We’re nearly halfway through the Q1 Earnings Season for the Gold Miners Index (GDX) and we’ve seen decent results overall. This included strong performances and positive free cash flow from most of the intermediate and major producers despite the fact that gold averaged just ~$2,070/oz in Q1. One of the more recent names to report its results was Coeur Mining (NYSE:CDE) and while production and revenue were higher, free cash flow has remained sharply negative for the time being. In this update, we’ll dig into the Q1 results, why the second half of 2024 should be much better and if its recent correction has improved CDE’s valuation:

Rochester Mine – Company Website

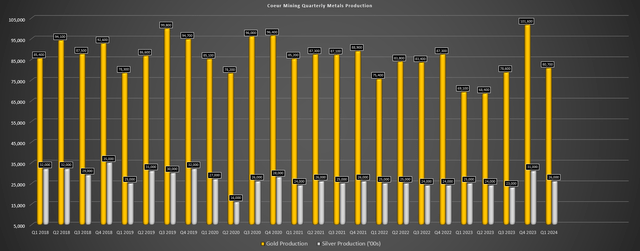

Coeur Mining Q1 2024 Production

Coeur Mining released its Q1 2024 results last week, reporting quarterly production of ~80,700 ounces of gold and ~2.6 million ounces of silver, translating to a 17% and 4% increase in gold and silver production year-over-year, respectively. The significant jump in gold production was primarily related to its Palmarejo Mine in Mexico, with the production of ~33,500 ounces of gold (+29% year-over-year) and ~1.82 million ounces of silver (+4% year-over-year) driven by higher grades and recoveries. Meanwhile, its Wharf Mine had another solid quarter with production of ~20,400 ounces of gold (+32% year-over-year) at much lower operating costs. And while Rochester had a much softer quarter with gold production down sharply year-over-year, this was largely related to a lack of ore stacked on its Stage 6 Leach Pad during the commissioning and ramp-up of the three-stage crusher.

Coeur Mining Quarterly Metals Production – Company Filings, Author’s Chart

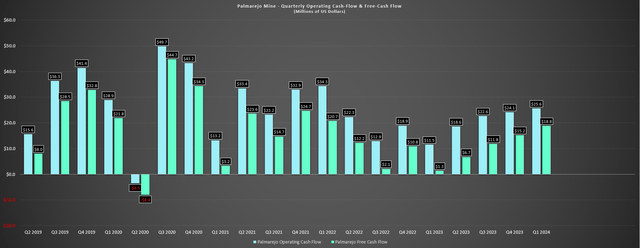

Digging into the results a little closer, Palmarejo processed ~501,000 tons at 0.07 ounces per ton of gold and 4.34 ounces per ton of silver, comparing favorably to grades of 0.052 ounces per ton of gold and 4.02 ounces per ton of silver and offsetting the lower throughput vs. Q1 2023. The higher grades helped to pull down Palmarejo’s adjusted cost applicable to sales to $901/oz for gold (Q1 2023: $926/oz) and $13.18/oz for silver (Q1 2023: $13.94/oz), translating to margins of $710/oz for gold or an 11% increase year-over-year based on its average realized selling price of $1,611/oz. Finally, free cash flow improved to $18.2 million vs. $1.3 million in Q1 2023. However, it’s important to note that while Palmarejo delivered impressive results in Q3, implied quarterly production for the rest of the year based on Coeur’s guidance midpoint is ~22,000 ounces of gold and ~1.5 million ounces of silver which should translate to much higher costs and reduced free cash flow generation vs. the strong Q1 performance.

Palmarejo Operating Cash Flow & Free Cash Flow – Company Filings, Author’s Chart

Moving to Kensington, the Alaskan mine processed ~167,400 tons at 0.14 ounces per ton of gold, with the higher throughput (Q1 2023: ~153,300 tons) mostly offset by lower grades. The result was a marginal increase in gold production to ~21,200 ounces (Q1 2023: ~20,900 ounces), and adjusted cost of sales jumped from already high levels to $1,840/oz vs. $1,775/oz in Q1 2023. This resulted in mine-site free cash flow of [-] $11.8 million, despite the benefit of record gold prices. On a positive note, production will increase as the year progresses at this asset and costs should improve to sub $1,750/oz, resulting in a better margin profile when combined with the higher gold price.

As for its flagship Rochester Mine following its major expansion, Coeur noted that the ramp up to sustaining throughput at the nameplate capacity of 88,000 tons per day is on track for the end of this quarter, setting the asset up for a much better H2. Hence, while production came in at relatively weak levels of ~5,800 ounces of gold and ~620,000 ounces of silver at extremely high costs ($1,817/oz gold and $16.30/oz silver), we will see a much better H2 from this asset with costs expected to decline to ~$15.00/oz for silver and $1,300/oz for gold and more in line with industry averages.

Rochester Mine – Google Earth

Meanwhile, although the site saw negative free cash flow of [-] $39.9 million in Q2 (Q1 2023: [-] $65.5 million), capital expenditures have declined materially to just ~$21.2 million in Q1, and we will see this asset generate positive free cash flow in the second half of this year as costs come down and production ramps up to much higher levels. The implied average quarterly gold for the remainder of 2024 is ~12,500 ounces, or a 100%+ increase from Q1 2024 levels. As for silver production, it’s expected to surge to ~1.7 million ounces, also a 100%+ increase from Q1 2024 levels, and the benefit of economies of scale will have a dramatic effect on operating costs for what’s otherwise been a high-cost asset.

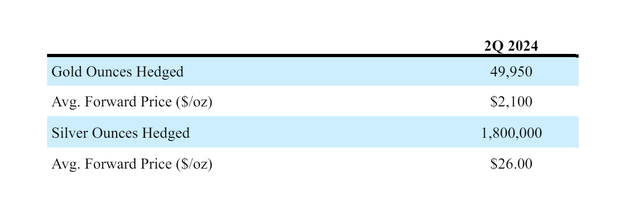

Finally, in South Dakota, Wharf had a decent start to Q1 2024 with gold production of ~20,400 ounces at $1,165/oz with positive free cash flow and is expected to have a stronger rest of the year based on its guidance midpoint of 91,000 ounces at ~$1,100/oz costs. This will allow for another year of significant free cash flow from this asset when combined with higher gold prices and Coeur will see the full benefit of higher metals prices in Q2 with the remainder of its hedges at $2,100/oz gold and $26.00/oz silver (making up over half of Q2 production) set to be delivered into in the current quarter. According to the company, it has no plans to hedge further, with its hedging program mainly used as insurance given its increasing leverage during a capital-intensive three years at Rochester with its Rochester Expansion that’s now complete.

Q1 2024 Financial Results

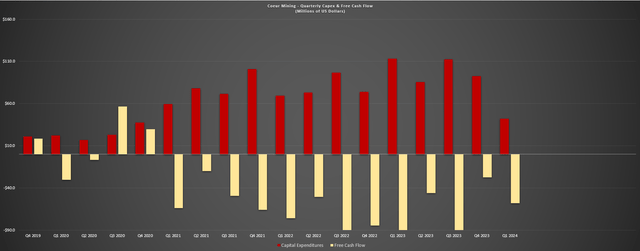

Despite the impact of hedges, Coeur saw a 14% increase in revenue to $213.1 million based on higher production and sales and average realized gold and silver prices of $1,864/oz and $23.57/oz, respectively. And while we won’t see a significant increase in its average realized gold price given that it continues to deliver over one-third of Palmarejo production for $800/oz under its existing gold stream, we should see a meaningful increase in silver production starting in Q3. Unfortunately, despite the sharp increase in revenue, operating cash flow came in at [-] $15.9 million while the company reported a free cash outflow of $58.0 million, significantly lagging its peer group despite the decline in capital expenditures year-over-year with just $42.0 million spent in Q2.

Coeur Mining Capital Expenditures & Free Cash Flow – Company Filings, Author’s Chart Coeur Mining Hedges – Company Filings

As for its balance sheet, Coeur continues to be one of the most leveraged producers, sitting on just shy of $600 million in debt and ~$520 million in May debt. Meanwhile, its share count increased slightly to ~400 million fully diluted shares after a flow-through financing earlier this year, and the hope is that metals prices stay up so that the company doesn’t need to issue more shares after what’s been a brutal four years for investors with non-stop share dilution.

Costs & Margins

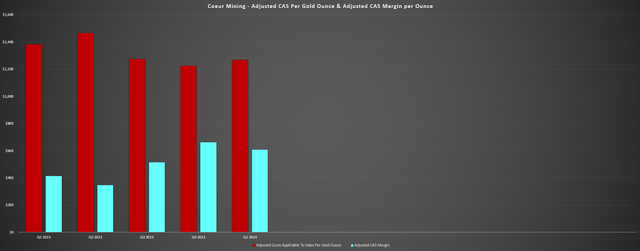

Looking at costs and margins, Coeur reported adjusted gold cost of sales of $1,267/oz, improving from $1,381/oz in the year-ago period. This was driven by the lower unit costs at Palmarejo related to higher sales, which more than offset the headwind of a stronger Mexican Peso and much lower costs at Wharf, also related to higher production. The result was an improvement in its gold margins to $607/oz (Q1 2023: $413/oz), and we should see this margin improvement improve further in H2 with higher gold prices, no hedge impacts, and much lower costs from Rochester which will contribute significantly more ounces per quarter. As for silver, Coeur’s adjusted cost applicable to sales per ounce came in at $14.63 vs. $15.83/oz and margins climbed to $8.94/oz vs $7.42/oz. However, we will see these figures climb materially as well in H2 with no impact from hedges (much higher realized silver prices), lower unit costs at Rochester with a significant increase in output, slightly offset by a weaker H2 from Palmarejo relative to the Q1 results.

Coeur Mining – Adjusted CAS Per Gold Ounce & Adjusted CAS Margin Per Gold Ounce – Company Filings, Author’s Chart

Overall, costs and margins worsened sequentially, but this was largely expected with a softer quarter from Rochester and difficult comparisons in Q4 2023. However, we did see an improvement on a year-over-year basis in both gold and silver margins per ounce and the real margin improvement will show up in H2-2024, as guided by the company in its year-end 2023 results.

Recent Developments

As for recent developments, the recent gold and silver price strength has certainly improved Coeur’s Q2 2024 and FY2024 outlook, with gold prices averaging ~$2,300/oz thus far in Q2 and silver prices averaging ~$26.00/oz. It’s important to note that while this is a very positive development for all producers sector-wide, Coeur will see an outsized benefit given that it’s a much higher-cost producer and battling five-year highs for the Peso at its gold/silver operation in Mexico. Hence, while I previously expected to see free cash flow come in below $70 million in FY2025 at more conservative gold/silver price assumptions, there now looks to be a path to $150+ million in free cash flow next year, which will help Coeur start chipping away at its massive debt load which sits at ~$586 million ($518 million in net debt), leaving Coeur sitting just shy of ~4.0x debt to adjusted EBITDA.

Silvertip Drill Core – Company Video

Looking at other developments, Coeur is planning an aggressive year of drilling at its Silvertip Project in British Columbia (Canada), with ~$5 million spent in Q1 and $11 to $14 million to be spent this year aside from $15 to $20 million on underground development and site support costs. The company noted that it expects to spend less on underground drilling and more on surface drilling this year, with its surface program expected to be “the most extensive ever undertaken by Coeur.” And while Silvertip is still years away from a restart given that this is a relatively high-capex growth opportunity at a time when Coeur needs to focus on de-leveraging, this is a more exciting part of the Coeur story with this being one of the better assets in its portfolio with it being a high-grade asset with significant exploration upside.

Silvertip’s current M&I resource is ~58 million ounces of silver, ~1.5 billion pounds of zinc, and ~770 million pounds of lead or ~7.1 million tons at ~8.1 ounces per ton of silver, ~10.6% zinc and ~5.4% lead.

Finally, while it’s still early days, Coeur noted it is confident in its ability to extend its reserve life at Kensington, which is one of its shortest life assets. If achieved, this would be a positive development because it would mean that Silvertip would not simply offset some ounces from Kensington (~90,000 ounces per annum) if it’s restarted by 2029, but would instead provide growth for the company, with the potential to increase consolidated gold-equivalent ounce production to 700,000+ GEOs. As stated in Coeur’s Q1 2024 results and Conference Call in relation to Kensington:

I am pleased with the progress of Kensington’s multi-year underground development and exploration program, which is expected to wrap-up mid-year next year, and we look forward to achieving our goal of extending its mine life beyond five years by year-end.

In upper Kensington, results from already outlined portions of Zone 30 continue to impress and excitingly, potential for new parallel zones has recently been identified and is being investigated. At the nearby Elmira deposit, infill and extension drilling continue to intersect wide and rich zones, especially in the upper portions of the deposit. There is high confidence that inferred resources here will be converted this year. By the end of 2024, we anticipate extending mine life to approximately five years, representing roughly a doubling since the start of the program two years ago.”

– Coeur Mining Q1-2024 Results & Q1 2024 Conference Call

Valuation

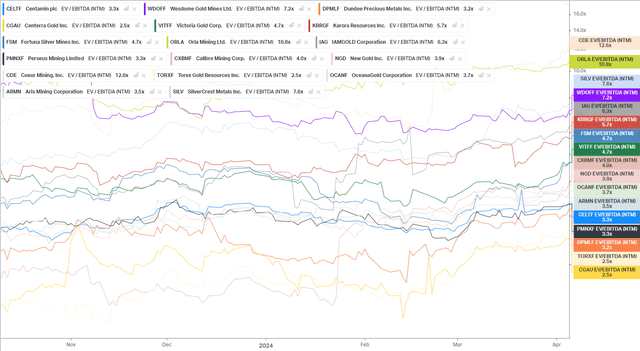

Just three weeks ago, I wrote on Coeur Mining, noting that it was risky to be chasing the stock US$5.30 with the stock trading at a much higher free cash flow multiple than most of its senior producer peers despite a lower quality portfolio and inferior track record of per share growth. Since then, the stock may be 6% lower, but so are silver prices and gold prices have also pulled back a little. The result is that we’ve seen limited improvement in Coeur’s valuation despite the pullback, with it trading at a market cap of ~$2.0 billion market cap and ~$2.52 billion enterprise value and ~16x FY2025 EV/FCF estimates.

Junior & Mid-Tier Producer Valuations vs. Coeur Mining – Koyfin

While the current multiple is an improvement from the past few years and H1 2024 when the company saw consistent free cash outflows during the construction of its Rochester Expansion, mid double-digit free cash flow multiples are typically reserved for large-scale diversified producers and elite mid-tier producers like Alamos Gold (AGI), not those companies that have struggled to create shareholder value. And while this doesn’t mean that CDE can’t head higher as a rising tide will lift all boats, I don’t see nearly enough margin of safety in CDE stock at current levels to justify starting new positions.

Summary

Coeur Mining had a mediocre Q1 with higher metals production and sales, but operating cash flow came in negative and the company continues to be a relatively low margin producer among its peer group. The good news is that its Rochester Expansion is complete, which will reduce capex going forward, and the company will be able to start attacking its heavy debt load next year. However, with the stock trading at nearly 16x FY2025 EV/FCF estimates and 1.1x P/NAV, I don’t see its current multiples as nearly attractive enough for what is a turnaround story with a spotty track record. In summary, I continue to see more attractive bets elsewhere in the sector.

Read the full article here