What does generally come to your mind first, when people mention luxury goods?

I would expect people to think about beach front villas, yachts, sport cars, but certainly fashion, watches and expensive cosmetics make the top of the list.

Moët Hennessy Louis Vuitton (OTCPK:LVMHF), Hermès International S.A. (OTCPK:HESAY) and Estée Lauder Companies (EL) are all companies which generally represent the luxury segment, but not all of these companies are created equal.

Not only LVMH is one of my largest investment positions, but it’s been my general go-to stock over the last decade during market pullbacks, due to its heritage brand portfolio, loyalty of customers due to their goods unreplaceable exclusivity and being 48% owned by Arnault family with a significant “skin in the game”.

The company has become epitome of luxury with €418 billion market cap, placing it as 2nd most valuable company in Europe.

Even though the company has been trading at cheap valuation couple months ago when I have last covered the company, in the face of overblown fears of slowing sales in the luxury segment. Since then the stock experienced a remarkable recovery, which pushed the valuation into the opposite direction, a stretched valuation.

While I am certainly not selling any of my shares, sitting on a double-digit gains, let me show you why I advise caution, despite the company being one of the best businesses to own.

Business Update

When I speak with fellow investors, one of the most common arguments I hear is that investing in discretionary businesses is a “fool’s errand” as the business tends to be very cyclical, driven by the state of the underlying economy and disposable income of consumers.

In theory this makes sense, the first thing that consumers generally cut spending on during periods of economic contraction is discretionary expenses such as clothing, cars and travel.

Where I tend to differ with others, is that in my view, LVMH being a luxury goods conglomerate, focusing on wealthy consumers is significantly more resilient to the economic swings due to the customer loyalty, exclusivity and pricing power, which enabled the company to average organic growth of 9.1% over the last 35 years.

LVMH’s target consumers are people aged 18 to 54, with a substantial annual income of at least $75,000. While the income may not seem a lot in many western countries, keep in mind that the company’s largest market is Asia.

Despite the resilience of its business and earnings, the company’s stock price has witnessed a good amount of volatility as of late, falling from it’s all-time-high of €905 for its native shares in April 2023, down to €620 in January 2024 amidst industry-wide fears of slowing sales growth.

Yet again, LVMH has defied odds and delivered earnings above expectations for full-year 2023 and the stock swiftly recovered, trading now for over €830. If you have capitalized on the overblow fears, you would be sitting on a 30% gain in just a few months.

One of the reasons why LVMH keeps delivering and rewarding its shareholders year-after-year is because the company, which is 48% owned by the Arnault family, has a very shareholder oriented mindset and owns well-recognized and legacy brands such as:

- Louis Vuitton

- Christian Dior

- TAG Heuer

- Veuve Clicquot

- Bvlgari

- Tiffany & Co.

… all which represent sought-after status symbol and exclusivity.

Going forward, it’s reasonable to expect that the luxury goods industry will witness some degree of normalization after couple years of 20%+ organic sales growth, which was partially induced by the loose monetary policy and excessive savings of consumers.

The leadership of LVMH well acknowledged this fact as during H1 2023 the growth has been 17%, partially impacted by the loosening of COVID restriction, especially in Asia. The H2 has already experienced a normalization of growth at about 10%, which is something we should be expecting going forward.

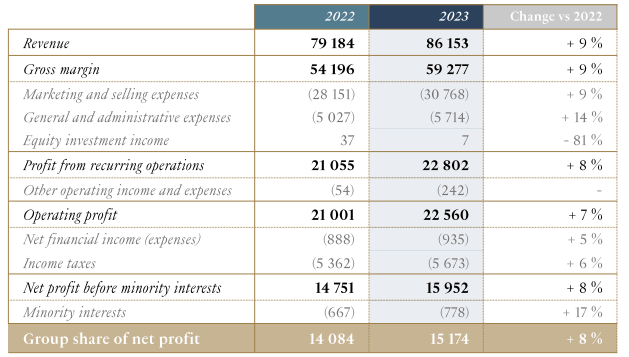

Last year has been a success for LVMH as the sales have increased from €79 billion in 2022 to €86.2 billion. This represents roughly 13% organic growth, well above the historical average, however, the sales were negatively impacted by the FX development, dropping to 9% growth on currency-adjusted-basis.

For the full-year the operating margin came in at 26.4% basically remaining flat YoY. What is more important thought, is that the company once again demonstrated its pricing power by retaining same margins, despite the Marketing and Selling Expenses increasing 9% on a YoY basis.

FY23 P&L (LVMH IR)

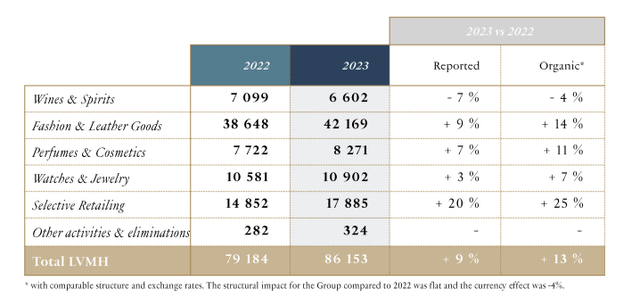

In terms of the business breakdown, Fashion & Leather Goods is by far the largest segment or “Maison”, representing close to 49% of the company’s sales. It’s of utmost importance that this segment keeps growing at a double-digit rate, which was well demonstrated last year as the segment achieved 14% growth on an organic basis.

Other key business segments:

- Selective Retailing: 25% organic growth driven by strong performance of Sephora which well exceeded expectations

- Watches & Jewelry: 7% organic growth thanks to strong dynamics

- Perfumes & Cosmetics: 11% organic growth driven by excellent results of J’adore perfume. Sauvage perfume is the most sold perfume for a third consecutive year, worldwide.

The sore in the eye of the company’s results has been the Wines & Spirits maison, which has been dragging down the performance throughout the whole 2023. The reason for the 4% decline is the tough comparison against previous year. Yet, Champagne sales were up for the year, while Cognac sales were dragging the segment due to weak consumption in US and China.

Segment Breakdown (LVMH IR)

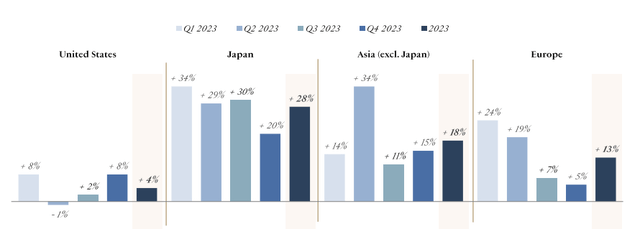

In terms of the geographical growth, Japan has remained the fastest growing region during the year, achieving 28%, however the weakening of Japanese yen against Euro was one of the factors why the company was hit by €700 million negative FX impact.

Asia (excl. Japan), which represents 31% of the company’s sales and is key market, started the year on a challenging footing due to the ongoing COVID restrictions, however the market still delivered double-digit growth both in 2023 and 2022, implying strength.

While the situation remains challenging in US market with sales increasing only by 4% YoY, Europe is a different story, returning to growth of 13%, similar to what the company has been accustomed to in the past, partially thanks to travel.

Growth by Geography (LVMH IR)

Even though LVMH does not provide official guidance for the next year, during the last earnings call, Bernard Arnault, has expressed his confidence to achieve around 13% organic sales growth in 2024, similar to 2023. The expectation is that the planned interest rate cuts could spur spending in the US, making it more dynamic and returning to high single-digit growth.

From a personal standpoint, I am expecting the company will continue growing their top-line somewhere between 10% to 12% which is rather “normalized” but sustainable growth going forward.

Risks

The potential problems which could hinder LVMH’s performance in 2024 are geopolitical tensions, whether between China and US over Taiwan or the ongoing military conflicts in Middle East and Eastern Europe, over which the company has no influence. These conflicts could inflict further damage to the prosperity of world economies or potentially lead to transport disruptions as we are seeing in the Red Sea.

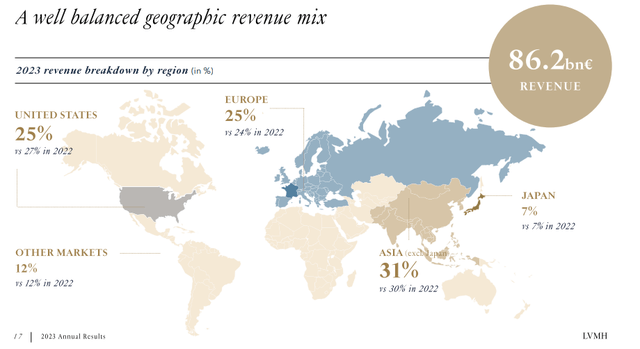

When investing in LVMH it’s key to understand that the company is truly global with markets like China, US, Europe and Japan all playing a major role in the company’s success. While the company cannot influence economic development in either of these countries, its important to be aware of the slowing economy in China, high interest rates in US and Europe which are impact disposable incomes of people.

Geographical Dependency (LVMH IR)

While operations across different economies brings its own advantages of diversification, another layer of complexity is the FX impact, which has cost the company €700 million in 2023 and may further exert pressure on the company’s bottom-line growth in the following years.

Valuation

Even though I consider LVMH the epitome of luxury and quality alike, we must be mindful of the valuation, as buying the business at a right valuation is a key to unlocking market beating returns.

Buying even high quality business as LVMH at elevated valuation might lead to years of underperformance and I would rather hold cash in high-yield savings account, yielding 5%, rather than own quality business which will almost certainly underperform.

The last time I covered the company, during the pull-back induced by the overblown fears of industry growth normalization, I have rated the company as a “Strong Buy” and I have enjoyed 20% ROI since, when accounting for the dividend.

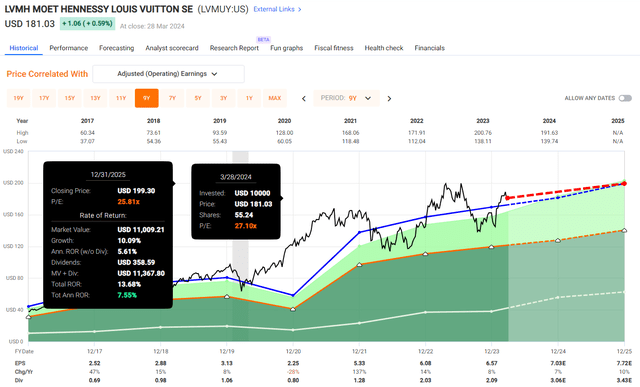

Today the situation is different, the stock has ran up 30% since its low in January and the company is currently trading at a blended P/E ratio of 27.1x.

When we zoom-out, since 2003 the company has been trading on average at 23.1x its earnings with average annual EPS growth of 12.8%.

In the meantime, LVMH has become €418 billion juggernaut, 2nd most valuable company in Europe, and the growth will be more difficult to come by and acquisitions might have significantly lesser effect on its bottom-line growth.

Yet, the expectations for the shares traded in the US is that the EPS growth will continue at a following rate:

- 2024: $7.03E, YoY growth of 7%

- 2025: $7.72E, YoY growth of 10%

- 2026: $8.41E, YoY growth of 9%

From the analyst forecasts we can see that indeed a normalization of EPS growth is expected and the times of high double-digit growth as experienced between 2020 to 2022 are mostly over, at least for now.

Nevertheless, we cannot disregard the quality of the company and its “AA-” credit rating by S&P Global, which certainly deserves a premium valuation, compared to some competitors such as:

- Compagnie Financiere Richemont SA (OTCPK:CFRHF), blended P/E of 21.5x

- Kering SA (OTCPK:PPRUF), blended P/E of 14.9x

Considering the expected EPS growth of LVMH to be around 8.5% over the next three years and its wide moat and leadership with significant “skin in the game”, I would expect the company’s fair value to be around 25x its earnings.

Assuming the growth materializes and the valuation contracts from today’s 27.1x its earnings to 25x, investors could reasonably expect returns of around 7.6% including the dividend.

LVMH Valuation (Fast Graphs)

The expected return falls short of a 10% to 15% minimum returns that investors should aim for by stock picking and I would advise caution, while waiting for a better entry point, hence I am downgrading the rating to “Hold” for the time being only due to the stretched valuation.

Takeaway

LVMH is an epitome of luxury and quality alike, being led by the Arnault family with 48% stake in the company, driving the shareholder-friendly nature of the business which has been rewarding shareholders handsomely for last two decades.

The luxury goods industry is well resilient to economic cycles catering to wealthier individuals, yet the growth is normalizing towards high-single digits to low-double digits, which was confirmed by the company’s leadership.

With the expected annual EPS growth to continue at around 8.5% over the next three years, we need to adjust the valuation expectations, which has become stretched recently after the 30% spike in share price since the January bottom.

Given the quality of business and its wide moat, I would expect the company to trade at a premium valuation of around 25x its earnings, which is well below today’s blended P/E of 27.1x, implying potential overvaluation which may result in poor performance for investors looking to initiate their positions at today’s prices.

I advise caution and to keep the company on a watchlist for the time being, capitalizing on any pullbacks which may make the company attractive once again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here