So far, 2024 has proven to be a heck of a roller coaster for shareholders of The Chemours Company (NYSE:CC), a business that’s centered around the sale of various products such as TiO2 pigment that can be used for ultraviolet light protection for architectural and industrial coatings, as well as a variety of other things like plastic packaging and laminate papers. The firm also sells a variety of other offerings such as industrial resins, membranes, Teflon, propellants, refrigerants, and more.

Given the nature of the business, you might think that the firm would experience a good deal of stability. However, 2024 has been brutal. After seeing shares end the 2023 fiscal year at $31.54 apiece, they have fallen as low as $15.10 per share. Today, they are toward the higher end of this range, hitting $26.26. But that alone represents a 9.1% drop compared to where units were just one day earlier. In fact, even though shares are near the higher end of their range this year, they are still trading 32.8% below their 52-week high point. They also happen to be 20.4% lower than when I rated the company a ‘buy’ back in May of 2021. Since then, the S&P 500 has dwarfed that return, skyrocketing 24.8%. As you will see, I do believe that the risk profile for the company is elevated. However, given how cheap shares are and what has already occurred, I would argue that it makes for a decent, though speculative, ‘buy’ prospect.

An interesting opportunity

While there are fundamental issues driving some of this downside, much of the pain seems to be associated with some internal drama within the organization. The first hint of something going on was in the middle of February when management announced that one of the directors on its board would not be standing for reelection and that another individual was taking her place. That on its own its not terribly unusual. But what followed on February 28th was. Management announced that the companies board had decided to appoint a new interim CEO and a new interim CFO. The individuals holding those two positions, as well as the Vice President, Controller and Principal Accounting Officer, were placed on administrative leave.

At the same time this announcement was made, the company announced that it was initiating an internal review that would be overseen by the company’s audit committee, with the assistance of independent outside counsel. This is unusual and points toward something questionable at best and illegal at worst occurring. Management did warn that the review would be looking at one or more potential material weaknesses associated with internal control over financial reporting for the business. But beyond that, details were scarce.

Management ended up coming out with additional details in early March. But it wasn’t until March 27th, after the market closed, that the company revealed everything. What the company found was that three former members of senior management, almost certainly the three members that were put on administrative leave, were able to delay the timing of certain payments, while accelerating other payments, for the purpose of manipulating cash flows. Based on the company’s findings, payments of around $100 million were delayed until the first quarter of 2024. These payments were originally supposed to be paid out in the final quarter of 2023. Also, the collection of up to $260 million worth of receivables that were originally not supposed to be received until the first quarter of 2024 were accelerated into the final quarter of 2023.

The Chemours Company

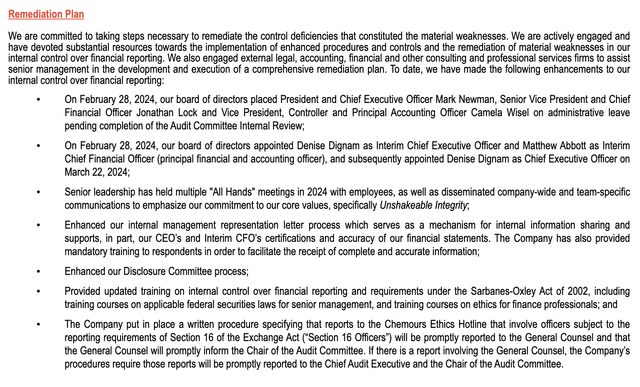

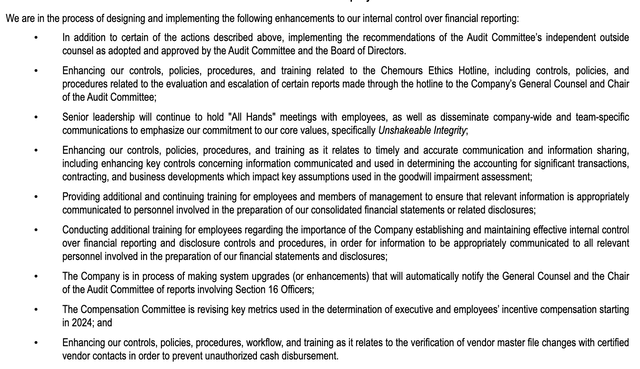

As detailed in the company’s annual report, which was just released on March 27th, the executives in question engaged in these activities for the purpose of trying to meet free cash flow targets that would have served as key metrics for determining incentive compensation to both executive officers involved and to employees. In addition to having to restate some of their financial results for both 2022 and 2023, the company acknowledged that there were for material weaknesses associated with financial reporting over internal controls within the company. Specifically, management identified four different controlled deficiencies, though they did not provide significant details about what these are. They did say that they had to do with things such as setting ‘an appropriate tone at the top’, designing and maintaining ‘effective controls related to information and communication’, designing and maintaining ‘effective controls related to vendor master data in order to prevent unauthorized cash disbursements’, and designing and maintaining ‘effective controls related to the evaluation and escalation of reports made to the Chemours Ethics Hotline’. In the image above, you can see a list of changes the company has already made to prevent this from happening again, while in the image below you can see ‘enhancements’ the company is making to its existing processes. Though it is worth noting that management has already incurred a ‘significant’ amount of expense associated with this review and that ongoing efforts aimed at dealing with it could result in even more costs moving forward.

The Chemours Company

Given the parties involved with this issue and given the fact that the CEO has already been replaced and that the company is looking for a new CFO to replace the interim one, it’s likely that all of the toxins infecting the company have been purged. Management did say that the internal control issues did not result in a material misstatement. However, they acknowledged that the changes could have turned into that. Normally when I see a company with material weaknesses regarding internal control over financial reporting, I don’t view the problem as all that significant. Given the amount of money involved in the shenanigans that occurred last year, I would argue that this was not a nothing burger. It certainly wasn’t something that, in the near term, would threaten the life of the company. But over time, it could turn into that. The fact that this threat now seems gone is definitely reassuring and opens up the door to the question of whether the company makes for an attractive prospect or not.

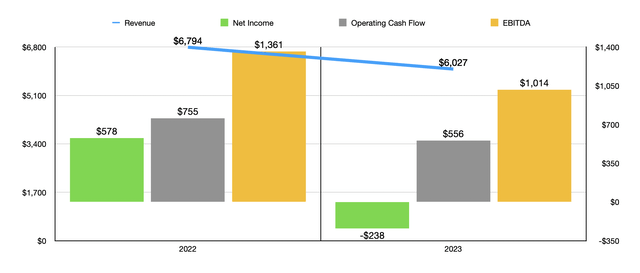

Author – SEC EDGAR Data

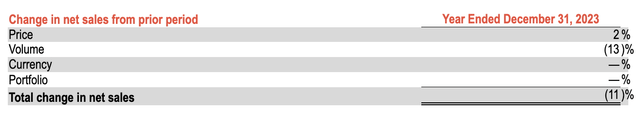

Fundamentally speaking, 2023 was not a particularly pleasant year for the business. Consider revenue. During that time, sales came in at $6.03 billion. This represents a decline of 11.3% compared to the $6.79 billion generated in 2022. This decline came in spite of a 2% benefit from higher pricing. It was driven, then, by a 13% drop in volume. This was mostly associated with volume declines that the company experienced involving its Titanium Technologies and Advanced Performance Materials segments that were only partially offset by higher volume in the Thermal & Specialized Solutions segment. Digging a bit deeper, the Titanium Technologies segment reported a 20% decline in volume because of what management called the ‘continuation of a cyclical downturn’ that began in 2022. A softening of demand also resulted in a 16% drop in volumes for the Advanced Performance Materials segment.

The Chemours Company

This decline in revenue was instrumental in pushing profits down. Net income went from $578 million to negative $238 million. Other factors impacting the bottom line in a negative way included a $137 million increase in restructuring, asset related, and other charges, as well as a $45 million increase in interest expense because of higher interest rates. The firm also suffered from a decline in its gross profit margin from 23.8% to 21.7%, combined with a surge in selling, general, and administrative costs from 10.5% to 21.4%. The gross profit margin decline was driven by higher raw material costs and lower fixed cost absorption for two of the company’s segments. It also suffered from a $40 million charge related to some of the raw materials and inventories that were written off because of a plant shutdown in Taiwan.

The business also suffered from $764 million in litigation expenses, which included $592 million related to its portion of the US public water system settlement agreement, as well as $24 million of third party legal fees related to that same settlement. Another $55 million involved its portion of the settlement agreement with the state of Ohio that was entered into in November of last year. And $13 million related to the company’s portion of the supplemental payment that it made to the state of Delaware related to a 2021 settlement. Other miscellaneous litigation matters cost around $80 million. This all fell under the selling, general, and administrative costs category. Despite these large payments, cash flow did better than I would have anticipated. It managed to fall from $755 million in 2022 to $556 million in 2023. Over the same window of time, EBITDA for the business declined from $1.36 billion to $1.01 billion.

When it comes to the 2024 fiscal year, the picture is really complicated. For starters, management is making some cost cutting efforts that should help. For the Titanium Technologies business, the firm achieved around $50 million worth of savings last year. It’s targeting another $125 million in savings this year. However, it’s expected to incur about $50 million worth of one time costs associated with these efforts in 2024. There’s also the fact that the large litigation expenses that I already mentioned are unlikely to repeat themselves this year. At the same time, however, it does look as though 2024 is going to see lower demand for the company’s offerings. The management team at the firm has not revealed guidance for 2024 as a whole period but for the first quarter of the year, they said they anticipate a 10% decline in revenue and a 15% decline in EBITDA in the Titanium Technologies segment. Both revenue and EBITDA are expected to fall around 20% in the first quarter of this year for the Thermal & Specialized Solutions business. Meanwhile, for the Advanced Performance Materials segment, revenue is expected to fall by around 10%, while EBITDA should drop by around 20%.

Author – SEC EDGAR Data

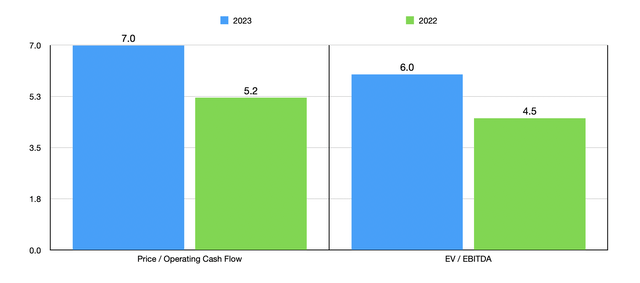

This does create a great deal of uncertainty. But if we look at cash flows, not a lot has to go right for shares to look quite attractive. As you can see in the chart above, the company is trading in the mid-single digit range relative to both operating cash flow and EBITDA. In the table below, I compared it to five similar firms. Although the stock is pricey on a price to operating cash flow basis relative to these five companies, trading higher than four of them, it’s the cheapest of the group when using the EV to EBITDA approach.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| The Chemours Company | 7.0 | 6.0 |

| Huntsman Corporation (HUN) | 22.2 | 13.2 |

| Sasol Ltd (SSL) | 2.7 | 6.7 |

| LSB Industries (LXU) | 4.8 | 6.3 |

| Basf SE (OTCQX:BASFY) | 5.8 | 9.1 |

| Braskem SA (BAK) | 4.0 | 20.9 |

Takeaway

Since shares bottomed out in February of this year, investors have seen upside of 73.9%. That demonstrates just how much volatility can play in your favor during uncertain times. Of course, most investors did not get a price that low. The vast majority probably got prices at or above where we are today. In that respect, Chemours has not been a very good prospect over the past year or so. Having said that, it does look as though the issues it was dealing with internally are resolved or close to it. The company has purged itself of hostile elements and management is making efforts to reduce costs moving forward. Some of the pains the business experienced in 2023 were large, but one time in nature. And even with those pains, shares look cheap on an absolute basis and relative to similar firms when using the EV to EBITDA approach. All combined, this makes me feel generally optimistic, optimistic enough to rate the business a ‘buy’, but with the caveat that this could still be a very volatile play for the foreseeable future. And those who cannot deal with that kind of volatility would likely be better off looking elsewhere for opportunities.

Read the full article here