It has been several months since I last looked at the VanEck Morningstar Wide Moat ETF (BATS:MOAT) in detail, so I thought it would be timely to revisit the fund, to see if any action needs to be taken with respect to my holding in the MAT ETF.

Reading through my prior article, I am struck by how prescient the MOAT ETF has been. Recall, in my August article, I remarked that “the MOAT ETF does not have positions in some market darlings like Apple Inc. (AAPL) and Tesla Inc. (TSLA)”. However, I also wrote that investors should not panic, because this absence was by design, as Apple had traded beyond Morningstar’s estimation of fair value for the consumer electronics giant and Tesla was not deemed to have a sustainable moat according to Morningstar’s analysts.

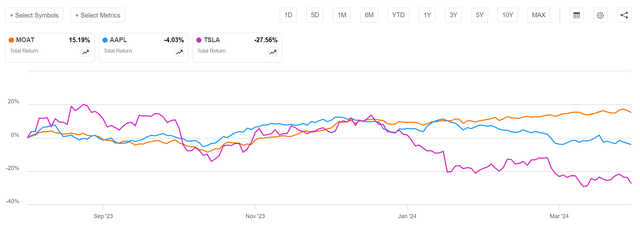

Since my article, the MOAT ETF has crushed the performance of Apple and Tesla with a 15% total return compared to a 4% and 28% loss respectively for Apple and Tesla (Figure 1).

Figure 1 – MOAT was prescient in avoiding AAPL and TSLA (Seeking Alpha)

It is gratifying for a fundamentally driven investor like myself to see that fundamentals still matter, even with respect to market darlings like the ‘Magnificent 7’ stocks.

Brief Fund Overview

For those new to the fund, the VanEck Morningstar Wide Moat ETF is one of my favourite ‘core holding’, as it gives investors convenient exposure to companies that are considered to have durable competitive advantages, according to Morningstar’s equity research team.

However, even the best companies, if bought at the wrong price, can lead to capital losses for investors. For example, back in the 1960s, a group of leading American companies was called the ‘Nifty Fifty’ and were widely regarded as ‘blue-chip’ stocks that one could buy-and-hold forever. Fundamental stock valuation metrics like price-to-earnings did not apply to this group of stocks, according to many investors at the time.

Indeed, many of the ‘Nifty Fifty’ companies like Coca-Cola (KO), McDonald’s (MCD) and Disney (DIS) continue to be market leaders more than half a century later. However, some market darlings from the 1960s like JCPenney and Polaroid have also been relegated to the dustbins of history.

According to Professor Jeremy Siegel’s analysis in his book Stocks for the Long Run, ‘Nifty Fifty’ stocks that routinely sold for P/E ratios above 50 consistently performed worse than the broader market in the subsequent 25 years with only a few exceptions.

Picking good companies is only half the battle to outperform the markets; the other half is buying these good companies at fair valuations. Readers interested in the mechanics of the MOAT ETF are encouraged to browse VanEck’s trove of literature on the fund or read my initiation article.

Current MOAT Portfolio

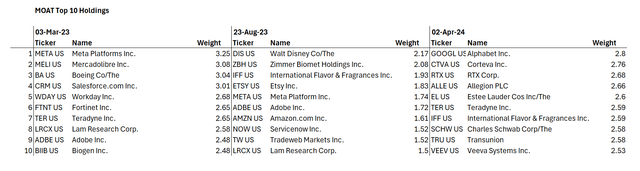

Figure 2 shows a comparison of MOAT’s current top holdings against the fund’s top holdings at the time of my prior articles. We can see that turnover is quite high for the MOAT ETF (51% turnover in fiscal 2023), as many of the top holdings have been replaced since August.

Figure 2 – MOAT top 10 positions through time (Author created with data from vaneck.com)

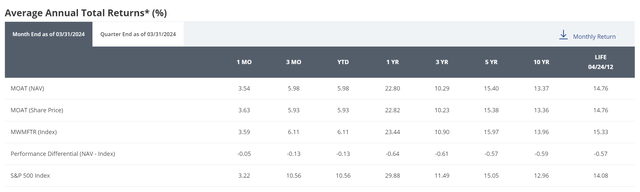

While high turnover might increase the MOAT ETF’s transaction costs, I believe the fund’s stellar record is a testament to the strategy’s effectiveness. In 2023, the MOAT ETF returned 31.7%, significantly better than the SPDR S&P 500 ETF Trust’s (SPY) 26.1%. Since inception, the MOAT ETF has returned 14.8% p.a. compared to 14.1% for the S&P 500 Index (Figure 3).

Figure 3 – MOAT historical returns (vaneck.com)

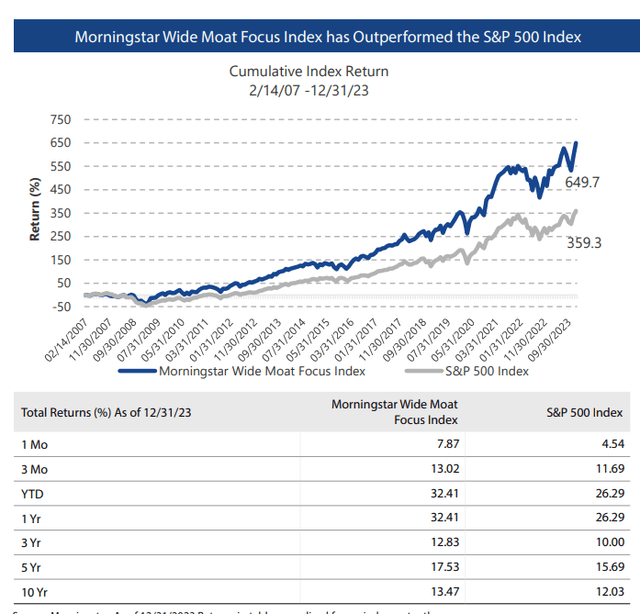

In fact, since the inception of the index, Morningstar’s Wide Moat Index, on which the MOAT ETF is based, has trounced the S&P 500 Index by almost 300% in cumulative returns (Figure 4). However, investors should not that this figure is before fees.

Figure 4 – MOAT Index vs. S&P 500 Index (vaneck.com)

But Valuation Is Stretched

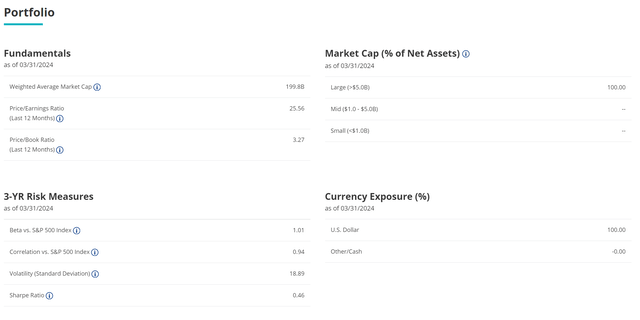

While MOAT’s long term performance is impressively, the portfolio’s current valuation is giving me some pause. Currently, the MOAT ETF has a portfolio P/E ratio of 25.6x (Figure 5). This appears high.

Figure 5 – MOAT portfolio characteristics (vaneck.com)

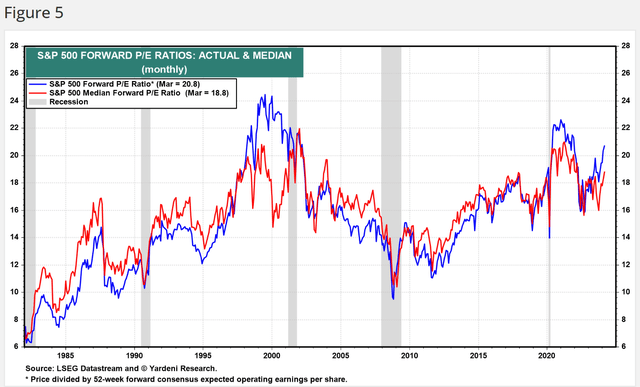

For comparison, the S&P 500 is currently trading at Fwd P/E of 20.8x, itself on the high side of historical data (Figure 6). While index valuations are not as high as in late 1999 or 2020, this is little comfort for investors looking to put fresh capital to work in the markets.

Figure 6 – S&P 500 historical P/E ratios (yardeni.com)

While I continue to believe MOAT’s strategy will lead to superior results over the long-run, I am hesitant to commit new capital to the fund at the moment.

Risk To Cautious Thesis

The biggest risk to my cautious thesis on valuations is that stocks can continue to head higher based on momentum; what is expensive can get even more expensive. Furthermore, in recent months, we have seen strong economic data and a tentative broadening out of the equity rally, with the S&P 500 delivering ~10% YTD gains despite market darlings like Apple and Tesla underperforming.

Conclusion

The VanEck Morningstar Wide Moat ETF continues to be one of my favorite funds, as its focus on companies with durable competitive advantages that has led to strong long-term performance for the fund.

As I discussed in my prior article, the absence of AAPL and TSLA from MOAT’s portfolio was by design and it appears the fund had made the right choice, as MOAT has vastly outperformed AAPL and TSLA since the article.

However, with MOAT’s portfolio trading at a P/E of 25.6x, I am personally hesitant to commit new capital to the fund, so I must downgrade it to a hold. While I like the fund, I believe patient investors may get a better entry if they wait awhile.

Read the full article here