Department store chain Kohl’s (NYSE:KSS) has seen its share of challenges in the retail sector. I have followed the company for a while and last summer, I wrote about how I was avoiding both the shares and the debt. After reviewing the latest earnings, I have become bullish on Kohl’s with three different income strategies for investors.

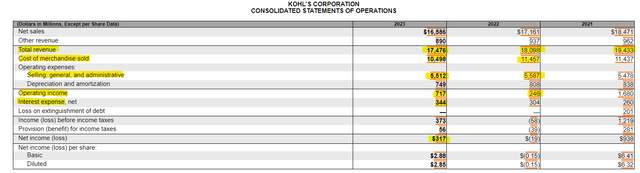

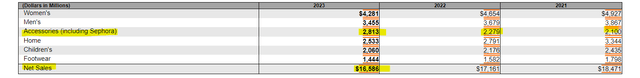

Kohl’s pattern of declining sales continued through 2023. Fortunately, the sales decline slowed from the previous year with just under $17.5 billion in total revenue. Additionally, the cost of goods sold fell by $1 billion and selling, general, and administrative expenses remained flat. Kohl’s prudent management of expenses allowed operating income to grow from $246 million to $717 million, which covers interest expenses by more than 2 to 1.

SEC 10-K

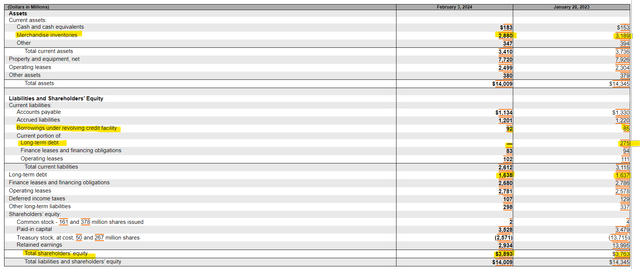

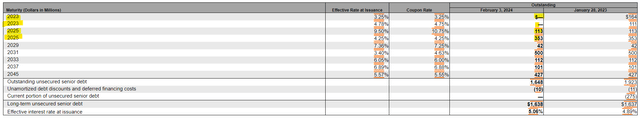

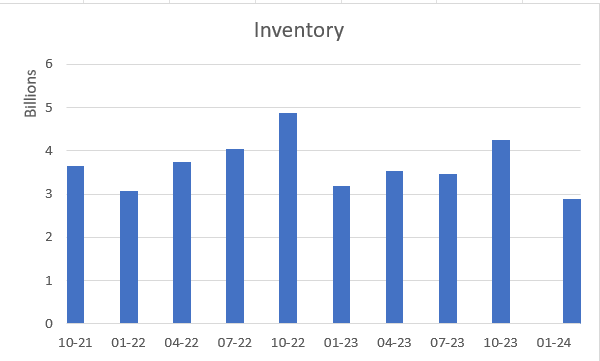

Kohl’s balance sheet also showed improvements in 2023. The company reduced its long-term debt by paying off current maturities with cash on hand and had an immaterial change in its revolving credit facility. Kohl’s also saw a drawdown in inventory, which helped cash flow (and debt reduction). Overall, shareholder equity grew by $130 million to just under $3.9 billion.

SEC 10-K

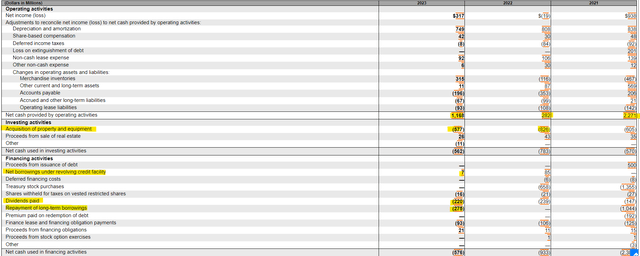

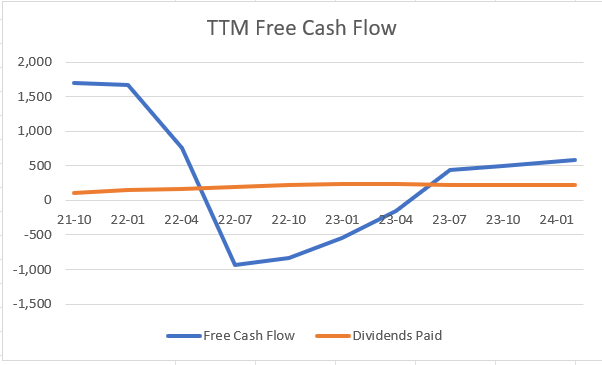

Kohl’s cash flow statement is what led me to become bullish on the company’s shares. Operating cash flow grew from $282 million to $1.1 billion in 2023. After capital expenditures, free cash flow went from negative to positive $600 million. With a dividend obligation of $275 million, Kohl’s was able to cover its dividend and pay down its current maturing debt with free cash flow. Kohl’s shares are currently paying a dividend yield of 7.6% and after a rocky 2022, the company is demonstrating sufficient free cash flow generation to cover the dividend and pay down debt into the future.

SEC 10-K TIKR

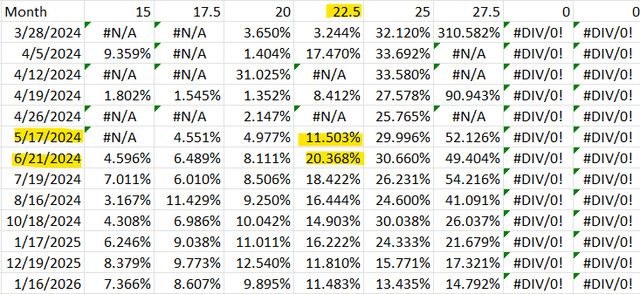

In addition to the purchase of shares, investors can earn income by selling put options on Kohl’s shares. At a strike price of $22.50 per share (nearly $4 lower than the current price), put options selling in May and June are generating double digit returns when annualized. Options prices are subject to volatility and changes in liquidity, so investors should check the bid/ask spread and volume of each contract before trading.

Yahoo Finance

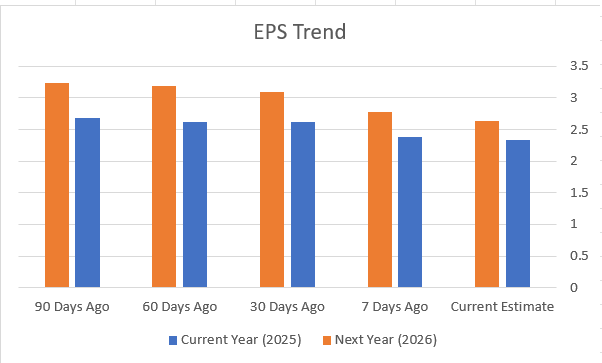

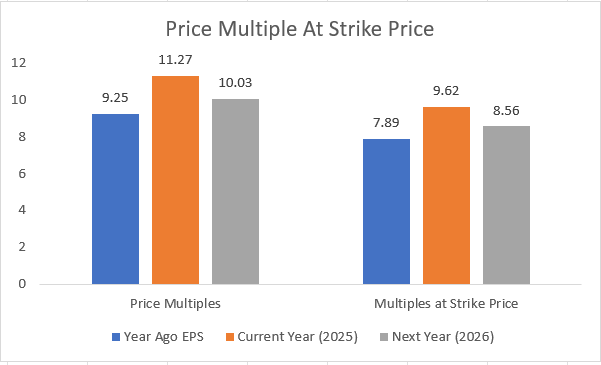

While analysts have continued to revise down this year and next year’s earnings estimates, the $22.50 strike price represents a good entry point for investors if they are assigned shares. At that strike price, investors would be buying shares at 8.5 times next year’s earnings (versus 10 times multiple at today’s prices.) Also, at $22.50 per share, investors would be acquiring Kohl’s shares at a dividend yield of nearly 8.9%, providing an opportunity to continue returns north of 10% with covered call options.

For investors wanting to go long on shares today, Kohl’s is trading at 10 times this year’s earnings with a market capitalization of under 80% of shareholder equity. Combine this with a multiple of 5 times free cash flow and Kohl’s clearly has attractive valuation metrics to qualify for a value stock.

Yahoo Finance Yahoo Finance

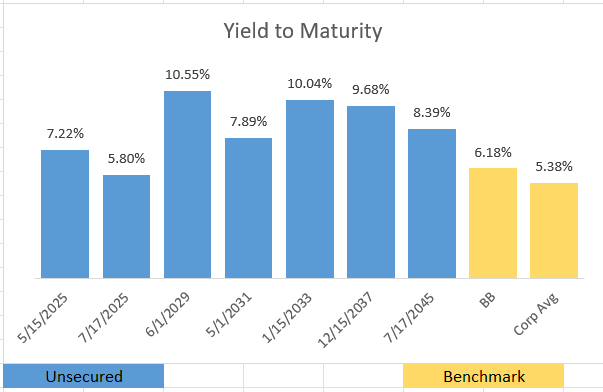

For income investors who want a little more safety, Kohl’s high yield bonds may make a better investment. While some bonds have not traded in a couple of weeks, three different maturities offer greater than 9% yield to maturity. Debt holders should be encouraged by Kohl’s robust free cash flow generation as it represents an ability to pay off more debt without the need for refinancing.

FINRA

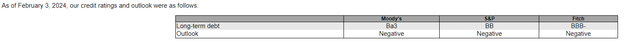

There are a couple of risks to an investment with Kohl’s. On the debt side, the company’s credit ratings are currently below investment grade with a negative outlook. This can become a headwind to debt prices if there is a downgrade. I do believe the opposite may happen where the retailer could see a credit upgrade, especially if it can pay off some of its high yielding debt maturing next year with cash on hand.

SEC 10-K SEC 10-K

Another risk that investors should be aware of lies within Kohl’s sales data. It appears as if Kohl’s partnership with Sephora is the only product area where sales growth is occurring. This can be concerning when $13 billion of the company’s $16 billion in sales are in areas of declining trend. Management seems optimistic that sales declines will stop in 2024 with guidance of -1% to 1%.

SEC 10-K

Finally, I would be remiss not to mention Kohl’s inventory, which is lower compared to historic trends. The company will likely need to dedicate $1 billion or more in operating cash flow over the next three quarters to replenish inventory for the holidays. Kohl’s does have the revolving credit capacity to deal with a build of inventory if cash runs out, but investors in Kohl’s shares will need to keep an eye on this as increased financing costs may impair future earnings and cash flows.

TIKR

Overall, Kohl’s has slowed its sales declines through a successful launch of the Sephora brand and has enhanced its free cash flow to cover its high yield dividend. The company is currently trading at attractive price to earnings multiples and offering good premiums on put options to give investors an even better potential entry point. I will be targeting the sale of cash-secured puts and won’t mind being assigned shares and collecting income.

Read the full article here