Overview

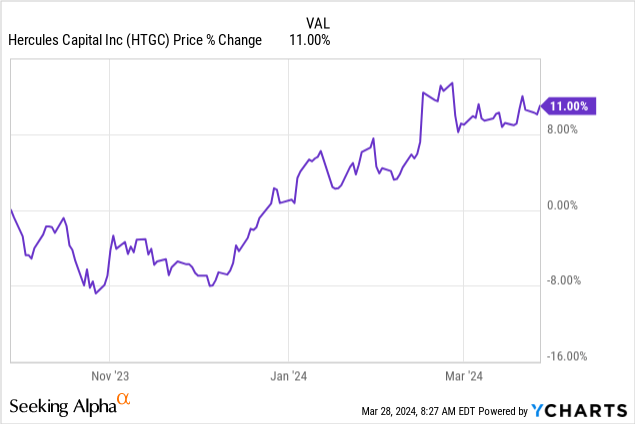

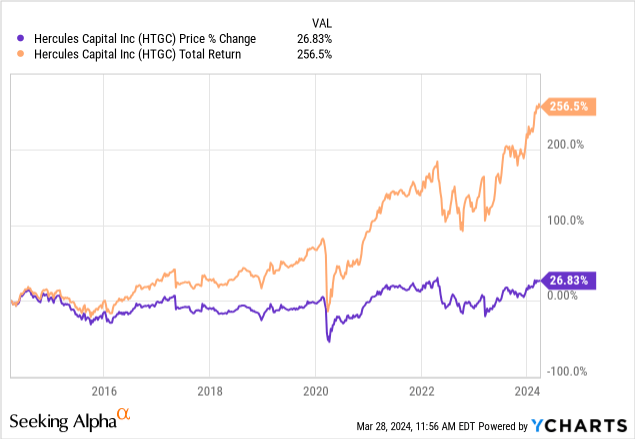

I previously covered Hercules Capital (NYSE:HTGC) back in August of 2023. Since then, HTGC has delivered a total return of over 13% due to the consistent NII (net investment income) growth and high dividend distributions. The price has run up over the last 6 months and now the dividend yield sits around 8.7%. Although the price has run up, I am upgrading my rating to a Buy at these levels. The price trades at a large premium to NAV (net asset value) at the moment but I plan to continue increasing my position to snowball my dividend income.

I’ve covered a ton of BDCs (business development companies) this month but I can easily say that HTGC stands out from the crowd. Their portfolio and strategy have proven effective and management continues to drive results. The indications of portfolio growth have been great and increased levels of profitability have resulted in several supplemental dividend payments.

The fed are anticipated to start cutting rates in the second half of 2024. Although I personally believe we will see very light cuts, I believe that HTGC is well suited to thrive regardless of any interest rate cuts. History has shown us that they’ve thrived in a near zero rate environment and in my opinion, their strong portfolio and investment strategy will continue to support and drive growth moving forward. Therefore, I am upgrading my rating to a Buy, even as the price is nearing all time highs.

Portfolio

HTGC’s portfolio is mostly comprised of debt investments and a warrant portfolio. Most of you are familiar with debt investments as the loans or debt that Hercules provides to their portfolio companies. They collect interest on this debt which go towards the total NII received. Their debt investments consist of 125 portfolio companies with investment sizes ranging anywhere between $5M to $200M with a total cost basis of $3.06B. The effective yield of their debt investment portfolio is 15.3%.

On the other hand, warrants are notes that give the holder the right to buy an exact number of shares of a company’s stock at an agreed upon price. This portion of HTGC’s portfolio is much smaller with a fair value of $186M but I feel that it’s worthy of mentioning because management seems to be trying to grow this area of the portfolio. It seems as if the warrants were issued alongside the debt investment portfolio to serve as an additional source of return that can contribute to the total investment income. The warrant portfolio contains 103 companies and equity holdings within 74 companies.

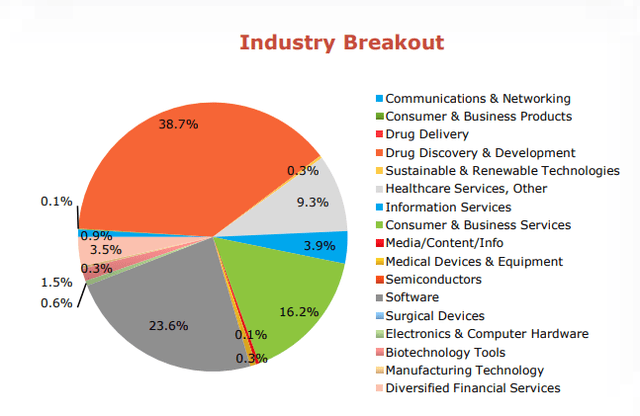

HTGC Q4 Presentation

I also like that the portfolio is diverse in industry with a major focus in healthcare & pharma as well as IT services, software, and equipment. Not only is the portfolio diverse in industry but they are also diverse in region. The majority of the portfolio companies are based within the western region of the United States, making up 47% of the exposure. They have a 27% exposure to the northeast region of the US as well as international exposure making up 11%.

About 84% of the portfolio is classified as senior secured 1st lien debt and 8.4% of the portfolio is considered senior secured 2nd lien debt. Equity investments make up about 5% of the portfolio while the previously mentioned warrant positions are only a small 1% of the total portfolio makeup.

Strategy & Interest Rates

Investment returns can be maximized here because HTGC is internally managed. This means that HTGC only pays its actual operating costs and nothing else, as opposed to externally managed BDCs that have to dish out fee expenses to a separate investment advisor. This concept may sound simple but it can severely impact the BDC’s performance. For example, take a look at Prospect Capital (PSEC) which is externally managed and a stock I recently covered. This means that HTGC is not incentivized to grow fees as the total amount of assets under management grows.

Hercules focuses on pre-IPO and M&A (merger & acquisition) venture capital backed companies that have demonstrated high levels of growth. Approximately 96% of their debt investment portfolio is comprised of floating rate loans. More importantly, these floating rate loans have interest rate floors which means that there is a limit in place on how low these rates can go. This offers great downside protection against the sensitivity to interest rate cuts.

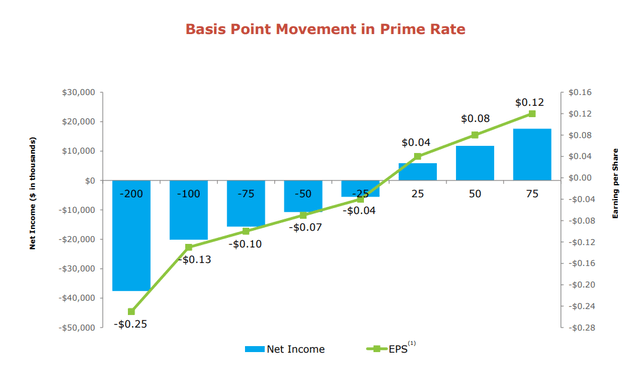

HTGC Q4 Presentation

We can see a visual of how interest rates may impact net income and EPS. No one knows how much the Fed will lower interest rates but it seem like they are staying cautious to see how the labor and employment market plays out. They are now anticipated to have fewer rate cuts. Therefore, I think moderate rate cuts around -50 basis points is a fair ball park area to expect. A -50bps drop would result in an estimated drop in EPS/NII by -$0.07 per share.

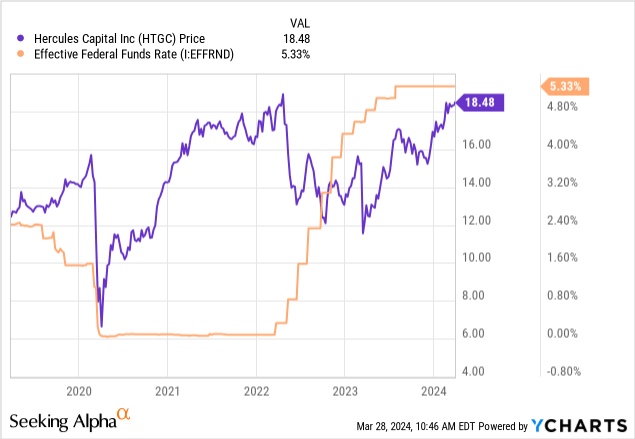

However, I want to point out that throughout a time period where rates were near zero, HTGC still managed to thrive. We can see the inverse relationship between price and the federal funds rate. As rates were cut near zero, the price of HTGC took off. Even as rates started to rise, the price came down a bit before accelerating back up again due to the increased levels of NII.

Financials

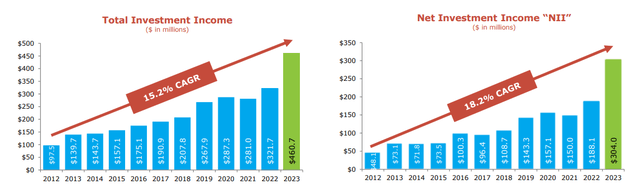

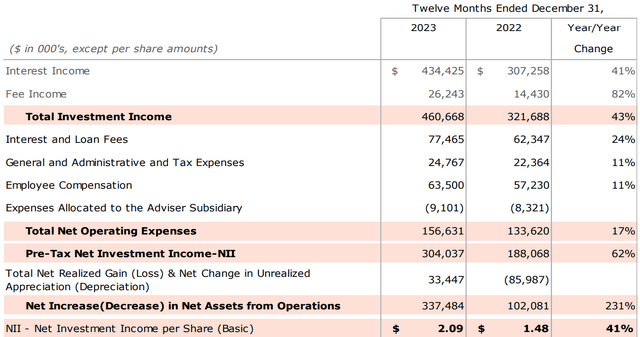

The most important metric here is the NII (net investment income) reported. During the most recent Q4 earnings report, NII was reported at $0.56 per share. This closed off their fiscal year 2023 with a total net investment income of $304M. This represents an impressive growth of 61.7% year over year! HTGC has really capitalized off the higher interest rate environment and have found a way to reward shareholders handsomely.

HTGC Q4 Presentation

Looking at the total investment income over the last decade, we can see that total income has grown at a CAGR (compound annual growth rate) of 15.2%. In addition, the total NII has grown at a CAGR of 18.2% over the same time period. This growth has helped management achieve a liquidity level of $744M available to invest.

We can also see how there is a total year over year growth of NII per share of 41%. For comparison, here are some of the NII growth metrics of relevant peer BDCs:

- Trinity Capital (TRIN): 25.6% YoY increase in NII.

- Ares Capital (ARCC): $707M total investment income & 10.5% YoY growth.

- Main Street Capital (MAIN): 13.5% YoY total investment income growth.

HTGC Q4 Presentation

Commitments have grown consistently higher year over year. For the close of fiscal year 2023, the total loan commitments was about $17.3B in comparison to the prior years $15.7B. It’s worth highlighting that since inception in 2005, there hasn’t been a single year where commitments have decreased lower than the prior year. Just to add context, new commitments are great because they mean that a steady income stream can go towards financing HTGC’s debt investment portfolio companies. In addition, it can help propel growth within the portfolio and further increase the levels of income produced within.

Risk Profile

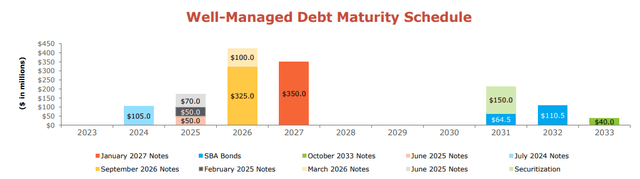

Their debt investments have a short term maturity horizon that typically sits between 36 – 48 months. In addition, there debt maturity schedule does have a sizeable amount of notes due in September of 2026 and January of 2027. However, this is far out and management has plenty of time to grow their portfolio with additional loan commitments. As previously mentioned, they have $744M in liquidity as a cushion.

HTGC Q4 Presentation

In addition, HTGC currently has solid investment grade ratings from Fitch and Moody’s.

- Fitch: BBB-

- Moody’s: Baa3

I expect interest rate cuts to be light and within the range of -50bps. If this happens, HTGC is well suited to continue delivering strong NII results in this environment. However, I may be incorrect and rate cuts may happen more aggressively than I anticipate. If this is the case, NII may be affecting more negative than anticipated and impact NII. As a result, the supplemental dividends are likely to slow down or stop altogether. So far though, there are no indications of slowing NII growth and the cash on hand is plenty to hand any future debts due.

Dividend & Valuation

As of the latest declared quarterly dividend of $0.40 per share, the current dividend yield is 8.7%. NII was reported at $0.56 per share which means that the dividend coverage here is approximately 140%. This is a huge margin of safety and the extra cash flow is one of the reasons that the fund has been able to issue several supplemental dividends. The latest supplemental dividend was in the amount of $0.08 per share and was issued in the beginning of March. This follows a prior supplemental dividend declared back in October of 2023 and a prior raise of 2.6% in August of 2023.

The dividend growth has been spectacular for an already high yielding asset. Over the last 5 year period, the dividend has grown at a CAGR of 5.10%. Zooming out to a longer time horizon of 10 years, the dividend has still grown at a CAGR of 3.36%. This is totally acceptable for a BDC that has a 4 year average dividend yield of 12.84%. The rise in share price significantly lowered the yield but there was once a time is recent history where you could’ve snagged shared with a yield above 15%.

Hercules trades at a higher premium to NAV than usual. As a result, many are opting to stay on the sidelines for better entry and I don’t blame them! However, I believe that you have to pay for quality. The price currently trades at a premium to NAV over 60%. For reference, the average 3 year premium is 43.22%. We saw the premium reach as high as 75% at the peak of 2022 and as low as a discount of -34% in the crash of 2020.

CEF Data

Although I do not believe we will see shares of HTGC trade at a discount again anytime soon, I do think we may see a slight price decrease when rates are lowered. However, HTGC’s portfolio is well suited to maneuver these rate changes as previously mentioned, so I am not concerned. In addition, if we remain in an environment where the average interest rate is higher, this would be a great thing for BDCs like HTGC as a whole. A higher interest rate translates to higher profitability metrics from the debt investments since the portfolio is mostly comprised of floating rates.

The price action here matters a bit less to me as HTGC can continue to deliver consistent high yielding dividend income. Over the last decade, the price has only appreciated by 27% while the total return is above 256%. This is due to the continued high distributions and I imagine that most investors that continue to hold HTGC also prioritize consistent income over price appreciation. As a result I am upgrading my rating to a Buy and plan to continue building my position and collecting steady dividend payments.

Takeaway

Hercules Capital remains a top tier BDC that continues to grow net investment income over time while delivering a high level of dividend income. The price has run up recently and the current premium to NAV sits above 60%. However, after taking another look at their growth, portfolio, and loan commitments, HTGC remains a top pick to ride out the future interest rate changes. Their portfolio is diverse across different regions and industries and therefore mitigates any sort of concentration risk.

The total return of HTGC has been stellar despite the mediocre price increase. However, investors don’t typically add BDCs to their portfolio for price growth. Instead, we focus on the income that HTGC can continue providing us. I upgrade my rating to a buy because of this continued NII growth and the ability to mitigate interest rate sensitivity with the well-crafted debt portfolio investments. In addition, new commitments to grow the portfolio have consistently increases year over year without ever slowing down.

Read the full article here