Founded in 2002, Tenable (NASDAQ:TENB) is a cybersecurity company with a market-leading VM (Vulnerability Management) solution. As per IDC’s 2022 report, TENB has also been holding first position in terms of global market share in VM space. It has over 44,000 customers, including 50% of Fortune 500.

All-time share performance has been average. Since going public in 2018, TENB has delivered a return of over 47%. A lot of the return seems to be driven by the performance in the past five years. Since 2021, however, share performance has been rather volatile. TENB has also recently gained some momentum, being currently up over 30% in the past year alone. Currently, it is trading at $45 per share.

I first covered TENB back in 2019, when it was trading at merely $24. With the stock trading over 81% higher since then, my bullish call has been proven right.

I would downgrade TENB to neutral for now. My 1-year price target of $47 projects about 5% upside. At this level, TENB does not yet provide attractive enough risk-reward, in my opinion. Nonetheless, I believe the stock still presents solid long-term potential. The neutral rating here simply means that interested investors who like to increase their positions at TENB should wait for a better entry point.

Financial Reviews

Fundamentals have been relatively decent. Revenue growth has been normalizing steadily over the past five years, dropping from above 30% YoY to 14% YoY as of the most recent quarter, Q1 2024. I believe the decline here is quite normal for a company at TENB’s scale. In FY 2024, TENB will be an $800 million company in terms of revenue, getting closer to a billion-dollar operation soon.

The growing business has also contributed to strong and consistent uptrend in operating cash flow (OCF) generation over the past five years. TENB was still a cash-burning operation back in 2020, but since then, it has consistently been expanding OCF generation every quarter. In Q1, TENB generated over $50 million of OCF, a record high that represents almost 30% growth YoY. This has effectively helped strengthen liquidity, which has also been on an uptrend within the same period. In Q1, TENB ended the quarter with $510 million of cash and short-term investments, an almost 8% increase YoY.

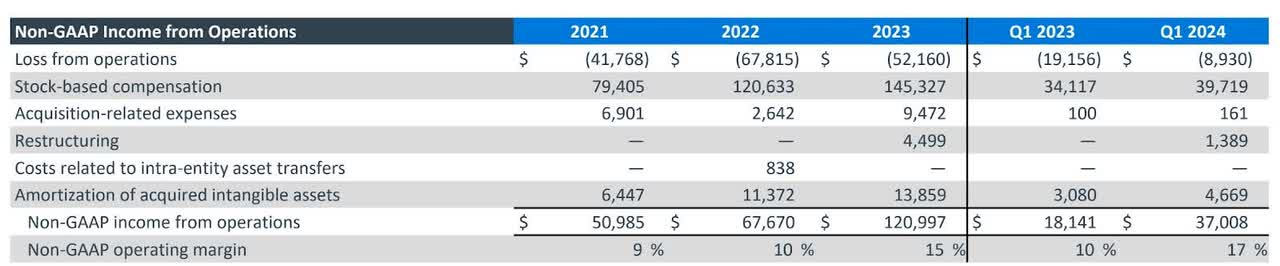

company presentation

In my opinion, TENB’s weak point would be the consistent pattern of GAAP unprofitability, which has been driven by a high level of SBCs (Share Based Compensation). Excluding SBCs alone, TENB would have been consistently generating double-digit operating margins that drive earnings. In Q1, for instance, non-GAAP earnings were over $30 million. However, TENB actually generated over -$14 million of net losses from GAAP standpoint.

Catalyst

In my opinion, the key catalyst for TENB into FY 2024 would be the growing exposure management trends within the cybersecurity space. As commented by the management in Q1 earnings call, TENB has gained quite a strong traction here, with healthy pipeline that should help maintain steady revenue growth into the FY:

Well, specifically with regard to Q2, pipeline remains healthy and this is the first time we’re setting expectations for the quarter and providing an outlook and the outlook we’re providing, we think, is strong, not only for Q2, but also for the year.

Source: Q1 earnings call.

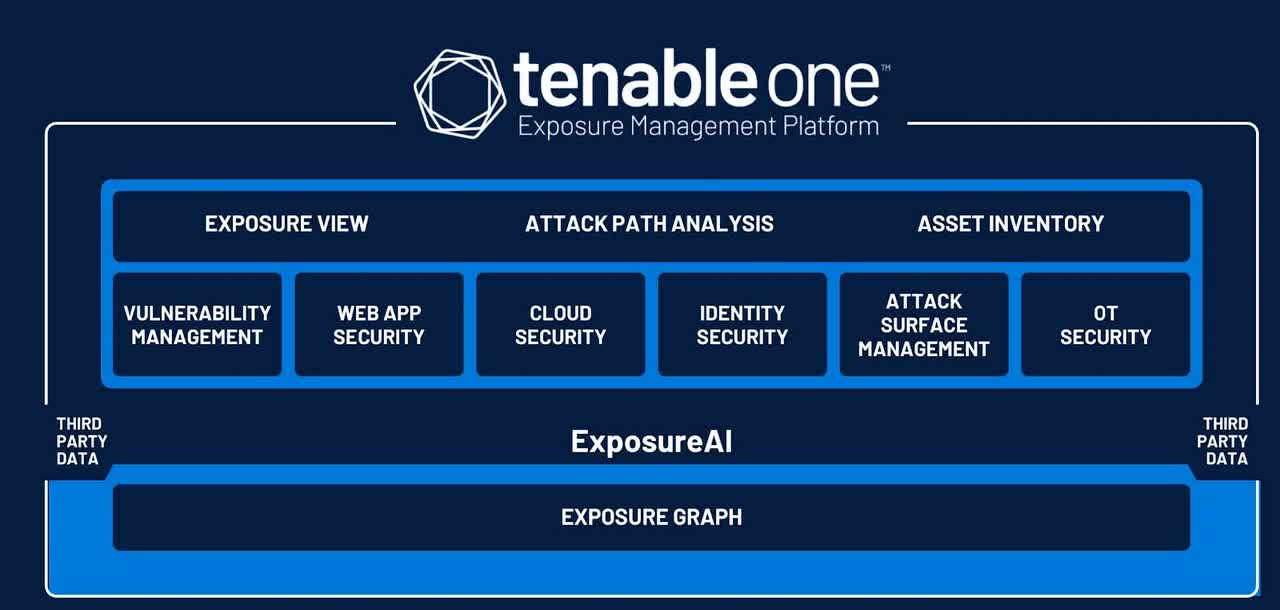

company presentation

This was also highlighted by the strong new enterprise logo wins. As of Q1, ACV (Annual Contract Value) from new logo wins grew 30% YoY, with $100K ACV accounts remaining at elevated level despite seeing a slight downtick, which was caused by the likely downsize of customers within certain verticals that experienced downturn last year.

Nonetheless, I believe the strength in exposure management trend should help offset this one-off headwind into FY 2024. I believe the trend has likely started to gain steam since last year, when a leading consulting firm, Gartner, released its report that identifies the top cybersecurity trends for the year. The report identified exposure management as one of the 9 key trends to watch by enterprise security leaders.

However, the fact that this report also highlights the high-level quantitative benefit of implementing continuous threat exposure management (CTEM) program might have strengthened its value proposition further, likely easing decision making:

CISOs must evolve their assessment practices to understand their exposure to threats by implementing continuous threat exposure management (CTEM) programs. Gartner predicts that by 2026, organizations prioritizing their security investments based on a CTEM program will suffer two-thirds fewer breaches.

Source: Gartner.

company presentation

Conceptually, exposure management deals with identifying, assessing, and addressing potential threats at pre-exploit phase. TENB should be in a good position to benefit from the growth in demand for exposure management solution, in my opinion, due to its relatively solid consolidated offering, Tenable One. As per the illustration, the offering brings in all vulnerability data across IT infrastructures in one single view, powered by AI, making it easy to anticipate threats. Launched in 2022, it already seemed to be introduced at the right time, just a year before the CTEM trend made headlines.

Risk

Risk remains minimal, in my opinion. Though some analysts seem to have anticipated TENB to see some challenges related to spending environment, it seems that demand and pipeline visibility have remained strong. If any, potential risk at present would be the intense and increasing competition in the overall cybersecurity space.

IDC / TENB website

Despite being named as leader in the space by IDC, TENB is not the only major player in the space. In the current VRM (Vulnerability Risk Management) space, TENB competes with well-known and well-performing cybersecurity players like Rapid7, CrowdStrike, and Qualys. Moreover, these players have also been investing in their platform to increase their competitiveness. Qualys and Rapid7, for instance, have been spending at the same level or higher than TENB on R&D as % of revenue. Meanwhile, I believe TENB could be in a more difficult position right now if it is to continue to outspend its competitors, since it is still yet to reach GAAP breakeven.

Valuation / Pricing

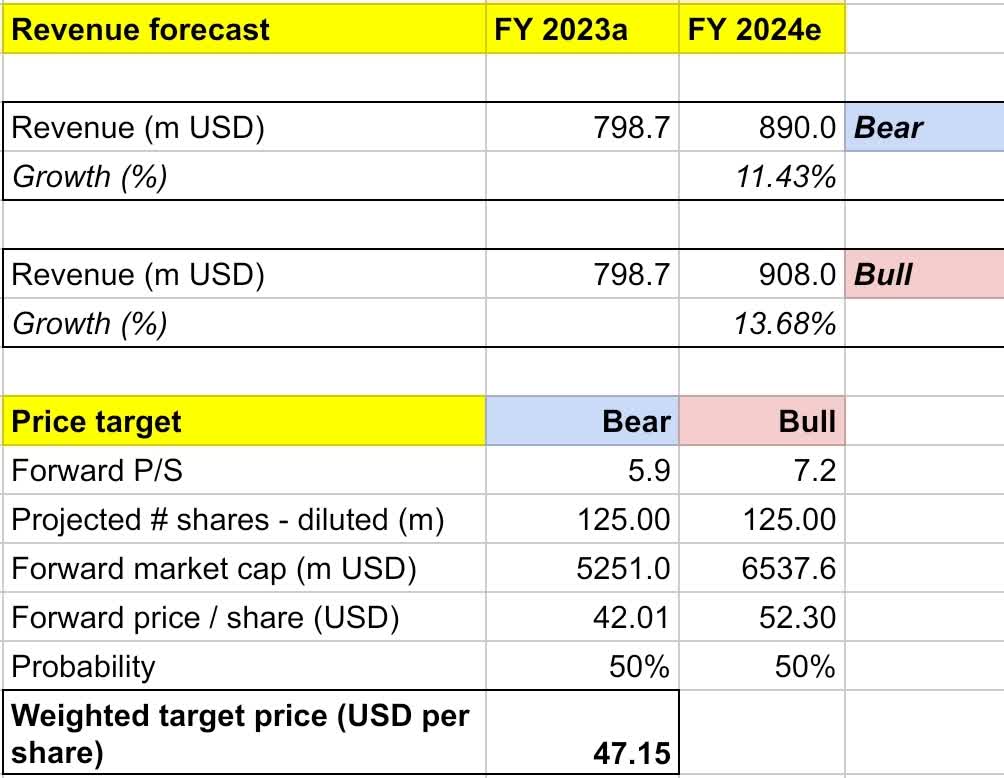

My target price for TENB is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (50% probability) assumptions – I expect revenue to grow 13.7% YoY to $908 million, in line with the company’s guidance. I assume forward P/S to expand to 7.2x, implying a share price appreciation to $52, pretty much revisiting its YTD high towards the end of FY.

-

Bear scenario (50% probability) assumptions – TENB to deliver FY 2024 revenue of $890 million, an over 11.4% growth, missing the low-end of its revenue guidance. I assign TENB a forward P/S of 5.9x, lower than where it is trading today, projecting a slight correction to $42.5. In this scenario, I expect TENB to face unforeseen challenges, such as shifting competitive dynamics that may create unfavorable situation for TENB.

own analysis

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $47.2 per share, projecting a 1-year upside of merely 5%. I would assign TENB a neutral rating for now. At this level, I believe TENB does not offer attractive enough risk-reward despite my conservative projection and the stock’s overall long-term potential.

My neutral rating here means that any interested or existing investors in TENB should wait until TENB presents better entry point before considering to invest or re-up their positions.

Conclusion

TENB is a global leading VM provider currently benefitting from the growing trend in exposure management. New logo wins continued to dominate sales activity and pipeline as of Q1, demonstrating attractive potential in FY 2024. However, TENB is not alone in this space. Competitors like Rapid7 and Qualys have also been investing quite a lot in R&D to increase their competitiveness. My bullish call in 2019 in TENB has been quite rewarding so far, with the stock up over 81% since then. However, I would assign TENB a neutral rating for now. The 5% upside projected by my price target model does not provide attractive enough risk-reward today.

Read the full article here