Introduction

I recently read a blurb in an AAII Journal article that referenced research that Lump Sum (LS) investing is better than Dollar Cost Averaging (DCA). I believe I eventually found the referenced piece published by Vanguard. In the research, the authors state, “Lump-sum investment strategies beat common cost averaging investment strategies two-thirds of the time, according to historical and simulated market data.” The data is quite compelling, thorough, and completely pointless. As someone with a mathematical background, it seems like such an obvious claim to make, I was surprised anyone spent time researching this.

Mathematics Is Real

First, there is the issue of math, which is quite real. For the purposes of my mathematical exercise, I will use an annual return of 10%, and assume that someone has come into a substantial windfall like $100,000. I will use a 10-year investment time horizon to demonstrate various scenarios. Here we go.

Single Deposit Scenario

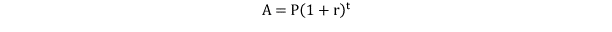

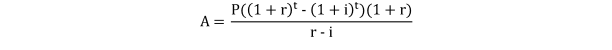

Let’s assume that we fully invest our $100,000 for ten years. We will use this compounding formula:

Author

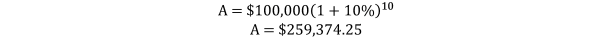

Using this formula, we arrive at the following final return:

Author

Systematic Deposit Scenario

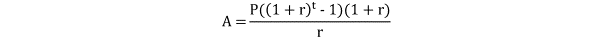

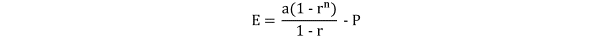

Let’s assume that our lucky person decides to DCA their money into an account yielding 10% per year over ten years. They will invest $10,000 per year at the beginning of the year. Here is the formula for systematic returns:

Author

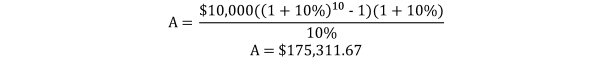

Using this formula, this is how our investor would have fared by delaying their investments:

Author

As one can see, the extra time in the markets for the LS investor yields a better final return than it would for our DCA investor. One does not need a broad-based Monte Carlo simulation to see that. Math makes it obvious.

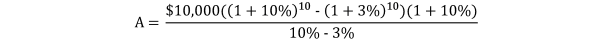

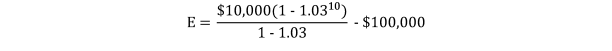

Systematic Investment with Step-Up

What if one were to earn an interest rate on their cash and made annual step-up deposits into their investment accounts? Perhaps someone decides to earn 3% on their savings accounts, and gradually invest their money over the ten years. Here is the formula for a step-up investment:

Author

If we assume that our investor will start with an initial $10,000 investment, and gradually step up their investment by 3% per year, we have the following calculations:

Author Author

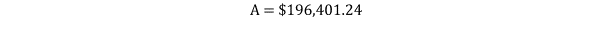

Meanwhile, we did earn interest on our savings as calculated by:

Author

For our purposes here, we will use our 3% interest rate and will say r = 1.03. Here is the algorithm:

Author Author

Even if we add the interest earned over the ten years, our stepped-up strategy leaves us with $211.040.03, still short of the $259,374 earned by using the LS strategy.

Reality Strikes

All of this works great in theory. Mathematics works; however, reality adjusts one’s theories. All the formulas and calculations shared so far assume nice smooth annual returns (10%). That is not how markets work. The ups and downs of investment markets create anomalies and inefficiencies that can allow the DCA strategy to outperform the LS strategy. According to the Vanguard study, it happens 32% of the time. Nevertheless, if one aims for positive expectations, front-loading an investment strategy is preferred, and mathematics proves that.

First, most regular folks don’t become beneficiaries of a windfall. We work for our money and save as much as we can. With that, I want to take this concept of DCA a little further. For this experiment, I will use the following scenarios for two investors. Our first investor will start contributing the maximum allowed contributions to their IRA. Our second investor will save their money until they have enough to contribute the maximum amount at the end of the year. I want to use IRA contribution limits because they have a step-up that has happened over the years. Here are the IRA contribution limits since 2001.

|

Year |

Contribution Limit |

Monthly Contribution Amount |

|

2001 |

$2,000.00 |

$166.67 |

|

2002 |

$3,000.00 |

$250.00 |

|

2003 |

$3,000.00 |

$250.00 |

|

2004 |

$3,000.00 |

$250.00 |

|

2005 |

$4,000.00 |

$333.33 |

|

2006 |

$4,000.00 |

$333.33 |

|

2007 |

$4,000.00 |

$333.33 |

|

2008 |

$5,000.00 |

$416.67 |

|

2009 |

$5,000.00 |

$416.67 |

|

2010 |

$5,000.00 |

$416.67 |

|

2011 |

$5,000.00 |

$416.67 |

|

2012 |

$5,000.00 |

$416.67 |

|

2013 |

$5,500.00 |

$458.33 |

|

2014 |

$5,500.00 |

$458.33 |

|

2015 |

$5,500.00 |

$458.33 |

|

2016 |

$5,500.00 |

$458.33 |

|

2017 |

$5,500.00 |

$458.33 |

|

2018 |

$5,500.00 |

$458.33 |

|

2019 |

$6,000.00 |

$500.00 |

|

2020 |

$6,000.00 |

$500.00 |

|

2021 |

$6,000.00 |

$500.00 |

|

2022 |

$6,000.00 |

$500.00 |

|

2023 |

$6,500.00 |

$541.67 |

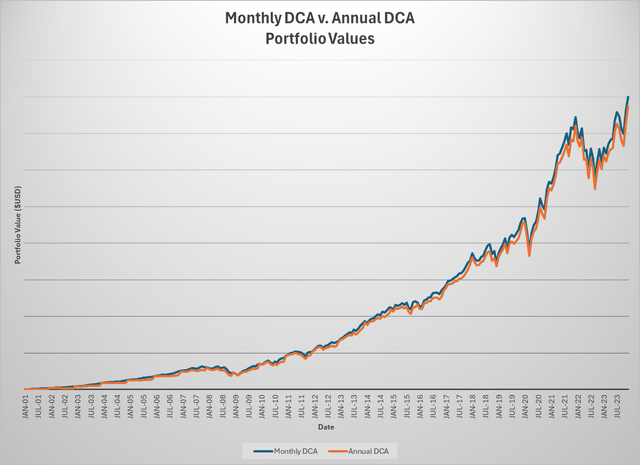

Our first investor will begin making monthly deposits into their IRA and invest in iShares Core S&P 500 ETF (ARCX: IVV). Our second investor will squirrel away their money until they have enough to invest the maximum amount on December 1st each year.

Results

From 2001-2023, IVV averaged an annual return of 8.15% (±16.61%). For our monthly investor, the internal rate of return was 11.73%. For our annual investor, the internal rate of return was 11.87%. By the end of 2023, the monthly investor has a portfolio worth $399,828.95. Our annual investor’s portfolio was worth $386,935.11. Even though the annual investor’s portfolio generated a better IRR, the monthly investor’s earlier start for each year allowed them more time in the market each year. Both strategies invested a total of $111,500.

Author

I did the same experiment with iShares Core S&P Mid-Cap ETF (ARCX: IJH) and iShares Core S&P Small-Cap ETF (ARCX: IJR). The results were the same where our monthly DCA investor outperformed our late annual DCA investor.

|

Final Portfolio Value (2001-2023) |

Monthly DCA Investor |

Late Annual DCA Investor |

|

iShares Core S&P Mid-Cap ETF (ARCX: IJH) |

$357,950.05 |

$347,253.39 |

|

iShares Core S&P Small-Cap ETF (ARCX: IJR) |

$352,698.57 |

$340,124.24 |

I ran the analysis to see what the results would be if one had the full contribution amount invested at the beginning of the calendar year. Not surprisingly, this was the optimal strategy over the monthly DCA strategy and the late annual DCA strategy.

|

Final Portfolio Value (2001-2023) |

Monthly DCA Investor |

Late Annual DCA Investor |

Early Annual DCA Investor |

|

iShares Core S&P Mid-Cap ETF (ARCX: IJH) |

$357,950.05 |

$347,253.39 |

$370,827.09 |

|

iShares Core S&P Small-Cap ETF (ARCX: IJR) |

$352,698.57 |

$340,124.24 |

$ 362,494.62 |

|

iShares Core S&P 500 ETF (ARCX: IVV) |

$399,828.95 |

$386,935.11 |

$408,271.96 |

My Take

The basic lesson I learned from the Vanguard study, and my DCA analysis, is basic. When you have the money to invest, do it. Don’t try to time the market. Let your time in the market do the work. When you have the chance to increase your investments, do that too. I read once where someone lamented that they could do only what they could do. That’s ok too. The key to all of this is to start investing some money, do it consistently, and do it as early as possible.

Good luck and have fun.

Read the full article here