Levi Strauss & Co. (NYSE:LEVI) is an apparel manufacturer. The company owns the famous Levi’s denim brand, along with Dockers and Beyond Yoga.

Levi’s (the brand) is one of the best-known mass-market apparel brands in the world. The brand has considerable pricing power, with LEVI enjoying gross margins close to 60%, even though 55% of its revenues come from wholesale. There are some indications that denim could be enjoying a cyclical upturn after the pandemic casualization of apparel led to lower interest in jean products.

The company has also made questionable decisions. Its move downstream to DTC has increased revenues and gross margins but has failed to materialize in higher operating profitability. In an effort to diversify out of denim, it purchased Beyond Yoga at a valuation that had to be impaired later.

Despite the company’s promising early FY24 results, I believe the stock is overvalued at these levels, trading at a P/E of around 18x for FY24E earnings as guided by management. I think such a multiple is only reasonable for the most outstanding companies, and LEVI is not one of them, despite its positive characteristics.

Company intro

As mentioned, LEVI is mostly known for owning Levi’s, the world’s leading denim brand. Levi’s FY23 sales amounted to $5.7 billion, more than doubling its closest competitor, Kontoor Brands (KTB), owner of Wrangler and Lee.

LEVI is a global company, with 56% of sales generated outside the US. The products are sold in over 45,000 doors worldwide, including 1,700 company-operated stores and another 1,200 exclusive franchise stores.

The company’s channel strategy is balanced, with 43% of sales coming from DTC, including a small percentage of e-commerce sales (5%). LEVI’s wholesale customer list is well diversified, with the top 10 customers accounting for 30% of revenues and no customer accounting for more than 10%.

In terms of products, denim bottoms are obviously the leaders, representing 60% of sales. The company’s best-known model, the Levi’s 501, generated more than $800 million in sales in FY23 (4Q23 call). Levi’s has historically been a male-weighted brand, with men representing 65% of revenues today, after a long process of diversification (men represented 75% of revenues in 2011).

Leveraged at good rates: I generally do not like apparel manufacturers and retailers to be financially leveraged. LEVI is an exception because its debt is at very convenient terms. The company owes $1 billion in two tranches maturing in 2027 ($500 million) and 2031 ($500 million) at a very attractive 3.5% fixed rate. The company also has $500 million in cash and short-term investments.

Strong owners: LEVI was founded more than 150 years ago by Levi Strauss, a German immigrant to the US. His heirs still control 65% of the company’s shares (although they do not participate in management). I generally like companies having strong shareholders.

Move downstream fails to deliver

Since 2011, LEVI has been moving downstream to DTC. Back then, DTC only represented 22% of sales (Investor’s Day), compared to 43% in FY23. The company expects to reach 55% of revenues from DTC by 2027.

The rationale behind moving DTC is to increase the company’s margins by capturing a bigger portion of end product revenues, gaining brand awareness by having a large retail footprint and controlling the customer experience. However, most of the time, this strategy fails to deliver. The reason, in my opinion, is that managing an apparel brand requires a very different set of capabilities than running a retail operation.

Unfortunately, this has been the case for LEVI. The company has grown sales significantly, thanks to the higher gross margin of DTC operations, but most of that improvement has been eaten by the cost of having retail operations. Again, from the Investor Day presentation, the company was generating sales of $4.8 billion at 8.5% operating margins in 2011 ($408 million in operating income), and it is generating sales of $6 billion at a margin of 7.2% today ($432 million in operating income)—more than ten years of flat operating profitability.

Diworsification

Another challenge for LEVI has been that it has probably reached its TAM limit, at least for denim bottoms. This is normal for apparel manufacturers. There is a limit to how many jeans people want to buy globally in a given year, and this has to be shared among all competitors.

In fact, during the Investor Day linked above, management commented that the company’s peak revenues were generated in 1996 at $7 billion. This means the company has been unable to surpass this level for almost 30 years despite efforts to diversify into women and tops and expand into other geographies.

A mistake many companies make when they find a limit to their market is what Peter Lynch called ‘diworsification’ (diversifying for the worse). Instead of returning capital to shareholders and increasing ROE, companies sometimes prefer to make acquisitions to reignite growth.

In the case of LEVI, the company acquired Beyond Yoga in 2021 for $400 million. I believe the company was trying to ride the women’s athleisure trend installed by Lululemon. LEVI clearly overpaid as it had to recognize impairments on goodwill and intangibles for $90 million in FY23. It is also unclear why a denim company with a male-weighted customer base had any synergies with a women yoga brand.

FY24 so far and valuation

LEVI has already reported 1Q24 results, and we can observe that the company is doing better. After a challenging FY23, particularly in wholesale, the company’s channels and geographies grew (adjusted for non-recurring revenues in 1Q23). Gross margins are up on cost reductions (offsetting some concerning price decreases to move wholesale inventory in 3Q23), and inventories are down 14% YoY.

The company is also in the middle of a restructuring process, under which it has fired almost 15% of its corporate workforce (1Q24 call). The company has also discontinued a value-price denim line (Denizen), it discontinued Levi’s footwear line, and it has reduced Levi’s SKU count by 15%. The objective is to reign on SG&A and deliver higher operating margins.

Another positive development is that denim seems to be on trend again. This has been commented on in LEVI’s call, but also in Kontoor’s (KTB) latest call and in other large retailers’ calls like Gap (GPS) and Abercrombie (ANF). In particular, wide-leg, baggy, and low-rise styles are trending. This is a positive development because this implies a big change from skinny jeans, both for men and women. If this is not a fade and transforms into a longer-term cycle, it could drive long-term demand.

Moving to valuation, however, these developments and more are already discounted. We can work with the company’s guidance for FY24, of revenues up 1 to 3%, adjusted EBIT margins of 10%, and an effective tax rate of around 20%.

If guidance is met, LEVI will post revenues of $6.36 billion and adjusted EBIT of $636 million for FY24. After removing interest of $45 million ($35 million from its senior debt and $10 million from the use of its credit facility for working capital) and removing taxes, we arrive at a net income of $472 million.

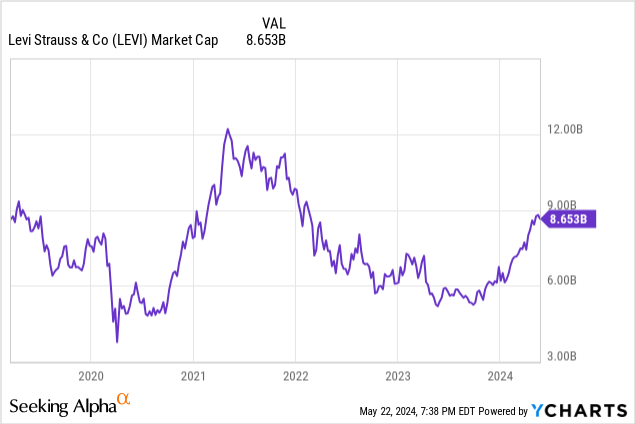

This FY24E expected net income of $472 million, compared with a market cap of $8.65 billion, yields a P/E ratio of 18.3x. In my opinion, such a multiple is reasonable only for the best companies in the best sectors. Apparel companies generally would require a discount (lower multiple) given their cyclicality and fashion risks. In addition, LEVI has not shown a history of good capital allocation (for example, with the overpriced acquisition of Beyond Yoga) and has not been able to cross its TAM ceiling for over 30 years. Despite the Levi’s brand power, I do not believe LEVI deserves an 18x P/E multiple and, therefore, consider the stock a Hold.

Read the full article here