Over the years, I have found that patience is incredibly important when it comes to investing. This is especially true during difficult times. Rarely can you expect to generate strong upside immediately after buying shares of a business. But during the time in which subpar performance reigns supreme, the psychological toll that it can take can be difficult to deal with. A good example of a firm that has woefully underperformed my expectations but that I still feel very bullish about is MarineMax (NYSE:HZO).

For those not familiar with the company, management claims that MarineMax is the largest recreational boat and yacht retailer on the planet. As of the end of its 2023 fiscal year, the business had 130 locations globally, including 81 retail dealership locations. It also owns and operates 66 Marina and storage locations. Back in March of last year, I found myself drawn to the business. Because of how cheap the stock was, I ended up rating it a ‘strong buy’ to reflect my view that investors should expect shares to outperform the broader market for the foreseeable future. But the exact opposite has so far occurred. Shares are actually down 8.4% since then, which is far worse than the 33.8% rise seen by the S&P 500 over the same window of time.

Digging into the picture, we can see that management has continued to increase revenue during a difficult environment. Having said that, this has come at a pretty hefty cost of significantly reduced margins. In the near term, it’s likely this trend will continue. But even with the pain that the company has experienced, shares look very attractive, both on an absolute basis and relative to similar enterprises. Due to this, and in spite of underperformance, I have decided to keep the firm rated a ‘strong buy’ for now.

Growing sales, falling profits

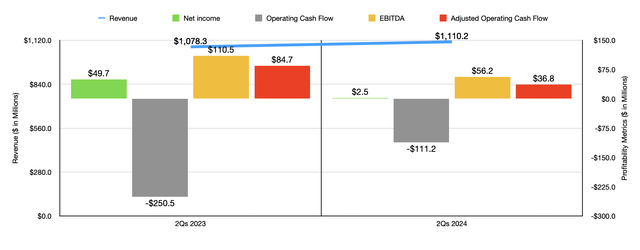

From a share price perspective, things have not been particularly pleasant for MarineMax or its investors. But the actual fundamental data itself has been a true mixed bag. Consider, for instance, financial results covering the first half of the 2024 fiscal year compared to the same time of 2023. Even though management stated that the current market for recreational boats is difficult, revenue managed to climb from $1.07 billion last year to $1.11 billion this year. This increase of about 3% was made possible because of a 3% rise in comparable store sales. Management attributed that mostly from new and used boat revenue as opposed to other things like services. However, the company did benefit to the tune of $0.4 million from acquisitions that it has made during this timeframe.

Author – SEC EDGAR Data

While it’s always great to see revenue increase, this has committed a pretty steep cost. The business went from $49.7 million in net profits in the first half of 2023 to only $2.5 million in profits the same time this year. This was driven by multiple factors. The firm’s gross profit, for instance, fell by $21.9 million, with the gross profit margin contracting from 36% to 33% in response to lower new and used boat margins as the company ‘aggressively’ drove sales in what management described as a ‘softer retail environment’. But this wasn’t all. Selling, general, and administrative costs, jumped by $29.6 million, largely due to inflationary pressures and the aforementioned acquisitions. Add on top of this that higher interest rates and higher debt balances pushed interest expense up by $14.9 million, and it’s easy to see at the bottom line for the company has been painful.

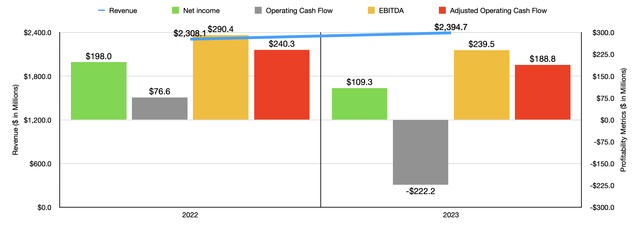

Author – SEC EDGAR Data

Other profitability metrics have followed a very similar path. Operating cash flow was the one exception. It went from negative $250.5 million to negative $111.2 million. But if we adjust for changes in working capital, we would get a decline from $84.7 million to $36.8 million. Meanwhile, EBITDA for the business was cut by nearly half from $110.5 million to $56.2 million. In the chart above, you can also see financial results for 2023 relative to 2022. Once again, we see an increase in revenue, but a decline in profits and cash flows. With results like these, it’s no wonder the market has been cautious.

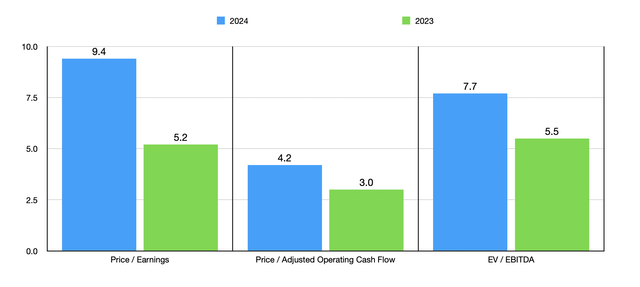

Even with this downside, shares look attractively priced. For this current fiscal year, management expects earnings per share of between $2.20 and $3.20. That is a pretty significant revision from initial guidance of between $3.20 and $3.70. But even so, that should translate to net profits of about $60.2 million. In addition to this, EBITDA is forecasted to be between $155 million and $190 million. This is also lower than the initial guidance of $190 million to $215 million. If we use the midpoint of guidance provided by management, this should translate to adjusted operating cash flow of about $136 million.

Author – SEC EDGAR Data

Using these figures, I valued the company as illustrated in the chart above. The company went from looking incredibly cheap to just cheap. But even so, these trading multiples are incredibly appealing in this kind of environment. In addition to being cheap on an absolute basis, shares are also cheap relative to the shares of other similar companies. In the table below, I compared MarineMax to five similar firms. On a price to earnings basis, only one of the five companies was cheaper than it. On a price to operating cash flow basis, our prospect ended up being the cheapest. Only when we use the EV to EBITDA approach does the playing field even to some extent, with three of the five companies being cheaper than it on this basis.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| MarineMax | 9.4 | 4.2 | 7.7 |

| Brunswick (BC) | 15.2 | 9.5 | 8.7 |

| MasterCraft Boat Holdings (MCFT) | 6.1 | 4.7 | 3.2 |

| Marine Products Corporation (MPX) | 12.1 | 9.0 | 8.1 |

| Malibuu Boats (MBUU) | 13.9 | 6.1 | 7.2 |

| BRP Group (DOOO) | 9.8 | 4.4 | 6.0 |

When I see fundamental performance worsen, I always ask myself what the cause is. In this case, we have perhaps the best kind of deterioration. I say this because management is making a conscious decision to try and keep sales elevated. At the end of the day, all this means is that margins are compressing because of weak industry conditions. Industries go through booms and busts. And right now seems to be a bust. The good news is that this is unlikely to last forever. I say this because, according to the National Marine Manufacturers Association, which represents about 85% of the recreational boat, marine engine, and accessory manufacturers in the US, an estimated 85 million Americans go boating each year.

Such a large market is bound to continue growing as population grows. But this doesn’t mean that the picture will clear up quickly. Last year, for instance, the number of power boats sold at the retail level came in at 258,000. This year, we are expected to see a similar number. This weakness, which would be down as much as 3% from the prior year, is being driven in large part by the impact of high interest rates and a lower level of consumer confidence. But in all honesty, I don’t believe that we need a swift recovery to justify a bullish outlook. As I mentioned already, shares of the company are attractively priced. Even management thinks so. In March of this year, for instance, the company announced a $100 million share buyback program to replace the prior authorization that the company had. Although I typically prefer investments in growth initiatives and I believe that there could be some attractive assets given how weak the current environment is, buying back stock at such low levels appears logical.

Takeaway

From all that I can tell, MarineMax is going through a bit of a slump. Even so, it’s impressive that management has been successful in keeping revenue climbing, even if only modestly. At some point, conditions will improve. And when that does occur, the upside for shareholders could be quite strong. Given this line of thinking, I have no problem keeping the company rated a ‘strong buy’ right now.

Read the full article here