Thesis

We covered the BlackRock Flexible Income ETF (NYSEARCA:BINC) shortly after its inception almost a year ago. In our original piece, we described the new fund and the intent of the asset manager in a macro environment that was favorable to fixed income funds. We are going to re-visit this name close to its 1-year anniversary, and on the back of a violent upwards swing in rates in the past few weeks.

In our article, we are going to highlight why today’s environment is ideal to undertake a long position in BINC.

The market is pricing out Fed rate cuts

In the past few weeks, we have seen a violent re-pricing in rates:

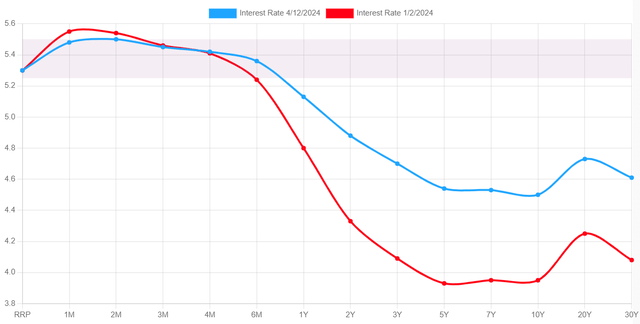

Yield Curve (ustreasuryyieldcurve.com)

The blue line in the above graph represents the current yield curve, while the red line represents the curve at the beginning of the year. Please note that above the 4-month tenor all points in the curve are much higher, especially in the so called ‘belly’ of the curve, which are the tenors from 2 years to 10 years.

Why has the yield curve moved up? Simple. Data has been much stronger than expected and inflation has moved slightly up rather than down. The market has moved from pricing in six rate cuts in 2024 to only one or two, depending on the investment bank making said forecast.

It is fascinating how fast market participants can move from one extreme to the other during a short period of time. While six cuts at the beginning of the year seemed much, no cuts for 2024 also represents another extreme in our view. Strangely, we have also seen a resurgence of participants talking about rate hikes and a 6% yield figure. We are in the camp of no further rate hikes, with the Fed being quite clear about that, and the political implications for further raising rates in an election year being unfathomable. Our base case is one cut in the summer, with the Fed staying pat for the rest of the year if data is still strong. In this base case, the Fed shows its intent to cut, while at the same time still maintaining high rates and a restrictive policy overall.

Bond funds are attractive, especially active ones

In today’s environment, bond funds are attractive given the significant move in rates, especially for long-term buy and hold investors. BINC stands out from the pack given its multi-sector portfolio and active approach to its holdings. Active funds can readily trade in and out of specific issuers and names as corporate actions develop, and a large asset management platform like BlackRock provides for an optimal base.

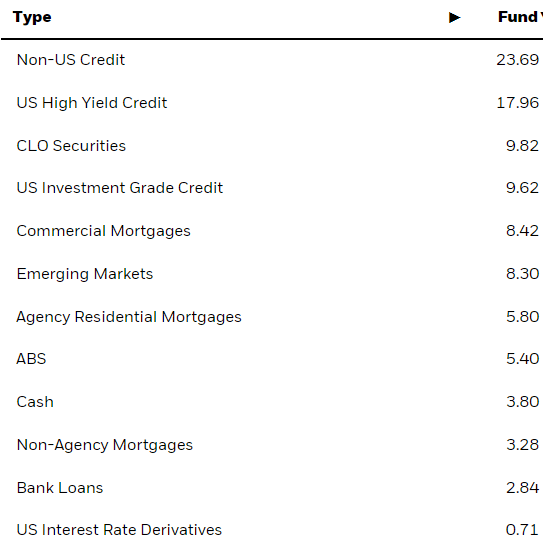

The fund currently has a large bucket dedicated to EM credits and CLOs beside traditional U.S. high yield:

Holdings (Fund Website)

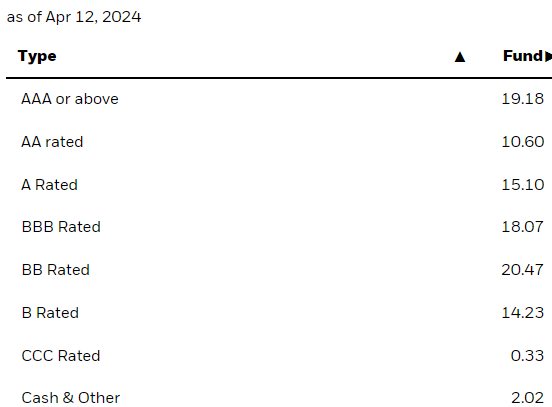

As a true multi-sector ETF, the vehicle takes positions across the credit spectrum, with a quasi-even distribution:

Ratings (Fund Website)

AAA names represent 19% of the fund (mostly MBS bonds), with the rest of the credit rating bands alternating between 10% and 20%. Please note that approximately 35% of the holdings are below investment grade.

The fund has a broad mandate and can switch its focus and positioning as the portfolio managers see fit.

High total return, low risk

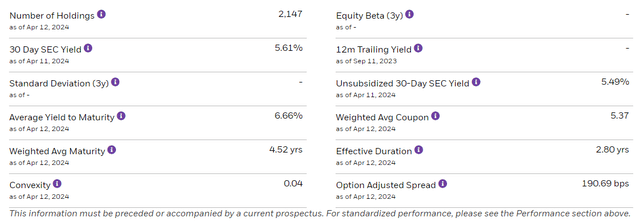

The beauty of actively managed bond funds is that they do not need to provide for eye-watering yields in order to deliver. BINC has a 5.49% SEC yield, yet it has managed to provide a total return exceeding 7% in the past year:

BINC Total Return (Seeking Alpha)

It is interesting to note that since inception, BINC has outperformed another bond fund favorite, namely the JPMorgan Income ETF (JPIE). We have covered JPIE here with a Buy rating. BINC has delivered almost 2% of ‘alpha’ via the trading acumen of its portfolio managers, despite the recent spike in yields.

The fund has a low duration of only 2.8 years and an OAS of 190 bps:

Yield and Duration (Fund Website)

After almost a year of performance history, we can say that the management team at BlackRock is doing a tremendous job, and in addition to yield and duration, the fund will be providing market alpha as well.

On the risk side, BINC has also delivered a stellar performance:

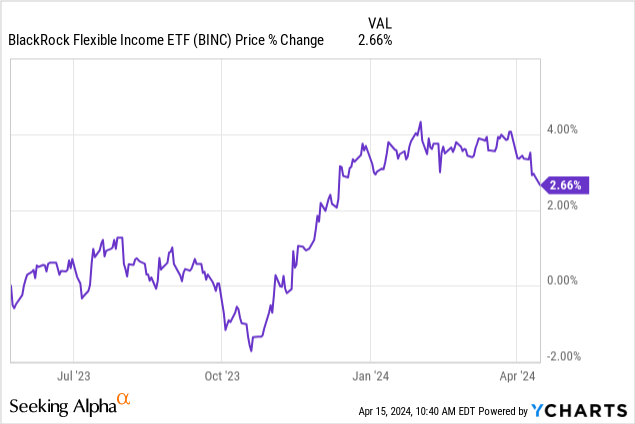

If we chart its performance, we will notice BINC has had a very shallow -2% drawdown since inception. The fund thus created a total return in excess of 7% with only a 2% drawdown. Those risk/reward figures are enviable, with many bond funds having done significantly worse. An active fund management is key to risk management, with portfolio managers being able to steer the fund towards the assets that are most viable at any point in time.

When looking at fixed income, an investor has to pay attention to drawdowns. It does not make sense to buy an asset that yields 8% but has -25% drawdowns. The risk/reward is not there. Conversely, an asset yielding 8% but with a -10% drawdown is appealing, while BINC is a home run with its risk/reward analytics.

What does the future hold for BINC

We like the fund and its construction, and its active management. From a pure bond math perspective, an investor should expect the 5.5% yield plus another 2.5% from duration in the next twelve months. Given the outsized active management results, we are going to add another 1.5% from alpha generation, thus penciling in a total return exceeding 9.5% in the next twelve months, all while the drawdowns will be limited.

We are basing the above expectations on our rates base case, which was outlined in the first section of the article. If we see a sudden deterioration in economic data and the Fed is forced to cut faster and deeper, BINC is set to benefit. Some of the duration impact in that case though will be offset by a widening in credit spreads.

Conclusion

BINC is a fixed income ETF. The fund comes from the BlackRock platform and represents an active approach to multi-asset bond ETFs. The vehicle has delivered a total return in excess of 7% in the past year, despite the recent spike in yields. BINC has thus managed to generate alpha from its active management, and has outperformed JPIE. We expect BINC to continue to outperform and generate market alpha in excess of its yield and duration components. Given the recent spike in yields, we find the current macro environment to be ideal to take a long position in BINC, with a 9.5% total return penciled in for the next 12 months.

Read the full article here