The Vanguard Information Technology ETF (NYSEARCA:VGT) is down over 7% over the past three weeks, which is equivalent to around 10 years of the ETF’s dividend yield. VGT has underperformed the return on cash since its 2021 peak, which marks a two and a half year period of zero excess returns, which included a 38% interim decline. The failure of the surge in investor sentiment surrounding the AI boom to drive meaningful risk-adjusted returns reflects the extreme valuations that undermine income, particularly compared to the high rates on cash, and create asymmetric downside risks. With rate cut expectations in retreat and the uptrend having ended, another significant decline should be expected.

The VGT ETF

The Vanguard Information Technology ETF seeks to track the investment performance of the MSCI US Investable Market Information Technology 25/50 Index, an index of stocks of large, medium-size, and small U.S. companies in the information technology sector, as classified under the Global Industry Classification Standard (GICS). The VGT’s is the largest ETF that targets the IT sector specifically, and offers a low expense ratio of 0.1%. Three stocks represent 45% of the index, led by Microsoft (MSFT), Apple (AAPL) and Nvidia (NVDA), with weightings of 18%, 15%, and 12%.

Apple’s Decline And Nvidia’s Rise Have Raised The PE Multiple To New Highs

The fund invests no more than 25% of its assets in any one security, and at least 50% in securities that each represent no more than 5% of the fund’s assets. Each 25/50 index is rebalanced quarterly as a float-adjusted, market-capitalization-weighted index. Since my previous article on the VGT in June last year, the composition of the index has changed dramatically, most notably with Apple’s share declining by around 8 percentage points, largely at the expense of Nvidia’s rise. Due to Apple’s cheaper valuations relative to Nvidia, this has had the effect of raising the PE ratio of the VGT’s underlying index, which now at 43x compared with 35x last June.

VGT Trailing PE Ratio (Bloomberg)

With a dividend yield of just 0.7%, the weakness in the ETF seen over the past three weeks from its March peak has wiped out the equivalent of 10 years of dividend income, bringing the VGT’s returns relative to cash back below its 2021 highs. For an asset that has seen a 38% decline over this period, this is a poor performance, and comes despite widespread optimism surrounding earnings growth related to AI. This highlights the risk of investing in stocks with extremely high duration as a result of extremely expensive valuations.

Rising Yield Pressure Suggests Another Large Correction Should Be Expected

If investors require a 10% annual total return on tech stocks in line with the long-term returns on the S&P500, this means they will have to grow dividends by 10-0.7=9.3% indefinitely. Even a 9.0% perpetual growth rate, the ETF’s fair value falls by 30%, while an 8.0% growth rate puts the fair value 65% below current levels. Fair value is of course highly sensitive to required rates of return, and it could be argued that the relative safety of the stocks in the index, due to their monopoly power, means that investors require a lower rate of return. However, with long-term investment grade bonds now yielding almost 6%, it is difficult to imagine investors requiring long term returns less than a few percentage points above this.

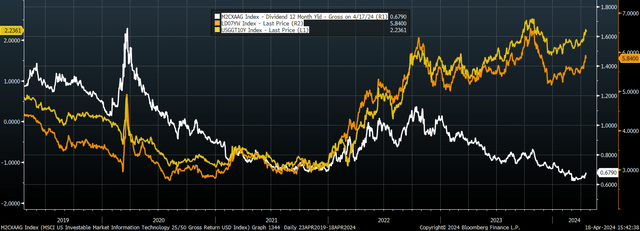

Current market conditions are reminiscent of previous periods when investors have suddenly required significantly higher return prospects resulting in sharp selloffs. As the chart below shows, the VGT has been sensitive to sharp rises in real Treasury yields and credit spreads in recent years, and both of these have begun trending higher as Fed easing expectations are being wound down.

VGT Dividend Yield, US 10-Year TIP Yield, And Long Term Corporate Bond Yield (Bloomberg)

The break of the uptrend from the October 2023 lows have shifted the technical outlook considerably, and the break below the February 21 low brings the pivot area at $466 into focus. Another peak to trough fall of 38% would put the VGT down at $334, and if this seems aggressive, keep in mind that this would drive up the dividend yield to around 1%, still 1.2pp below the real yield on USTs compared to 10-year average of 0.8pp above.

VGT ETF Price (Bloomberg)

Renewed AI Optimism Poses Upside Risks, But Downside Asymmetry Dominates

While I believe the risk-reward outlook facing the VGT is as poor as any market globally at this time, there are still potential catalysts that could drive the ETF higher. Both MSFT and AAPL are set to release earnings over the next few weeks, and any positive surprises could reignite investor sentiment regarding the potential for AI-driven growth. Another leg higher in Nvidia’s stock, which has been the key driver of the VGT in recent months, also cannot be ruled out. That said, current valuations, rising bond yields, and weakening price action suggest the path of least resistance for the ETF is lower.

Read the full article here