had $9.8B in potential liquidity available as of the end of Q1’24 which is set to make STWD a considerable force on the acquisition front.

Starwood Property

Starwood Property has, over time, proven to be quite opportunistic and specifically sought out market situations that other investors shied away from. With considerable firepower available to the commercial REIT, I believe this cash could be used to buy up cheap distressed real estate assets going forward. One area where I see Starwood Property become much more active is in the office market, which is currently reeling from lower occupancy rates in office buildings due to remote working trends.

I said in the introduction that Starwood Property is a promising investment candidate now that shares dropped below $19, implying a dividend yield north of 10%. Starwood Property’s shares dropped from about $21 to $19 last week due to liquidity problems at one of Starwood Property’s private, non-traded REIT vehicles, Starwood Real Estate Income Trust (SREIT)… which manages approximately $10B for investors.

The REIT limited the possibility for investors to redeem their investment in the non-traded REIT (curtailing redemptions to 0.33% of net assets per month), causing wide-spread concerns about potential fire sales. According to news reports, Starwood Real Estate Investment Trust had to tap a $1.3B credit facility in Q1’24 to meet redemption requests and only last week tightened redemption requirements in a bid to conserve liquidity and avoid forced asset sales.

Last week, fears over losses at Starwood Real Estate Income Trust have started to affect the pricing of Starwood Property. These problems, however, should not affect Starwood Property, whose shares are traded in public markets. And given the distribution coverage analysis that follows, I don’t believe investors have to be worried here.

Distribution coverage analysis

Starwood Property’s distribution coverage looked as good as ever in the first fiscal quarter, due chiefly to a strong performance in the REIT’s core segment commercial and residential lending. This segment generated a solid $0.59 per-share in distributable earnings in Q1’24 which was more than enough to support the current dividend payout of $0.48 per-share. The resulting distribution coverage ratio was 1.23X in Q1’24, meaning Starwood Property earned 23% more in distributable earnings than it needed to cover its quarterly dividend. The distribution coverage trend is also positive and is actually showing signs of improvement compared to previous quarters.

| Distributable Earnings, per-share | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Average |

| Commercial and Residential | $0.56 | $0.64 | $0.63 | $0.63 | $0.62 |

| Infrastructure | $0.06 | $0.03 | $0.07 | $0.06 | $0.06 |

| Property | $0.07 | $0.07 | $0.07 | $0.18 | $0.10 |

| REIS | $0.07 | $0.05 | $0.10 | – | $0.07 |

| Corporate | ($0.27) | ($0.30) | ($0.29) | ($0.28) | ($0.29) |

| Total DE | $0.49 | $0.49 | $0.58 | $0.59 | $0.54 |

| Distribution | $0.48 | $0.48 | $0.48 | $0.48 | $0.48 |

| Coverage | 102% | 102% | 121% | 123% | $1.12 |

(Source: Author)

Cheap valuation

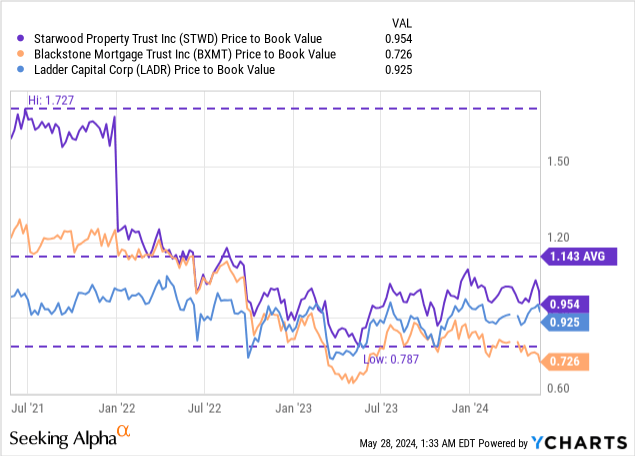

The sell-off last week made Starwood Property cheaper, and shares can now be acquired at a solid 5% discount to book value. The 5% discount is still the lowest discount in the industry group that includes Blackstone Mortgage Trust (BXMT) and Ladder Capital (LADR). The drop in valuation, in my opinion, is temporary and could be reversed as soon as investors calm down about SREIT’s liquidity requests. Starwood Property is now also trading 17% below its longer term (3-year) average price-to-book ratio. My fair value estimate for STWD is $19.85 per-share (equal the REIT’s GAAP book value), so shares do have 5% upside to book value and 19% upside to the longer-term valuation average of 1.14X P/B.

Risks with Starwood Property

As I said above, SREIT;s liquidity crunch should have had no impact on publicly traded Starwood Property. SREIT’s problems are related to redemptions, which is not an issue for Starwood Property. Quite to the contrary: redemptions are no issue at all for publicly traded REITs as the market provides sufficient liquidity for investors to sell their shares should they choose to do so. What would change my mind about Starwood Property is if the REIT were to see a drastic deterioration in its distribution coverage ratio, or if it were to experience a sudden decline in balance sheet quality.

Final thoughts

Every once in a while a buying opportunity emerges out of nothing and I believe this to be the case here today with Starwood Property. The REIT’s share price recently fell below $19, leading to the Starwood Property’s dividend yield to surge to more than 10% due to SREIT’s change in redemption rules. I believe that SREIT’s issues should not have affected the valuation of Starwood Property and the risk profile is even more skewed to the upside considering that the REIT only recently reported very strong distribution coverage, chiefly due to its outstanding commercial and residential lending performance. I am a buyer here!

Read the full article here