Simulations Plus (NASDAQ:SLP) is a software and services provider that is benefiting from the growing use of computational tools in drug discovery. While Simulations Plus has a strong business, its valuation is high given modest growth prospects and a heavy reliance on acquisitions and consulting revenue. I would not expect a meaningful correction based on this though, as the market generally places a large premium on high margin simulation software companies. It does call into question the potential long-term returns of investing in Simulations Plus, particularly if growth is increasingly driven by services going forward.

Market

Drug discovery is hampered by the time and cost to bring a drug to market, with a large part of the problem driven by high failure rates during clinical trials. Biosimulation software can accelerate development and result in safer and more effective drugs, helping to resolve some of these issues.

The biosimulation market offers double-digit growth, and Simulations Plus wants to gain market share through a combination of R&D and acquisitions. This strategy is supported by the fact that the biosimulation market is highly fragmented and underpenetrated, with only a few large players.

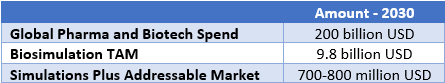

Table 1: Simulations Plus Estimated TAM (source: Created by author using data from Simulations Plus)

The FDA Modernization Act 2.0 could be a tailwind for biosimulation in coming years. The act allows the FDA to consider data other than animal studies, including computer-based modelling, when assessing pre-clinical candidates. Quantitative clinical pharmacology and structure-based approaches can be used to assess the risk of new drugs and are likely to see increased demand as a result of the act.

While interest rates have hit the pharma and biotech markets hard, Simulations Plus has suggested that it is seeing encouraging signs of strength, particularly from companies with candidates in clinical trials. Market conditions have reportedly improved over the past 12 months, and Simulations Plus expects conditions to continue improving throughout 2024. Customers remain cautious about spending, though, and China in particular has seen a pullback in spending.

Simulations Plus

Simulations Plus is a developer of modelling and simulation software for drug discovery and development, which increasingly includes machine learning. Simulations Plus’s software simulates the behavior of drugs and diseases in humans and other species, which can help customers understand the properties of drug candidates, improve formulations, select dosing and optimize clinical trial designs. The company also offers consulting services, ranging from drug discovery to clinical trials and regulatory submissions.

Simulations Plus currently offers 12 software products:

- GastroPlus

- DDDPlus

- MembranePlus

- ADMET Predictor

- MedChem Designer

- DILIsym

- NAFLDsym

- ILDsym

- IPFsym

- RENAsym

- MITOsym

- MonolixSuite

GastroPlus is currently Simulations Plus’s largest source of software revenue, with over 200 companies globally licensing the software. It simulates the absorption and drug interaction of compounds administered to humans.

ADMET (Absorption, Distribution, Metabolism, Excretion, and Toxicity) is used to predict the properties of molecular structures. Over 80 companies are licensing Simulations Plus’s ADMET Predictor. Going forward, the company wants to utilize ML to improve model performance and assist with data curation.

The MonolixSuite provides pharmacometrics modelling and supports non-parametric analyses, population analyses and modeling, and clinical trial simulation. More than 100 companies are using the MonolixSuite. Simulations Plus also believes that there are synergies between its software and consulting businesses.

Consulting is a large part of Simulation Plus’ business and demand has been increasing. Simulations Plus offers a range of consulting services, including:

- Population pharmacokinetic and pharmacodynamic modeling

- Exposure-response analyses

- Clinical trial simulations

- Clinical trial design

- Support for regulatory submissions

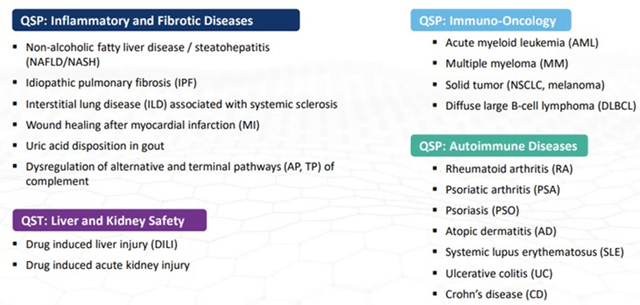

Simulations Plus also provides consulting services in support of QSP modeling across a broad therapeutic coverage area. Simulations Plus want to expand QSP into more indications within oncology and is currently engaged in client sponsored development in neurology.

QSP is a rapidly growing field of biomedical research that aims to model the mechanisms behind disease progression and quantify the pharmacokinetics (movement of drugs through the body) and pharmacodynamics (the body’s biological response to drugs) of pharmaceuticals.

Figure 1: Library of Existing QSP and QST Models (source: Simulations Plus)

Simulations Plus also offers in silico drug design and optimization services, including:

- AI enabled drug discovery and optimization

- High-throughput screening library design and hit visualization and analysis

- QSAR/QSPR modeling and simulation

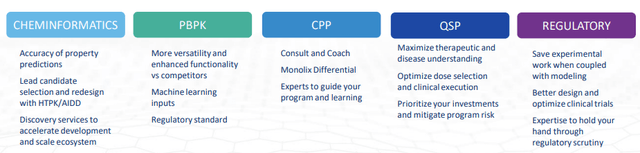

Simulations Plus’s offerings provide customers with a range of benefits, primarily based around improving clinical outcomes and reducing costs. The company believes that it has a number of competitive advantages, including:

- Integration of a portfolio of related solutions with synergies

- Access to data, provided by its scale, breadth and history

- Leading ML models (likely dependent on data)

Figure 2: Simulations Plus Benefits (source: Simulations Plus)

Acquisitions

Simulations Plus is an active acquirer, both to support growth and build out its technological capabilities. Simulations Plus acquired Cognigen in 2014, providing population modelling and simulation research services. Clinical-pharmacology consulting services include pharmacokinetic and pharmacodynamic modeling, clinical trial simulations, data programming, and technical writing services in support of regulatory submissions.

Simulation Plus acquired DILIsym in 2017, providing the company with Drug Induced Liver Injury (DILI) simulation software and related consulting services. DILIsym has also developed a simulation program for analyzing nonalcoholic fatty liver disease.

Simulations Plus acquired Lixoft in 2020. Lixoft offers a range of software, including Monolix, Simulx and PKanalix.

Simulations Plus acquired Immunetrics in 2023, increasing the range of therapeutic areas addressed by the company’s QSP software by more than 50%. The acquisition expands Simulation Plus’ business into underserved areas, like immunology and oncology.

While there is nothing inherently wrong with engaging in acquisitions, particularly given the fragmented nature of the biosimulation market, this needs to be viewed in light of Simulations Plus’s high valuation. The company invests very little in R&D and only appears capable of generating fairly modest organic growth. This means that Simulations Plus must have an adequate set of acquisition opportunities and be able to execute deals at a reasonable price in order to generate adequate returns for investors.

AI

Simulations Plus has long leveraged machine learning in its products, but recent advances in generative AI have created some doubts about the company’s competitive positioning. Simulations Plus believes that ADMET Predictor is illustrative of its AI capabilities, with the company suggesting that startups are finding it difficult to replicate the capabilities of its ADMET Predictor tool.

While there is a threat, generative AI also presents an opportunity, which Simulations Plus can capitalize on with its data and existing portfolio of solutions. AI also potentially reduces the time and cost of developing a drug, which could increase the supply of drugs entering clinical trials in coming years. If this were to occur, it would likely increase demand for Simulations Plus’s software and services, even if there is increased competition.

The company believes that its access to accurate public and private data is a competitive advantage and barrier to entry. While other companies also have access to public data, this data often needs extensive curation to provide value. Simulations Plus’s private data comes from its long history of working with clients and regulatory agencies and provides a more robust competitive advantage.

Financial Analysis

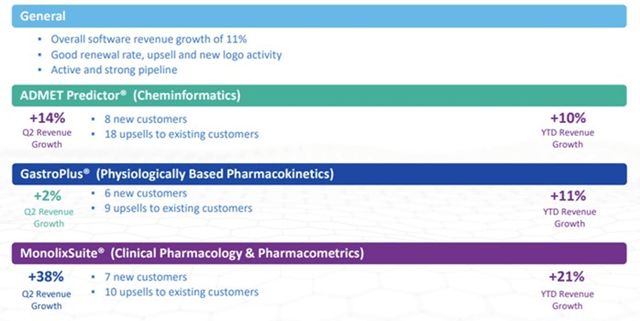

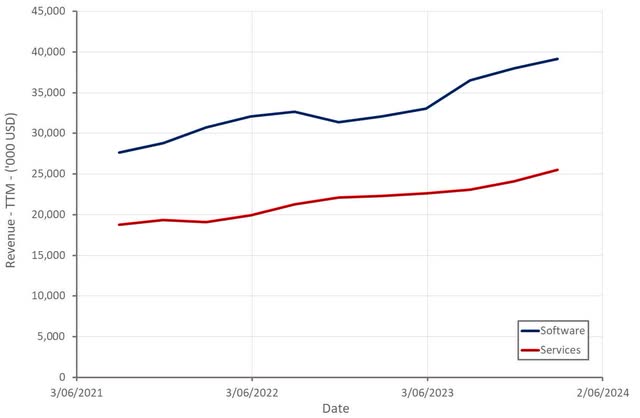

Simulations Plus’s revenue increased 16% YoY in the second quarter, with software revenue up 11% and services revenue increasing 27%. Software revenue increased 11% YoY in the second quarter, with solid growth across regions, excluding Asia. Clinical Pharmacology & Pharmacometrics revenue was up 38% YoY in Q2, with Monolix continuing to take market share. Simulations Plus is seeing rising average revenue per customer for its software business, along with fairly high renewal rates (in the mid-90s based on fees).

Figure 3: Q2 Software Highlights (source: Simulations Plus)

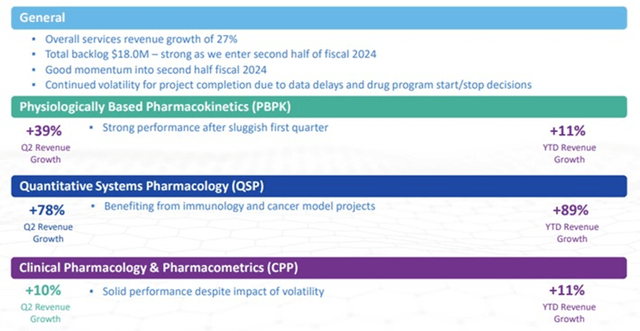

Services revenue increased 27% YoY during Q2, and Simulations Plus’s backlog remains strong. Services revenue growth is currently being driven by Simulation Plus’ QSP business unit, benefiting from immunology and cancer model projects.

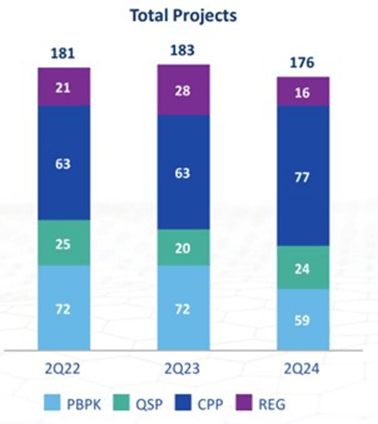

Figure 4: Q2 Services Highlights (source: Simulations Plus) Figure 5: Simulations Plus Services Projects (source: Simulations Plus)

Simulations Plus is targeting 66-69 million USD revenue in FY2024, which would represent 10-15% growth. This guidance could mean that growth drops into the single digit range towards the end of the financial year. Software mix is expected to be in the 55-60% range. Longer term, Simulations Plus wants to grow at or above the market rate while increasing profit margins.

Figure 6: Simulations Plus Revenue (source: Created by author using data from Simulations Plus)

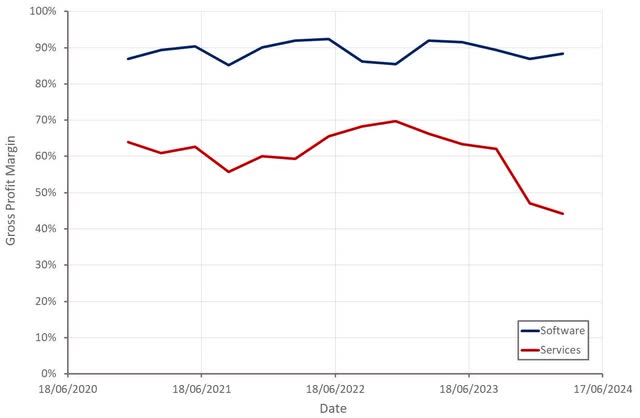

Simulations Plus has been undergoing a business unit reorganization and as a result, all services personnel expenses (~1.3 million USD shifted from general and administrative expenses) have been moved into cost of revenue. As a result, Simulations Plus’s services gross profit margin is down significantly in recent quarters.

Figure 7: Simulations Plus Gross Profit Margins (source: Created by author using data from Simulations Plus)

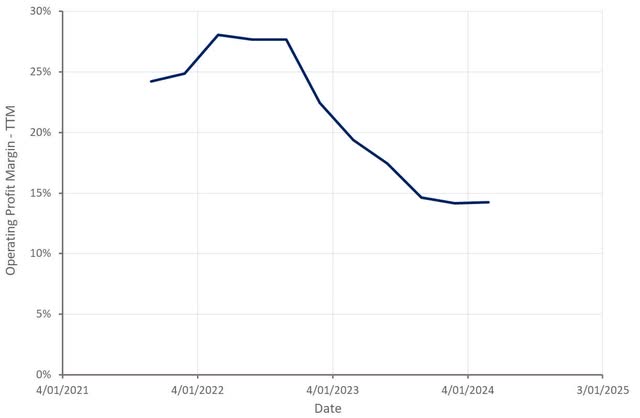

While Simulations Plus’s operating profit margin is only modest, it has high EBITDA margins and generates strong cash flows, with the discrepancy largely the result of stock-based compensation and the amortization of intangibles. Given the company’s reliance on acquisitions to drive growth, amortization reflects a real cost to the business. If Simulations Plus chooses to pull back on acquisitions, it will be capable of distributing a large amount of cash to shareholders, though.

Figure 8: Simulations Plus Operating Profit Margin (source: Created by author using data from Simulations Plus)

Conclusion

While Simulations Plus has a relatively large market opportunity and is capable of generating strong cash flows, the company’s valuation is high, particularly given its reliance on acquisitions and the fact that a considerable portion of its revenue comes from consulting.

Simulations Plus is a quality company with bright prospects, and yet there is a high probability that the stock continues to tread water in the near-term. Analysts have Simulations Plus pegged for mid-teens revenue growth through the next decade, but multiple compression could see the stock still provide poor returns, even if this growth is realized.

In addition, near-term risks remain elevated. If inflation and interest rates remain higher for longer, any rebound in biopharma activity is likely to be delayed. The valuations of tech companies are also likely to come under further pressure in this scenario.

Figure 9: Simulations Plus EV/S Multiple (source: Seeking Alpha)

Read the full article here