Margins Drive NGS

I discussed Natural Gas Services Group (NYSE:NGS) in the past, and you can read the latest article here, published on July 6, 2023. Over the past year, it shifted its strategy to maximizing rental fleet utilization, strengthening its operating profit margin. Even though it reduced its rented units and horsepower following lower natural gas prices, its focus on crude oil-centric shale plays has paid dividends. I think it will have more contracts for high-horsepower units under long-term contracts that will stabilize its cash flows in the medium-to-long term. As it reviews its unutilized fleet, it estimates that many such assets can be upgraded to smart systems.

However, investments in new assets caused a cash flow drain in Q1 2024. Inflationary pressure in labor and lubricants can also keep the operating margin under pressure in the short term. Nonetheless, its reasonably healthy balance sheet will ensure its finances do not go out of balance even if energy prices swing adversely. The stock is reasonably valued compared to its peers. I suggest investors “hold” the stock.

Why Do I Keep My Rating Unchanged?

In my previous article published on July 6, 2023, I discussed how NGS kept its compressor units and horsepower stable despite a challenging industry environment. I also discussed the rising cost of new natural gas compression equipment. I wrote:

In Q1, it accelerated its build schedule and secured contracts worth $20 million-$25 million. Its services are “sold out” for 2023. However, the new natural gas compression equipment is becoming more expensive. The steep fall in natural gas prices is unlikely to make any sharp recovery anytime soon, although it can show incremental improvements.

After almost a year after the last article, NGS shifted its operations to oil-dominant shale plays and upgraded its fleets. This helped it improve rental fleet utilization. It also raised prices in select categories, which would mitigate the inflationary impact. In Q1 2024, however, its natural gas compressors in the rental fleet and pumping capacity decreased. As it placed several new units in place, it drained working capital, turning free cash flow negative. Given a fairly reasonable relative valuation, I keep my rating at “hold.”

Crude Oil Price And Its Effects

In the Q1 earnings call, NGS’s management sounded optimistic about its outlook, citing primarily a relatively steady crude oil price. Over the past year, the crude oil price has increased by 10%. Given the current momentum, I expect energy production to increase in the near to medium-term. The stability kept demand for the company’s rental equipment robust because 75% of its active frac fleet is located in oil-dominant shale basins.

Key Strategies

One primary strategy For NGS is optimizing the existing utilized fleet. Its rental fleet utilization increased from 62% in FY2021 to 66.5% in FY2023. It kept steady at that level in Q1 2024. So, the company finds it beneficial to stabilize utilization in view of keeping a steady operating margin. It also plans to monetize short-term assets. As short-term assets decline, it will augment the company’s working capital. Through this process, it will look to generate $12 million of cash by FY2024. Also, to strengthen margin, the company is raising prices in select categories, which will also mitigate the inflationary impact.

The company has initiated a process of reviewing its unutilized fleet. It estimates that 650 of such assets can be upgraded to smart systems, including electric drives or high-pressure gas lift units. This can reduce the operational runtime in the coming quarters. It increased automation for increased interface and more accurate customer services.

Plus, the company will expand its rental fleet. As the energy environment improves with better crude oil pricing, it can contract high-horsepower units under long-term contracts. However, it will pursue a cautious approach in committing capex in this regard. The contract terms will improve, and NGS will continue to look for M&A opportunities to strengthen its growth trajectory.

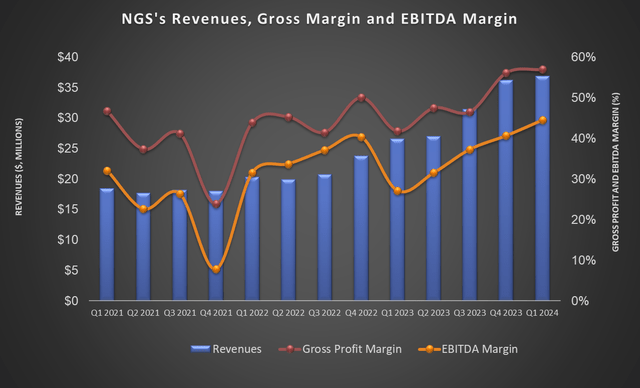

Operating Margins Stay Strong

Seeking Alpha

As of March 31, 2024, NGS had 1,245 rented units with over 444,220 horsepower. This means the natural gas compressors in rental fleet units decreased compared to a quarter earlier. Total HHP, however, was relatively resilient, resulting from new large-horsepower unit activations. Not only did rental unit utilization improve in Q1, but the gross margin and adjusted EBITDA also increased.

My Estimates

Reflecting the recovery, NGS expects adjusted EBITDA growth in the range of 34%- 47% in FY2024. Such strong growth can significantly improve the company’s financials (and valuation), given that a significant portion of its revenues are recurring in nature. So, it will have stable and growing revenue tied to long-term contracts, which will likely put it at a higher pedestal than some of its competitors.

Over the past 12 quarters, NGS’s EBITDA increased by 32% on average. It will have keen eyes on maintaining stability, although the short-term pressure from inflationary costs will dent its outlook. So, I think the management’s growth estimates are slightly more optimistic than it warrants. I would reasonably consider 15%-25% EBITDA growth over the next four quarters.

Challenges And Risk Factors

Seeking Alpha

US natural gas production increased in the past year until February 2024. However, the EIA expects natural gas production to fall by 2% from Q1 to Q2 as a result of low natural gas prices. In 2025, production is slated to increase by 2%, according to the EIA. I think the natural gas market will remain volatile in the near term, with a negative bias, following abundant supply and low prices.

Although the overall drilling environment has been favorable, natural gas production lacks a solid growth story, especially with the uncertainty over LNG exports. Similarly, a sudden drop in crude oil price can have a more severe effect on its performance. Investors should keep in mind that the commodity market tends to slip fast when adversely affected.

In 2022, inflation affected the US economy negatively. Although it has been under control following the interest rate hikes, in 2024, I see the possibility that inflation can strike again. This can elevate NGS’s cost structure, including labor costs, parts costs, lubricants, and other items used in its operations. The company, from time to time, passes on the cost hike to the consumers through price hikes. However, it also diminished its advantages in a competitive market.

Analyzing Q1 Performance

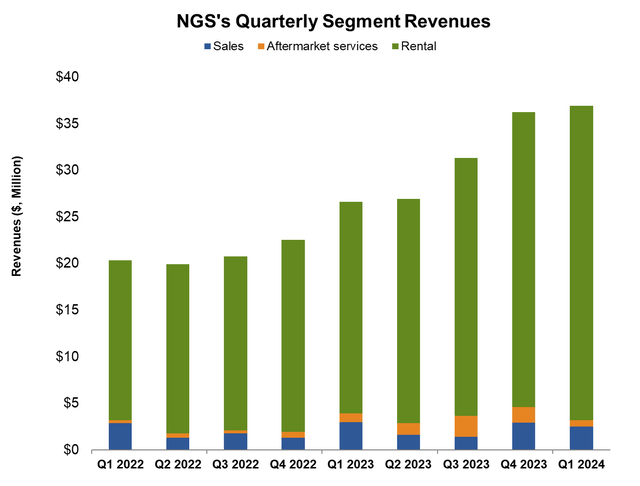

NGS’s Filings

In the earnings press release announced on May 15, the company disclosed that its sales increased marginally in Q1 2024 compared to Q4 2023. Despite much lower rental units, higher horsepower packages and pricing improvements kept the topline steady.

The company’s adjusted gross margin expanded by 40 basis points (quarter-over-quarter) in Q1. Because the company has deployed relatively new fleets, repair and maintenance costs have gone down. However, investors should keep in mind that with increasing size, its incremental labor and overhead costs will grow. As a result, the recent momentum in the margin expansion may not continue, and its gross and EBITDA margins may come under pressure in the near-term quarters.

Debt And Cash Flows

In Q1 2024, despite higher revenues, NGS’s cash flow from operations (or CFO) decreased steeply (by 69%) compared to a year ago. The working capital problem is primarily related to higher accounts receivables as the company put in place several new units. The company is working on resolving these issues and expects to see progress in either Q2 or Q3 of 2024. Capex fell, too. So, free cash flow (or FCF) remained negative in Q1 2024 but improved over a year ago.

In 2024, the company estimates capex will remain at $40 million-$50 million, which would be 16% lower than FY2023. The company’s liquidity (cash and equivalents plus available borrowing from credit facility) was ~$46 million on March 31, 2024. Its leverage (debt-to-equity) is lower than its peers (NOA, CCLP, and AROC). So, a fall in capex, with steady liquidity, would keep the balance sheet under little strain in the near term.

Target Price And Relative Valuation

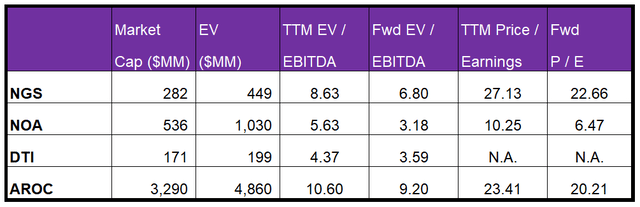

Author Created and Seeking Alpha

NGS’s current EV/EBITDA multiple (8.6x) is higher than its five-year average (6.4x). So, it appears to be overvalued versus its past. If the stock trades at its five-year average, it would provide a 40% downside. The stock price has more than doubled since my last publication on July 6, 2023, thus erasing any potential upside.

NGS’s forward EV/EBITDA multiple contractions versus the current EV/EBITDA is less steep than its peers. So, its adjusted EBITDA is expected to rise less sharply than its peers in the next four quarters. This typically results in a lower EV/EBITDA multiple. Its current EV/EBITDA multiple (8.6x) is lower than its peers (NINE, OIS, and PTEN). So, the stock is reasonably valued compared to its peers at this level.

As I discussed earlier in the article, I expect 15%-20% adjusted EBITDA growth in the next four quarters. Feeding these values in the EV calculation and assuming the forward EV/EBITDA multiple holds, the stock can trade between $19.2 and $22.1, implying a slight downside in the near term. However, given my expectations of a natural gas price recovery, I also think investors can expect upsides in the medium term.

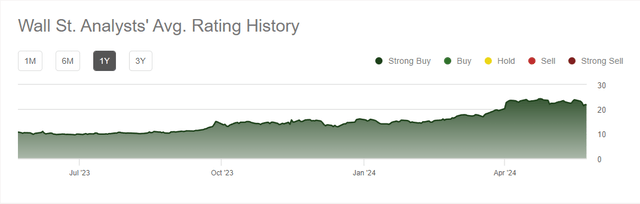

Analyst Rating

Seeking Alpha

According to data provided by Seeking Alpha, three sell-side analysts rated NGS a “buy” (including “Strong Buy”), while none rated it a “hold” or a “sell.” The consensus target price is $31, suggesting a 42% upside at the current price.

What’s The Take On NGS?

Seeking Alpha

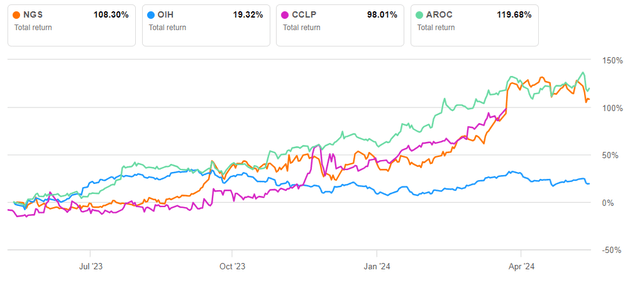

NGS is focused on increasing rental fleet utilization to improve operating margin. It reduced rental fleets in Q1 compared to a quarter ago as it monetized short-term assets to improve working capital. With a better energy environment, it will contract high-horsepower units under long-term contracts. Given the recurring nature of revenues, the long-term contracts will boost its topline stability and cash flows in the coming quarters. So, the stock strongly outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

However, the continued weakness of natural gas prices forced NGS to realign its operations, leading to increased working capital requirements. Also, there are concerns over the cost structure inflation related to labor costs, parts costs, lubricants, and other items. The company has a low debt level. Given the reasonable relative valuation, my expectations of a rising operating profit margin, and its effect on the valuation, I think investors would want to “hold” it at this level.

Read the full article here