Overview

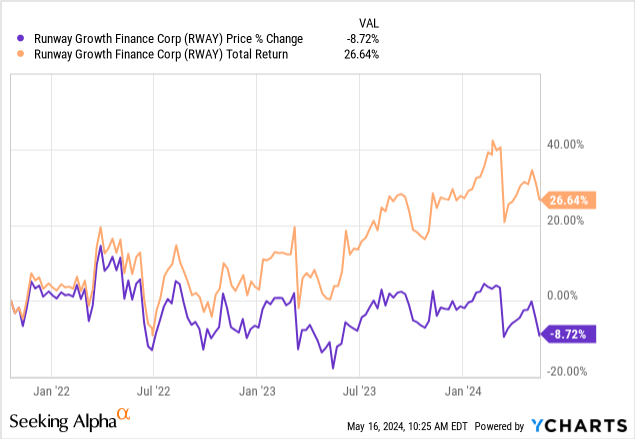

Runway Growth Finance (NASDAQ:RWAY) is a bit of a different type of business development company than I usually cover. I’ve covered a ton of BDC that invest in early to mid-stage companies that are looking to raise capital to fuel growth but RWAY takes a different approach by focusing on late-stage growth companies and venture capital. These companies are a bit more matured and as a result, allows RWAY to lend growth capital with minimal dilution. RWAY is externally managed by Runway Growth Capital. RWAY has provided negative price growth over the last 5 year period but total return remains positive due to the high distribution level.

The current dividend yield sits at 13.6%, making this one of the higher yielding business development companies in the sector. This high yielding can make it extremely appealing for investors looking to prioritize current income generation over growth potential. However, this BDC has a short history only dating back to 2021 so it really hasn’t had the chance to build a reputation around whether or not the dividend payouts are consistent.

The price currently trades at a discount to NAV (net asset value) which may indicate an attractive entry point. However, since the historical price and NAV data are so short, we can only base estimates and analysis on future projections around the quality and structure of their portfolio. Therefore, I thought digging into what RWAY’s investment structure is would be a great starting point for us to evaluate.

Strategy & Holdings

RWAY pulls in their income by lending to companies looking to fund the growth of their business. With this in mind, it’s important to for RWAY to maintain favorable criteria that limits risk involved with their debt investments. Thankfully, all of their debt investments are comprised floating rate loans that have been able to efficiently capitalize on the higher interest rate environment that we are currently in. As interest rates sit higher, this directly translates to higher interest payments that borrowers of capital owe RWAY. As a result, net investment income rises for RWAY and they are able to reward shareholders with distribution raises and supplementals.

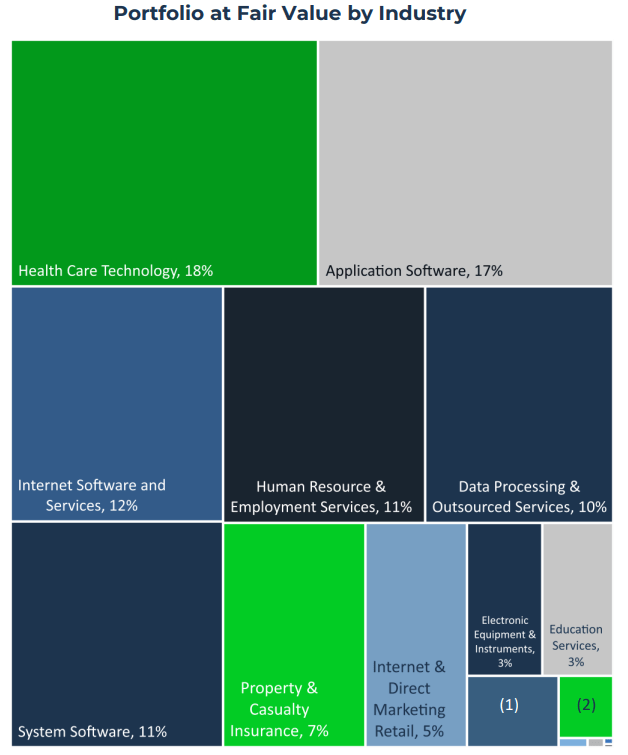

RWAY Q1 Presentation

We can see that the portfolio of investment are diverse in nature, spanning across many different industries. The leading allocation goes to the health care technology sector, making up 18% of the portfolio at fair value. This is closely followed by application software companies that account for 17%. Lastly, Information Software and Services make up the third largest portion of the portfolio at 12% of fair value. The portfolio currently consists of 30 debt and 80 equity investments to 53 different portfolio companies.

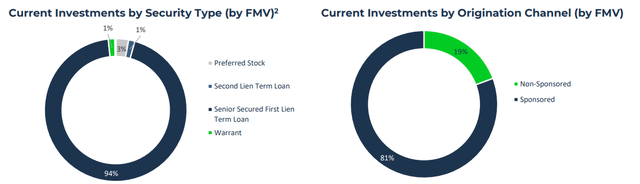

RWAY Q1 Presentation

Another factor contributing to the strength of their portfolio is that fact that the risk levels are mitigated by focusing on senior secured first lien debt. This form of debt accounts for 94% of their investments at fair value. Senior secured first lien debt adds a layer of security as this form of debt sits at the top of the corporate capital structure. This means that senior secured first lien debt has the highest amount of priority when it comes to repayment. This increases the probability that RWAY will not lose all capital in scenarios where portfolio companies may be going through a bankruptcy and liquidating their assets.

Financials

RWAY reported their Q1 earnings at the beginning of May and the results were strong. NII (net investment income) was reported at $0.46 per share. This is a slight improvement year over year from the NII per share of $0.45 reported in Q1 of 2023. This growth was accompanied by total investment income totaling $40M, which was a quarter over quarter increase from the $39.2M reported in Q4 of 2023. When looking at the earnings history, we can see the increase of NII play out alongside the rise of interest rates which tells me that RWAY’s current portfolio construction has efficiently capitalized on the rate environment.

Seeking Alpha

We can see that the Q1 results of 2022 only pulled in an NII per share of $0.30. For context, interest rates didn’t start rising rapidly until the midpoint of 2022 and this is exactly where we see the shift in rising NII start to take place. A contributing factor to this high level of income growth is the growing average yield on their portfolio. The weighted annualized yield on debt investments for the first quarter amounted to 17.4%.

RWAY has one of the lowest leverage ratios in the BDC sector. Management has laid out a debt to equity ratio target range of 0.8x – 1.25x. Their current debt to equity ratio sits at 0.91x for Q1, which is an improvement from last quarter’s 0.95x and last year’s Q1 of 1.04x. A lower debt to equity ratio means that the business relies on less leverage to fund operations which overall decreases the risk profile.

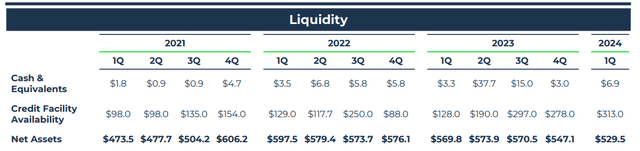

RWAY Q1 Presentation

Lastly, liquidity remains strong for RWAY which offers reassures that they have the capital to ride out any unexpected headwinds. Their cash position remains strong at $320M including cash and cash equivalents. In addition, RWAY has access to $313M in borrowing capacity if needed. During Q1 they also received 2 separate prepayments totaling $34.5, which reinforces the strength of their portfolio.

Dividend

As of the latest declared quarterly dividend of $0.40 per share, the current dividend yield sits at 13.6%. As previously mentioned, NII for the quarter was reported in at $0.46 per share. This means that the current level of net investment income covers the distribution by a comfortable 115%. This coverage gives confidence the current distribution level is in no threat of being cut. However, it’s not quite large enough for me to feel confident that future interest rate cuts would not threaten it.

Lower interest rates would directly translate to lower NII per share since their portfolio is comprised of floating rate debt. As rates come down, so would the interest payments these receive from borrowers. A larger margin of coverage could possibly mean that the distribution would be less vulnerable to possible rate fluctuations. For example, if rates come down and NII per share gets reduced by 20%, a hypothetical NII per share of $0.38 would no longer cover the current distribution amount.

For now though, there is not concern of the distribution being reduced. This is reinforced by the fact that there have been several supplemental dividends issued due to the high levels of cash flow. At the declaration of the most recent base dividend, RWAY also announced a supplement of $0.07 per share that will be paid out at the same time. In fact, RWAY issued 4 different supplemental dividends of varying amounts throughout 2023 and I anticipate this current fiscal year to also have additional supplementals.

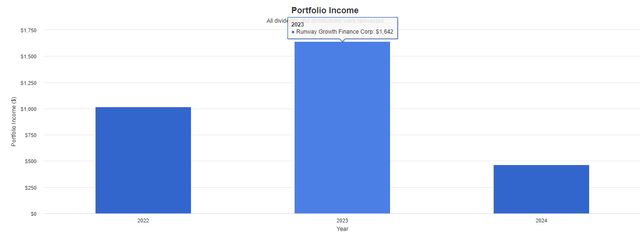

Portfolio Visualizer

Through these supplementals and base raises, we can see how the dividend growth would have played out over just a 2 year time difference. Using Portfolio Visualizer, let’s assume you made an initial $10,000 investment at the start of 2022. This calculation assumes no additional capital was ever deployed but dividends were reinvested every quarter. In 2022 your annual dividend income received would have been $1,019. In 2023 this total would have now grown to $1,642, representing a whopping income growth of over 61% in a short period of time.

Valuation

The current price of RWAY still sits slightly below its inception price range of $12 per share. The price has bounced between the ranges of $11 – $13 per share for about a year now which means that we are currently on the bottom end of the trading range. To further cement this, the price currently trades at a discount to NAV of 12.35%. The largest the discount has ever reached was back in 2020 around 24.66%. While this may not be as relevant due to the short history of the BDC, I thought it was still worth noting to paint a visual of where we lie.

CEF Data

The price has really struggled to gain any sort of momentum. This can likely be attributed to the poor timing around the fund’s inception. It launched following a worldwide pandemic that cause volatile and uncertain markets. This was followed by a low interest rate environment that helped fuel a ton of borrowing and higher valuations. However, this was then cut short but the most rapid rise of interest rates accompanied by higher inflation to levels that we haven’t seen in over a decade.

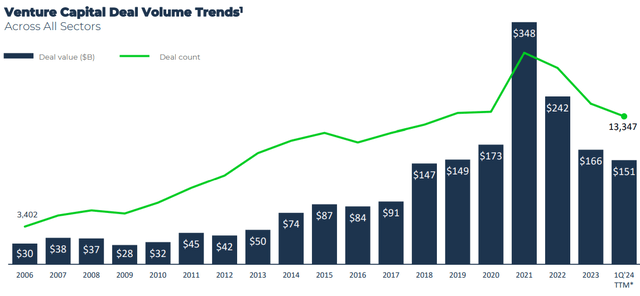

When you consider these factors, the price of RWAY has actually maintained quite well. The higher levels of NII per share has helped offset the fact that NAV has not really increased since inception. However, I believe that a lot of this slowdown relates to the fact that the volume of venture capital deals has decreased. We can see that the volume of deals have steadily decreased year over year since the peak of 2021 when rates were near zero.

RWAY Q1 Presentation

My guess is that the market is currently awaiting the Fed to being cutting interest rates. Lower interest rates translates to more affordable debt capital and an incentive to increase the volume of deals. Now that the latest CPI numbers have come in around inflation, many sources seem to think that rate cuts could happen as early as September.

While the market seems to be awaiting whether or not rates will be cut, I believe this presents an opportunity to continue accumulating. In addition, this provides us an opportunity to continue collecting a high level of well-covered dividend income. In terms of a short term goal, the average Wall St. price target sits at $12.84 per share which means there’s a potential upside of 9.4% from the current price level.

Risk Profile

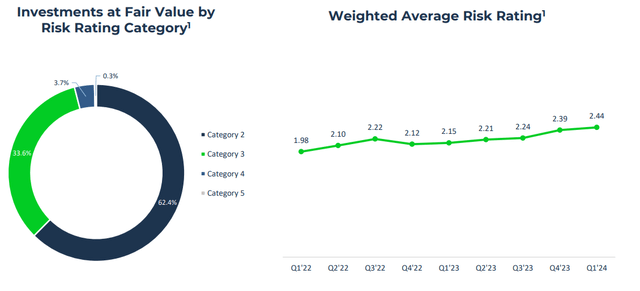

The risk profile remains pretty solid as RWAY is constructed of mostly senior secured debt and has focuses on a floating rate. Similar to other BDCs I have covered, RWAY uses an internal rating system that consists of a numbered scaling system 1 – 5. The lower the number, the higher the credit quality and the higher the number, the worse the credit quality is. What immediately stands out is that none of their investments are rated at a 1. This does leave some vulnerabilities as it may indicate that management is not picking the most quality borrowers.

RWAY Q1 Presentation

These concerns further extend when realizing the credit quality within has actually decreased since the last quarter. A handful of portfolio companies have decreased in quality and moved into a higher rating bracket, while none moved up in rating quality. However, 96% of the portfolio sits at a risk rating of 3 or better which is what really matters. Combing through their last earnings call, I was able to find the following insert about the credit quality specifics.

The quarter-over-quarter change in our internal portfolio risk rating resulted from three investments, which each declined one category from their Q4 2023 ratings of Category 2, 3 and 4 to ratings of Category 3, 4 and 5, respectively. The Category 5 investment is Ming Healthcare, which continues to be on non-accrual. – Tom Raterman, CFO

RWAY also has two separate portfolio companies that are in non-accrual status. While a specific rate isn’t provided, we can assume this accounts for about 1% of the portfolio based on the principal balances of each.

- Mingle Health Care: $4.3M outstanding principal

- Snagajob: $42.3M in outstanding principal.

For reference, peer BDCs Gladstone Investment (GAIN) had 3 portfolio companies in non-accrual status and CION Investment Corp (CION) had a non-accrual rate of 0.86% at fair value.

Takeaway

In conclusion, RWAY has a diverse portfolio spanning across many industries and a solid portfolio construction consisting of floating rate and first lien senior secured debt. While these are good attributes, there are some current growing troubles related to the slowdown in volume of venture capital deals. I anticipate that this volume will start to increase once again when interest rates start to get cut in the future. Until then, we may continue to see a decrease in value which will translate to RWAY struggling to grow NAV. Additionally, the current credit quality leaves a lot to be desired as no portfolio companies are rated in their highest bracket and the quarter over quarter has decreased. However, the current distribution remains well-covered and the high level of income growth has been extremely suitable for investors looking to capture a reliable source of high income. Therefore, I rate RWAY as a current Hold and plan to revisit when market conditions improve.

Read the full article here