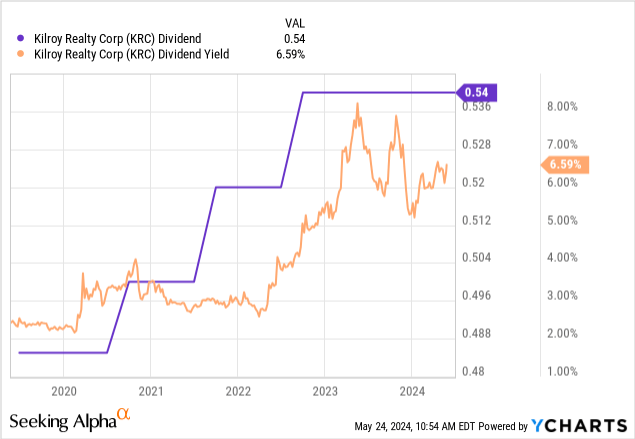

Kilroy Realty (NYSE:KRC) has dipped 18% year-to-date as market enthusiasm over a potentially dovish pathway for Fed rate cuts in 2024 has given way to angst from a return of higher for longer. There is a rising probability of zero rate cuts in 2024, an event that would see REIT continue to trade on historically low multiples. KRC generated fiscal 2024 first quarter funds from operations (“FFO”) of $1.11 per share, beating consensus and up by 2 cents sequentially with guidance for FFO to come in between $4.15 to $4.30 per share for its full year 2024. This was raised by 5 cents at the midpoint versus prior guidance for a full-year FFO of $4.10 to $4.25 per share. KRC also last paid a quarterly cash dividend of $0.54 per share, unchanged from its prior fourth quarter, and $2.16 per share annualized for a 6.65% dividend yield.

Kilroy Realty Fiscal 2024 First Quarter Form 10-Q

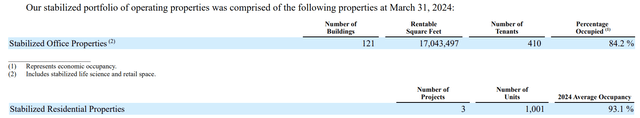

KRC is an internally managed REIT with a stabilized portfolio constituted of 121 office buildings leased to 410 tenants spread across 17 million rentable square feet with an 84.2% occupancy rate as of the end of the first quarter. The REIT also owns 3 stabilized residential properties with 1,001 units and a 93.1% occupancy rate. Critically, KRC is trading hands for a 7.68x multiple to the midpoint of its 2024 FFO range, a substantial drop from a roughly 17x multiple in the first quarter of 2021. The drop is substantial with the new multiple a reflection of the Fed’s fight with inflation pushing interest rates to 22-year highs at 5.25% to 5.50%. This represents the core headwind for the REIT’s total return profile with the dividend being kept stable since 2022.

Leasing Momentum And Occupancy

KRC’s first first-quarter leasing figures were strong with 400,000 square feet of leases signed, the highest volume since 2017. GAAP rents were up 8.6% but cash rents dipped by 2.9%. Occupancy at 84.2% fell 80 basis points sequentially from 85%, maintaining a negative trend that has formed an anchor for the short office trade since the pandemic drove companies towards hybrid modes of work. The portfolio was 85.7% leased as of the end of the first quarter, so occupancy could stabilize if KRC maintains leasing momentum in the second and third quarters.

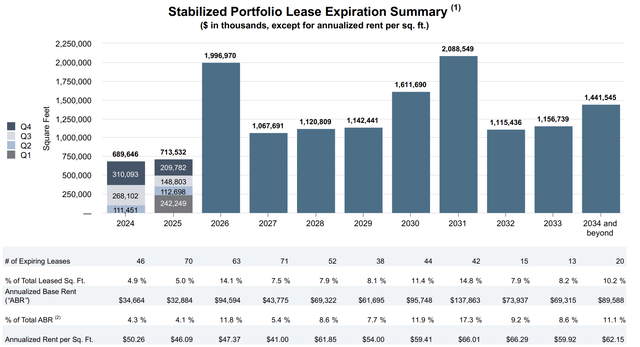

Kilroy Realty Fiscal 2024 First Quarter Supplemental

The REIT has 689,646 square feet of leases expiring in 2024 with another 713,532 square feet of leases expiring in 2025. This represents 4.3% and 4.1% of annualized base rent respectively. Current leasing momentum is positive and KRC is guiding for occupancy to end 2024 at 82.5% to 84%. A dip in occupancy was flagged when I last covered the REIT, and the low end of KRC’s occupancy guidance would mean its portfolio roughly aligns with the US national office vacancy rate of 18.8% as of April. This rate grew by 210 basis points over its year-ago comp and could be set to hit 20% sometime in 2024. Longer term the ongoing collapse of new office supply, office-to-residential conversions, and return-to-office mandates could see this rate stabilize.

Developments, Liquidity, And Leverage

Kilroy Realty Fiscal 2024 First Quarter Supplemental

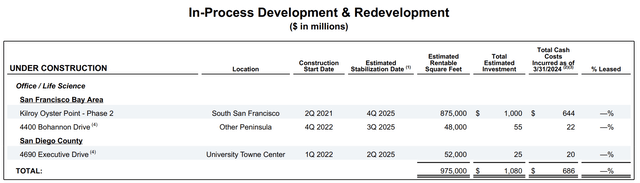

KRC is currently covering its dividend 195% from the midpoint of 2024 FFO guidance, hence, the dividend yield is safe and sustainable. Total returns will come from the realization of this yield and a potential capital uplift from a partial recovery of the multiple to FFO. KRC’s spending on developments and redevelopment is high with the REIT guiding for total development spending of $200 million to $300 million for 2024. Under construction properties are all set to come online by the end of 2025 with this set to add 975,000 rentable square feet.

Kilroy Realty Fiscal 2024 First Quarter Supplemental

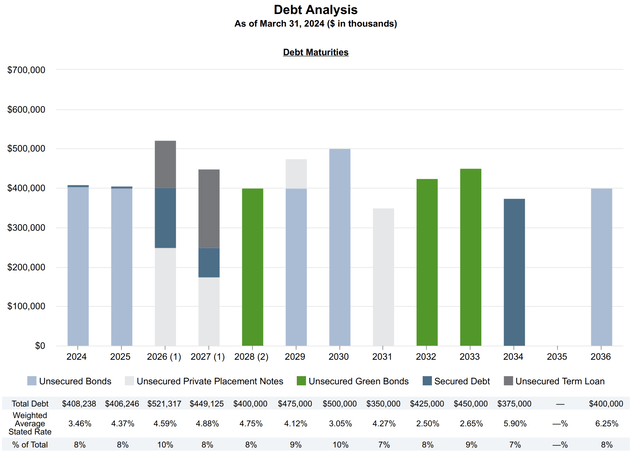

KRC’s cash and short-term investments at the end of the first quarter were $900 million, with another $1.1 billion available under its unsecured revolving credit facility. This is with $408 million in total debt coming due in 2024 and a roughly similar amount in 2025. KRC’s debt maturity schedule has a broadly even spread with the recast of the revolver extending its maturity to July 2028 before extension options.

Kilroy Realty Fiscal 2024 First Quarter Supplemental

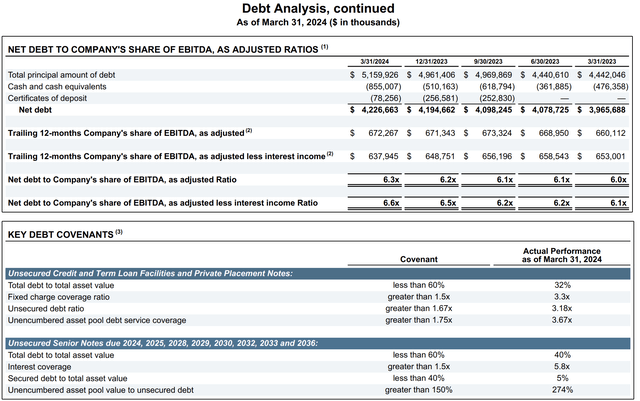

The REIT remains well within compliance with its debt covenants but its net debt to EBITDA as adjusted ratio has been worsening. This was 6.3x at the end of the first quarter, up from 6.0x a year ago. The REIT’s dipping occupancy represents a structural headwind, but I’m still comfortable on the long side here with the recent strong leasing volume and the heavy coverage of the current dividend distribution both core factors of the bullish case. Interest rate cuts are coming though and this should form a positive key catalyst for the REIT.

Read the full article here