By James Smith, Chris Turner & Michiel Tukker

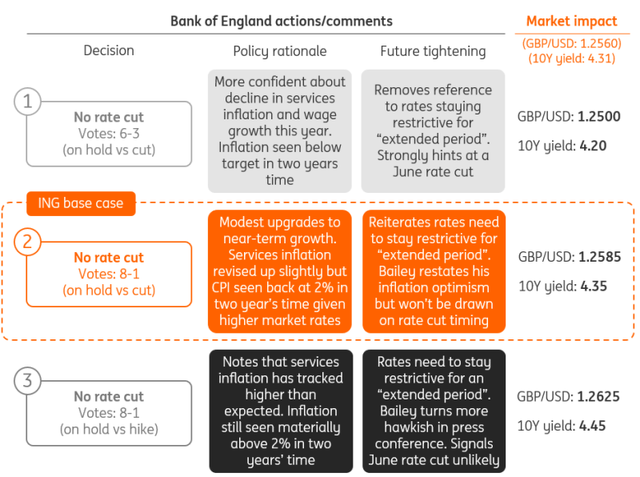

Three scenarios for Thursday’s Bank of England meeting

ING

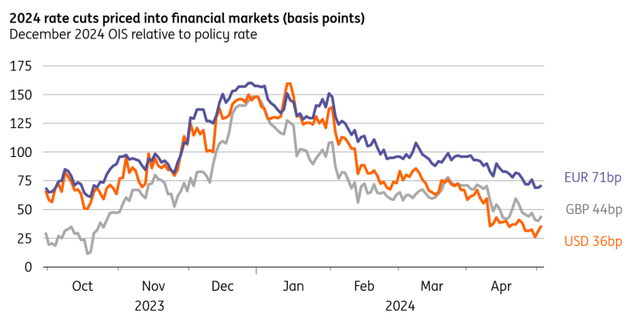

Markets aren’t fully buying the BoE’s new-found optimism

Can the Bank of England diverge from the Federal Reserve on rate cuts? Bank officials – including Governor Andrew Bailey – have been not-so-subtly hinting that it can. We agree – we expect the first rate cut in August, or maybe even June, and three or four cuts in total this year.

Markets are yet to be fully convinced. Investors are pricing 41bp of cuts this year, only slightly more than the US.

The Bank’s May meeting is therefore an opportunity for officials to change the narrative, though we think the committee will tread carefully.

Bailey has stated clearly that he doesn’t think the current US inflation problem is shared in the UK, a message we expect to be hammered home in Thursday’s post-meeting press conference. And Deputy Governor Dave Ramsden – previously a hawk – said recently that the balance of risks on inflation is now tilted to the downside. That undoubtedly opened the door to a rate cut in June and strongly implied that markets are underpricing the extent of rate cuts this year.

UK rate cut pricing is much closer to the Fed than ECB

Macrobond, ING calculations

Division on the committee lowers chances of big changes this Thursday

Admittedly, this dovish view isn’t shared by everyone. The well-known hawks on the committee have been pushing back on the idea of near-term cuts, while Chief Economist Huw Pill opted against endorsing the more optimistic messaging from his colleagues.

In our view, those comments have reduced the chance of wholesale changes to the Bank’s forward guidance on Thursday. For some time now, the Bank has said rates need to stay “sufficiently restrictive” for an “extended period”. Officials have stressed that statement can still be true after the Bank starts cutting rates. But words matter, and we think that statement would be rewritten to some degree ahead of the first move.

Any change to that language on Thursday would be a pretty big clue that the Bank intends to cut in June. We think it’s more likely that officials keep this unchanged to keep their options open. Remember, there are two sets of inflation and wage data before June’s meeting, and we think the April services inflation data due later in May poses some upside risk to the Bank’s current forecast.

April is typically when firms implement contractual or index-linked price rises, and experience from 2023 showed this can be unpredictable. We don’t think the Bank will want to second guess that release and recent US inflation data is a cautionary tale.

But even if those crucial sentences in the policy statement don’t change, we think the overall story from the BoE will continue to be more optimistic. Of course, higher oil prices will probably provide a near-term boost to the Bank’s inflation forecasts, and we suspect projections for services inflation will be nudged slightly higher too in the very short term.

The bigger picture though is that, since February’s meeting, markets have priced out roughly 50bp of rate cuts and that will probably mean lower inflation forecasts in the medium term. The Bank’s main forecast is premised on market rate expectations and previously this resulted in headline inflation at 2.3% at the two-year horizon.

Officials have tended to play down the significance of these numbers as a policy signal. But a revision of this medium-term inflation forecast back to 2% would suggest that the Bank is comfortable with pricing in rate cuts for this year. And there have been hints that the Bank is becoming slightly more confident in its forecasts generally. Governor Bailey recently noted that not only is inflation much closer to target now, but inflation surprises (i.e., deviations from forecasts) have been more minimal, too.

Tellingly, the Bank chose in February to remove the upside skew it had previously applied to its inflation forecasts. Admittedly, it was always a bit of a mystery how this skew was calculated, but the fact that the Bank told us it thought inflation risks were balanced was notable. Following those comments from Ramsden, could we see the new forecasts actually come with a downside skew to the inflation forecasts? It’s possible, though probably more of a tail risk.

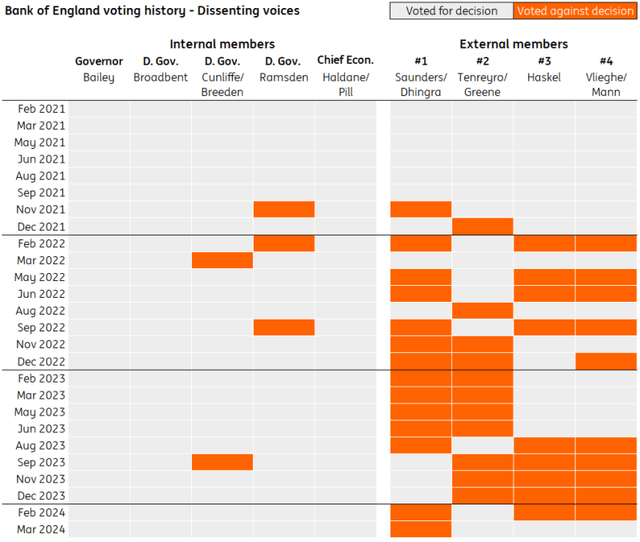

Don’t read too much into Thursday’s vote split

Markets will also be looking at Thursday’s vote split to gauge how close the Bank is to cutting rates, but we think this is not a reliable signal. Back in March, just one committee member – Swati Dhingra – voted for a rate cut, and the remaining eight members voted to keep rates on hold. We suspect it will be the same story next week.

History tells us that the “internal” committee members – that’s the Governor and his three deputies, plus the Chief Economist – tend to move as a pack.

The chart below shows that since November 2021, when the first vote was cast for a rate hike, individual internal members have only voted against the overall majority five times out of a possible 100 votes. By contrast, the four external members tend to dissent much more regularly – over half of the votes were cast against the majority over that same time period.

In other words, we shouldn’t read too much into the rate split this month. If no internal member votes for a rate cut this month, history suggests that nothing is stopping all five of them from voting for a rate cut in June or August.

Internal members tend to vote with the majority 95% of the time

Bank of England, ING analysis

Market implications

Global bond markets are currently quite sensitive to central bank commentary given the high degree of uncertainty surrounding the timing of rate cuts everywhere. In the US, Federal Reserve Chair Jerome Powell triggered lower US short-end rates by downplaying inflation risks earlier this week. Markets had felt the recent US inflation data had warranted a more hawkish reaction from the Fed and investors are hoping the Fed’s reason for the dovishness was well-founded. There’s also a heightened sensitivity of UK rates, which means unexpected nuances in the Bank of England’s narrative on Thursday could prompt a considerable gilt yield reaction.

If we’re right that the Bank keeps its forward guidance unchanged, and keeps its options open on the timing of rate cuts, we suspect that would leave gilt yields just slightly higher as a June rate cut is priced out further. But there’s a clear risk the Bank does turn more dovish, with implicit hints at a June cut, and that would prompt bonds to rally. We suspect in that scenario, markets would go back to pricing two full rate cuts for 2024, thus steering rates closer to the expected path of the ECB.

When it comes to the FX market reaction, we know that sterling is very sensitive to this story. Here, we saw EUR/GBP break close to 0.8650 last month on the back of the dovish comments from Dave Ramsden – only to reverse sharply lower when Huw Pill rained on the parade. Should Thursday’s BoE meeting fail to provide clarity on the timing of the first rate cut, we could see GBP/USD edging 25 pips higher – or even 75 pips higher where Huw Pill’s views somehow resonate.

However, our core 2024 view is that sterling will underperform when it becomes clear that the BoE is ready to move. The risk is that we have to wait for June before seeing some independent sterling weakness – the time when the BoE presumably prepares the market for an August rate cut. Yet, EUR/GBP seems well-supported in the 0.8500/8550 area, and we remain happy with our third and fourth quarter EUR/GBP forecasts of 0.87 and 0.88, respectively.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Read the full article here