Since the last time I wrote about China’s e-commerce behemoth Alibaba Group Holding (NYSE:BABA) in December last year, its stock price has gone nowhere, with a ~2% decline since. Year-to-date [YTD], it has seen an even bigger fall (see chart below). This is hardly surprising considering that the company’s third quarter (Q3 FY24) figures released since have continued to be uninspiring.

However, the company is betting on AI to drive it forward, which certainly has potential. Here, I consider how this plays out against the rest of the business to determine what’s next for the stock.

Focus AI

Particularly since ChatGPT took the world by storm in 2022, the high potential of the AI industry has been increasingly recognised. In China alone, the market for AI is expected to grow at a compounded annual growth rate [CAGR] of ~18% between 2024 and 2030 to reach a size of ~USD 105 billion.

I pointed out the last time that Eddie Wu’s promotion to the top job from being the Chief Technology Officer was in line with this focus. The use of AI tools to improve efficiency for merchants associated as a part of the growth strategy for Taobao and Tmall Group, Alibaba’s biggest revenue generator with a contribution of 44% as of 2023, is also an example of the focus (See under ‘Growth strategy for the segment’ of the link above for more details).

Now, AI could even give a new lease of life to its sagging cloud intelligence group, which Alibaba tried to hive off last year before it changed its mind.

Slashing prices and investing in startups

The recent reduction in the price of its cloud services is seen as one way of gaining the AI software developer market. It expects to reduce prices on average by 20% for its products, though for some of them, it’s expected to be as much as 55%.

Investing in AI startups is another way that Alibaba is making inroads into the space. The most recent highlight is its USD 1 billion investment in Moonshot AI in February, whose claim to fame is the Kimi chatbot, China’s answer to ChatGPT. More recently it invested another USD 600 million in Minimax, another generative AI company. Not only can these investments create early demand among AI developers for its cloud services, but they can also support the company’s own use of AI for its business, as outlined in its strategy for the Taobao and Tmall Group.

Cloud services lag but see impressive EBITDA growth

The segment is still quite small compared to Alibaba’s total revenues. It contributed just 11% to the company’s revenues in the first nine months of the company’s financial year (9m FY24, year ending March 2024). But it’s also growing rather slowly. For 9m FY24, it grew by just 3% year-on-year (YoY) compared to the 9% increase in total revenues.

It’s not without potential though, and beyond just AI. The segment saw an impressive 51% increase in adjusted EBITDA during this time, compared to a 15% total adjusted EBITDA increase. If the company’s bet on AI does ramp up growth in its cloud services, over time it could be just the comeback recipe Alibaba is looking for. The company’s operating margin on average over the past five years has declined ~15% from ~34% in the five years prior.

Of course, for now, the recent price reductions are likely to impact the very healthy EBITDA margins for the segment but they might still remain ahead of those for the company as a whole.

Big player in China market

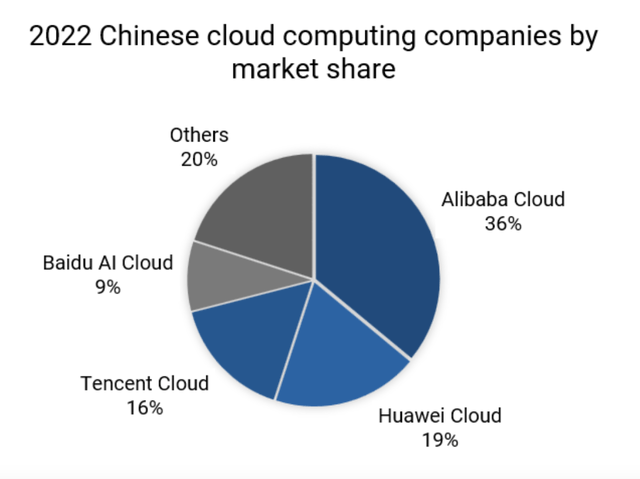

Moreover, Alibaba is the biggest player in China’s cloud services market, with a 36% share of the total as of 2022. The second biggest, Huawei, lags significantly behind with a 19% share (see chart below). This gives Alibaba an advantage in growing the segment, though clearly there’s plenty of competition here too, which raises the question as to whether it can indeed improve its margins.

Source: Daxue Consulting

Taobao and Tmall Group’s performance is concerning

However, with the biggest chunk of growth dependent on the e-commerce arm, the Taboo and Tmall Group, for investors looking at a short-to-medium-term investment timeframe, it’s still the key segment to focus on. And it’s not looking good. After an 8% increase in revenues in H1 FY24, the growth dropped to 6% for 9m FY24 on weak performance in Q3 FY24. Its EBITDA also grew by a far smaller 4% compared with the 15% for Alibaba as a whole.

Market multiples are competitive

At the same time, the stock’s market multiples continue to look attractive as net income attributable to shareholders has managed to grow by a very healthy 56%, partly on better results at operating results but also because of smaller investment losses.

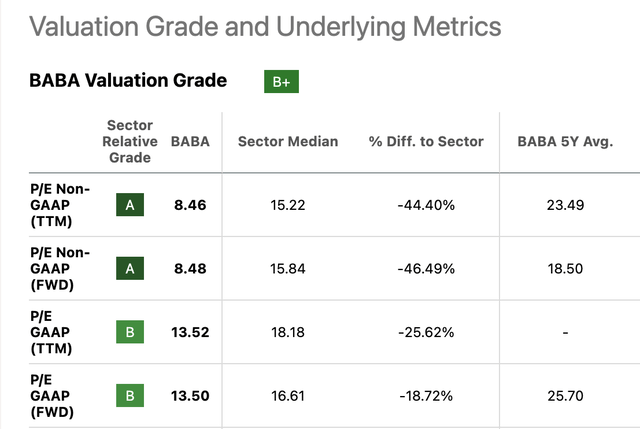

If it continues to grow at this rate in Q4 FY24, the forward GAAP price-to-earnings (P/E) ratio would be 11.7x for FY24, which is higher than the 11x estimate the last time I checked. However, it’s still way lower than that for the consumer discretionary sector at 16.6x and also its own five-year average of 25.7x. In fact, all its P/Es are lower right now compared to the past average (see table below).

Source: Seeking Alpha

What next?

Based on its continued attractive market multiples, its sustained strong position in the e-commerce market and the potential for gains in its cloud services business, I’m retaining a Buy rating on Alibaba.

However, I am increasingly concerned about the weak performance of its e-commerce segment, the Taobao and Tmall Group, especially at a time when China’s economy isn’t doing as well as hoped. Increased competition from the likes of Temu owner PDD Holdings (PDD) doesn’t help either. The company does have a revival strategy in place but it would be good to see some outcomes from that sooner rather than later.

If there are no signs of improvements in the next results report, especially in revenues for its cloud services after the recent price cuts, it would be a good idea to reassess the rating. And that would be so even with attractive market multiples because it would imply that the stock is valued low for a reason.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here