Introduction

Danaher Corporation (NYSE:DHR) is a Life Science Tool and Service conglomerate that holds a duopoly over the manufacturing services, analytical equipment, and consumables side of the biotech and pharmaceutical research and production space alongside Thermo Fisher Scientific Inc. (TMO). As a duopoly, both have returned similar gains for investors for decades, with DHR totaling a 15.3% CAGR over the past 20 years, compared to TMO’s 17%. As aggressive growth has been fueled by M&A into high growth opportunities in the sector, it is actually quite impressive how similar the company’s financials have been over the years, despite one major difference: spin-offs.

One of, if not the most, discussed bear cases for Danaher is the frequent spin-offs. Some suggest that this means prior acquisitions were not smart and management has done poorly to integrate assets. Others suggest that diversification is the most important way to reduce risk, and so Danaher is riskier now. However, when comparing Danaher to the three recent incidences, this may not be the case. Over the past 10 years, Danaher has spun-off three public entities comprising their former applied and environmental – Veralto (VLTO), dental – Envista Holdings (NVST), and process control/industrial – Fortive (FTV) segments. The main reason for the shedding of excess: all three groups have EBITDA and Net Income margins below the parent, DHR. To determine the value derived through the shedding process, I provide a table of market cap and revenues below.

As shown, Danaher accounts for over 75% of the total market cap, but only 64% of total revenues. This reflects a higher valuation, through both increased profitability and reduced operational complexity (what investors like). This is also despite the three spin-offs being quite profitable for their industries themselves, but DHR’s focus on Life Sciences takes advantage of the most financially lucrative opportunity. Even at over $150 billion in market cap, I also see higher growth opportunities thanks to the healthcare industry exposure. As such, I believe from here on out, DHR has the ability to outperform most industry constituents, and should be considered for most investors as their primary Life Science exposure. The question will be whether investors will also benefit with Danaher’s bright financial outlook.

|

Spin-off |

Market Cap ($B) |

Revenues ($B) |

|

Veralto (Applied and Environmental) |

22.0 |

5.0 |

|

Envista (Dental) |

3.6 |

2.6 |

|

Fortive (Process Control and Industrial) 2016 |

29.7 |

6.1 |

|

Danaher (Life Sciences) |

183 |

23.9 |

|

Total |

238 |

37.6 |

Mixed Life Sciences Outlook

It is well known across the financial world that the healthcare industry is one of the less cyclical areas of the market. This is primarily due to the continual need of life saving medicine despite economic conditions, along with the search for innovative and lucrative new treatments that has entities investing 24/7 in next-generation technology. With Danaher a key player in providing tools and services for the entire industry, the opportunity is clear. However, despite tailwinds blowing most of the time, especially during so-called black swan events such as the pandemic, higher interest rates have caused the most significant bear market for the healthcare industry in at least a decade. The primary issue is that there has been a dearth of funding for the pre-revenue biotech sector leading to significant pullbacks in operational costs and investments at these firms.

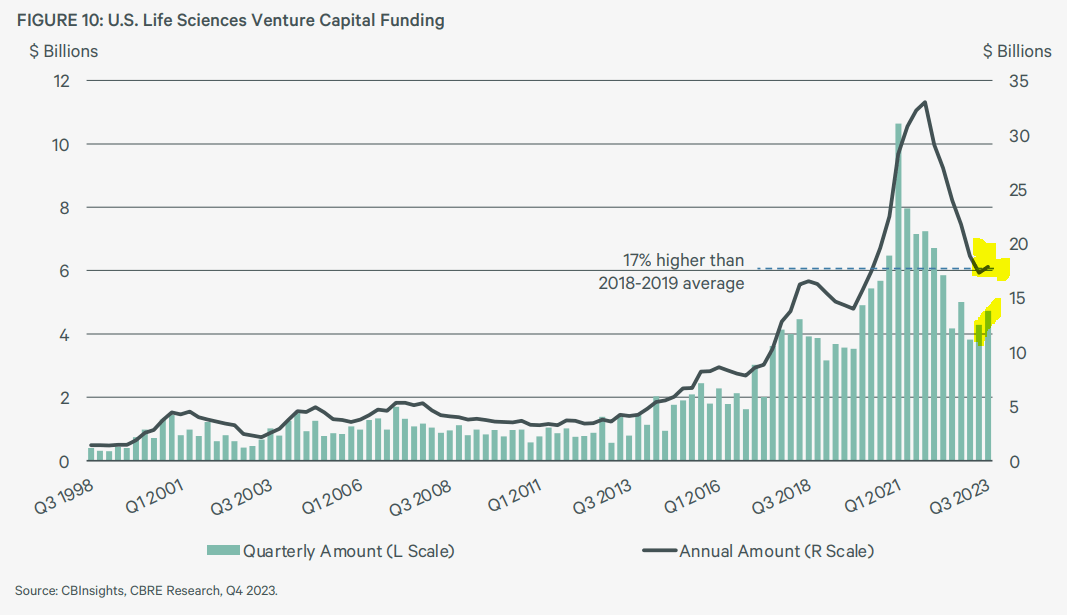

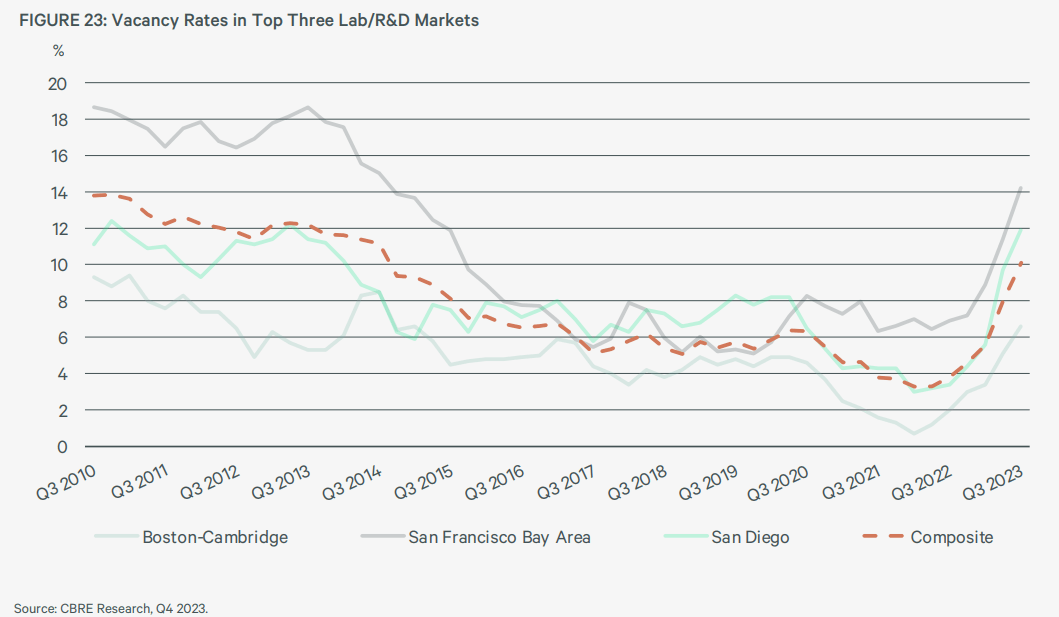

According to data presented by CBRE Research (CBRE), Life Sciences Venture Capital funding has declined from over $30 billion annually in 2021 to a low of ~$17 billion in 2023. However, as of the third quarter of 2023, there has been an uptrend in venture funding, and this may signal an important turnaround for the sector. At the same time, the real estate firm has recorded a huge increase in lab space vacancy rates in the three biotech hubs of Boston-Cambridge, the San Francisco Bay Area, and San Diego. The vacancy rates averaged 5-7% from 2016-2020, they are currently above 10% and show no sign of improvement as there are no start-ups to fill the spaces. This pattern is not new for the post-pandemic era, and increased vacancy and a lack of funding were a critical issue after the financial crisis, taking almost 2016 to fully recover.

During that post-GFC period, Danaher was just beginning to enter into the Life Sciences sector after primarily being an industrial conglomerate. A trio of significant acquisitions in the 2000s, Leica Microsystems, Vision Systems, and AB SCIEX/Molecular Devices, helped fuel an accretive growth phase through the weak market environment starting in 2009. Then, in 2011, another key purchase of Beckman Coulter established Danaher as an HC industry leader at a great price in hindsight. These purchases helped revenues climb from $10 billion at year end 2006 to $18 billion in 2012. Unfortunately, the weak market conditions were reflected as stagnant growth for the following eight years, with revenues not surpassing peak levels in FY 2013 until 2020.

Now in 2023, the Life Sciences are back in a bear market with weak funding and Danaher’s revenues have gone negative the past few quarters. As of last quarter, DHR has seen 1.98% annualized revenue growth for the past 10 years despite the great pandemic bull market. Rest assured, the weak revenue growth is unlikely to remain an issue moving forward. First, as venture capital spending returns, new start-ups will fill vacancies and signal a healthy market. We also have more clarity about Danaher’s prospects now that Life Sciences are the sole focus. And, there is one critical factor that is not taken into consideration when only considering revenue growth: profit generation is what drives the valuation.

CBRE Life Sciences Outlook 2024 CBRE Life Sciences Outlook 2024

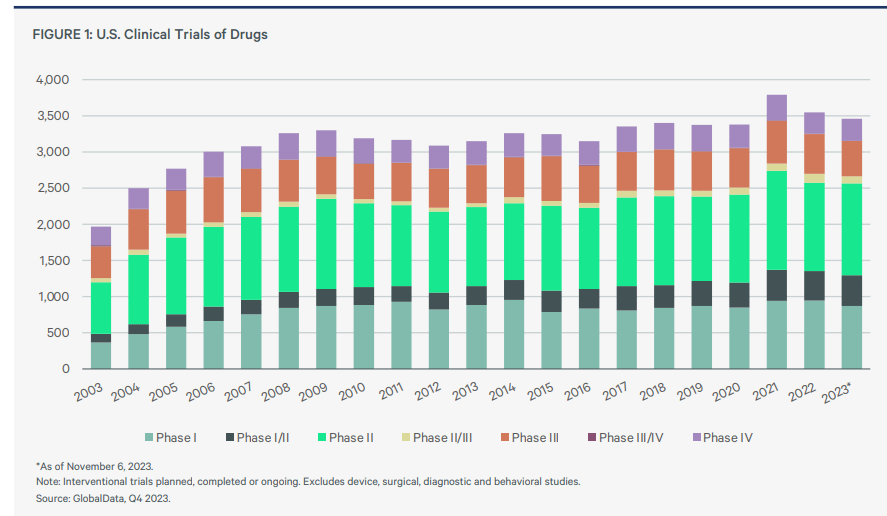

Despite a lack of funding for the start-up market, headwinds turn neutral when we look across the entire market. As shown with further CBRE data, US clinical trials have remained resilient, and typically do even during bear markets. The areas of cyclicality remain in early stage phase I or II trials, while phase III and IV levels remain stable through time. This suggests the large, profitable biotechs and pharmaceuticals remain resilient due to the general stable opportunities of the healthcare industry. As such, there is always a base for Danaher to rely on, especially when over 75% of company revenues are based on recurring or consumable sales. Other favorable data on the late-stage side of the market includes the fact that 2023 is expected to see over 50 FDA novel drug approvals, a level that is second only to 2018. With new, advanced therapies comes the need for new, advanced tools and services that Danaher provides.

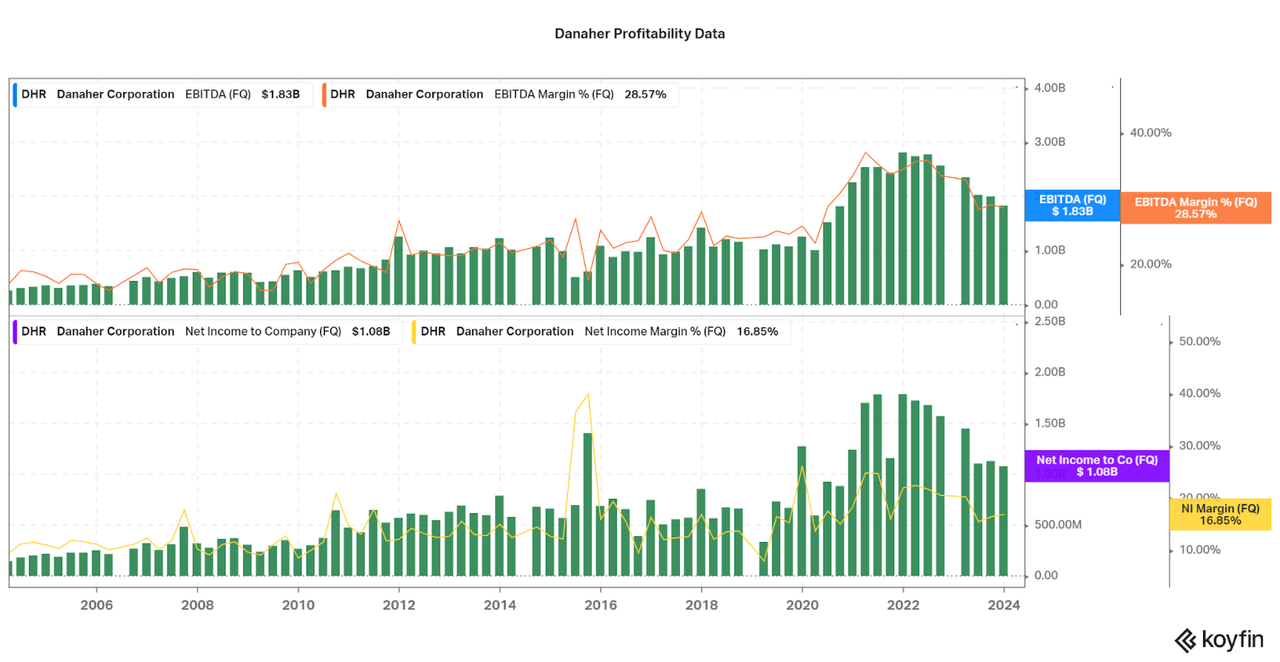

So, despite temporary issues, Danaher is well positioned for success from the opportunities of profitable biopharma companies. The best place to see the company’s long-term success is on the bottom line. As revenues remained flat, EBITDA and Net Income margins only improved thanks to rising recurring and advanced service revenues. Now that Veralto has been spun-off, there is little in the way for Danaher to not perform in line financially with Thermo Fisher, who has always had more Life Science exposure. This means that I expect EBITDA margins to remain at the current level of 28% or higher, and NI margins to remain above 20% during a bull cycle. If this occurs alongside meaningful Life Science M&A and innovation, investors can expect earnings growth in-line with the past 20 years, or about 3-5% above the broader market.

CBRE Life Sciences Outlook 2024 Koyfin

Conclusion

While the market may seem weak to some, Danaher clearly has a bright future as they transition to a full healthcare focus. I am not the only one who believes in the opportunity, as Danaher is trading up and only $40-50 away from all-time highs seen at the height of the pandemic. This high valuation is the biggest risk point at the moment, but easily negated with recurring investments. However, investors looking to take advantage of the current market may look to wait for profitability to bounce back over the next few quarters as non-Veralto earnings come through. Others can also continue to nit-pick between choosing TMO or DHR, although I recommend going with both as diversification.

The table below highlights how similar the companies are, with TMO facing more leverage, but a lower valuation. I also see Danaher being more successful in the diagnostics space with assets like Beckman Coulter generating higher operating margins, although TMO is the clear winner across life science applications. This back and forth nitpicking is now even more extreme with DHR’s full healthcare lean, and I believe that there is no need to do so when both companies are incredibly strong compared to other companies across the stock market. Now it is just a battle of management adeptness and whether these companies continue the M&A driven growth path of the past two decades. For more details, refer to my article on Revvity (RVTY) that suggests the third major LS/DX player in the industry may have the chance to outperform both the giants.

|

Company |

Consumables / Recurring / Services Mix 2023 |

Operating Margin (%) (Life Sciences / Diagnostics) |

10 Year EPS CAGR (%) |

Current / 5 Year Avg. NI Margin (%) |

Leverage (ND / EBITDA) |

P/E (TTM) |

EV/EBITDA (TTM) |

|

Thermo Fisher |

82 |

36/22 (Adj) |

16 |

14/16 |

3.1 |

38 |

22 |

|

Danaher |

75-80 |

19/26 |

5.3 |

20/19 |

1.4 |

44 |

26 |

I hope this quick summary is insightful for those hoping for a continued uptrend for Danaher despite losing billions in revenues due to spin-offs. While I believe a slower moving, but profitable conglomerate is more risk-friendly, a renewed focus on organic growth with Life Sciences exposure is not a bad decision by any means. This will allow Danaher to have more equal footing with TMO, as the available pool of M&A targets dwindles for both firms. There is already plenty of forum talk about Life Science purchasers being unhappy with the duopoly’s growing domination of the market, and it will take only the best management to handle monopoly risks moving forward. But, so far so good as recurring revenues have increased to top-tier standard of ~80% as a way to generate profits and leverage remains low to remain flexible in the weak market. I believe higher highs will be made, and investors will remain quite happy.

Thanks for reading. Feel free to share your thoughts below.

Read the full article here