Now that we have Qurate Retail’s (NASDAQ:QRTEA) 2023 annual report, I want to provide an update on an article I wrote exactly one year ago that looked at potential bankruptcy scenarios for the company. When my previous article was written, QRTEA had just posted its first year of negative free cash flow in well over a decade and it looked like the company was on the verge of bankruptcy or massive shareholder dilution. QRTEA’s situation has improved thanks to operational improvements, the divestiture of an unprofitable division, and careful cash management. QRTEA isn’t out of the woods yet, but with its downside better protected, I have made it a full position in my portfolio.

In this article, I will highlight some important updates from the previous year and run through some updated cash flow projections. This article won’t include a deep dive into the company; I’ve already written multiple articles about QRTEA which can be referenced as desired.

Qurate’s Situation Improved Dramatically In 2023

Management made tangible improvements at QRTEA in 2023. Looking at the company’s balance sheet, QRTEA’s cash position was bolstered by two sale-leaseback transactions that closed at the beginning of January (2023), as well as by proceeds received from insurance claims filed against their Rocky Mount facility. QRTEA ended the year with just over $1b in cash and was able to pay down nearly $1b worth of debt during the year.

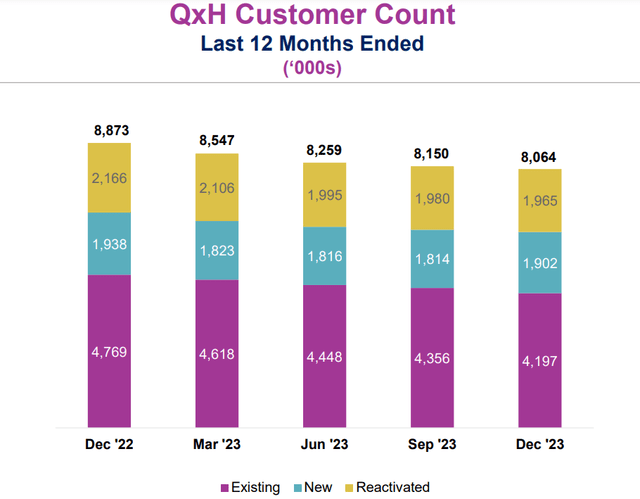

Operational improvements were also made. I was pleased to see QRTEA walk away from their Zulily subsidiary in May, though it was unfortunate that the company essentially had to pay Regent to take it off of their hands. Zulily had been burning around $100mm of cash annually, so its removal should help QRTEA’s bottom line going forward. The company also lowered SG&A expenses by nearly $100mm, cleaned up inventory levels, and made the necessary supply chain adjustments to account for the loss of the Rocky Mount facility. QRTEA’s “new” customer count increased in Q4, though the decline in existing customers continued. It is still a problem that the existing customer count is declining, but the hope is that an increasing number of new customers means an eventual increase in long-term customers.

Qurate Customer Counts (Qurate Investor Presentation)

For 2023, QRTEA booked just under $11b of revenue, posted a small net loss of $94mm, and generated $570mm in free cash flow.

Qurate’s Debt Obligations Look Manageable

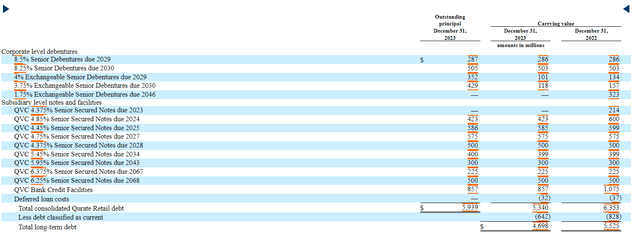

The crucial question to the QRTEA investment thesis is whether the company is going to be able to meet its outstanding debt obligations over the next 8 years. The 8-year horizon is important because the company’s preferred shares (QRTEP) come due in 2031 and will require $1.27b of cash. The company has other significant debt repayments due in that time window as well. After 2031 repayments are minimal until the 2040s and 2060s:

Qurate’s Upcoming Debt Repayments (Qurate 10-K)

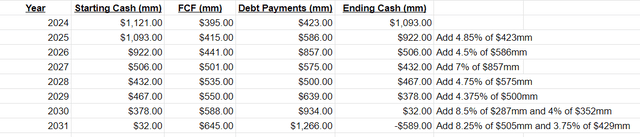

To help organize QRTEA’s debt repayments, I built some simple cash flow schedules. The most difficult component to estimate is QRTEA’s average free cash flow over the next 8 years. Trying to estimate cash flows this far out, or even over the next two to three years, is going to involve a lot of guesswork and I’m not suggesting any of the forthcoming scenarios are going to happen exactly as described. Cash flow will be lumpy from year to year and management will likely make different choices along the way, but I find it modeling different scenarios helps paint a general picture of the company’s situation.

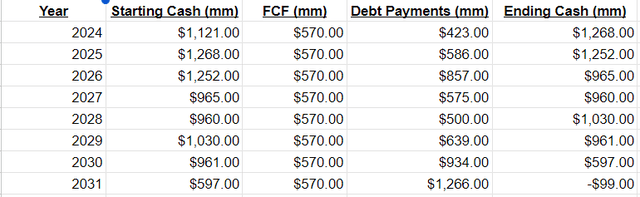

I’ll start, as a benchmark, by looking at the scenario where QRTEA averages $570mm of annual free cash flow (2023’s value):

Author’s Spreadsheet

If QRTEA can, on average, match 2023’s performance then the company would be able to pay down their entire revolver in 2026 and meet just about all of their debt obligations. I think it is fair to assume that they could find a way to cover the $99mm shortfall; $585mm in annual free cash flow is enough to close that gap.

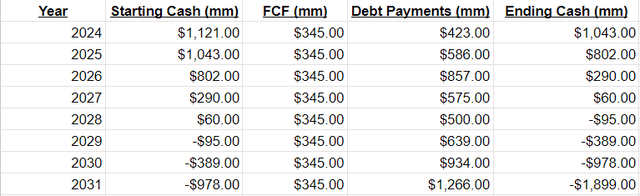

It is worth noting, however, that the $570mm number includes ~$225mm of insurance proceeds. Backing out the insurance proceeds is more indicative of the company’s operating performance for the year, and if we extrapolate using that number the picture is less rosy:

Author’s Spreadsheet

$345mm in annual free cash flow is an improvement over 2022, but not enough to comfortably handle their debt obligations.

This second scenario is also missing some important details, however. Zulily wasn’t divested until about halfway through the year, so there was an extra half-year of drag on 2023’s cash flow. In addition, as QRTEA pays off their debt they will lower their annual interest payments, which will be accretive to cash flow. In my final “benchmark” scenario, I add back $50mm of additional annual free cash flow to account for the Zulily divestiture and the annual interest reduction from paying off each year’s debt obligations. This is my attempt at a more “realistic” scenario, using 2023 as a benchmark and assuming things don’t get dramatically better or worse:

Author’s Spreadsheet

This scenario is a bit of a mixed bag, as on the one hand QRTEA still won’t have cash available to fully meet the preferred redemptions in 2031, but on the other hand, the deficit amount is manageable and could be met with a future credit revolver or a small amount of dilution.

The final scenario doesn’t give QRTEA any credit for future growth, but it also assumes that the company’s revenue and cash flow don’t begin to slide again. At the very least, in all three scenarios, QRTEA looks to be in a position to pay down its revolving credit facility if needed, which increases the odds that it could extend it on favorable terms instead and keep more cash available for other debt repayments. My takeaway is that the company is in much better shape than it was a year ago, but the share price has only appreciated 10% since then (albeit after crashing to a low of $.40/share and then surging back to $1.18/share as of the time of this writing).

Valuation Thoughts And A Rough Price Target

This will be a familiar idea to those who have read my previous articles, but valuing QRTEA is tricky because its long-term outcome is binary. The company will either go bankrupt eventually (or heavily dilute shareholders) because its business model can no longer reasonably support their debt burden, or it will generate enough cash flow to comfortably meet their obligations and become a multi-bagger. Scenario three demonstrates QRTEA’s multi-bagger potential. If we assume that the $600mm gap in 2031 could be pushed to a credit facility, then QRTEA would have that debt plus the remaining ~$1.8b of outstanding notes and debentures for a total debt of $2.4b. In that scenario QRTEA is generating $650mm in annual free cash flow in 2031; using the company’s current 9x EV/FCF multiple would give an EV of $5.85b and a market cap of $3.45b, nearly 7x the company’s current market cap of $500mm. A $3.45b market cap translates to $9/share and would be a 27% compound annual growth rate over the next 8 years.

I’ll say it again: these are very rough and unsophisticated estimation scenarios. It is unlikely, for example, that management will fully pay down their credit facility; they will likely just extend it. The company may be able to issue additional notes in the future or choose to redeem some debt early at a potential discount. I present these scenarios as a simplified way of thinking about the company’s debt burden and what will be required to meet their payment schedules. A core reason why I like the QRTEA thesis is that is simple. The company’s future will rest on whether or not they can generate consistent free cash flow; if they can there is a lot of upside here, but if not then the company is likely to be a zero or near-zero. The plan is to monitor their annual cash flow and update my scenarios accordingly; if things stay on track I will hold, if things start to look shaky I will reassess.

Risks To The Qurate Thesis

There are plenty of risks for a QRTEA investor. The core risk, as mentioned, is that QRTEA won’t be able to generate enough cash to meet its substantial debt obligations. Whether they go bankrupt or just do a large equity raise at a poor valuation doesn’t matter much to me; the outcome in either case is bad.

Two particular areas of operational concern are the declining customer counts and the company’s fragility. As noted above, QRTEA’s core of existing customers continued to decline in 2023, and the pace of decline actually increased from Q3 to Q4. One of management’s goals last year was to slow the rate of customer decline, and despite the uptick in new customers the decline in existing customers accelerated. We don’t know if this decline is primarily driven by an aging customer base, the decline of cable network subscriptions (QRTEA still generates the plurality of their revenue from live TV programming), or other forms of competition, but it is clear there are more headwinds than tailwinds for QRTEA at the moment.

Because of QRTEA’s impending debt repayment schedule, their position remains fragile. All it would take is one or two underperforming years over the next 8 to throw them off track. A major consumer recession, the emergence of a new competitor that directly targets QRTEA’s older customer base or another one-off event like the Rocky Mount fire are all possible and would hit the company at a time when they are vulnerable. The company’s healthy $1b cash position will help smooth over this risk in the short term, but QRTEA will need to be building up cash in the 2020s to be ready to make large repayments in 2030 and 2031.

Conclusion

QRTEA’s turnaround isn’t complete; I won’t have full confidence in the company until I see growth in existing customers and topline revenue. That being said, I don’t think the company is on track for bankruptcy anymore and I don’t think they will need to do a large equity raise in the near future. I think a share price target of $9 could be reached within the next 8 years, providing a compound annual growth rate of over 25%. Although QRTEA is far from risk-free, I have bumped it up to a full position in my portfolio and plan to hold until my price target is reached or until something materially changes within the company.

Read the full article here