Nektar Therapeutics (NASDAQ:NKTR) has an interesting drug in its pipeline, rezpegaldesleukin (rezpeg), that has the potential to treat inflammation in a new way. The company is underway on a large study in atopic dermatitis, and recently announced it had initiated enrollment in another study in alopecia areata. This article takes a look at that data, the trial design and the timeline of readouts.

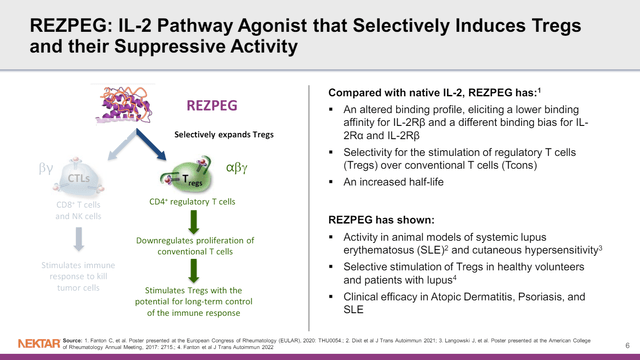

Rezpeg stimulates regulatory T Cells

Rezpeg is a modified form of interleukin-2 (IL-2) designed to activate the IL-2 receptor found on regulatory T-cells (which contains alpha, beta, and gamma subunits), but not the IL-2 receptor on cytotoxic T-cells or NK cells (which contains beta and gamma subunits).

Figure 1: Mechanism of action for rezpegaldesleukin. (NKTR Presentation, March 2024.)

By activating the regulatory T-cell, it is possible to reduce the function of multiple other inflammatory cell types as a means of addressing inflammation. This differs from more conventional means of addressing inflammation that instead involve targeting pro-inflammatory T-cell types or inflammatory cytokines and other mediators directly.

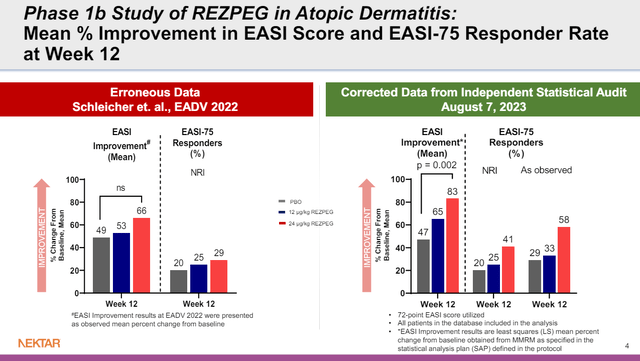

NKTR was previously developing rezpeg with Eli Lilly and Company (LLY), running phase 1b studies in atopic dermatitis and psoriasis, among other studies. LLY has since terminated their agreement, after which NKTR discovered some incorrectly calculated data from the analysis of the phase 1b atopic dermatitis and psoriasis studies. The corrected data paint a stronger picture of the potential of rezpeg, certainly in atopic dermatitis (see figure), so it isn’t surprising NKTR is keen to continue development of the drug.

Figure 2: Comparison of data in terms of mean EASI improvement and proportion of patients achieving EASI-75, before and after correction of data. (NKTR presentation, August 7, 2023.)

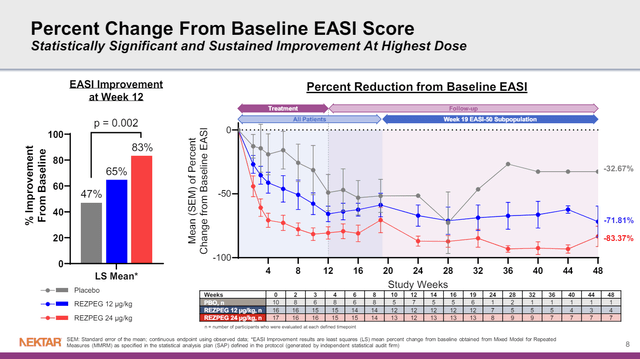

To look further into that phase 1b data, since NKTR is now running a much larger phase 2 study of rezpeg in atopic dermatitis, the plot of Eczema Area and Severity Index (EASI) scores over time is of value. That study had 10 patients in the placebo group at baseline, 16 patients in the 12 ug/kg rezpeg arm, and 17 patients in the 24 ug/kg rezpeg arm. I find it most useful to look at the difference between arms of the study during those first 12 weeks, as there is more data in that time period.

Figure 3: Plot of Eczema Area and Severity Index scores over time (right panel), or percentage improvements from baseline at week 12 (left panel). Lower table notes the number of participants who were evaluated at each timepoint. (NKTR Presentation, March 2024.)

After 12 weeks of treatment, patients entered a follow-up period where they were no longer being treated. After week 19, however, the follow-up is only in patients who achieved a 50% improvement in EASI scores (EASI-50). That’s based on the design of the study, where those who did achieve an EASI-50 response weren’t part of the follow-up beyond 19 weeks, so you couldn’t plot their data anyway. As such, I wouldn’t fault NKTR for the above figure, but it is worth pointing out. For example, note the red line in the figure, the higher dose group of rezpeg. The line trends up between 16 and 19 weeks, perhaps with the drug being stopped at week 12, its effects are now wearing off. Then the line drops from 19 to 24 weeks, but so does the number of patients that such a point is calculated from (n = 13 at week 19, n = 8 at week 24). Still, if those 8 or so patients are followed (look at the red line from week 24 to week 48) their mean reduction in EASI score from baseline remained fairly striking.

In terms of safety, the phase 1b data showed a numerically increased rate of infestations and infections with rezpeg treatment compared to placebo, but there were no serious or severe adverse events.

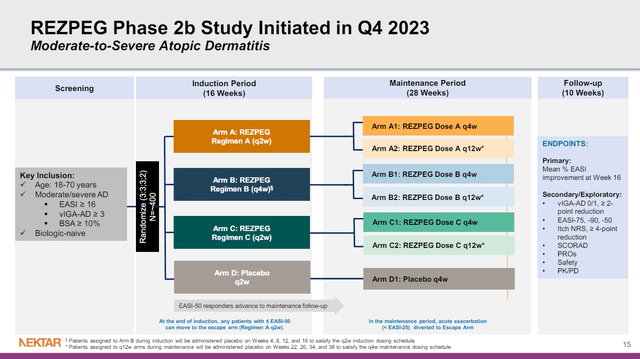

A phase 2 study of rezpeg in atopic dermatitis

As for the phase 2 study of rezpeg in atopic dermatitis, NKTR is looking at multiple doses, dose intervals and maintenance dosing. Certainly, the ability to maintain therapeutic benefit with once every 12 week dosing would provide an obvious marketing advantage to other drugs being dosed every two or four weeks.

Figure 4: Design of NKTR’s phase 2 study of rezpegaldesleukin in atopic dermatitis. (NKTR Presentation, March 2024.)

A 3:3:3:2 randomization means that out of 400 patients, about 72 would be randomized to placebo, so even in the smallest arm, we won’t be dealing with the numbers we saw in the phase 1b study that make interpretation more difficult. NKTR currently expects to report data from the study in H1’25.

A phase 2 study of rezpeg in alopecia areata

In alopecia areata, the immune system attacks the hair follicle, leading to hair loss. NKTR has initiated a phase 2 study randomizing 84 patients with severe to very severe alopecia areata to rezpeg in two doses or placebo. NKTR also expects to report results from the phase 2 alopecia study in H1’25. Regarding the timing of the readouts from the two phase 2 studies of rezpeg, it looks like data from the atopic dermatitis data would come before the alopecia data.

… So atopic dermatitis will actually come first, in the first half, and then alopecia we believe will read out, you know, a month or so, or maybe two months after that.

Jennifer Ruddock, CBO at NKTR, HC Wainwright & Co 2nd Annual Autoimmune & Inflammatory Disease Virtual Conference, March 28, 2024.

There is near-term data from NKTR-255

NKTR-255 is an IL-15 receptor agonist that may help the immune system fight cancer. Based on an overview of catalysts ahead, it seems like interim data is expected from the Javelin Bladder Medley study in H2’24. That study looks at Merck KGaA’s (OTCPK:MKGAF; OTCPK:MKKGY) Bavencio (avelumab, an anti-PD-L-1) alone in urothelial carcinoma vs. Bavencio in various combinations. One of the combinations tested is Bavencio plus NKTR-255.

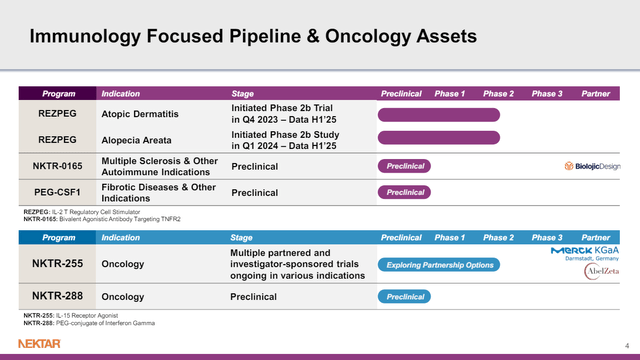

Figure 5: NKTR Pipeline. (NKTR Presentation, March 2024.)

Of course, the problem is there is no way to tell if NKTR-255 will improve the efficacy of avelumab. Even if it does, there are two other drugs, Gilead Sciences (GILD) sacitzuzmab govitecan (Trodelvy, an antibody-drug conjugate) and M6223 (an anti-TIGIT antibody), being trialed in combination with avelumab. Notably, Trodelvy is already known to be active in urothelial carcinoma, achieving accelerated approval in that certain urothelial cancer patients in 2021. Further, other anti-TIGIT antibodies have shown promise in combination with anti-PD(L)-1 antibodies, and this is mentioned as part of the rationale for testing the combination of avelumab and M6223. If NKTR-255 can outperform these agents, then it will be a huge win, but I find that hard to predict with little to examine in terms of the activity of NKTR-255 in urothelial carcinoma.

Financial Overview

NKTR finished 2023 with cash, cash equivalents and short-term investments of $303.6M. The company also had a further $25.8M in long-term investments on the balance sheet, bringing total cash and investments in marketable securities to $329.4M as of December 31, 2023. NKTR reported revenues of $23.9M in Q4’23, with R&D expense of $29.9M and G&A expense of $17.3M in the same quarter. Net loss for Q4’23 was $42.1M and net cash used in operating activities was $192.6M.

On March 4, NKTR announced it was selling 25M shares worth of pre-funded warrants as part of a private placement to raise $30M in gross proceeds. Adding that to NKTR’s cash and investments, I’d assume pro forma cash and investments of about ~$360M (not considering expenses associated with the offering). NKTR then would have 7-8 quarters of cash runway at the 2023 rate of burn, so could make it to the end of 2025. The 2023 rate of burn might be aggressive for cash burn calculations, however, as NKTR initiated a restructuring in April 2023. NKTR’s guidance then, of cash lasting into Q3’26, likely accounts for that.

There were 183,617,817 shares of NKTR’s common stock outstanding as of February 27, 2024, giving NKTR a market cap of $240.5M ($1.31 per share). Adding 25M shares worth of pre-funded warrants, we could come up with a diluted share count of 208M and diluted cap of $273M.

Conclusions, rating, and risks

NKTR’s phase 2 study of rezpeg in atopic dermatitis, given its 400-patient enrolment, and design evaluating less frequent treatments (every 12 weeks), has the potential to confirm that NKTR has a differentiated asset in atopic dermatitis. The alopecia areata study is smaller and will likely read out after the phase 2 in atopic dermatitis study, but does offer another shot at goal with rezpeg which could turn out to be a pipeline in a drug if NKTR has identified the best indications to target.

In the meantime, however, it does look like we are headed to interim data from the Javelin study of various agents in combination with avelumab in urothelial carcinoma. I can’t see a way to make a prediction as to whether or not NKTR-255 will offer any benefit there, and the competition is tough. That does mean that if NKTR-255 looks competitive, NKTR’s stock could rally hugely, but of course, if the interim results aren’t encouraging, I wouldn’t be surprised to see NKTR fall. Right now, I rate NKTR a hold, then. I would look to change that rating to a buy closer to H1’25, where depending on the share price and timely enrolment in the phase 2 rezpeg studies, NKTR could rally on a run-up into results and potentially with positive results. I won’t rate NKTR a sell, even though I can’t make much of a prediction about how NKTR-255 will perform in the Javelin study because NKTR is currently trading below cash, and this could limit any fall in the stock on bad news from that trial.

There are several risks to holding NKTR here, a few of which I’ll mention. The first obvious risk would be that rezpegaldesleukin does not impress in trials in atopic dermatitis and alopecia areata. The drug has failed to hit the primary endpoint before, as it did in a phase 2 trial in Lupus. While there were hints of efficacy in that trial, expectations might be a bit higher in atopic dermatitis. As such, even a positive result, if it doesn’t compare well to existing competition, could see the stock fall.

Secondly, NKTR may see delays in enrolling its studies, leading to catalysts being moved into the future, while the company burns through cash. Such updates in the expected timing of readouts can cause the stock to sell off.

Lastly, NKTR’s other pipeline members, while not a focus of NKTR’s presentations, can produce readouts that cause the stock to fall. Notably, if interim data from a study of NKTR-255 plus avelumab in urothelial carcinoma don’t impress, the stock could fall.

Read the full article here