Written by Nick Ackerman, co-produced by Stanford Chemist.

BlackRock Science and Technology Term Trust (NYSE:BSTZ) is one of ten different funds from BlackRock that Saba Capital Management is currently going after. With a deep discount and that as a major potential catalyst to see some changes with the fund, BSTZ continues to remain an interesting investment. That said, BSTZ is one of the funds that they don’t appear to be making as much of an effort on in terms of owning a relatively smaller stake.

Investors investing in BSTZ today should be aware of the activist and the latest proxy material going out ahead of the annual meeting. However, they should also be prepared and willing to own the fund as it stands today with no changes. In other words, I probably wouldn’t be one to buy this fund just because Saba is going after, as there are other options where they are going at funds more aggressively.

BSTZ Basics

- 1-Year Z-score: -0.70

- Discount: -16.67%

- Distribution Yield: 7.07%

- Expense Ratio: 1.35%

- Leverage: N/A

- Managed Assets: $1.628 billion

- Structure: Term (anticipated liquidation date around June 26th, 2031)

BSTZ’s objective is “providing total return and income through a combination of current income, current gains and long-term capital appreciation.” To achieve this, they will “invest at least 80% of their total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology.”

Performance – Deep Discount, Weak Performance Continues

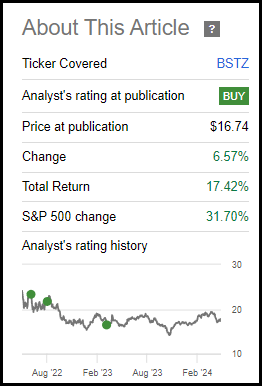

It’s been a while since our last update, but since then, the fund’s total return performance hasn’t been too stellar relative to the S&P 500 Index. The fund invests in a sleeve of private investments, and those have seen a lack of IPOs that should otherwise drive some performance – assuming those IPOs are successful, of course.

BSTZ Performance Since Prior Update (Seeking Alpha)

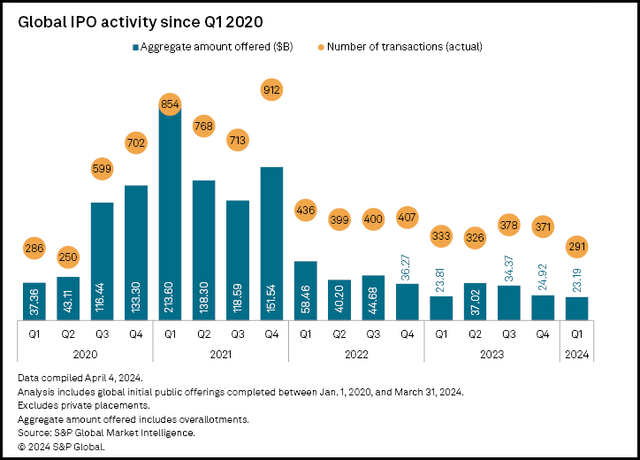

IPOs overall have still been quite slow, but the performance of BSTZ has been pretty lackluster nonetheless. Globally speaking, Q1 2024 actually saw the weakest IPO quarter since going back to the Covid pandemic.

Global IPO Activity (S&P Global)

During the 2020/2021 speculative bull run, when this fund was booming, we had plenty of IPOs, and everyone was rushing into unprofitable speculative names. More IPOs don’t guarantee that BSTZ will do better, but it certainly would have a better shot. They are holding significant exposure to some quite large tech companies that could hit the public market and see a huge pop.

When the IPO market was booming, it was hard not to notice just how much it benefited BSTZ. Now, I don’t see the fund ever returning to those levels unless we get that sort of unbridled exuberance again.

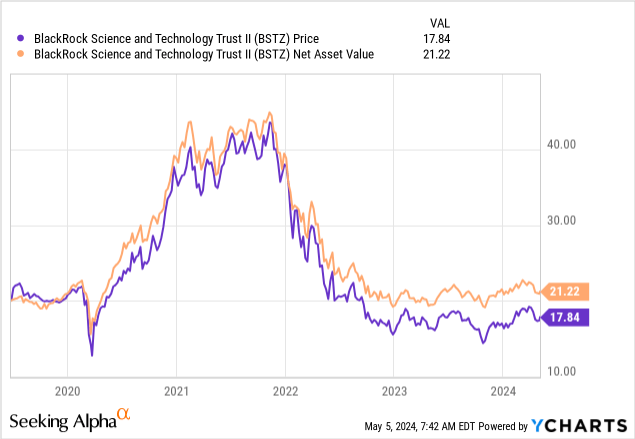

YCharts

That said, I believe the fund can still deliver some solid results, nonetheless, going forward. It doesn’t have to return to $40+ a share to see decent total returns over the long run.

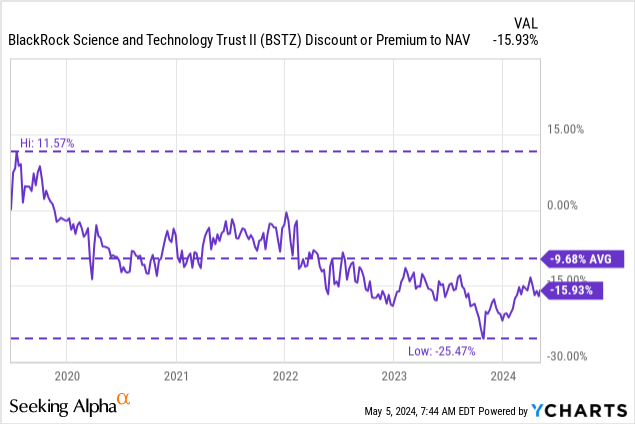

One of the ways that the fund could perform better, aside from seeing the IPO market open up more, would be from the fund’s discount. It is off the deepest discount level that we saw in 2023’s October market correction, but still trading below its longer-term average.

YCharts

A relatively wider discount is attractive when investing in CEFs, but there is a bit more going on with BSTZ here, as we noted at the open. One possible catalyst for narrowing that discount would be the pressure from the activist group Saba Capital Management.

Activist Pressure

Saba Capital Management is looking to get representation on the Board as well as terminate the investment management agreement with BlackRock (BLK). If the management agreement is terminated, the Board will be in a position to seek a new advisor for the fund. Of course, if Saba members are elected to the Board, Saba Capital Management could be one likely candidate to presume that role.

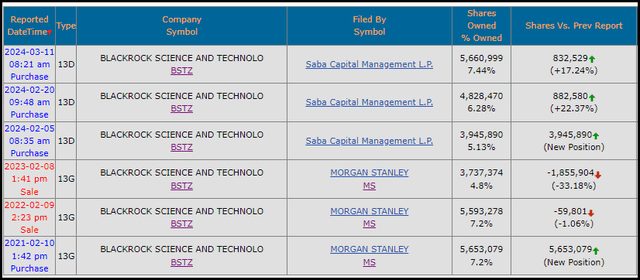

Of the ‘battles’ Saba is waging against the BlackRock closed-end funds, BSTZ is one in which they haven’t taken that large of a stake – at least relatively speaking. They own around 7.44% of the fund’s outstanding shares.

BSTZ Ownership (SecForm4)

That’s still plenty of voting power, where they can definitely sway the vote. However, they own just over 27% of BlackRock ESG Capital Allocation Term Trust (ECAT), just over 19% of BlackRock Health Sciences Term Trust (BMEZ), and 22.7% of BlackRock Innovation and Growth Term Trust (BIGZ) – just for some better context.

That doesn’t mean that Saba still can’t be successful in taking over BSTZ or pressuring the fund; it’s just that they are making less of an effort with that fund, it would seem.

That is the most major new development since our last update, and of course, that’s a huge development in terms of the future of the fund.

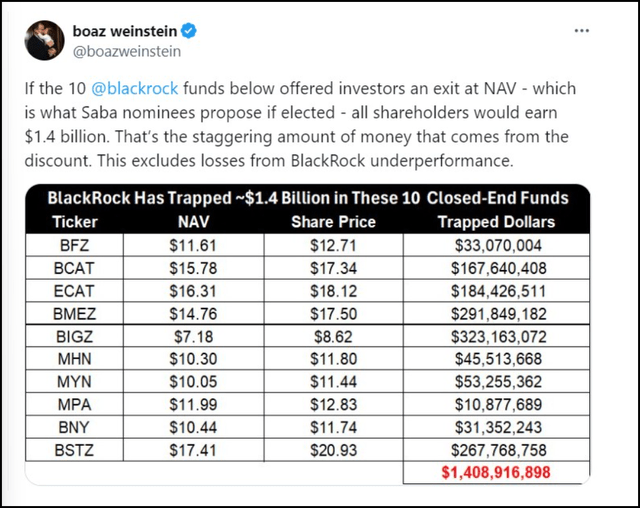

It is unclear what Saba’s exact intentions are if they gain control of the fund, or if this is just using this pressure as leverage for negotiations. Boaz Weinstein mentioned in a tweet that if the Saba nominees are elected, they are looking to provide investors an exit at NAV.

Boaz Weinstein Tweet (SEC Filing)

However, there are a few routes to do that, which is the part that isn’t exactly clear.

Activists usually try to push funds for tender offers, which can unlock some of the discounts for investors by allowing them to sell a portion of their shares at a higher than current market price. Generally, this route doesn’t allow an exit at 100% of NAV as they conduct these offers at just below NAV, around 95-98%. A tender offer for 100% of NAV is certainly possible, though.

Alternatively, they can successfully push the fund to merge or convert to an ETF or traditional mutual fund; that’s another way the discounts can be unlocked. This route has been mentioned, and it seems like merging into already existing ETFs could work for several of these funds. The BSTZ and BMEZ, as well as BlackRock Innovation and Growth Term Trust (BIGZ), could be a bit different as they have a sleeve of private investments, which are often illiquid or restricted. Open-ended funds such as ETFs and traditional mutual funds are limited to 15% in illiquid investments.

Further, a more drastic measure would be liquidating the fund completely, and in that way, NAV would also be returned to investors. However, with BSTZ and the other CEFs that have a sleeve of private investments, we could run into another issue. This route could be drawn out. It’s likely some of those assets would have to go into a liquidating trust of some sort and be sold at a later time.

Speaking of tender offers, several BlackRock funds, including BSTZ, announced the adoption of a “discount management program.” This was a separate deal negotiated with Karpus Investment Management, another activist group. They have a significant position in BlackRock Municipal Income Fund (MUI), which separately announced a potentially different deal.

For BSTZ and several of the other BlackRock funds, the program is for potential tender offers to repurchase 2.5% of shares at 98% of NAV. There are four measurement periods over the next year, which means up to 10% of shares total in tender offers. The timing of the announcement here, while the Saba proxy is out, is likely not a coincidence. It could be one more shareholder-friendly move that BlackRock could point to that they already have in place for investors.

Distribution Changes

Since our last update, which has been quite a while, there has been another change, and that was to the distribution policy. However, Stanford Chemist hit on that subject in-depth last fall when that change occurred.

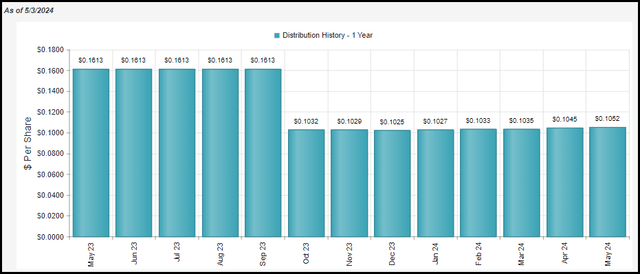

The main point of the policy is that the fund pays a 6% annual rate based on NAV. Thanks to the significant discount, the distribution yield is actually pushing to just over 7%. That said, this distribution adjusts monthly now. Investors in CEFs tend to avoid distributions that change monthly, so this was a somewhat unusual and unfriendly shareholder move.

BSTZ 1 Year Distribution History (CEFConnect)

At the end of the day, there really is no difference in terms of the fund’s performance. Whether the fund pays out the cash to shareholders or retains it, the end results should be about the same. It seems likely they were hoping to put in place this policy to avoid too much NAV erosion.

At 6%, this should be a level that the fund can perform over the long term. But, if they were looking to reduce investors ‘suffering’ from a deep discount, this likely wasn’t the right move to make it change every month.

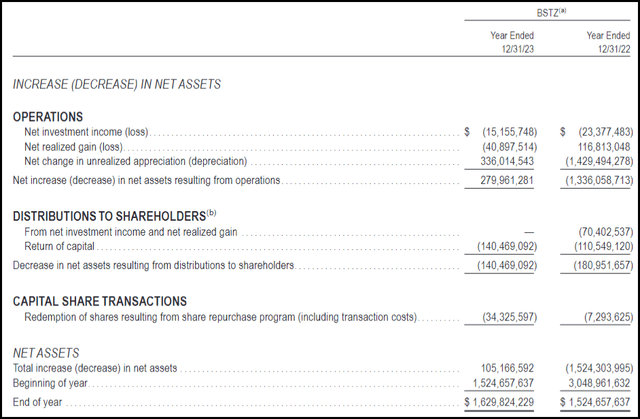

As is usually the case, to fund these distributions, the fund would need capital gains. The fund also writes some covered calls, which can help to provide some option premiums to support the distribution.

Last year, we saw that the fund produced no net investment income, which isn’t unusual for a tech-heavy fund. They also didn’t realize any gains, but had significant unrealized appreciation – though only recovering a fraction of the losses they saw in 2022.

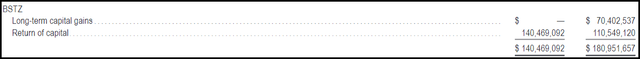

BSTZ Annual Report (BlackRock)

For tax purposes, given the earnings above, seeing return of capital distributions is not unsurprising. 2023 was a much better year for the fund as it saw nearly 20% for total NAV returns, but not realizing any of those gains means ROC.

BSTZ Distribution Tax Classification (BlackRock)

BSTZ’s Portfolio

BSTZ has not made any new private investments for quite some time, but this seems likely because the fund already comprises the portfolio with a significant 33% weighting. That is primarily all restricted securities, as they also listed 33.1% of the fund’s net assets as of their last annual report. This was actually around the same level it was at the end of 2022 as well.

These private securities are going to be level 3 securities, which are valued using “unobservable inputs.” That can lead to some skepticism in terms of the actual value of the underlying portfolio and, therefore, if the discount listed based on the NAV is really the ‘true’ discount. BlackRock uses a third party to assign values, which should help. In the end, though, a private investment’s value is only what someone is willing to buy it for.

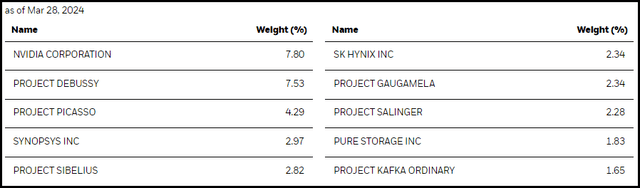

When listing the fund’s private investments, they list them as “project” names, as we’ve discussed in the past on their website.

BSTZ Top Ten Holdings (BlackRock)

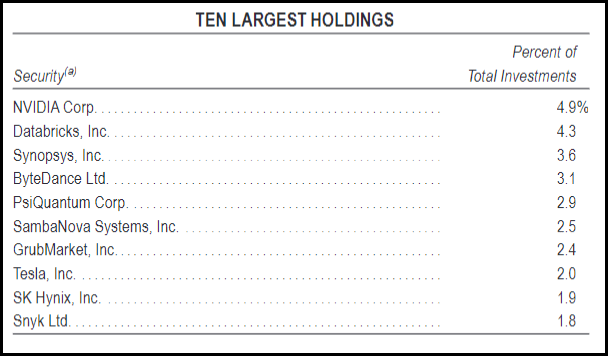

However, in their annual report, they are listed properly, and that also includes their quarterly commentary. Unfortunately, the last quarterly commentary that was available was from the same time as the annual report, which was for the end of 2023.

BSTZ Top Ten Holdings 12/31/2023 (BlackRock)

The largest holdings remain NVIDIA (NVDA) and Project Debussy (Databricks), but they have seen their weightings climb quite materially from the end of 2023 to the end of March 2024. Databricks is one of those companies that could be a huge blockbuster IPO.

Project Picasso (PsiQuantum) has also come up from the fifth-largest holding to the third as of the latest update.

ByteDance is no longer listed as a top holding, as it was under the name “Project Bond.” That was previously a name we saw last year and is listed as one of the top ten holdings at the end of the annual report. It is unclear if they liquidated the position in the first quarter or not, as we don’t have an updated quarterly commentary or an N-PORT filing for Q1 yet.

Of course, for those who follow the news, ByteDance is a Chinese company that is the owner of TikTok. The U.S. passed a law that they will have to divest this social media app or face a ban. With this disruption to the company and TikTok being a key driver for ByteDance, BSTZ could have seen the valuation decline significantly, or they exited the position. Either would have seen it removed from being a top-ten holding previously.

Conclusion

BSTZ is trading at a deep discount and continues to muddle through with its significant sleeve of private investments. If we got into a more IPO-friendly environment, it is possible the fund could start to perform better. A better performance would see the NAV lift, and the distribution would lift along with it.

On the other hand, this fund could be about to change drastically if Saba Capital is successful in taking over. While they are making an effort to take over some Board seats and eject BlackRock as the investment manager, they are taking a smaller stake in this fund to do so. I believe that means one should probably look elsewhere if they are trying to play the activist angle.

Read the full article here