ONE Gas, Inc. (NYSE:OGS) recently promised dividend growth for the next four years, and envisions significant regional growth driven by growing population in the I-35 corridor in the United States. Given recent efforts for clean energy solutions, and recently announced capital expenditures, I believe that the company will most likely be under the radar of many investors. There are some risks coming from the total amount of debt, competition, and changes in the interest rates. With that OGS does seem cheap at the current price mark.

One Gas

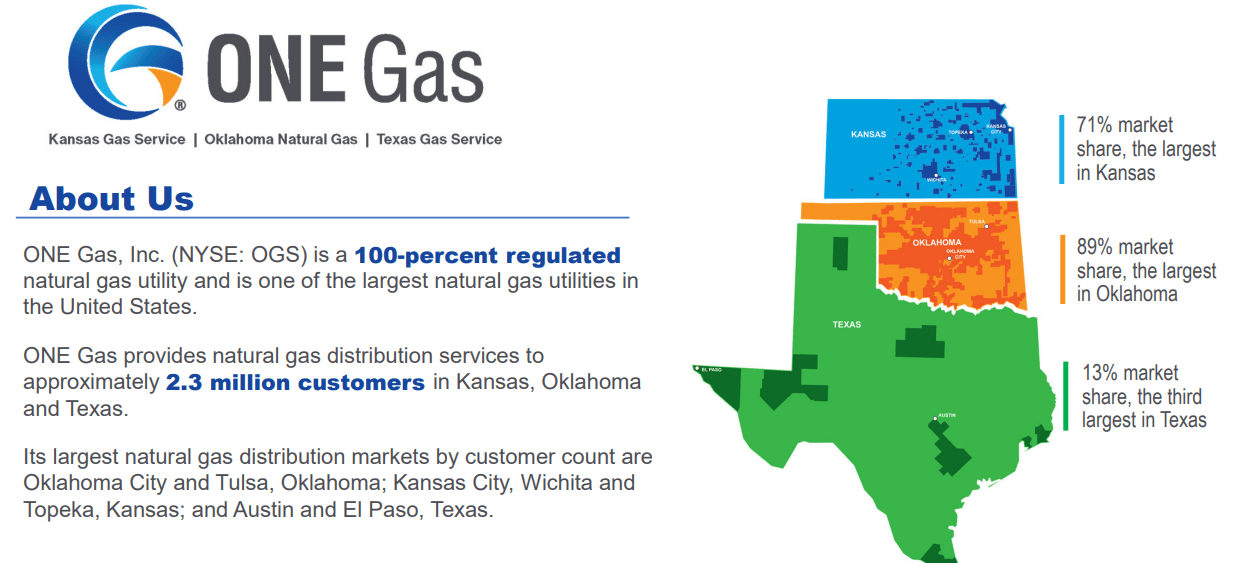

One Gas provides natural gas distribution services prioritizing safety and reliability. Its extensive network serves millions of customers in the states of Oklahoma, Kansas and Texas.

Source: Investor Presentation

ONE gas leads the natural gas distribution sector, serving 2.3 million customers. It has different divisions, Oklahoma Natural Gas, Kansas Gas Service and Texas Gas Service, supplying approximately 89%, 71% and 13% of the respective state markets.

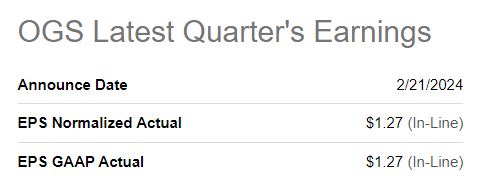

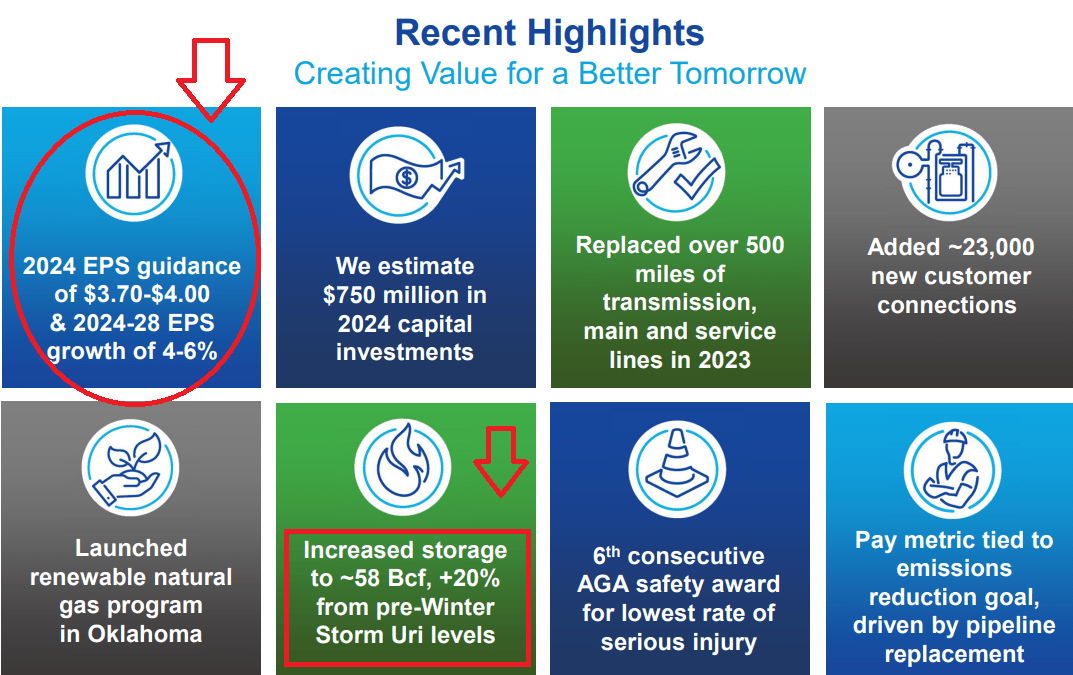

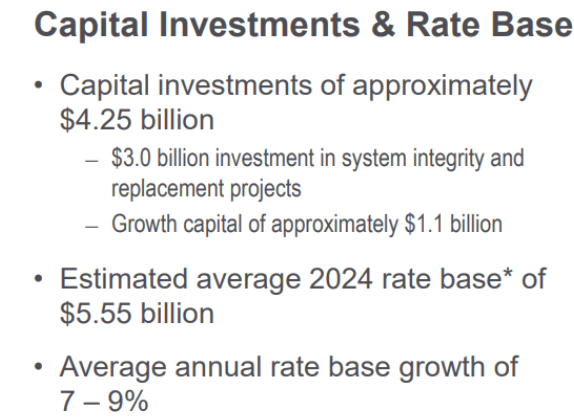

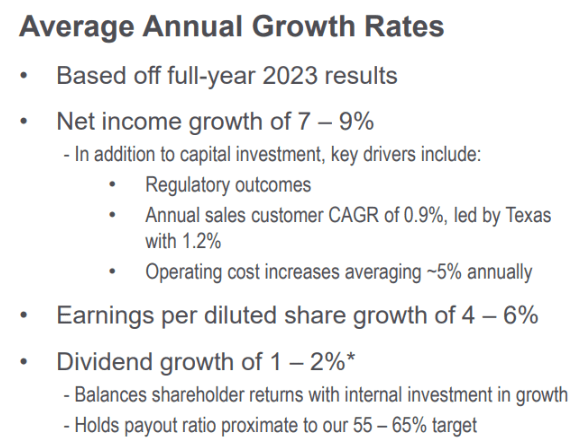

I believe that recent EPS, and most importantly the expectations given for future EPS from 2024 to 2028 are good reasons to revise the stock. The company expects to increase capital investments, and storage, which could bring EPS growth close to 4%-6% in the next four years.

Source: Seeking Alpha Source: Investor Presentation

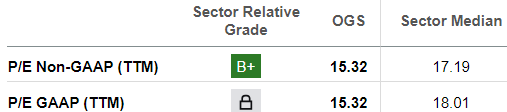

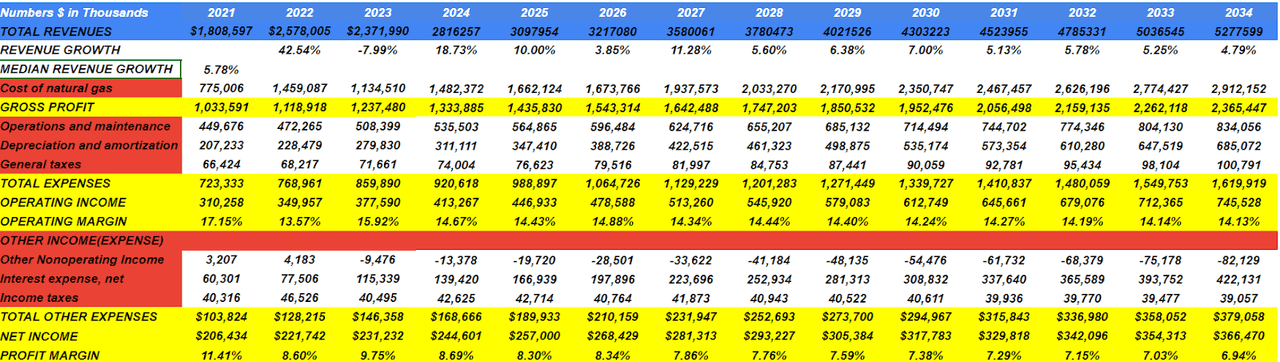

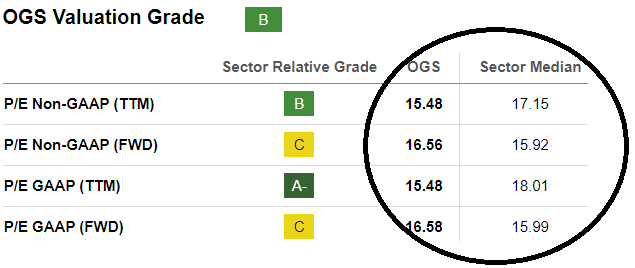

Other analysts out there are expecting net revenue growth in 2024, and 2025, as well as EPS growth. We would be talking about forward PE close to 15x-16x, which appears lower than the median PE ratio reported by other peers.

Source: Seeking Alpha

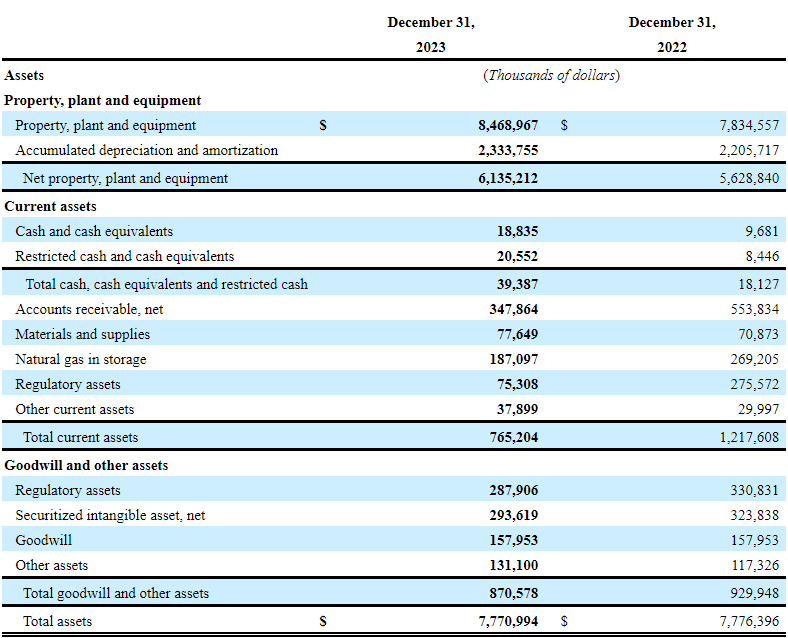

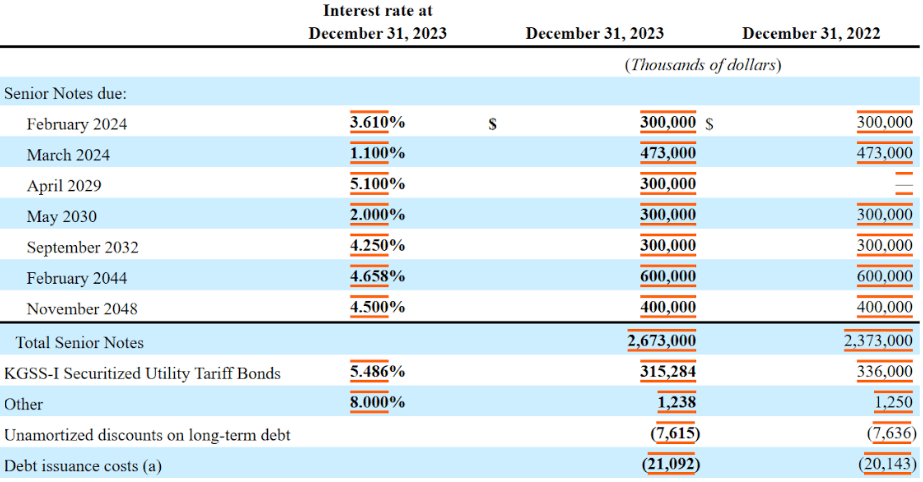

Balance Sheet

As of December 31, 2023 the company reported $6.1 billion in net property and equipment, which is close to 9% larger than the figure reported in 2022. Clearly, One gas is making relevant investments in new capital expenditures. Total current assets stand at $762 million, which is lower than 1x. However, I believe that banks out there would most likely offer financing given the total amount of property, and equipment accumulated.

Source: 10-k

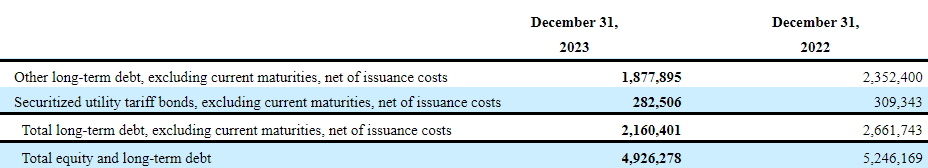

With regards to the list of liabilities, it is worth mentioning the company’s current debt worth $772 million, and notes payable of $88-$89 million. Other long-term debt stands at $1.87 billion. I believe that the company will most likely be conducting negotiations with debt holders during 2024. Beneficial news will most likely have a beneficial impact on the stock price.

Source: 10-k Source: 10-k

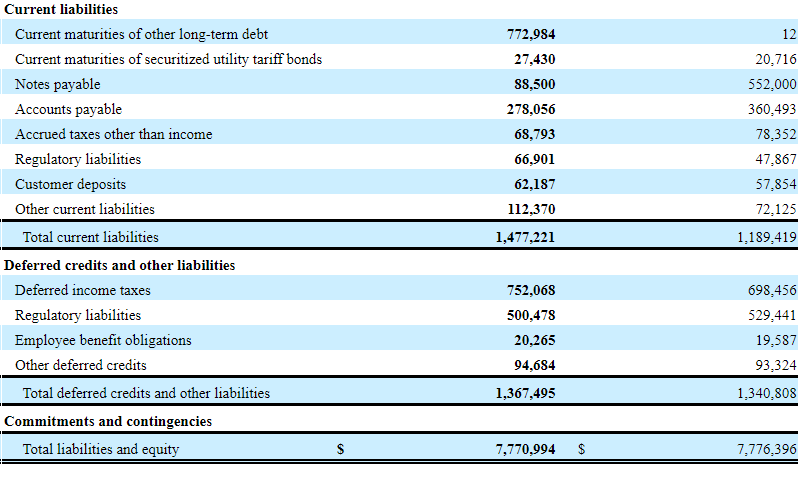

I revised the interest rate agreements reported by One Gas because the total amount of debt is not small. The company strengthened its financial capacity by expanding its unsecured credit facility to $1.2 billion and extending its maturity to March 2028. Additionally, One Gas increased their commercial paper program to $1.2 billion. Besides, they have issued senior bonds to refinance debt and corporate purposes.

With cautious debt management, I believe that ONE gas maintains an appropriate balance between its financing sources and its commitments, thereby ensuring its ability to meet its financial obligations and continue its operations efficiently. The interest rate being paid stands at between 5.1% and 1.1%. With these conditions, I assumed a WACC between 6% and 7% in two case scenarios. I believe that my figures are conservative.

Source: 10-k

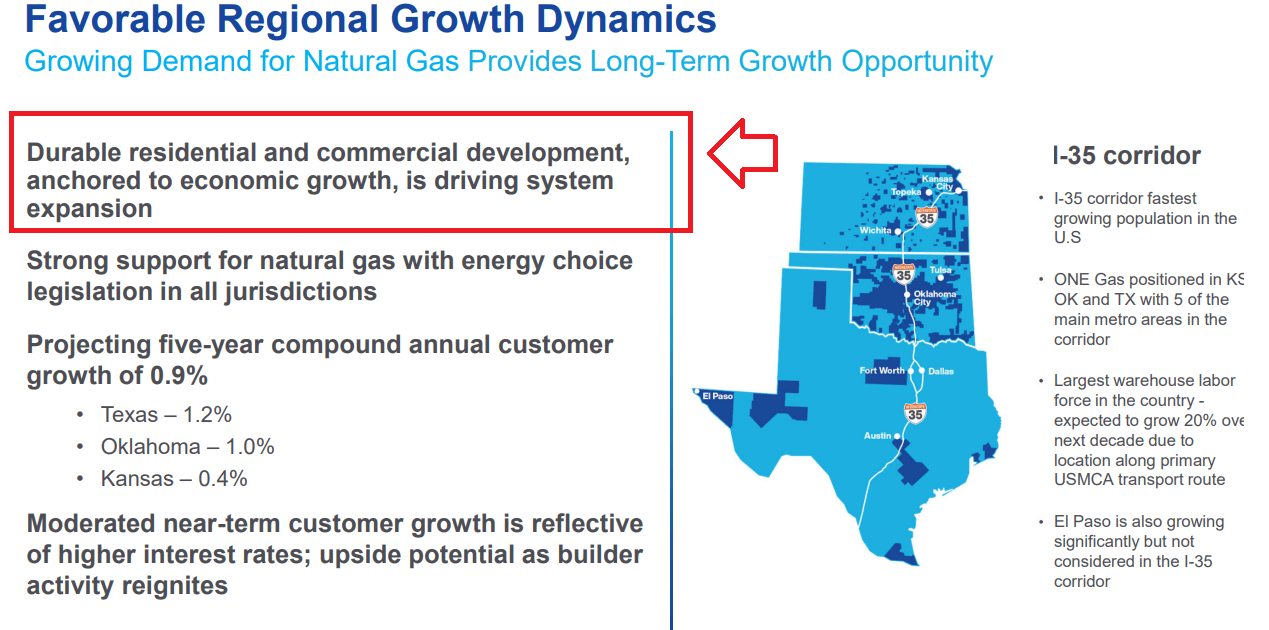

Regional Growth Dynamics Will Most Likely Lead To Economic Growth

One Gas will most likely benefit from the growing population in the I-35 corridor, which appears to exhibit the fastest population growth in the United States. With this in mind, and sufficient capital expenditures, One Gas is well positioned for net income growth.

The company also noted that clients show strong support for natural gas, which may benefit the company’s net revenue growth. Under my best case scenario, I assumed that regional growth could contribute to net income growth from now to 2034.

Source: Investor Presentation

Net Income Growth Catalyst: Capacity Increases, And Operating Efficiency

One Gas reported investments in workforce development, as well as capital expenditures related to system expansion, and capacity increases. As a result, I believe that One Gas could deliver more services, or better services to existing, or new customers. In the best case scenario, I believe that shareholders may enjoy net sales growth, and net income growth thanks to these efforts.

Source: Investor Presentation Source: Investor Presentation

Dividend Growth Expected May Accelerate The Demand For The Stock, And Lower The WACC

The company recently assumed that with net income growth close to 7%-9%, EPS could grow close to 4%-6%, and dividend growth may stand at 1%-2%. In my view, under the best case scenario, dividend growth could bring significant stock demand from new investors. As a result, I believe that expecting lower cost of capital is likely.

Source: Investor Presentation

Investors Looking For Clean Energy Could Also Accelerate The Demand For The Stock

One Gas prioritizes clean energy solutions and offers energy efficiency programs for customers, along with payment and assistance options to ensure reliable, affordable service.

Experts in the assessment of the clean energy market noted that it could grow at close to 23.6% from 2022 to 2030. One Gas will most likely not report growth close to 23.6%, however the growth in the clean energy market may serve as a net sales catalyst for the company.

The Clean and Renewable Energy Market was valued at USD 219.66 billion in 2021 and is predicted to reach USD 1,450 billion by 2030 with a CAGR of 23.6% from 2022-2030. Source: Nextmsc

In this regard, it is worth noting that One Gas believes that their assets are considered essential to a clean energy future. The company is working to reduce its emissions.

Our assets are essential to a clean energy future. We are focused on reducing our emissions and supporting our customers’ emission reduction efforts. Source: 10-k

Under my base case scenario, I assumed that investors looking for companies in the clean energy industry may accelerate the demand for One Gas shares. Higher demand for the stock may also lead to lower cost of capital.

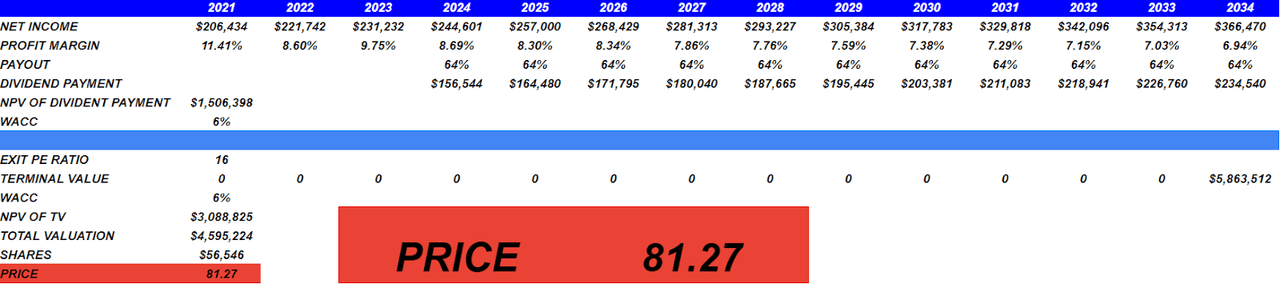

Best Case Scenario: My Dividend Discount Model Implied A Valuation Of $81 Per Share

Under my best case scenario, I assumed that the initiatives announced by One Gas including capital expenditure, emissions reduction, and dividend growth will be successful. As a result, One Gas could report net income growth, and net sales growth. I really did not think out of the box. My figures are in line with the income statements reported by management in the past.

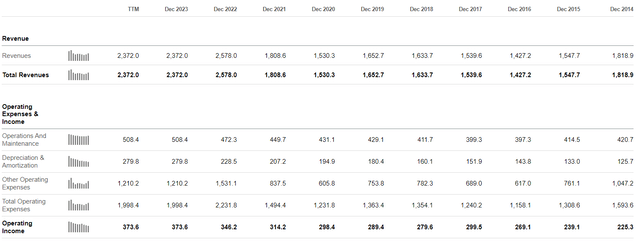

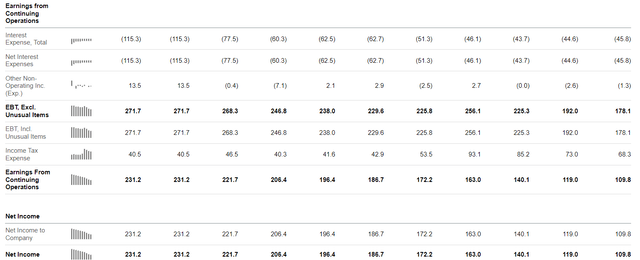

Source: Seeking Alpha Source: Seeking Alpha

I assumed 2034 total revenues of $5.277 billion, and 2034 revenue growth of 4.79%, with median revenue growth of 5.78%. These gains entail expenses such as the cost of natural gas for $2912 million, which would imply 2034 gross profit of $2365 million.

Together with the operations and maintenance for $834 million, I used depreciation and amortization close to $685 million, and the general taxes for $100 million, giving us a total expenses of $1619 million, and generating an operating income of $745 million. We would be talking about an operating margin of 14.13%.

In addition, with 2034 interest expense of about $422 million, added to the income taxes very close to $39 million, net income would stand at $366 million, and the profit margin would be 6.94%.

Source: My Financial Model

With payout of 64%, foreseeing 2034 dividend payment of $234 million, and WACC of 6%, I also assumed an exit PE ratio of 16x generating a NPV of TV close to $3.088 billion.

Source: Seeking Alpha

Finally, total valuation would stand at $4.595 billion, and the fair price would stand at $81 per share.

Source: My Financial Model

Risks

In my opinion, there is the possibility of suffering damage or loss due to various risks inherent in the distribution of natural gas, such as leaks, accidents, extreme weather conditions, terrorism and disasters. Even if you have insurance, damages may not be fully covered due to restrictions and exclusions.

Other operational hazards and unforeseen interruptions include adverse weather conditions, accidents, explosions, fires, the collision of equipment or vehicles with our pipeline facilities and catastrophic events, such as severe weather events, hurricanes, thunderstorms, tornadoes, sustained extreme temperatures, earthquakes, floods, acts of terrorism, pandemics and other health crises, or other similar events beyond our control. Source: 10-k

Being able to recruit and maintain skilled employees is crucial, as job competition and turnover can impact efficiency and safety. Furthermore, labor conflicts could have negative consequences on the organization. These risks could result in legal liability, additional expenses and a decrease in customer confidence, significantly impacting the company’s financial and operational situation.

I also believe that increases in the interest rates, or failed negotiations with debt investors could lead to increases in interest expenses. As a result, I believe that the company’s trading multiples would most likely decline. In the worst case scenario, the stock price would fall.

Finally, considering the number of promises made with respect to EPS growth, and dividend growth, I believe that failed delivery of those results may upset the market. As a result, I believe that some large stakeholders may sell their shares, which may lead to lower stock valuations.

Competitors

ONE Gas faces consumer preference for natural gas over other energy sources and its competitive prices. The rivalry focuses on the provision of energy for heating, cooking and drying clothes. In the smaller residential and commercial sectors, there is significant competition between natural gas and electricity. Typically, the choices made by customers and contractors at the time of initial installation determine the equipment and power source that will be used over the life of the equipment. Changes in the competitive position of natural gas could impact consumption and customers.

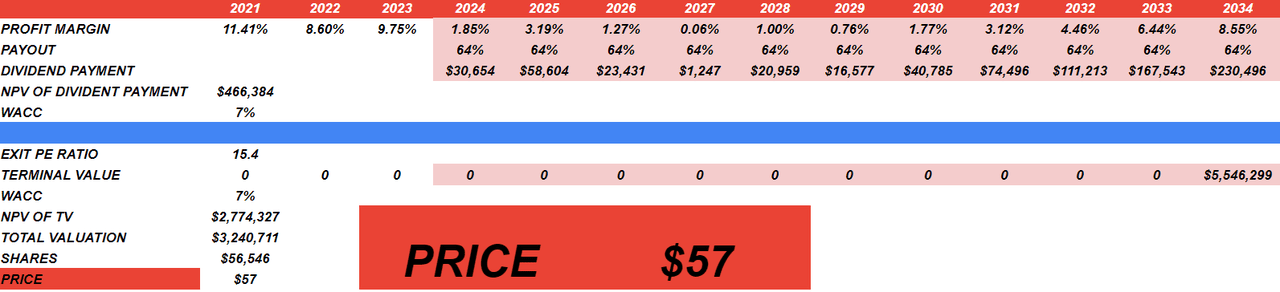

My Bear Case: Failed Emissions Reduction, Lower Dividend Growth Than Expected, And Lower Capex Than Expected

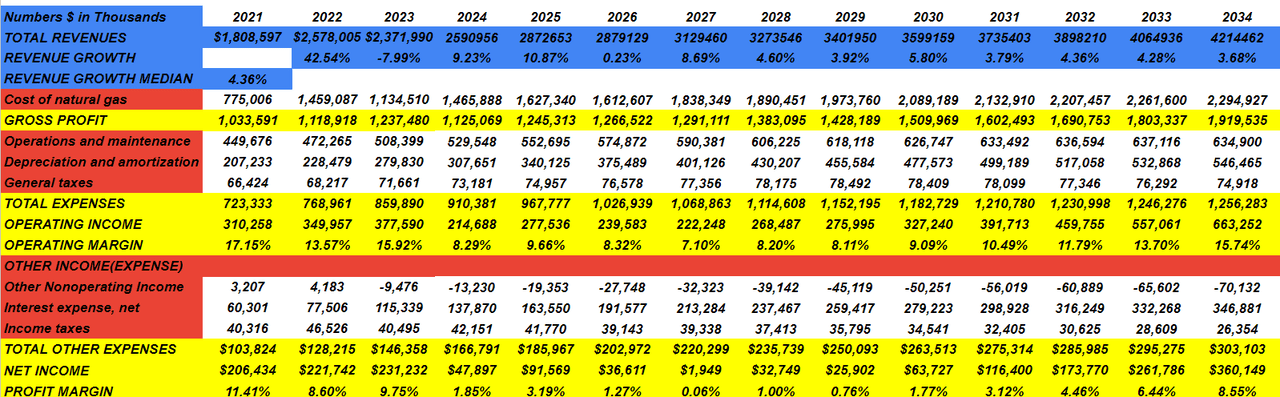

Under my bear case scenario, I assumed 2034 total revenues of $4.214 billions, with revenue growth of 3%, and median revenue growth of 4%.

Besides, taking into account expenses such as the cost of natural gas for $2294 million leaves us with a gross profit of $1919 million, the operations and maintenance may be $634 million, while the depreciation and amortization will be around $546 million.

Besides, I predict that the general taxes will be around $74 million, thus giving a total expenses close to $1256 million, thus giving an operating income of $663 million. Finally, net income would stand at close to $360 million.

Source: My Financial Model

If we also assume a payout of 64%, 2034 dividend payment would be close to $230 million, and the NPV of dividend payments would stand at close to $466 million.

Finally, with the WACC being 7%, I estimate an exit PE ratio of 15.4x, which implies a NPV of terminal value of $1.63 billion. Finally, total valuation would be close to $2.80 billions, and with a share count of 56.546 million, the fair price would stand at $57.

Source: My Financial Model

Conclusion

In my opinion, One Gas delivered beneficial guidance with respect to future EPS growth close to 4%-6%, and dividend growth expectations. In addition, beneficial indications about future capex increases, and efforts for clean energy solutions will most likely lead to more interest from investors. Furthermore, I believe that its focus on safety, efficiency and customer service supports its leading position in natural gas distribution. Yes, the company faces significant risks, such as competition and operational dangers inherent to the sector, and the total amount of debt is not small. With that, I believe that One Gas is trading a bit undervalued at this point in time.

Read the full article here