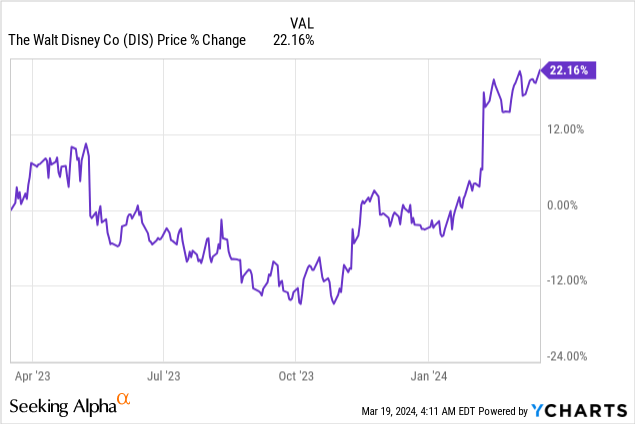

Shares of Disney (NYSE:DIS) went into a new up-leg after the entertainment company announced that it will massively increase in its capital returns in FY 2024. Disney also reported that losses in its direct-to-consumer business narrowed significantly in the December quarter which makes it likely that the streaming company will be able to report its first-ever operating profit in its DTC business this year. With more capital returns awaiting shareholders, Disney’s shares are now much more attractive for investors from a capital return point of view as well. With shares trading at a reasonable P/E ratio, I believe Disney remains a very interesting investment for investors in 2024.

Previous Rating

I rated shares of Disney a strong buy after the company’s third-quarter fiscal results in October 2023, chiefly because of Disney’s subscriber boost at the time: The Recovery Could Be Epic. Additionally, Disney has now guided for significant capital returns, including a $3.0B stock buyback as well as a 50% dividend increase. Lastly, after years of reporting losses in its core streaming segment, Disney is seeing improving fundamentals in its direct-to-consumer business and could report a positive earnings contribution on a full-year basis for the first time in 2024.

Improving Fundamentals In DTC, 2024 Could Be An Inflection Point

The streaming segment has been a bit of a headache for Disney in recent years in part due to high losses, but also due to growing competition as many entertainment companies launched their own streaming subscription services. Operating and subscriber losses in streaming were one reason that held me back in FY 2023 from issuing a buy recommendation.

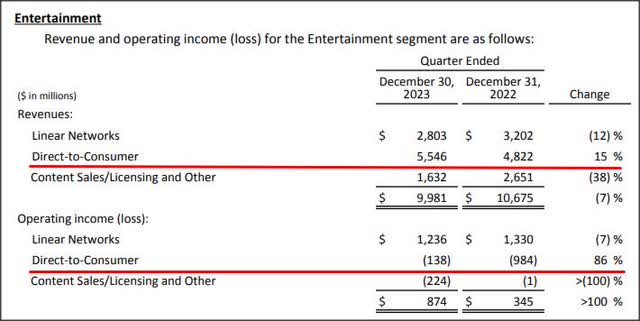

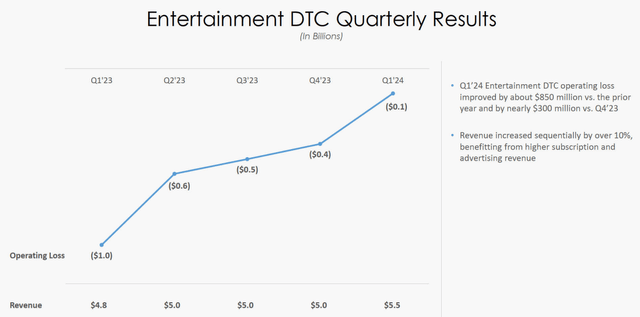

However, the entertainment company is making rapid progress right now in terms of improving its profitability and it seems that Disney has now a large enough subscriber base that profits are finally on the horizon. The DTC business generated $5.5B in revenue in the December quarter, showing 15% year over year growth and it is now by far the largest revenue stream within Disney’s Entertainment segment.

Disney

Disney saw a massive improvement in the DTC segment’s operating income in the last quarter, indicating that the company could move towards its first-ever positive full-year operating income in FY 2024. The segment’s losses declined by $850M year over year and the narrowing of losses is a major reason to assume that Disney is rapidly nearing an important inflection point here. A positive full-year operating profit in DTC, in my opinion, could be a powerful catalyst for Disney to ensure that the current share price rally can continue throughout 2024.

Disney

Why Disney Is Now A Capital Return Play

Disney’s CEO Bob Iger announced a 50% increase in the firm’s dividend in February which means investors will get paid a $0.45 per-share semi-annual dividend starting in July. Disney paid a dividend of $0.88 per-share quarterly before the pandemic, so the dividend still has a long way to go to reach pre-pandemic levels, but the streaming company is clearly on the right path.

The company also guided for $3.0B in stock buybacks in FY 2024 which is made possible by Disney’s aggressive cost-saving strategy that is set to deliver annualized cost-savings of $7.5B by the end of the current fiscal year. These buybacks will be the first stock buybacks since FY 2018 and mark another positive development in Disney’s business rebound after the pandemic.

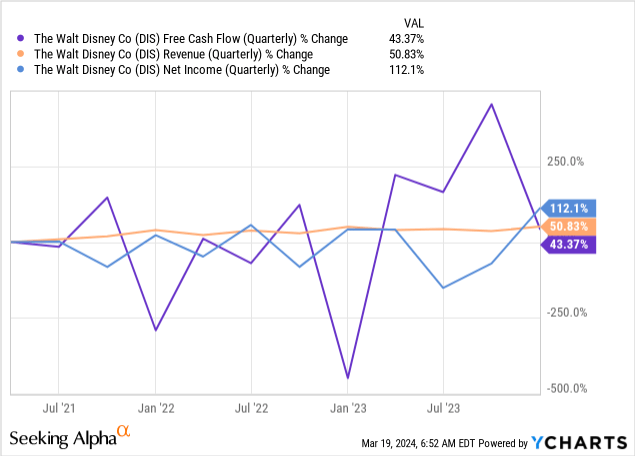

Cost-savings and momentum in streaming have resulted in significant upswing in Disney’s free cash flow momentum. In the December quarter, Disney generated $886M in free cash flow, showing a year over year improvement of $3.0B. In the last three years, Disney’s free cash flow has increased more than 40%, driven chiefly by a post-pandemic rebound in the entertainment business.

Disney’s Valuation

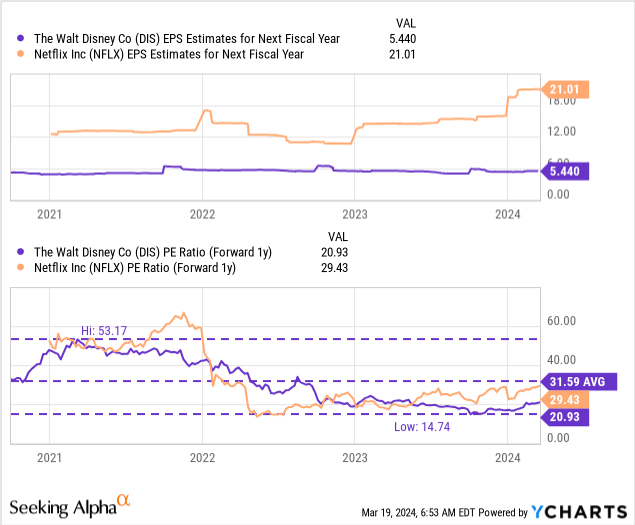

Disney is projected to generate $5.44 per-share in earnings next year, implying 17% EPS growth. Based on earnings, Disney is valued at a P/E ratio of 21X which is low relative to its historical valuation and the P/E ratio of rival streaming company Netflix (NFLX)… which I currently rate a hold.

Netflix is expected to reach 23% EPS growth next year, so the streaming platform has a slight edge in terms of earnings growth, but the difference in valuation, in my opinion, is not really justified, especially with Disney moving toward DTC operating income profitability. Disney is also trading significantly below its 3-year average P/E ratio of 32X, implying a discount of 34%.

With Netflix trading at near-30X earnings and Disney’s longer-term average P/E ratio being around 32X, I believe shares have considerable revaluation potential… especially now that Disney also pays shareholders more generously. A 30-32X P/E ratio, which is justified based on DTC earnings progress, stock buybacks and rival/historical P/E, implies a fair value range of $164-175. In my opinion, Disney could return to this price range if it makes continual progress in lowering its DTC losses and repurchasing shares.

Risks With Disney

The streaming markets are becoming a lot more competitive which means that price competition could heat up going forward. Disney also had a number of theatrical releases that didn’t do well including Haunted House, Jungle Cruise and Turning Red which inflicted losses in the hundreds of millions of dollars on the company. What would change my mind about Disney is if the streaming platform were to lose a ton of subscribers or failed to steer the DTC business toward operating income profitability.

Final Thoughts

Disney now has two catalysts that could further support the shares in the current up-leg: 1) Disney is nearing a critical inflection point in terms of reporting its first-ever positive operating income in the increasingly important DTC segment, and 2) Disney is becoming a capital return play after the company’s CEO announced a $3.0B stock buyback and 50% dividend increase. Shares of Disney have responded positively to these developments, but I believe they still have upside potential as the company completes its turnaround. In my opinion, the dividend, the low P/E ratio, and the fundamental progress in the streaming segment are reasons for growth investors to own the shares in FY 2024.

Read the full article here