Investment Thesis

Previously, in Mar 2024, I rated Lightspeed (NYSE:LSPD) (TSX:LSPD:CA) as a hold given my uncertainty over the company’s ability to sustain its growth while progressing towards profitability. Recently, after LSPD released its 4Q24 result, its share price has risen by a staggering 16%, indicating that the market was impressed by LSPD results and this has prompted me to look into why.

After analyzing its 4Q24 quarter, I believe the increase in share price is mainly attributed to its significant improvement in reducing its operating losses. Furthermore, management has announced a restructuring which is expected to further close its gap to profitability.

Aside from the improvement in bottom line, management continues to deliver robust growth for its transaction-based revenue, and with the anticipation that subscription revenue will re-accelerate in FY25, this is expected to accelerate its path to profitability. In my assessment, the market reacted positively to these improvements as they grew more confident in LSPD’s ability to achieve profitable growth.

Considering all these positive developments and valuation implying a 13% upside, I have decided to raise my rating from a “hold” to “buy”.

Thoughts on 4Q24 Earnings

1) Subscription Revenue

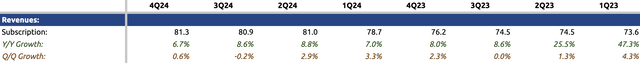

Subscription revenue

In 4Q24, LSPD’s subscription revenue grew 6.7% YOY to $81.3 million, which is a growth deceleration from previous quarters. This growth decline can be explained by, previously, LSPD’s account managers diverted from the role of promoting and upselling software to efforts in upselling its payment solution. Now, with the significant progress made in payment revenue, they will refocus on selling software, which is expected to re-accelerate in revenue growth in FY25.

2) Transaction-Based Revenue:

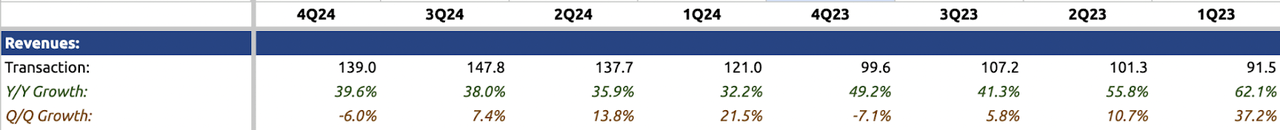

Transaction revenue

In the same quarter, LSPD achieved 40% YOY growth in its transaction-based revenue (i.e., payment revenue), generating $139 million. This is an impressive result, as this quarter’s growth rate has surpassed that of the past couple of quarters, despite the increasing size of its revenue base.

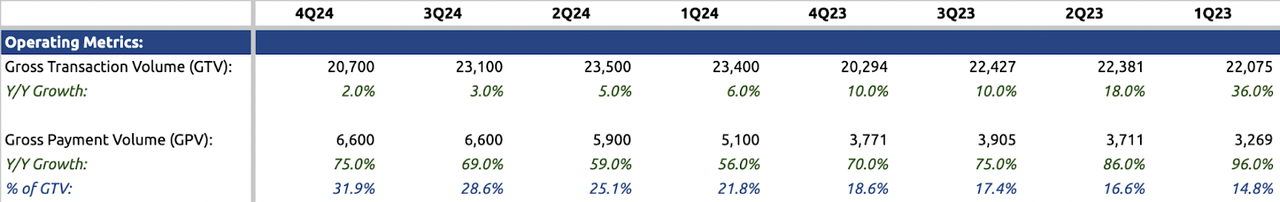

Operating Metrics

This growth in revenue is driven by several factors, including a notable 75% YOY growth in gross payment volume (GPV), which now makes up 32% of its total gross transaction volume (GTV) compared to 15% 2 years ago. By the end of FY25, it’s expected to reach between 40% to 45%. This not only underscores the rapid growth in volume but also reflects Lightspeed’s increasing market acceptance. As more customers adopt its payment solution, and existing ones drive more payment volume, revenue for Lightspeed continues to climb.

Transaction-based revenue was also partly propelled by Lightspeed Capital, where LSPD provides cash advances to merchants to support their businesses. In return, merchants agree to repay the principal amount plus additional fees by remitting a percentage of their daily sales until the advance is fully repaid. However, this business is still in its infancy, generating only $20 million in revenue in FY24.

This is a playbook I’ve seen played out similarly for Toast (TOST), suggesting Lightspeed is following a similar trajectory as it expands its payment solution to more retailers. While both companies target SMB customers, Toast focuses solely on the restaurant industry, whereas LSPD spans multiple sectors, notably restaurants and retail.

Despite Toast commanding 13% of the U.S. SMB market within the restaurant industry, which has a total of over 870,000 locations, significant opportunities remain for LSPD to penetrate the U.S. market. Furthermore, there also lie significant opportunities in the retail sectors, as well as in international markets, including Europe and APAC, where competition is less intense. During the 4Q24 earnings call, management noted that while GPV is still primarily driven by the U.S., international GPV has doubled year-over-year, and gross margins are higher in these markets. However, it’s important to note that while competition is less intense internationally, the sales cycle is longer. Management mentioned last quarter that more time is needed to educate these markets, so it will take longer for LSPD to gain market acceptance.

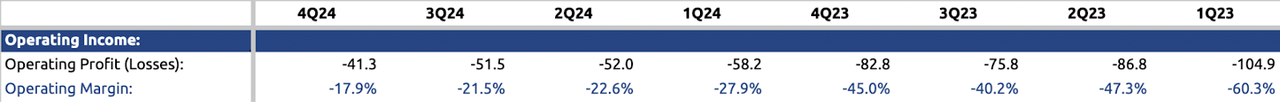

Profitability

Shifting gears to profitability, the operating margin for the quarter was -17.9%, a significant improvement from both the previous quarter and the same period last year. Additionally, management has announced a restructuring that will result in a 10% reduction in headcount-related expenses, and they plan to explore further cost-cutting measures throughout the year. These initiatives are expected to accelerate their path to profitability, with meaningful improvements anticipated in FY25 and FY26. This has likely exceeded Wall Street’s expectations, leading to a rise in share price after the release of their 4Q24 results, as investors grew more confident in the company’s ability to achieve profitable growth.

Forward Valuation Implies 13% upside

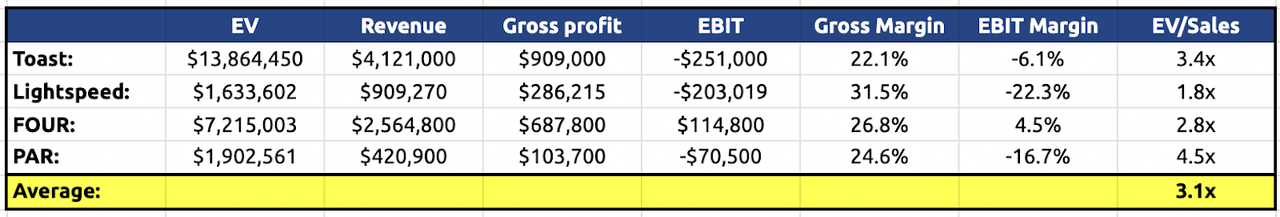

LSPD Peer Comparison

At the current EV/Sales ratio of 1.8x, LSPD is priced at a significant discount compared to its peers, likely due to the market pricing in the risk associated with its lower operating margin.

Based on management’s guidance of 20% total revenue growth in FY25, this would result in forward revenue of $1.09 billion. Applying the current 1.8x multiple, this translates to a forward FY25 enterprise value of $1.96 billion. Including net cash of $717 million, the forward FY25 market cap would be $2.3 billion, implying a 13% upside from the current market cap.

Conclusion

In conclusion, there has been a notable improvement in LSPD’s business fundamentals since my last coverage of the company in March 2024, particularly evident in its enhanced operating margin. Additionally, management’s implementation of cost-cutting measures is poised to further accelerate its path to profitability, alleviating some of my concerns regarding the firm’s ability to achieve sustained growth while attaining profitability. Moreover, the company has witnessed a growing momentum in its payment volume, driving robust year-over-year revenue growth for its transaction-based revenue during the quarter. This also suggests to me that LSPD is gaining increasing market acceptance among retailers and restaurant operators. As management pivots towards selling its software solution, subscription revenue growth is expected to regain momentum alongside its payment solution revenue.

In terms of valuation, based on management’s guidance of 20% YOY revenue growth in FY25, my valuation implies a 13% upside from its current market cap. Therefore, considering these positive developments and the upside in valuation, in which I believe there is minimal downside risk at current EV/Sales of 1.8x, I have upgraded my rating from a “hold” to a “buy”.

Read the full article here