I’ve been covering the realm of ultra-short securities for quite some time. I’ve written Buy and Strong Buy articles about many ultra-short bond ETFs, and even one about how great Money Market Funds are these days. In most of the articles, I discuss the fact that ultra-short assets are attractive now, but might not be for long. However, ultra-short bonds haven’t gotten any less attractive. In fact, they may be more attractive than ever.

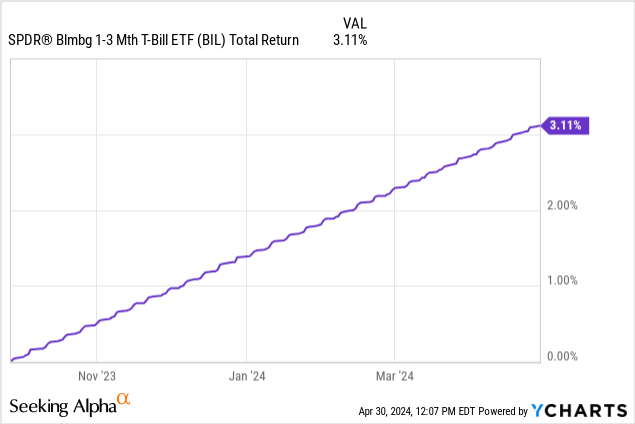

I covered SPDR Bloomberg 1-3 Month T-Bill ETF (NYSEARCA:BIL) about seven months ago. I gave it a Strong Buy and my thesis was very simple; it has a high yield and that it was likely to stay relatively high for some time. Only three interest rate cuts were predicted by the Fed in 2024, and I made the argument that even if the Fed funds rate was decreased by 75 bps, BIL is still a good investment. Since then, BIL has returned a little over 3.1%.

While this return may seem underwhelming when compared to that of equities, remember that BIL is a practically risk-free investment. BIL’s 30-day SEC yield is 5.20%. Almost 5 and a quarter percent for an investment that is as risk-free as it gets is pretty great. I think BIL is just as attractive as ever, if not more. I maintain my Strong Buy rating.

Holdings and T-bills

BIL holds 1-3 month T-bills and that’s it. The ETF’s average maturity is about 0.09 years. Because of the nature of T-bills, BIL is a very low-volatility ETF. BIL’s holdings have such a low duration that interest rate risk isn’t a factor. When rates are raised or cut, there is very little effect on BIL’s price. While no price volatility has its benefits, it also points us to BIL’s biggest risk.

What happens when the yield is gone?

Normally, when rates are cut, bond ETF investors are happy. As the ETF’s yield goes down, the ETF goes up in price. With ultra-short bonds, that’s not the case. When the yield goes down, BIL will not appreciate. The risk that BIL carries is that when rates are cut, you’re not in a good position. After a rate cut, BIL investors will lose some of their yield and receive almost no capital appreciation. When rates are cut, the bonds that BIL is buying up will have a lower yield, and in 3 months every T-bill that BIL holds will have a lower yield. With longer-term bond ETFs, even after rates start to fall, all the bonds bought before that will have that higher yield locked in until maturity or until the bond is sold. These longer-term ETFs will experience a greater return because of capital appreciation and because the higher yields will be paid longer. Despite the reinvestment risk, there is some good news for BIL and other ultra-short bond ETFs, as explained next.

Rate cuts appear to be few and far away

Back in December of 2023, the market was pricing in 8 rate cuts, the first of which would happen in March. Once it became apparent that a March rate cut wasn’t going to happen, the market pushed it back to June. Now the market has pushed its prediction back yet again. The CME FedWatch Tool is now implying just one rate cut in December. If the market is right, investors can get the 5.2% yield for 8 months before a single rate cut happens. This is why I believe BIL is more attractive than ever. Investors can own it knowing they are likely to have over half a year before they even need to worry about its yield going down. Even when that rate cut does happen, 4.95% risk-free is still great. Investors need to take advantage of this practically risk-free investment.

When will BIL become unattractive?

I think there are 2 scenarios where BIL becomes unattractive. The first is if multiple rate cuts happen faster than expected. If BIL’s yield falls below 4%, I don’t think it’s a Strong Buy anymore. It would still be a great place to park uninvested cash to earn a nice yield, but it isn’t an amazing opportunity like it is now. The other scenario, which I think is more likely, is that longer-dated bond yields un-invert compared to ultra-short-term bonds. If the 2-year yield becomes higher than the yield of ultra-short bonds, buying 2-year bonds would be far better. Rather than just having the yield locked in for 3 months, you get it for 2 years. As of now, the 2-year treasury bond yield is at 5%. In my opinion, this is enticing. But the chance that longer-term bond yield un-invert isn’t high. For this to happen, investors would have to not expect any rate cuts for years. While I do believe we won’t have many rate cuts in 2024 and 2025, I’m confident we will have several. Once these cuts happen, the yield curve could un-invert and then lead us to scenario 1.

Readers Takeaway

Right now, BIL offers a very low-risk, high-yield investment. BIL has been attractive for a long time, but with the forecast for rate cuts being pushed further and further out, I believe that BIL is more attractive than ever. It’s important to keep an eye on longer-dated bonds because their yield may become high enough to prompt you to make the switch from ultra-short to intermediate or even long-term bonds at some point. BIL can be used by investors in so many different ways. Whether you own BIL as a part of your fixed-income portfolio or just a place to park uninvested cash, its high yield for low risk should be taken advantage of.

Read the full article here