Investment Overview

Elevance Health (NYSE:ELV) will announce its Q1 2024 earnings next Thursday, April 18th ahead of the market open. When I last covered the company for Seeking Alpha it was July 2020, and Elevance – then known as Anthem – stock was trading at $271 per share. I gave it a “Buy” rating.

At that time, Anthem’s stock price was being buffeted by pandemic headwinds, and most of the market believed the business, provided these headwinds eased, was undervalued. That proved to be the case – Elevance stock today is worth >$500 per share, and up nearly 90% since my “buy” call from 2020.

Where might the share price be headed next? In this earnings preview, I’ll try to answer that question by taking a deeper dive look “under the hood” of Elevance’s business.

From Share Price Peak To Present Day – Elevance Stock, Climbs, Peaks, Plateaus

Elevance achieved its highest share price of nearly $550 in October 2022, shortly after the company raised its full-year 2022 guidance, citing robust performance, with Q3 revenues coming in at $39.6bn, and a medical benefit ratio – which is essentially healthcare costs paid divided by total premiums received – of 87.2%.

One year on from that, Elevance reported Q3 2023 revenues of $42.5bn – up 7% year-on-year – and a benefit expense ratio of 86.8% – a 40 basis point annual uplift. The company’s total operating margin fell slightly year-on-year, however, from 6.1% across the first nine months of 2022, to 5.6% across 2023 to the end of Q3. Its share price fell in value to ~$450 per share.

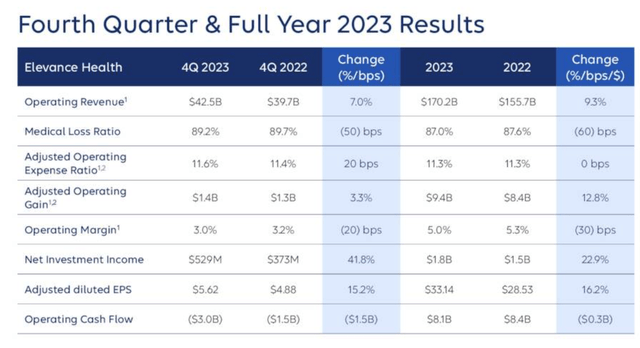

Management blamed “medical cost trend on higher levels of post-pandemic care”, for the operating margin miss, but if we take a look at 2023 earnings as a whole, we can see a trend of improvement across numerous metrics, including the 60 basis point improvement in medical loss ratio, and higher EPS of $33.14, albeit on an adjusted basis.

Elevance 2023 earnings overview (Elevance presentation)

These results – released at the end of January this year – seemed to trigger a mini-revival in the share price, which has climbed >$500 again, despite a relatively modest set of FY 2024 guidance, as shown below:

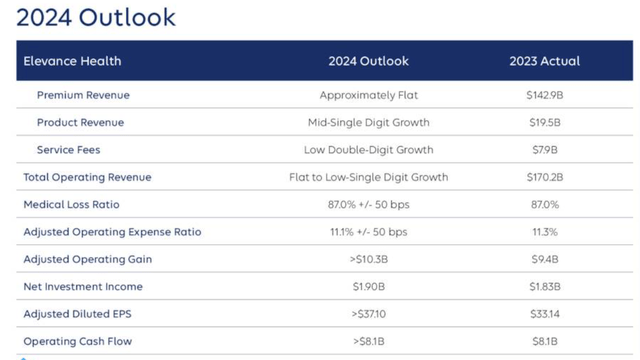

Elevance 2024 guidance (earnings presentation)

In fairness to Elevance, management is promising annual improvement across many metrics – overall revenues, net income, and earnings per share (“EPS’), and has been able to guide for the same medical loss ratio as last year, at a time when most health insurers are seeing margins shrink, owing to higher overall medical costs.

Elevance Dodges Worst Of Medicare Advantage Rate Fallout

The worst hit part of the health insurance sector at present is Medicare Advantage. Once believed to be the future of healthcare for the over-65s, Medicare Advantage plans are administered by private health insurers on behalf of the government, and offer unique extras such as dental care, and fitness programs.

Health insurers are paid a fee per plan administered and calculated by the Centers for Medicaid and Medicare Services (“CMS”), based on historic costs of administering care in different parts of the US. The CMS also awards all plans a star rating of 1-5, and offers additional bonuses to insurers based on how many of their members are in plans rated 4 stars and above.

As I wrote recently in a Seeking Alpha note on rival health insurer Humana, which has massive exposure to Medicare Advantage (“MA”):

Apparently, >30m Americans now have MA plans, which come with additional benefits, such as eye and hearing exams, fitness and dental plans, telehealth services, meal benefits, and even acupuncture. With that said the plans also come with certain drawbacks, such as not being able to visit physicians who are “out of network,” and a rising trend of claims being denied by insurers, or being settled only after lengthy delays.

What is not in doubt is that traditionally, MA plans have been highly lucrative for health insurers, and for brokers that sell healthcare plans. Research shows that gross margins for MA plans are twice that of ordinary plans, while private plans cost the government – and, therefore, the tax payer – on average 4% more that standard plans.

The good thing for Elevance shareholders, now that the CMS is pushing back against MA rate rises and attempting to claw back tax payers money – is that the company has a relatively low exposure to MA. Of the 47m medical plan memberships on its books, only ~2m are MA plans, and that number rose just 4% year-on-year.

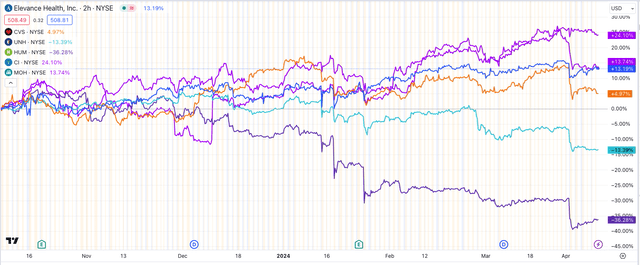

Share prices of different health insurers compared (TradingView)

As we can see above, when the CMS announced a week ago that it would not be raising MA plan payment rates from the 3.7% stipulated earlier in the year, most health insurers’ stock prices fell sharply. Elevance’s did fall, but not as significantly as the likes of Humana (HUM), CVS Health (CVS), and UnitedHealth (UNH), who have the highest exposure to MA. Across the past 6 months Elevance stock is +13%, while CVS, UnitedHealth, and Humana stock is +4.5%, -14%, and -36% respectively.

Essentially, the health insurance market has to a certain extent been flipped on its head, with MA plans suddenly squeezing margins, as opposed to widening them. Elevance’s more traditional and diverse range of healthcare plans are allowing it to maintain and even improve an already impressive medical loss ratio, while e.g. Humana’s ratio climbs >90%, and CVS reported a jump from 85.5%, to 88.5%, in Q4 2023.

With that said, Elevance – like Humana – still sees long term benefit in the MA industry, but is not prepared to undertake a “race to the bottom”, offering lower and lower plan premiums in order to bolster membership numbers. Elevance CEO and President Gail Boudreaux told analysts on the Q4 2023 earnings call with analysts:

Unfortunately, pockets of the Medicare Advantage market have remained hyper competitive despite a more challenging funding environment. While our plans continue to offer attractive and valuable benefits, we took intentional actions as part of our 2024 bid strategy to address product sustainability, and as such, we experienced greater-than-expected attrition in certain markets.

As a result, we expect our Medicare Advantage membership to be roughly flat in 2024 on an organic basis, but earnings to improve. Importantly, cost trends in our Medicare Advantage business continued to develop as we expected, and we are confident that the assumptions underlying our bids for 2024 are appropriate.

Elevance clearly retains an interest in the MA market, even if its 2m members are dwarfed by UnitedHealth’s ~9m members, and Humana’s ~6m – while CVS has grown to 3.3m members, adding >500k new members in the 2024 open enrollment period which has recently ended. Elevance may have to improve the level of service it is offering, however – according to Elevance’s 2023 annual report / 10K submission:

Based on our membership at September 1, 2023, 34% of our Medicare Advantage members were in plans with 2024 Star ratings of at least 4.0 Stars, compared to 64% of our Medicare Advantage members being in plans with 2023 Star ratings of at least 4.0 Stars based on our membership at September 1, 2022.

This change in our 2024 Star ratings is expected to impact our Star quality bonus payments and plan level rebates beginning in 2025. We expect a reduction to our 2025 operating revenue of approximately $500 million, net of offsets from contracting provisions.

Elevance – After A Year Of Progress, A Year Of Consolidation Beckons

The market is educated to believe that Elevance is a classic blue chip, dividend paying healthcare giant whose share price is resistant to volatility, making buying similar to buying a fixed-interest security, but that would not be entirely true.

At current price, Elevance’s dividend of $1.62 per share offers a yield – at current share price of $509 – of just 1.3%. As an additional fillip to investors, the company completed $2.7bn of share repurchases in 2023, although it seems there are no more programs ongoing at this time.

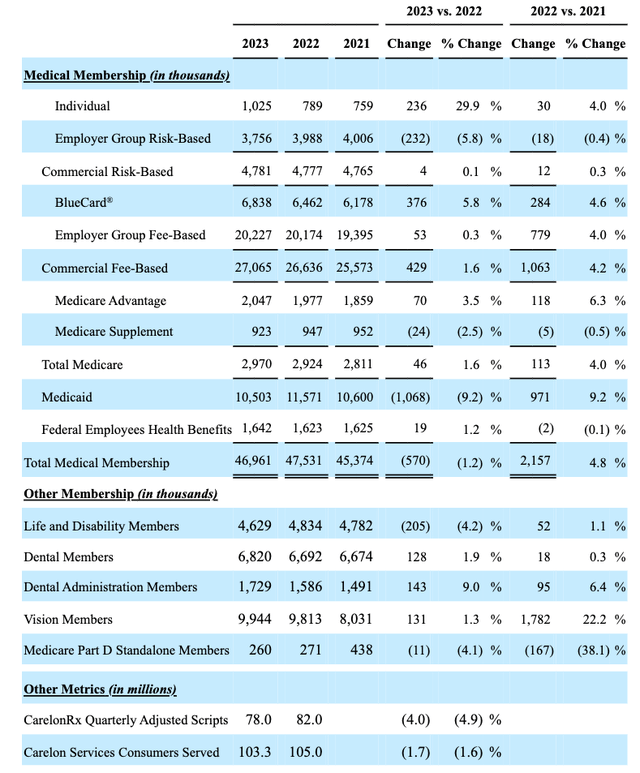

Elevance membership by category (Elevance 10K submission 2023)

As we can see above, Elevance has some 27m commercial, fee based members, ~3m Medicare members, and 10.5m Medicaid members, however revenues reported in 2023 were $43.3bn from commercial, $35bn from Medicare, and $56.6bn from Medicaid, with Federal Employees Health Benefit (“FEHB”) customer revenues contributing $13.64bn.

On top of these revenues, which come to $148.6bn, Elevance adds revenues from its Carelon Rx division, which “markets and offers pharmacy services to our affiliated health plan customers”, arranging 78m scripts in 2023, the company says (down 4% year-on-year), and Carelon Services, which offers a “broad array of healthcare related services and capabilities to internal and external customers”, and served 103m customers in 2023 – down ~1.7% year-on-year.

Operating revenues grew by >9% year-on-year in 2023, to $170.2bn, with the Health Benefits segment increasing operating margin from 4.3% in 2022, to 4.6% in 2023, Carelon RX’s margin decreasing to 5.8%, from 6.5% (likely due to government pressure on drug pricing negotiations), and Carelone Services’ margin rising to 4.8%.

While Elevance is guiding for an operating gain of >9% year-on-year in 2024, it is also expecting membership numbers to shrink overall, to 45.8 – 46.6m members. Management expects Medicaid membership to fall by ~930k members in 2024 due to administrative issues caused by “changes in our footprint” (although there is confidence these members will return in time), while commercial membership is expected to grow by >750k, with Medicare Advantage membership remaining flat.

In summary, 2023 was a reasonably strong year for Elevance, with good and bad elements. On the plus side, the company has been able to focus on building out its strategy with Carelon, and changing its overall reporting strategy to position Carelon at the centre of its operations. It has delivered operating revenue growth and increased its medical risk ratio margin.

On the more negative side, it has lost members year-on-year, and been buffeted slightly by issues around Medicaid enrollment and Medicare Advantage plan pricing.

Looking ahead to 2024, management has referred to this year as a “reset year”, with CEO Boudreaux telling analysts on the Q4 2023 earnings call:

We anticipate that our health benefits business is going to continue to grow in 2025 after a reset year in 2024. We should see an accelerated impact to that growth, which will drive revenue for Carelon.

I think we feel that we’ve positioned our business very prudently and that the balance and resilience of our enterprise and our earnings power of our health benefits in Carelon together gives us a lot of confidence in our ability to achieve our long-term targets.

According to its Q4 2023 earning presentation, the company’s strategic priorities are focused on:

margin recovery of our commercial risk-based business, the strategic repositioning of our Medicare Advantage plan offerings in certain markets, continued penetration of Carelon Services capabilities in our health plans, and transformation of our cost structure.

Concluding Thoughts – Would I Make Elevance A “Buy”, “Sell”, or “Hold” Ahead of Q124 Earnings?

As discussed, by most measures Elevance enjoyed a strong 2023, results wise, across most metrics other than overall membership growth. While memberships may fall again in 2024, management is confident that growth is possible in 2025, and is positioning itself accordingly, while bottom line improvement has been promised for 2024 – management’s guidance for EPS of $37 in 2024 translates to a forward price to earnings ratio of ~14x.

Meanwhile, the operational focus will be on improving the commercial and medicare elements of the business, and using Carelon to optimise margins and bring members back.

With its limited exposure to MA plan markets, Elevance may perform better in 2024 than several peers with a higher exposure, such as Humana, CVS Health, and UnitedHealth, although I would argue that firstly, this reduced exposure to turbulent MA markets is already priced in, and longer-term, it’s clear that Elevance will re-focus on MA when it feels it has its strategy right.

Elevance’s share price, after making solid gains from 2020 to the beginning of 2023, remained flat or down for the majority of last year, however its current share price of $514 is close to an all-time high.

Thinking about Elevance’s current market cap of ~$120m, it is close to 4x the value of Humana’s $38.5bn market cap, yet Humana’s revenues in 2023 were $106m, compared to Elevance’s $171bn, and its net income ~$2.5bn, compared to Elevance’s ~$6bn. Meanwhile, CVS Health’s market cap of $93bn is lower than Elevance’s, yet its revenues of $358bn were >2x higher than Elevance’s, and net income of $8.35bn also substantially higher.

In short, the health insurance market provides a somewhat confused picture at the present time, with an overriding focus on what is happening within the MA market influencing current stock prices and valuations arguably more so than actual performance and management guidance.

Ironically, my suspicion is that this scenario may favour companies that have a higher exposure to MA, and whose stock prices have already undergone a more significant correction, than companies like Elevance whose core focus lies elsewhere.

Elevance will doubtless show compelling profitability and revenue growth in 2024, maintain margins and potentially achieve EPS of $37 per share on a non-GAAP basis, but will this be enough to drive share price gains?

Looking past these numbers, the lack of membership growth in 2024, including falls in Medicaid and flat MA growth, may damage Elevance’s share price and valuation in 2024 as the market digests a year of consolidation, not growth.

As such, with a dividend yielding <1.5%, and having experienced a quick recovery from the recent market sell-off related to MA plan pricing, yet set for a potentially underwhelming year, if I were holding Elevance I’d be tempted to consider selling, and moving my money to a company that is positioned to do a little bit more with it in 2024.

I don’t have any doubts that Elevance has the capabilities to achieve a higher valuation and perhaps a share price >$600 one day, but during a year of consolidation, it may be reasonable to also expect a year of downward share price drift, with earnings not quite living up to the premium price Elevance stock now trades at.

Read the full article here