MannKind Navigates PAH Market with Strong Q1 Earnings Surge

MannKind Corporation (NASDAQ:MNKD) is up 21.4% since my last look in February. Back then, my focus was on the company selling 10% (1% of its 10% royalty) of its Tyvaso DPI stake for $150 million upfront (with an additional $50 million possible). To me, this signaled that MNKD’s remaining Tyvaso DPI stake was worth upwards of $1.8 billion. MannKind’s valuation at that time was just under $1 billion, so this signaled some undervaluation. Subsequently, my rating was buy.

Recall that United Therapeutics (UTHR) developed Tyvaso DPI using MannKind’s “technosphere technology.” So, MannKind’s total stake was 10% prior to selling a small portion to Sagard Healthcare. Tyvaso DPI is utilized in the treatment of pulmonary arterial hypertension [PAH].

Last week, MannKind reported Q1 earnings. Let’s take a look. Total revenues were up 63% year over year to $66.26 million. Royalties related to Tyvaso DPI were up 94% to $22.65 million. The cost of revenue/goods sold was $18.598 million (a gross margin of 71.9%). R&D and SG&A expenses were $10 million and $22.329 million, respectively. Net income was $10.63 million (EPS 0.04), compared to a net loss of $9.795 million in Q1 2023.

United reported their Q1 earnings on May 1. Tyvaso DPI recorded $227.5 million, up an impressive 92%. Despite a number of patients switching from nebulized Tyvaso to Tyvaso DPI (e.g., due to convenience), even the nebulized version is seeing 21% year-over-year growth. So, Tyvaso is seeing significant interest in a $7 billion PAH market with patients who often require a combination of therapies.

The market is anticipated to be disrupted by Merck’s (MRK) Winrevair, which was approved for PAH in March. Winrevair addresses vascular remodeling by inhibiting activin signaling, which is a different mechanism of action than Tyvaso. Benefits were seen in Winrevair clinical trials, even in patients receiving multiple PAH therapies. So, while Winrevair is unlikely to eat into Tyvaso’s market share, which is particularly useful in improving exercise capacity, it is expected to become a cornerstone in PAH treatment.

On the legal front, United continues to battle Liquida (LQDA) regarding their “generic version” of Tyvaso, Yutrepia (a dry powder version of treprostinil). Expected to launch later this year, Yutrepia is anticipated to take market share away from Tyvaso DPI. To what extent, exactly, is the ultimate unknown. In my view, Yutrepia does not provide obvious advantages over Tyvaso DPI, and being second-to-market, where Tyvaso DPI is relatively entrenched, figures to create around an 80/20 market share favoring the entrenched drug (Tyvaso DPI) due to factors like first-mover advantage and brand loyalty.

Financial Health

As of March 31, MannKind reported $193.27 million in cash and cash equivalents and $107.457 in short-term investments. Total current assets were $383.1 million, while total current liabilities (owed within 12 months) were $99.896 million. This is good for a current ratio of nearly 4, indicating MannKind can reasonably cover short-term obligations.

MannKind has some notable long-term liabilities on the balance sheet, including $227.2 million in senior convertible notes, $137.4 million in liability for the sale of future royalties, and $94.2 million in financing liability. As a result, total liabilities ($710.8 million) outweigh total assets ($480.879 million), implying that the company is significantly leveraged, which may raise concerns about financial stability.

Because the company was profitable last quarter, a historical cash runway estimate based solely on burn rate is less relevant. However, it is important to note that any unexpected changes in revenue or increases in short-term debts could have a significant impact on MannKind’s ability to remain solvent. Stability in profitability does not guarantee future financial health if external factors or operational costs change unexpectedly.

During a February earnings call, MannKind directly addressed analyst and investor concerns about its balance sheet. Regarding the royalty deal:

Many of you asked, could we have sold more? Why didn’t we sell more? And the reality is, we didn’t need to sell more. We wanted to make sure we were comfortable with carrying the level of debt and cash on the balance sheet to control our future.

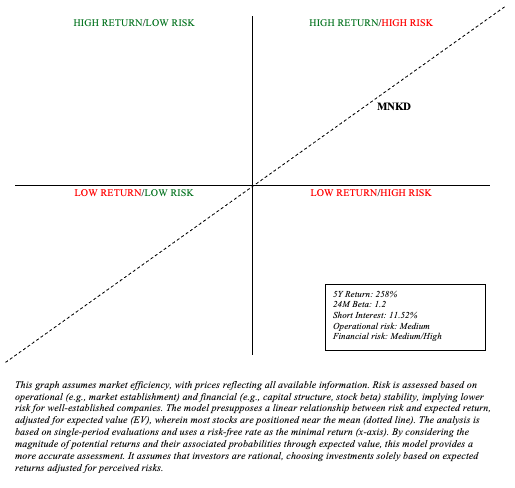

Risk Reward Analysis and Investment Recommendation

When weighing risk and reward, there is a significant financial risk moving forward. It is clear, however, that the company is content with its current balance sheet, and there are no significant short-term concerns. Furthermore, MannKind’s Tyvaso DPI stake mitigates financial risk (assessed as “medium/high”).

Author’s visual representation

Operationally, I remain bullish on Tyvaso DPI’s prospects in the PAH market, despite the recent approval of Winrevair and the expected arrival of Yutrepia. Additionally, MannKind’s technosphere technology, as a platform, may provide some optionality, as seen in other developments like their inhaled insulin product, Afrezza (although this has procured little NPV).

All in all, MannKind remains a buy, but it is probably most appropriate for a barbell portfolio strategy, in which an investor allocates 90% of funds to low-risk investments, like Treasuries and broad-market ETFs, and the remaining 10% to high-alpha investments, like MNKD.

Read the full article here