It hasn’t been a poor start to Q1 2024 for China’s electric vehicle [EV] company NIO (NYSE:NIO), with a dramatic 52% year-to-date [YTD] price fall after it already saw a 7% decline in 2023.

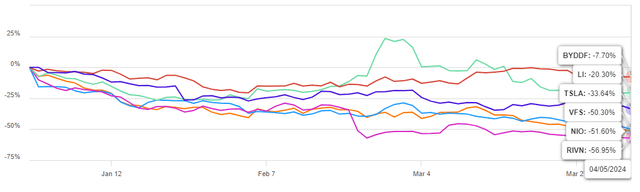

As disappointing as this is, the performance needs to be seen in the context of the sector as a whole. The S&P Kensho Electric Vehicles index has also seen a 7.2% decline YTD. Moreover, all the five biggest EV stocks by market capitalisation have seen far bigger dramatic price drops, indicating that NIO isn’t alone. In fact, NIO’s drop isn’t even the worst, with Rivian (RIVN) seeing an even bigger fall (see chart below).

YTD price returns, 5 biggest EV stocks by Mcap (Source: Seeking Alpha)

However, there are fundamental reasons to be concerned with respect to NIO as well in terms of its deliveries and prospects for Q1 2024 revenues. On the other hand, the company’s pressing forward in improving EV battery technology, which could bode well for it in the future as well. Here, I consider both aspects to assess what could be next for the stock.

Weak February delivery figures drag down Q1 2024 numbers

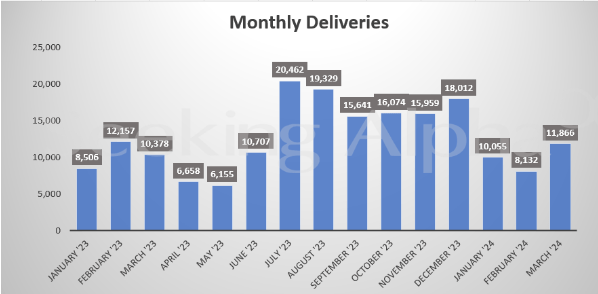

The company’s weak delivery numbers have definitely cast a shadow on what to expect for Q1 2024 revenue growth. The deliveries fell by 3% year-on-year (YoY) in the first quarter (Q1 2024), making it the only other company besides EV biggie Tesla (TSLA) to report a fall.

Source: Seeking Alpha

At the same time, there are two points worth noting here. First, the fall is smaller than the 8.5% seen for Tesla. And second, the decline can be explained by weak performance in February which saw the Lunar New Year. Deliveries during the month slipped by 33%. By comparison, in January and March, deliveries saw healthy growth of 18.2% and 14.3% respectively.

It’s not an entirely satisfactory explanation, though. Other EV companies like BYD (OTCPK:BYDDF) and Li Auto (LI) saw a 13% and 53% increase in deliveries in Q1 2024 by comparison, indicating that demand for NIO’s cars may well be on less solid footing.

Revenue softening more likely than not

Given the delivery trends, it’s unsurprising that the company expects revenues in Q1 2024 to drop by 1.7% YoY in RMB terms (2.2% in USD terms) at the midpoint of its guidance range of RMB 10,499-11,087 million (USD 1,479 – 1,562 million). This compares poorly with an already small 3.8% increase in Q1 2023.

Still, recent past data indicates that there’s some room for optimism. In Q4 2023, for example, the company’s actual revenues exceeded the midpoint of the guidance range of USD 2204-2289 million by 7.2%. If the same was repeated in Q1 2024, NIO would actually see a revenue increase by 4.8% in USD terms instead of contracting.

That said, there’s reduced probability of a surprise upside in Q1 2024 compared to Q4 2023. In Q4 2023, the company had the advantage of a 4.6% YoY increase in deliveries as opposed to a 3% decline now. However, it does indicate that the numbers could turn out better than anticipated.

Long-range battery pack under production

Moving beyond the past quarter, there are certainly positive developments underway for NIO. When I last wrote about the stock, the company’s CEO, William Li, had just marketed its long-endurance battery pack with a 14-hour livestream. Cut to now, and mass production of this battery pack has begun and is expected to be available for purchase from this quarter.

With the battery pack purchase being a pricey one, in line with the price of the company’s ET5 sedan, it will be available only to rent initially. The option of purchasing a car sans the battery pack is a savvy move and can make NIO more competitive. When the company launched this service back in 2020, the upfront cost of a car purchase reduced by 20% as a result. This has worked well for the company. The numbers sold between 2021 and 2023 are more than double those sold between 2018-20.

Moreover, cost reductions are more relevant than ever now that there’s increased price competition among manufacturers, which is impacting margins. NIO, for instance, saw a drop in gross margin to 5.5% in 2023 compared to 10.4% in 2022. If the latest battery packs find favour with customers, margin erosion might just find some containment.

Upgrading EV technology with battery swaps

In another move, the company continues to expand its partnerships with Chinese EV manufacturers for battery swaps. When I last checked, it was already in partnership with Changan and Geely Holdings. Chinese manufacturers Chery and JAC have also come on board now.

Adding to early signs of profits in battery swaps as pointed out the last time, the company has now said that it has completed 40 million swaps. It also aims to add 1,000 battery swap stations this year, adding to its existing 2,300, which reflects its confidence in the technology.

Low market multiples

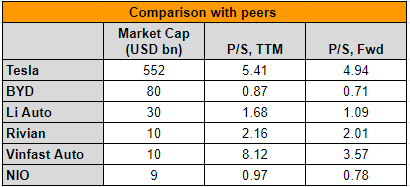

With NIO’s price now at the lowest levels since mid-2020, the stock’s trailing twelve months [TTM] price-to-sales (P/S) ratio has dwindled to 0.95x. It was already low compared to peers at 2.1x when I last checked. While other EV stocks have tumbled as well, NIO is now cheaper than all of them (see table below).

Source: Seeking Alpha

Based on the average TTM and forward P/S for the five biggest EV stocks, there’s at least 3x upside to the NIO stock now.

What next?

The big question though is whether the upside can materialise anytime soon. I wouldn’t be too pessimistic. The company’s revenues in Q4 2023 surpassed its expectations, and the same can happen in the upcoming quarterly numbers due later this month. And while its deliveries have been weak, if they can show sustained growth going forward, the Lunar New Year related weakness in February can be seen as a one-off. That remains to be seen though.

The company does have new ideas up its sleeve, though. It has made fast progress from demonstrating the effectiveness of its long-range battery pack to starting production. The pack is expected to be available shortly as well. It also continues to progress in collaborating with other EV manufacturers on battery swaps, which comes with the advantage of a much shorter charging time.

Impressive as the EV technology developments are, however, they are yet to pay off. In the meantime, its numbers are looking disappointing. But considering that the stock price has already dwindled as much as it has, I don’t see any point in selling the stock right now either. May as well wait and watch what happens next, and there are indeed positive possibilities. I’m retaining a Hold rating on NIO.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here