Viper Energy (NASDAQ:VNOM) is now projected to generate $3.76 per share in free cash flow at current strip prices for 2024. This is a $0.26 per share increase compared to when I looked at it in January, helped mainly by stronger oil prices. Approximately 56% of Viper’s production is oil, and it has full participation in increasing oil prices until oil reaches the mid-$90s.

Viper also boosted its total production guidance for 2024 by 1,000 BOEPD and it should benefit from Diamondback’s massive Endeavor deal resulting in future dropdown opportunities.

That being said, I have moved to a neutral position on Viper now given that it has gone up by 30% since my January report. It appears fairly priced for a high-$70s long-term WTI oil environment now.

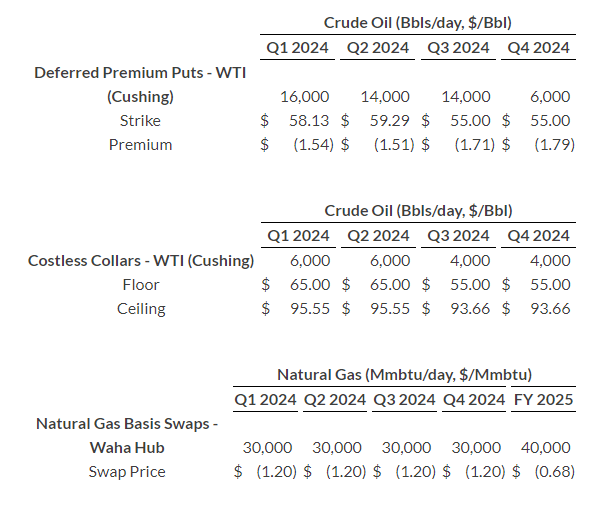

Hedges

Viper’s oil hedges don’t really have much of an effect on its financial results, except for the $7 million in deferred put premiums that it needs to pay. Viper has some protection against a major drop in oil prices (generally into the $50s), while it has a ceiling affecting 17% of its projected oil production from Q2 2024 to Q4 2024. That ceiling averages in the mid-$90s, though, so strip prices could basically go up $10+ before Viper’s upside exposure to oil pricing is reduced. Viper currently has no oil hedges beyond 2024.

Viper’s Hedges (viperenergy.com)

Viper also has around 48% of its natural gas production hedged with Waha basis hedges. The Waha hedges are at negative $1.20 to NYMEX for 2024, which appears to be slightly unfavorable for the year as a whole, but provides some near-term production with prompt contract Waha basis differentials reaching negative $2. Viper’s 2025 Waha basis hedges are at negative $0.68 to NYMEX, 52 cents better than its 2024 hedges.

2024 Outlook And Notes On Valuation

Viper kept its oil production guidance for 2024 at 25,500 to 27,500 barrels of oil per day, but increased its total production guidance by 1,000 BOEPD to a new range of 45,500 to 49,000 BOEPD.

WTI oil strip prices have improved to approximately $82 for 2024, although Henry Hub is down to $2.40. At those commodity prices, Viper may be able to generate $937 million in revenues after hedges.

|

Type |

Barrels/Mcf |

Realized $ Per Barrel/Mcf |

Revenue ($ Million) |

|

Oil (Barrels) |

9,672,500 |

$81.00 |

$783 |

|

NGLs (Barrels) |

3,786,875 |

$24.00 |

$91 |

|

Natural Gas (MCF) |

22,721,250 |

$1.40 |

$32 |

|

Lease Bonus and Other Income |

$40 |

||

|

Hedge Value |

-$9 |

||

|

Total |

$937 |

Viper is now expected to generate $665 million in 2024 free cash flow, including the free cash flow attributable to Diamondback’s non-controlling interest in Viper.

This adds up to approximately $3.76 per share in projected 2024 free cash flow.

|

$ Million |

|

|

Production and Ad Valorem Taxes |

$63 |

|

Cash G&A |

$16 |

|

Cash Interest |

$69 |

|

Cash Taxes |

$124 |

|

Total Expenses |

$272 |

With Viper’s 75% payout ratio, that results in a projection of $2.82 per share in shareholder returns for 2024, or an average of $0.70 to $0.71 per share each quarter.

Viper’s base quarterly dividend is $0.27 per share. It spent $95 million on share repurchases in 2023. If it spends $100 million on share repurchases in 2024, that would allow it to pay out around $2.26 per share in base plus variable dividends in 2024, or a quarterly average of $0.56 to $0.57 per share.

I’ve bumped up my estimate of Viper’s value by $2 per share to $37 to $38 per share at long-term (after 2024) $75 WTI oil. This reflects the expectation for improved 2024 free cash flow as well as Viper’s production guidance being moved upward a bit.

Diamondback’s Endeavor deal is also likely to open up some more opportunities for Viper in the future. I have not attributed value for that yet though, and will revise Viper’s estimated value based on future dropdown deals as they are announced.

Conclusion

Viper Energy is now expected to generate $665 million in 2024 free cash flow, or approximately $3.76 per share. It has full exposure to oil price upside until the mid-$90s, so it has benefited from the recent increase in oil strip prices.

Viper’s production guidance for 2024 also increased a bit from its preliminary estimates. While it did not increase its oil production guidance, its total production guidance went up by 1,000 BOEPD.

I now believe that Viper Energy is close to fairly priced for a long-term $75 WTI oil environment. I’ve bumped up its estimated value at that long-term oil price to $37 to $38 per share.

Viper is trading at slightly above that, reflecting more of a long-term high-$70s oil environment or 2024 production at the high-end of its guidance. Viper’s value could also be boosted through drop-down deals involving the Endeavor assets, although I have not really factored that into Viper’s current estimated value. I now have a neutral rating on Viper due to its share price rising 30% since January.

Read the full article here