April inflation printed at 0.3% for the month and 3.4% for the year, stubbornly resisting Federal Reserve efforts to bring it down to 2%. This is a disappointment for those who expect the Fed to lower interest rates, but they continue to forecast a reduction sometime this year, say in September, perhaps even lowering the inflation target.

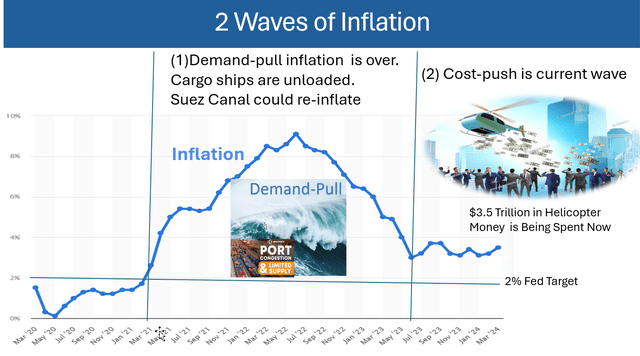

But the facts are (1) the current wave of inflation will last a long time, and (2) the first wave would have ended without the Fed’s help because it was transitory.

Two waves of inflation

Inflation has plummeted from its 9% high in June 2022 to its current 3%. It was transitory, lasting just 3 years. This decrease would have occurred without Federal Reserve actions because supply chain disruptions caused by COVID were destined to get resolved as shipping containers eventually got unloaded. This form of inflation is called “Demand-Pull.” It is caused by demand for goods and services exceeding supply.

The next inflation wave will challenge the economy and the Fed. It will not be transitory. A pivot back toward a Zero Interest Rate Policy (ZIRP) will intensify the problem.

Target Date Solutions

The other form of inflation, called “Cost-Push,” is not transitory. It is classic inflation caused by too many dollars chasing too few goods. It happens when a government prints too much money, as has been happening globally over the past decade.

Argentina and Venezuela are resource rich countries that are still suffering from hyperinflation, defined as inflation above 50% because their governments made serious monetary mistakes that the US is repeating.

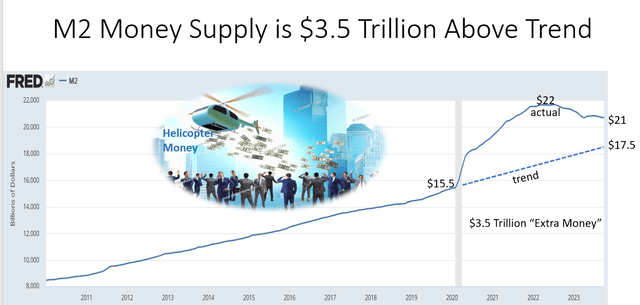

The US has printed more money for COVID than any other country, exposing it to cost-push inflation that will last a long time and will drive inflation above the current 3%. It’s the next wave. As shown in the following image, US money supply is about $3.5 trillion above trend – the amount needed to run the economy. There is $3.5 trillion in “too much money.”

Federal Reserve

The theory behind the problem

Who is paying for COVID? When was the last time you heard the words “balanced budget”? COVID relief has a colossal $5 trillion price tag.

“Modern Monetary Theory” (MMT) is the purported justification for the money the US has “printed” over the past 15 years since 2008. This theory says that governments who own the printing press can print all they want to solve economic crises, unless it causes inflation, in which case that money needs to be taken back with taxes.

There is little political will to suck that money out of the economy with taxes, so inflation will persist.

Cowboy wisdom advises that when you find yourself in a hole, you should stop digging. Lowering long-term interest rates (“Easing”) requires money “printing” whereas “tightening” allows interest rates to be determined by market forces.

The Federal Reserve is the arsonist charged with putting out the inflation fire

It’s ironic that the Fed is coming to the rescue to control inflation when it is complicit in creating it.

“Printing” is not actually running the presses. The US Treasury borrows money as Treasury bonds and bills. In ordinary times, there are plenty of buyers for these bonds, but recent times have not been ordinary, so the Federal Reserve buys them, manipulating bond prices to execute a Zero Interest Rate Policy (ZIRP). In this way, money is created out of thin air.

According to the Federal Reserve, its balance sheet has skyrocketed from normal levels under $1 trillion to $8 trillion currently, with most of the increase coming during the pandemic.

The plan is to unwind this $8 trillion sometime in order to return to the $1 trillion typically held historically. The consequences of this shrinking of the Fed’s balance sheet are unknown. It’s an experiment of magnitude that has never been run before.

Conclusion

The US stock market is very expensive by most measures, and it has enjoyed the longest bull run ever. But observers believe that the Fed will intervene to avoid a stock market crash – it will stimulate the economy by lowering interest rates, especially in an election year. Lowering interest rates in the face of cost-push inflation will fuel the inflation fires that the Fed is charged with extinguishing.

The Fed should “stop digging.”

Read the full article here