Summary

We’ve had a lot of requests to add another article to our series on MEEC to reflect the recent trial win. This article serves as a follow-up to our previous piece, which outlined the settlement reached with approximately half of the defendants involved in MEEC’s refined coal lawsuit.

Both of these articles build upon our initial piece from June 2021. For those seeking insight into the company’s background and the lawsuit, we recommend starting with our first article.

In this note, we provide updates on several aspects covered in our previous articles, including the trial outcome, damage amount, potential for enhanced damages, updated valuation, and additional insights gleaned since the trial.

Refined Coal Lawsuit – MEEC Wins Its Day In Court

For many years, Richard MacPherson, CEO of MEEC, has expressed his anticipation for the day the company would have its moment in court to prove its infringement case. Recently, that day arrived, and the outcome could not have been more favorable for MEEC.

First and foremost, the jury awarded the company $57 million, finding that the defendants willfully infringed upon MEEC’s enforceable patents or induced others to do so. This victory holds significant importance for the company, as it not only injects much-needed cash onto its balance sheet but it also enables the cleanup of the remaining Alterna Capital debt, a critical step towards a potential NASDAQ uplisting.

It also validates the enforcement of their patent position, which management expects to be utilized to double or triple the underlying coal business in the coming 12-24 months. Now that the jury sided with MEEC and applied $1/ton on the coal burned in damages, as expected.

We believe the verdict strengthens MEEC’s patent enforcement approach. Management anticipates doubling or even tripling of the underlying coal business over the next 12-24 months. With the jury’s decision to apply $1/ton of coal burned, there is now a simple calculation to provide insight toward potential damages for each remaining infringer, which we expect will facilitate negotiations moving forward.

It’s worth highlighting the significance of the jury’s determination regarding the defendants “willful infringement,” as it now grants the judge discretion in addressing the damage caused by such infringement. While this process is complex, it primarily relies on the judge’s discretion, which considers various factors including case details, post-trial filings, and the upcoming bench trial scheduled for late May. The judge’s decision could result in either no additional damages or a multiplier ranging between 1.5x and 3x ($85-171M). Based on our analysis and understanding of the case, we think there is a better than 50-50 likelihood that MEEC may indeed receive enhanced damages.

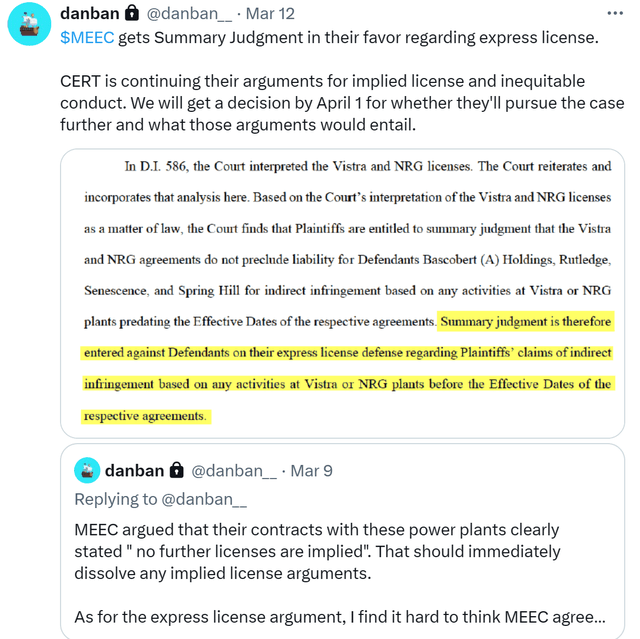

To be transparent, CERT has requested a one-day bench trial, aiming for dismissal of the case based on the grounds of an implied license. Specifically, CERT’s argument suggests an implied license through certain customer agreements, MEEC maintains a steadfast position, asserting the absence of any implied licenses as per their contractual agreements with clients. @danban__, on X, has been closely monitoring the trial’s developments and frequently shares valuable court documents on his feed. Below, I highlight a March 12th post indicating the judge’s apparent inclination to align with MEEC’s stance regarding implied licenses.

Danban__ tweet (danban__)

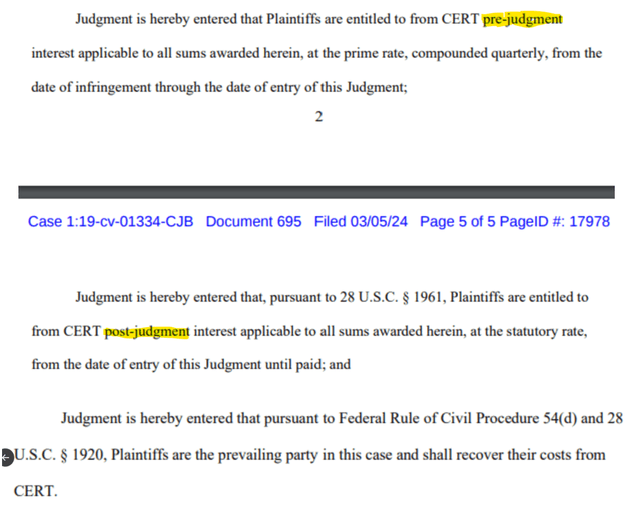

It is also worth highlighting that after the trial, MEEC filed a motion to apply interest on damages at 8.5% compounded quarterly, starting from the judgment date, and at the prime rate since the case began in 2019 until the judgment date, in addition to seeking reimbursement of legal fees. If approved, combined this could result in $15-25 million in additional cash payments for MEEC, augmenting the $57 million in damages. Once more, I refer to another @danban__ post for the pertinent excerpt, this time from a March 5th post.

tweet (Danban__)

Upon the conclusion of the current case at the end of May, CERT has the right to file an appeal. While their decision on filing an appeal remains unknown, it’s not uncommon for defendants to leverage an appeal for negotiation purposes. We believe there’s a decent likelihood that CERT will pursue an appeal if only to bolster their negotiation position.

While any appeal process carries inherent risks, based on the current case and our understanding of the facts, we do not foresee a successful appeal at this juncture. It’s worth noting that MEEC has requested the judge to apply compound interest to the damages quarterly at 8.5% between the award and payment, meaning that if CERT does appeal, the original $57 million judgment will accrue interest rapidly.

Addressing concerns about CERT’s ability to pay, we believe that their business insurance provides adequate coverage to fulfill the judgment. Additionally, comments from Rick regarding the consideration of CERT’s financial capacity by legal counsel offer reassurance in this regard.

Most importantly, we believe that MEEC has already received, or is on track to receive, $30-40M in cash from the first two settlements. We expect this will be sufficient to cover debt repayment and potential investments in entering the potable water business. We’ll delve more into this topic shortly, but it’s worth noting that MEEC plans to enter this market in a cost-effective manner, potentially through the acquisition of an underperforming plant or a joint venture, minimizing the initial investment required.

Overall, the recent trial outcome represents a significant milestone for MEEC, positioning the company for substantial growth and stability in the future.

What Does This Mean For MEEC?

The clarity surrounding the cost of damages and the validity of the company’s patents provides a significant advantage as they approach the several dozen power plants still infringing on their patents. In addition, Rick consistently expresses a preference for establishing supply agreements with these companies going forward. This approach offers a carrot-and-stick scenario: if the infringing companies agree to a 5-year supply agreement with a couple of 5-year extension options, MEEC will forgive the past damages.

One pushback I’ve had is regarding the expiration of the majority of MEEC’s mercury capture patents in August 2025. A common question arises as to why infringing companies wouldn’t simply delay addressing the issue until the patents expire or opt for one short-term license. Rick has consistently emphasized the stick MEEC still holds: despite patent expiration, the company can still pursue legal action against each infringer for past damages incurred over the last 6 years of the program. For reference, the majority of tonnage was burned in the final 6 years of the program. Additionally, companies that switch to MEEC’s technology experience improved boiler efficiency and associated mercury capture rates.

During a recent investor update call with Adelaide Capital, the company’s investor relations firm, Rick highlighted that once the company secures a customer’s supply business, they have maintained a near 100% retention rate on those customers. Insights from previous conversations with Rick indicate that this is due to the company’s customization of the sorbent for each customer’s boiler. This not only enhances mercury capture efficacy but also allows for the utilization of less product compared to competitors generic methods.

Despite concerns around the decline of the coal business, it’s important to note that several dozen power plants, which are still operational, currently utilize MEEC’s patented process without a license. Consequently, these utilities will need to acquire licenses moving forward. This is expected to drive 2-3x revenue growth in the base business over the next 12-24 months. While the timing of these wins is difficult to predict, we anticipate they will begin in the next 30 days or so. Additionally, opportunities in potable water remediation are anticipated to emerge in the second half of 2024, further contributing to growth prospects.

Alterna And Balance Sheet Updates:

One of the most underappreciated pieces of news that emerged just before the trial’s conclusion was MEEC’s submission of a Form 8-K, that significantly revised the terms of their debt and royalty agreement with their largest shareholder, Alterna Capital. In aggregate, we estimate that the renegotiated deal will save the company nearly $25 million in cash, funds that would have otherwise gone to Alterna had the deal remained unchanged. This restructuring has enabled MEEC to settle approximately $35 million in debt for around $13 million in cash, with $9 million of that already repaid.

Additionally, Rick negotiated an agreement whereby MEEC would aid in placing Alterna’s MEEC equity holdings with new investors in exchange for further reductions in the remaining $4 million owed. On March 19th, the company announced the completion of the first of these transactions, resulting in MEEC placing 2.6 million shares into the hands of long-term holders while simultaneously reducing the remaining debt by approximately $1 million. Furthermore, the completion of this first placement within 30 days of the new agreement prevented the triggering of a $960,000 debt payment to Alterna from MEEC.

I often get the question, why did Alterna renegotiate for less? There are a couple of factors at play here. Firstly, it is essential to recognize that the deal was renegotiated before the trial’s conclusion on February 27th, suggesting that Alterna may have lacked confidence in MEEC’s success and thus was more amenable to negotiating a lower settlement at that time. Additionally, Alterna primarily operates as a debt capital company and is not focused on equity. The accumulation of a significant equity position in MEEC was a result of the company’s inability to pay interest over the past few years. However, this does not change the fact that Alterna’s primary focus is debt rather than equity. Yet they wound up with a significant equity holding in MEEC that they need to unwind now that the company is in the process of paying off the debt. Lastly, Rick likely had some leverage due to the previously negotiated 7 million share repurchase option negotiated at $0.50/share.

From recent discussions and MEEC’s recent filings, it seems that in exchange for the 7 million share option and MEEC’s assistance in placing Alterna’s equity position, Alterna agreed to reduce cash payments owed to them by nearly $25 million.

While investors may be somewhat disappointed at the missed opportunity to retire 7 million shares from the outstanding share count, we believe that this renegotiated deal offers MEEC and its shareholders a more favorable total economic outcome. Specifically, it saves almost $25 million in cash payments to Alterna, or approximately $0.25/share in cash savings that the company can utilize to grow its core business and expand into new markets such as wastewater remediation and REE.

Regarding the initial Alterna share placement, some investors seem to have misunderstood its implications. We reached out to Rick and specifically asked if the recent Alterna placement involved his friends and family. He clarified that neither he nor his friends purchased the shares. According to Rick, the term ‘friends and family’ is commonly used, particularly in Canada, to refer to any long-term holder or early investor in a company. Thus, in this context, the ‘friends and family’ investors imply long-term and early shareholders of MEEC.

Furthermore, the reason these shares were placed at a discount is that they are restricted shares that cannot be sold for a certain period, rendering them unsaleable on the open market. We also want to highlight that by transferring these shares, Alterna is no longer an affiliated party with MEEC, facilitating the placement of the remaining shares more easily.

A 5-10% discount to the prevailing market price when large blocks of shares are exchanged is not unusual. There are even firms that specialize in this type of block trading, such as Jones Trading. Moving forward, we anticipate that future Alterna share sales will be conducted consistent with typical large block transactions and discounts relative to the prevailing market price.

Lastly, it is worth mentioning that for the remaining 9.3 million shares that Alterna owns, MEEC can either place these with a third-party holder or buy all or a portion of those shares itself, similar to the original share buyback. However, one key difference is that the buyer, whether MEEC or a third party, would be purchasing shares near market price, rather than the $0.50 negotiated as part of the previous option agreement, plus MEEC gets credit against retiring its debt. If MEEC repurchased the shares, it presents a potentially better deal because, not only would they retire them, they also receive ‘dollar for dollar’ credit toward reducing their debt. In this scenario, paying a bit more for shares would facilitate a greater amount of debt paydown.

Recent Updates: SE Asia, Forever Chemicals, REE And The Adelaide Capital Call Highlights

We will start this section with what we consider the most significant negative update since the last article. During the aforementioned Adelaide Capital investor call, the company announced its decision to postpone the pursuit of opportunities in Southeast Asia. Rick cited the abundance of water remediation opportunities, mercury licenses and several potential acquisitions as taking precedence in the near term.

While the delay in Southeast Asia consulting revenue is disappointing, we prefer to see the company focusing on building its new business in water remediation. We believe that consensus is regulations for Forever Chemicals , such as PFAS and PFOS, are likely to be enacted in 2025. Therefore, concentrating on establishing manufacturing and the required technology is essential to capitalize on this new forever chemical opportunity, which we see as a key value driver for the company.

On the same call, Rick shared his view that the Forever Chemicals business is following a similar path to how MEEC successfully commercialized its mercury removal product. However, this time, they plan to rely on trade secrets and business know-how instead of patents to protect the technology. Management believes this approach will provide them with a robust mix of intellectual property protection and make it more challenging for competitors to replicate the technology, as previously occurred with mercury removal.

Rick also mentioned that they are currently about 30-40% complete with the technology development for forever chemical removal. It was also noted that a potential small, activated carbon plant acquisition could expedite the cycle time for technology development, enhancing their ability to sell significant quantities of the product by 2025. Management believes that entering the Forever Chemicals market in this manner minimizes cash expenditures and will accelerate entry into the market.

In addition to the activated carbon plant acquisition, Rick provided further insights into the company’s exploration of joint ventures (JVs) to build a larger activated carbon plant as the water remediation business develops. This larger plant would be crucial for the company to capitalize on the growing demand resulting from new forever chemical regulations. We believe this is how Rick plans to scale the water business in a capital efficient manner.

Regarding rare earth elements (REE), the company is currently in discussions to progress to field testing with several utilities, with more information expected in the coming months. In addition, Rick is considering several technology acquisitions in the REE space to expedite entry into this large market. While we do not anticipate any revenue from this business until 2026, advancing this timeline should be positively received by investors.

Another noteworthy aspect from the Adelaide investor call was Rick’s comments on legal fees. He expressed his belief that the lawyers took on the case motivated by a sincere desire to rectify an environmental wrong. Consequently, he mentioned that they were able to cover the legal costs from operating cash flow, and the lawyers will receive a “small amount” of the settlement/damage proceeds. Previously, we assumed that lawyers would take about 25% of the proceeds, but now it seems they may receive closer to 15-20%.

Rick has consistently emphasized the company’s focus is on driving growth in both the core business and new verticals while maintaining a conservative spending strategy. He acknowledged MEEC’s history of operating with a weak balance sheet and assured investors that the recent cash is not burning a hole in his pocket and he is in no rush to return to those days.

Positioning For An Imminent Uplisting To NASDAQ

Over the last year and a half, management has positioned MEEC to be uplisted upon reaching the appropriate share price. There are only two remaining hurdles to uplist the company to a major exchange are, first, pay off the debt. We now see how the company plans to address this situation with the newly renegotiated deal with Alterna and initial $9M payment. We anticipate the company being debt free sometime in the second half of the year. Second, they need to get the share price above $2 which we anticipate should not take long as more and more of the lawsuit news filters out to the market.

Why Do We Like MEEC Now?

At 1035 Capital, we aim to uncover overlooked stocks that are undergoing positive catalysts improving the fundamentals of a business. We specifically focus on catalysts to improve sales growth rates, margin levels, and asset efficiency. MEEC appears to fit all of these categories and is a type of stock we refer to as a “triple threat” which can often become a massive wealth compounder once the market understands the significance of the improvements occurring.

We continue to believe that MEEC is very overlooked being on the OTC with limited sell-side coverage. In our opinion, the numerous catalysts related to the mercury control market alone support a significantly higher stock price but when we consider the substantial opportunities in Forever Chemicals and rare earth elements, the upside to this stock is notable. Better yet, we believe the biggest hurdle to the stock, which was how do they fund the new growth opportunities, has now been put to rest with the recent settlements and trial judgement.

The manufacturing assets in place combined with accelerating contract awards from the recent lawsuit all position the company well for sales growth and improving margins over the next few years. We believe that the company’s manufacturing assets in place (that are already funded) can support all of the anticipated mercury removal growth without needing significant new capital.

Furthermore, MEEC is well-positioned to benefit from a realization of the importance of developing a reliable source of rare earth elements while also cleaning up the environment within the US. These materials are critical to many of our current technologies and will become increasingly important going forward. Concurrently, MEEC is providing a solution to the forever chemical problem that is beginning to be widely recognized as a significant health issue. The current administration is very focused on climate change as well as building green industries in the US. While the increasing recognition of the health threats posed by Forever Chemicals are likely to lead to new regulations in the near term. MEEC appears poised to benefit from both of these trends.

In addition, MEEC is standing at the precipice of uplisting to a major exchange. Upon uplisting, we anticipate seeing several new sell-side companies picking up coverage of the company. We would not be surprised to see B Riley, Roth, Lake Street, Northland, Craig Hallum, and others pick up coverage of this profitable and growing green tech player shortly after uplisting.

We expect that the additional sell-side coverage combined with an uplisting to a major exchange is likely to drive increased institutional interest and ownership of the company. This influx of institutional ownership should drive a higher share price over time. Taking this into consideration, as well as our belief that the company is primed for an inflection in growth, margins, and asset efficiency, which historically has also been an excellent combination for driving a higher share price, and we think the time is right to consider a position before the crowd notices what they have been missing here.

Valuation

Pinpointing the value of MEEC is a challenging exercise due to the lack of comparable companies. For this task, we employ a sum-of-the-parts approach. Assuming total proceeds from the tax lawsuit of approximately $100M, or roughly $1.00 per share. Reduced debt payments and legal fees contribute $0.30 per share collectively. Plus $0.50 per share to account for the potential $100M+ cash from enhanced damages.

In addition, we anticipate the base mercury business doubles or triples revenue to the 50-60M range over the next 18 months, we assign a 2x sales multiple, which adds another $1.25 per share to the valuation. We believe the potential in Forever Chemicals warrants a value of at least $1.00 per share. Similarly, we conservatively assess the REE opportunity at another $0.50 per share. Finally, we attribute a value of at $0.33 per share to cleaning up the balance sheet.

Summing these parts, we arrive at a sum-of-the-parts valuation of approximately $5.00 per share.

Risks

- Faster transition to green energy leads to declining coal revenue

- Unexpected regulatory changes, or lack thereof

- Inability to penetrate new markets

- Loss of major customers

- Loss of patent protection on the SEA® Technology

- Negative outcome of Refined Coal lawsuit appeal

- Competition pressures pricing

- Inability to add new partners

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here