LTC Properties Inc. (NYSE:LTC) is a senior-focused healthcare real estate investment trusts that owns approximately 50% senior housing and 50% skilled nursing facilities in its real estate portfolio.

Senior-focused healthcare REITs are attractive from an investment angle because of long-term secular trends in the U.S. senior population which suggests that the share of people aged 65 or older is going to increase substantially moving forward, thereby setting up attractive supply-demand dynamics for REITs like LTC Properties.

Furthermore, LTC Properties provides passive income investors a very well-covered (on an LTM basis) dividend and I think that LTC is suited to be a long-term holding for those investors that want to fund their retirement with a highly reliable dividend payer.

My Rating History

Shifting demographics in the U.S. population, a rising senior population and a broad real estate footprint were reasons for me to recommended LTC Properties in December to passive income investors.

The REIT has seen a substantial increase in its pay-out ratio in the fourth quarter, related to asset sales, but I anticipate this FFO -based pay-out ratio to normalize in the coming quarters which means a higher degree of dividend safety should be restored.

Portfolio Review, Secular Demand Drivers For Senior-Focused Facilities

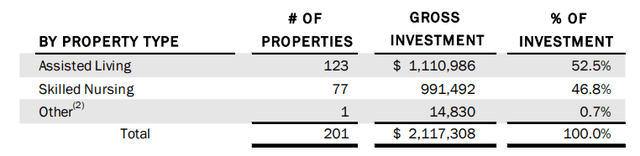

LTC Properties is a senior-focused healthcare REIT with significant property investments in assisted living and skilled nursing facilities. The trust owned a total of 201 of such facilities at the end of the fourth quarter reflecting a gross investment volume of $2.1 billion.

Investments By Property Type (LTC Properties)

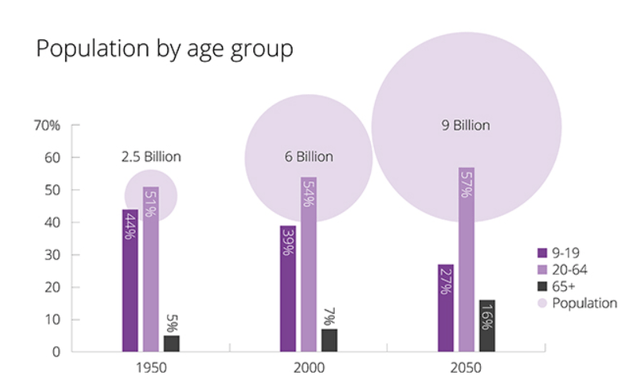

LTC Properties is subjected to secular, long-term drivers in funds from operations and occupancy going forward as the world’s population is aging.

Worldwide, we are going to see a rapid aging of the elderly cohorts in our societies, a trend that will be particularly profound in Western countries where high living and work safety standards have led to an increase in life expectancy rates.

The portion of the world population that is aged 65 or older was just 7% in 2020 and this percentage is poised to more than double to 16% by 2050, thereby creating secular demand growth for those healthcare REITs that focus on catering to the needs of the elderly.

Population By Age Group (AETNA)

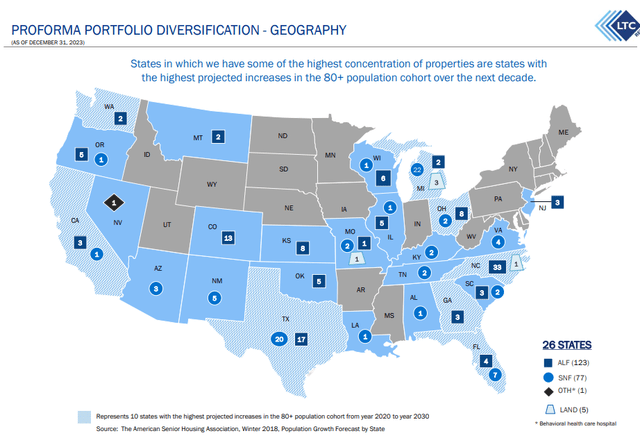

LTC Properties’ real estate assets are spread out all over the United States and have a particularly heavy concentration in markets that have a large elderly population such as Texas, Michigan and Florida. Texas is by far the largest state, in terms of investments, with 37 facilities representing a real estate value of 328.5 million (which is equal to 16% of all investments).

Portfolio Diversification By Geography (LTC Properties)

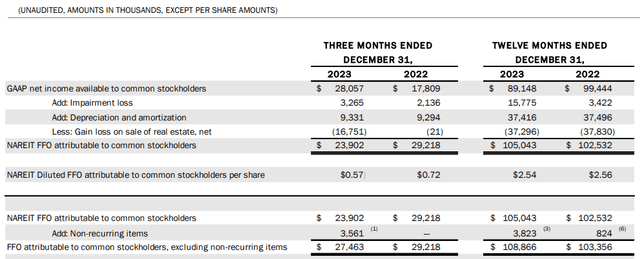

LTC Properties is shrinking its portfolio and sold some properties in 2023 that were in the hands of underperforming operators which caused a decline in the trust’s funds from operations on a YoY basis.

The trust recognized a $3.56 million loss related to the pending sale of seven properties in Texas and transition of three properties to new operators in the fourth quarter. In total, LTC Properties produced $27.5 million in funds from operations, excluding non-recurring items, in 4Q23, reflecting a decline of 6% YoY.

Funds From Operations (LTC Properties)

Dividend Coverage

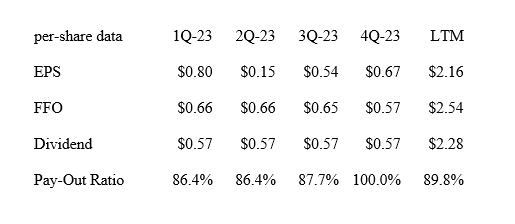

LTC Properties earned $0.57 per share in funds operations in the fourth quarter, reflecting a decline of 21% YoY due to asset sales. LTC Properties, as a consequence, saw an uptick in its FFO-based pay-out ratio to 100% in 4Q23, leading essentially to no margin of dividend safety whatsoever.

However, as the healthcare REIT focuses on new investments in 2024, I think that the trust will be able to grow it funds from operations again, and by doing that also improve its pay-out metrics.

Even with the rise of the pay-out ratio to 100% in 4Q23, LTC Properties easily covered its dividend with funds from operations on a full year basis (90% pay-out ratio). Thus, I don’t see an imminent dividend adjustment risk for LTC Properties and actually anticipate that the pay-out ratio will fall back to the 86-90% range in 2024.

Dividend (Author Created Table Using Trust Information)

Reasonable FFO Multiple

Based on 4Q23 run-rate funds from operations of $0.57 per share, LTC Properties is valued at just 13.9x FFO which compares to a 12.9x FFO multiple when I last covered the trust in December. From a historical perspective, LTC Properties represents decent value, in my view.

I think that LTC could earn at least $2.30-2.40 per share in FFO in 2024, which basically implies that FFO is flat-lining this year, which in turns translates into a present year FFO multiple of 13.5x.

Omega Healthcare Investors Inc. (OHI), which also owns a large senior-focused healthcare portfolio, is selling for 13.3x (adjusted) funds from operations, also based on 4Q23 run-rate FFO.

Omega Healthcare Investors, however, had a pay-out ratio in the mid-90s in 2023. I don’t think that OHI is poised for a dividend cut either and I own both REITs in my passive income portfolio.

Risks with LTC Properties

If LTC Properties runs into trouble with some of its operators, the present level of FFO leaves no margin of error in the short-term, meaning a delay in rent payments could force the pay-out ratio to rise above the 100% threshold which would make the dividend less sustainable from a coverage angle. Additional asset sales might also hurt the trust’s short-term FFO performance.

A dividend cut, of course, would be the worst possible outcome for the investment thesis here.

My Conclusion

Despite the increase in the FFO-based pay-out ratio to 100% in the fourth quarter I think that LTC properties is well-positioned to participate in the growth of the underlying senior healthcare market, particularly as it relates to senior living facilities that cater to the advanced-age needs of the elderly population.

I think that LTC Properties will be able to return to a lower FFO-based pay-out ratio throughout the year as it reinvests proceeds from pending asset sales into new income-producing facilities.

Thus, I am not concerned about the dividend and think that the value proposition for this 7.2% yielding, monthly-paying healthcare trust is very solid for passive income investors.

Read the full article here