Investment thesis

The stock market continues growing impressively in 2024, with big tech and semiconductors continuing to fuel the rally. In my opinion, the greedier investors are, the higher is the probability of a stock market correction. Since growth stocks are usually more vulnerable to corrections, I am now looking at potential high-yield safe harbors. The British American Tobacco (NYSE:BTI) stock looks like a high-quality defensive stock with a massive 9.6% forward dividend yield. The business is highly profitable and the balance sheet is healthy, which makes the dividend yield safe. The stock is massively undervalued due to the secular decline in cigarette smokers, but BTI looks like a very solid short-term play to weather the potential short-term storm in growth stocks. All in all, I assign BTI with a “Strong Buy” rating.

Company information

British American Tobacco is one of the largest tobacco cigarette companies in the world. The company owns such well-known brands like Kent, Pall Mall, Rothmans, Lucky Strike.

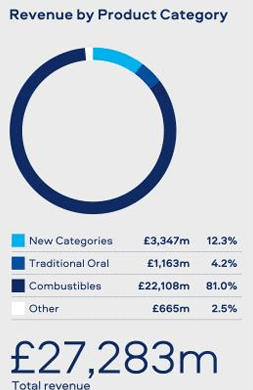

The company’s fiscal year ends on December 31. BTI generates 81% of revenue from its legacy products, but also strives to diversify the revenue mix in line with the changing consumer preferences.

BTI’s latest annual report

Financials

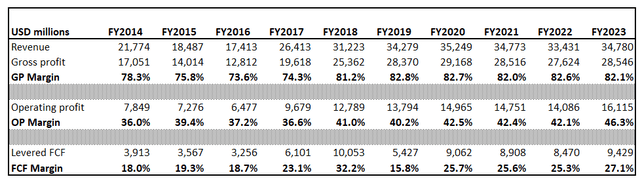

As I usually do, I start analyzing new company by zooming out and looking at the financial performance over the long term. BTI’s revenue grew with an impressive 5.3% CAGR over the past decade. Profitability metrics are also stellar and has expanded notably as the top line grew.

Author’s calculations

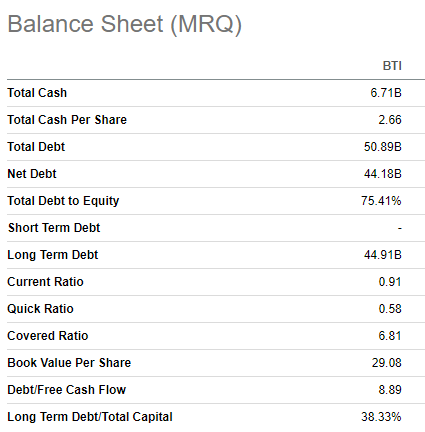

The company’s stellar profitability in general and its free cash flow [FCF] margin in particular allow the company to sustain a healthy balance sheet with quite moderate leverage and keep shareholders happy with returns. BTI currently offers a 9.6% forward dividend yield which is massive in my opinion. The dividend is growing relatively slowly with a 2.8% CAGR over the past five years.

Seeking Alpha

As we have seen in the “Company information” section, the company generates more than 80% of revenues from its legacy brands representing smokeable cigarettes. At the same time, I appreciate the management’s understanding the necessity to diversify the revenue mix in line with the evolving environment. The company is expanding its business towards healthier alternatives to traditional cigarettes, which include vapes/e-cigarettes [Vuse], heated tobacco [glo], and oral pouches [Velo and Grizzly].

BTI’s latest annual report

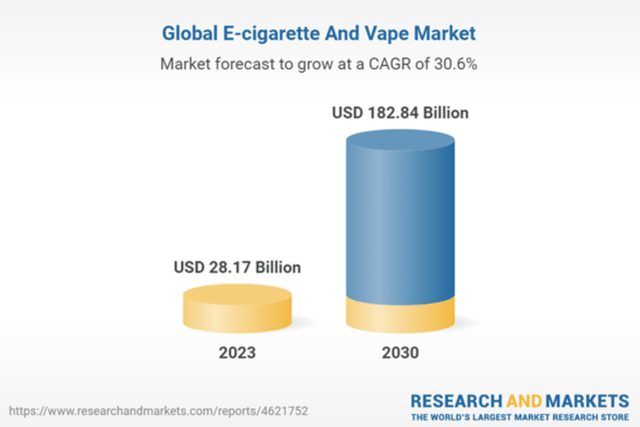

As we can see in the above screenshot from the BTI’s latest annual report, all these products already have a notable market footprint. It is vital for the business to diversify its revenue mix amid secular unfavorable trends for the traditional tobacco industry. Forecasts for these new industries suggest that it is highly likely thar the abovementioned product categories will eventually replace smokeable products like cigarettes.

Forecasts for the vapes/e-cigarettes market are optimistic as the industry is expected to compound with a 30.6% WACC by 2030. The growth rate is massive and is not very different from the expected growth rate for the hottest topic at the moment, generative AI. Since BTI’s Vuse brand is already present in 63 markets across the world, I think that the company is positioned well to absorb this favorable industry trend.

researchandmarkets.com

More to say, Vuse has a dominant position in this emerging industry. The brand has a staggering 42% market share, which looks like a formidable catalyst for the business success. Having a strong market share in a rapidly growing market will highly likely help BTI to sustain its stellar profitability for longer. The heated tobacco market, where BTI is presented with a “glo” brand is even hotter than vapes and e-cigarettes. The industry is expected to grow with an unbelievable 52% CAGR. BTI’s presence in this rapidly growing market is also impressive, since glo has a solid 19.4% market share.

Unfortunately, I did not find BTI’s brands’ market shares in the nicotine pouches market, but the company’s success in legacy brands and new emerging industries adds to my optimism regarding the ability to gain a solid presence in nicotine pouches market as well.

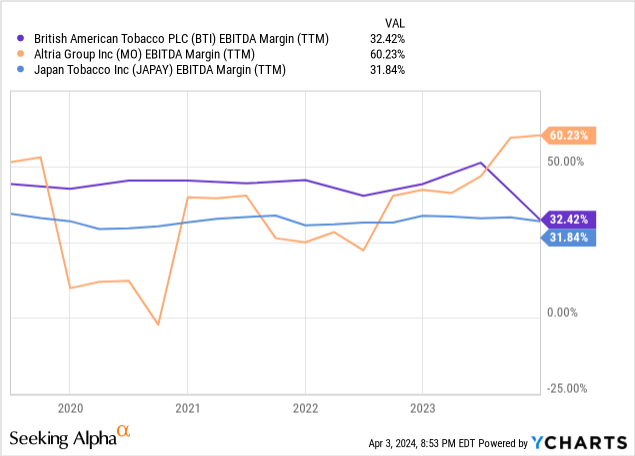

If we look at BTI’s performance against its closest rivals Altria (MO) and Japan Tobacco (OTCPK:JAPAY), we see that in terms of EBITDA margin the company has been leading in recent years. The sharp dip during the last fiscal year was due to one-off non-cash charges to P&L, which I will describe in more details in the “Risks to consider section”. Furthermore, BTI dealt with more stability during the pandemic, while Altria’s EBITDA deteriorated significantly in 2020-2021. Overall, BTI’s leadership in EBITDA suggest that the company demonstrates the best-in-class business efficiency.

Looking forward, I expect BTI’s profitability to recover in foreseeable future. To monitor my thesis in the days ahead, the dynamic of changes in the revenue mix will be crucial. Since the company’s legacy smokeable products business is in the secular decline, the importance of smokeless products cannot be overestimated. I expect the share of new products in the company’s revenue mix to grow. Since these products already have solid market footprint which I have described, I believe there is a high probability that new products will continue gaining momentum as customer preferences are shifting from smokeable to smokeless options.

Valuation

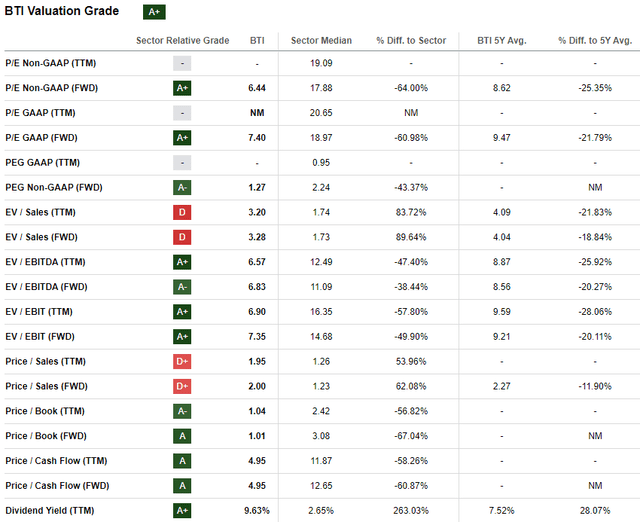

BTI had a modest start in 2024 with a 3.5% year-to-date rally. Over the last twelve months the stock lost around 15% of its price, substantially lagging behind the broader U.S. market. Valuation ratios apparently signal undervaluation since the current multiples are substantially lower than the last five year’s averages.

Seeking Alpha

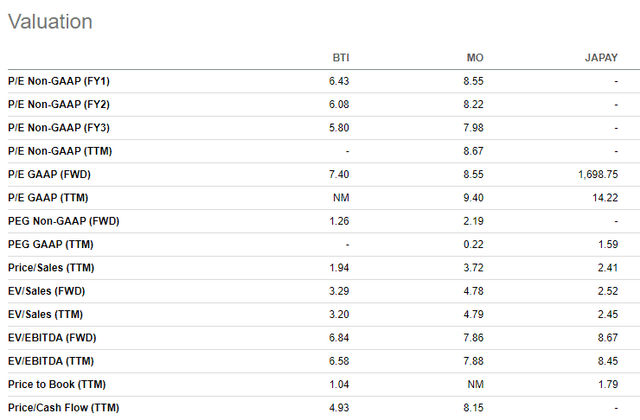

If we look at the peer analysis, BTI’s valuation ratios are notably lower compared to Altria’s. This looks fair to me given the temporary dip in profitability last year, and means that BTI has a substantial potential to recover towards MO’s multiples.

Seeking Alpha

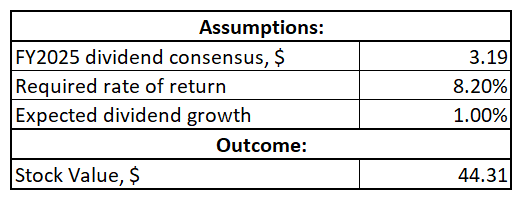

Looking at valuation ratios only is not sufficient to me to be confident in undervaluation. Therefore, I will run a dividend discount model [DDM] simulation. I use an 8.2% required rate of return, which aligns with the recommendation from valueinvesting.io. For the base year dividend I use an FY2025 consensus estimate, which currently stands at $3.19. I am very conservative in respect of the long-term dividend growth projection and implement a 1% growth rate.

Author’s calculations

According to my DDM simulation, the stock’s fair price is $44.3. This is 46% higher than the current market price. A 46% upside potential together with above 9% forward dividend yield look like a compelling investment opportunity to me.

Risks to consider

The company’s legacy cigarette business operates in an industry which experiences secular decline. As people across the world become more educated and aware regarding risks for health caused by smoking cigarettes, smoking rates has declined significantly in recent decades. And this is likely to be the reason why investors sentiment around the stock is weak as it lost 26% of its value over the last five years. If we look at the BTI share price chart below we can see that the stock is unlikely to be a good long-term bet. Readers should understand that my bullish thesis works for dividend investors who are seeking for a safe harbor in current times when technological stocks have rallied far.

Seeking Alpha

It is difficult to drive organic growth in a declining industry. Therefore, BTI relies on acquisitions to drive growth. Apart from a massive multi-billion acquisition of Reynolds, the company also had several smaller [but still large] investments over the last decade. BTI also acquired shares of the largest Brazilian cigarette company, Souza Cruz SA, in another multi-billion deal. There also were several other smaller investments, and I will not mention all of them. The key idea here is that having an aggressive acquisition strategy is inherently risky. Merger costs might be higher than expected, there is always a risk that synergies might not play out as planned, and the investment might not pay back at the end of the day. And that actually what happened with the Reynolds investment as the company recorded a $31 billion impairment charge last year, which was a big negative catalyst for the stock.

Bottom line

To conclude, BTI is a “Strong Buy” with current valuation and the massive forward dividend yield. The balance sheet is healthy and financial performance is still strong, which makes the dividend safe. I would not recommend to invest in the stock for long-term, but BTI looks like a good safe harbor to earn solid dividend amid the current vast uncertainty regarding the sustainability of the growth stocks’ rally. I think that the probability of capital rotation to high-quality value stocks is highly likely in case of a new correction in growth stocks. However, as we have seen in 2022, this is unlikely to last longer. Therefore, I think that BTI is a strong high-yield play for the next 12 months.

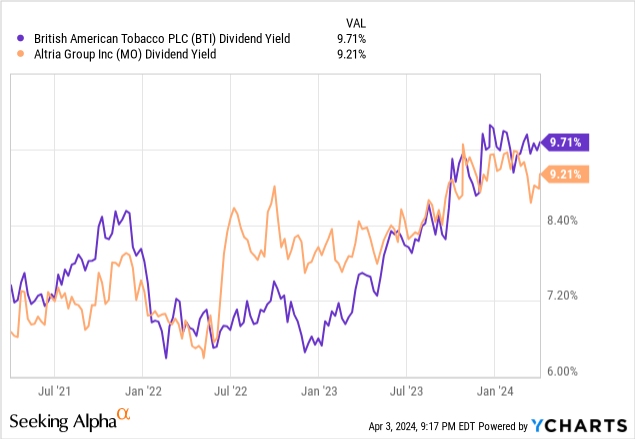

I have high confidence in BTI as an excellent high-yielding option thanks to its consistently stellar profitability, successful transition to new emerging industries, and clean balance sheet. The company’s major rival, Altria, is also a prominent high-yielding name but its forward dividend yield is lower and my peer valuation ratios analysis suggests that BTI is much attractively valued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here