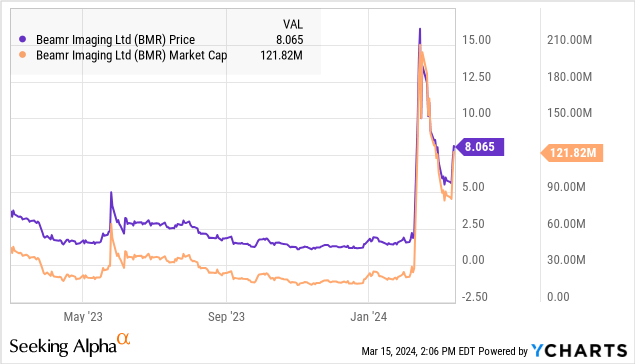

Beamr Imaging Ltd. (NASDAQ:BMR) has flashed across our radar with a spectacular 450% rally year-to-date. The Israel-based software company offers solutions that optimize video encoding and image compression, reducing digital file storage size while maintaining high-resolution quality. Integration of artificial intelligence (AI) tools and collaboration with NVIDIA Corporation (NVDA) helps explain the optimism towards the stock.

That said, the reality is that Beamr with a market cap sitting around $120 million is on the border of “penny stock” territory in our book. We’ll keep BMR in the category of speculative and high risk but feel it’s worth keeping an eye on with 2024 shaping up to be a transformative year in the company’s growth strategy.

BMR Earnings Recap

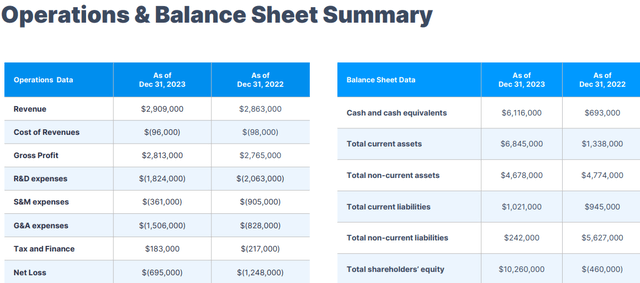

Beamer reported its Q4 results with full-year revenue of $2.9 million, up 2% from 2022. This included the boost from new contracts balancing other transactions that were terminated. Following the company’s IPO last year, efforts to rationalize costs including a drop in sales and marketing kept total expenses under control. Accounting adjustment narrowed the net loss to -$700k narrowed compared to -$1.25 million in 2022.

The company ended the year with $6.1 million in cash and cash equivalents, while a recent secondary offering into 2024 added another $13.8 million in gross proceeds. Favorably, the level of long-term debt at $242k is low.

source: company IR

What Does BMR Do?

In terms of financials, there’s not much to get excited about with the company drawing parallels to a tech startup. Still, the attraction here is the propriety technology and portfolio of patents that have positioned Beamr as the market leader in this niche of video compression.

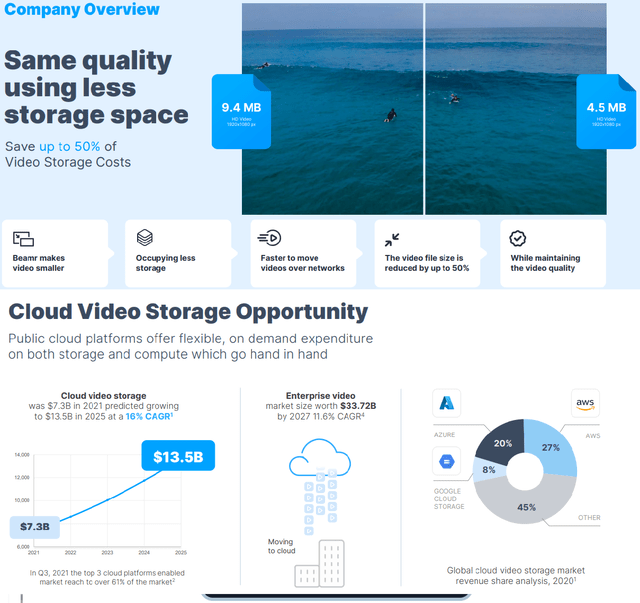

The idea here captures explosive growth in cloud video media with a cost associated with the necessary file storage. This is critical for content distributors, streaming platforms, and movie studios that are uploading petabyte levels of data.

Simply put, Beamr’s content-adaptive bitrate (CABR) system maximizes compression of video files while maintaining resolution, format, and visual quality. Customers can save up to 50% on video storage costs which can represent millions of dollars as part of the value-added proposition.

Notably, groups like Netflix, Inc. (NFLX), Paramount Global (PARA), Vimeo, Inc. (VMEO), and Walmart Inc. (WMT) have been cited by Beamer as among over 50 existing enterprise customers.

source: company IR

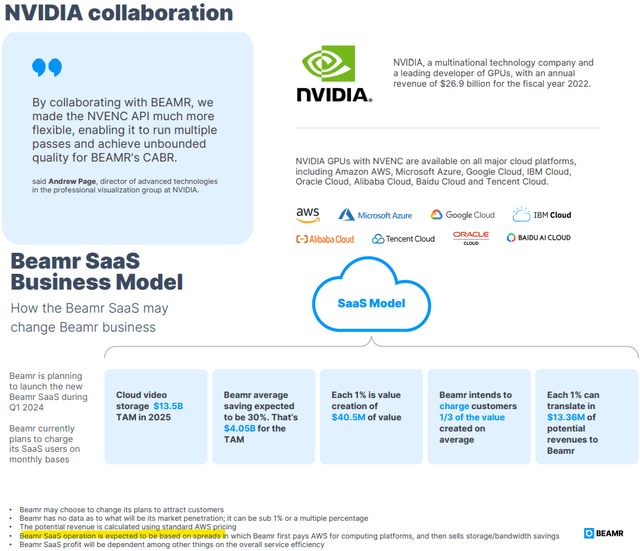

The latest development into Q1 2024 is the launch of Beamr SaaS, which incorporates an API powered by Nvidia’s NVENC GPU-based accelerated hardware video encoding.

Users are charged as a percentage of the value in savings compared to standard Amazon.com (AMZN) cloud AWS storage pricing. In other words, Beamer is reselling the storage, by running the files through its optimization service and keeping a spread as income.

From the cloud video storage market expected to reach $13.5 billion in 2025, the potential that Beamr captures just 1% of that bandwidth could translate into $13.4 million in revenue as a baseline target from this operation.

In terms of the collaboration with Nvidia, there is also an effort to advance the adoption of the emerging video format (AV1). Beamer has an automated process to transfer videos as a solution for companies to move forward with AV1 which can represent a separate growth driver going forward.

Other business opportunities include an expansion into segments like Internet-of-Things, user-generated content, and generative AI where video file compression has a variety of applications.

source: company IR

What’s Next For BMR?

The understanding is that 2024 will be a critical year for the company to confirm the commercial viability of its technology and ultimately deliver strong growth. The collaborations with big tech players and a long list of major corporations as existing customers provide Beamr some immediate credibility.

The good news here is that coming from just $3 million in revenue for all of 2023, it won’t take much to move the needle with any new business making an incremental impact. If Beamr’s CABR solution is capable of delivering the promised cost savings to users, there’s a good case to be made that the service should sell itself.

On the other hand, we can’t overlook what are serious questions regarding the actual addressable market and long-term financial roadmap. There is a risk that cloud service providers like Amazon’s AWS could shift pricing for video storage down the line, limiting the appeal of the video compression technology.

We’ll need to see more to get an idea if it’s possible for the company to reach a milestone of generating +$10 million in annual revenue before beginning to justify a $150 million valuation and the current 40x sales multiple on 2023 revenue.

Final Thoughts

We rate BMR as a hold, implying an otherwise neutral view of the stock price from the current level. With the recent momentum, we won’t be surprised if the stock continues higher fueled by some layer of AI optimism, although assigning an intrinsic value is very difficult.

As-is, BMR has an interesting story but a lot to prove and we expect shares to remain extremely volatile reflecting its micro-cap status and otherwise limited earnings potential.

Over the next few quarters, we’d like to see management provide financial guidance with measures like the gross margin and adjusted EBITDA market target as key monitoring points.

Read the full article here