Over a year ago, I published “U.S. Bancorp: Net Interest Margin Compression Could Quickly Erase Profits This Year.” At that time, I had a bearish view on U.S. Bancorp (NYSE:USB) under the view that its moderately high leverage combined with rising deposit rates would cause its NIM to compress, causing the company to lose most of its net income. At that time, most, but not all, analysts were bullish on USB because its dividend looked strong, potentially overlooking the negative outlook developing in its income.

Since then, USB has seen its EPS collapse as expected. Its quarterly EPS was $0.49 in Q4, showing a relatively significant drop in its income, giving it a similar net income to its 2020 lows. The stock has lost roughly 7.5% of its value since then, despite a large rally over recent months. From the date the article was published to its October trough, USB had lost around 32% of its value. That said, it recovered most of those losses over Q4 as virtually all stocks experienced a “Santa Claus” rally.

Today, U.S. Bancorp is in a precarious position again. It is nearly back to its pre-correction price and shows technical resistance around the $45 level. Further, the economy is now showing more interesting signals regarding the potential for increased bank liquidity issues later this year associated with trends in the monetary market. Additionally, some aspects of U.S. Bancorp’s business have changed. Combined with its leverage and renewed focus, I believe USB requires another deep-dive look to consider how it may fare in the rest of 2024 and whether it could provide investors with positive value.

The Battle For Deposits Is Slow But Growing

One of the core issues in banks today is the general lack of deposit growth across the economy. U.S. Bancorp is a large bank, but it is not necessarily so large that it does not need to worry about losing depositors. Many smaller banks are losing deposits today and can only stop the bleeding by raising savings account rates by nearly 5%, which causes most to lose net interest income unless they shift toward even less secure assets.

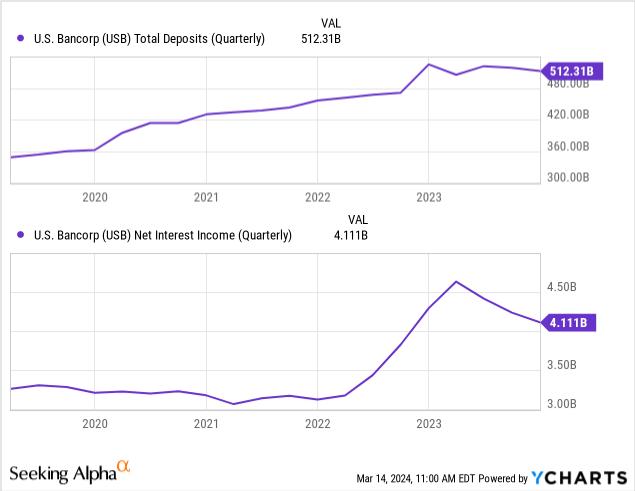

When I covered USB last, I believed the company would look to maintain deposits by raising savings account rates, causing its NIM to decline. However, that did not entirely occur, as the bank was initially able to hold deposits without losing net interest income. Since 2023, its deposits have slightly declined, while its net interest income is now starting to slip at a faster pace. See below:

U.S. Bancorp continues to avoid paying much for deposits. Personally, I am surprised to see how little deposit losses most large banks have faced despite not paying any interest on savings. People with savings can easily get 5%+ FDIC-insured savings through smaller banks or the money market at zero technical risk. Despite that, most people (who aren’t wealthy or businesses) with significant savings continue to stay with near-zero rate banks, essentially giving them a substantial ROI on their cash. This phenomenon is notable as it is the primary reason why many larger banks have more stable net income today compared to the regional banks, most of which are at risk of failing due to their collapsing NIMs and high leverage.

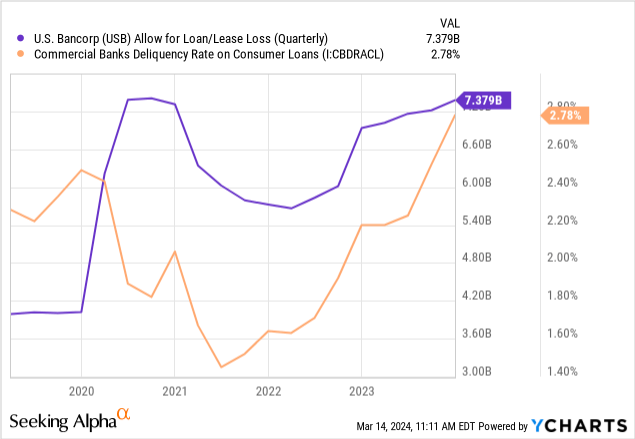

Despite my view that U.S. Bancorp would see significant NIM declines, it has generally maintained a 3% level over the past year. It has likely accomplished this by shifting some assets into slightly higher credit loss risk assets. Like many banks, U.S. Bancorp’s allowance for credit losses has increased markedly, rebounding to the 2021 peak level (much of which was not lost), coinciding with the significant increase in consumer loan delinquency rates across the US. See below:

U.S. Bancorp’s loan portfolio is spread out between each significant segment. At the end of Q4, over a third was in commercial loans, 14% in commercial real estate (a particularly troublesome segment today), 31% was in residential mortgages (which are low risk but have lost tremendous fair value), and the remaining split between credit cards and other retail. This gives USB adequate exposure to the risks in the US monetary system and economy, particularly its high CRE loan exposure due to the enormous losses in the sector. In Q4 22, 0.61% of USB’s CRE loans were nonperforming, rising to 1.45% in Q4 23 and likely rising higher as CRE prices dipped again over Q4 due to higher mortgage rates.

Note U.S. Bancorp’s High Unrealized Losses

U.S. Bancorp is also more leveraged than many may believe if we consider its assets’ fair value. This is a huge issue that caused the failure of many regional banks over the past year. While many investors still believe that unrealized losses do not matter, that is only true in the event of very stable liquidity. In reality, liquidity is never stable, particularly for more leveraged banks in a Fed-driven monetary system. So, investors must account for the risk that held-to-maturity assets will be moved to available-for-sale, creating significant loss realization.

At the end of last quarter, USB had investment securities at an amortized cost of $84B, with a fair value of $74B and weighted average maturity of 8.7 years. Thus, selling those assets before 8.7 years may cause up to $10B in loss realization. As in most cases, most of those securities are agency MBS, offering <3% mortgages around 2020, which are now worth little since inflation is higher than that.

Investors occasionally count for securities, but not always fixed-rate loans, which carry similar or more significant unrealized losses. However, those are not considered a “fair value” measure since they’re not liquid assets. From its annual report loan portfolio breakdown, USB carries ~$107B in residential mortgage loans over fifteen years to maturity. We can also see that ~55% of its total mortgage loans (~$115B) are fixed-rate, giving me a $59B “high duration risk” residential mortgage loan exposure estimate. Its daily average balance sheet notes these residential mortgage loans (fixed and variable) carry an average yield of 3.71%.

Since the floating rate ones will all be well over 3% today, that implies the fixed-rate ones are likely near or under 3% where they’re at risk of very high duration risk losses. Of the estimated $59B in loan long maturity, low rate, residential mortgage loan assets, I estimate their fair value is likely closer to $47B at the end of Q3, given their duration risk losses should be higher than that of the MBS securities due to their longer maturity length (over fifteen years). This adds an estimated -$12B fair value adjustment to USB’s equity value, on top of the -$10B from its securities position.

Crucially, most analysts will not account for fair value losses on illiquid loans, believing that they will recover their value after being held to maturity. These unrealized losses are also somewhat difficult to calculate because we lack all the necessary data. However, given that these loans will not mature for fifteen years or more (likely close to thirty), the unrealized losses should be considered a major add-on risk to USB’s liquidity.

In other words, unrealized loans and securities losses are the non-issue unless liquidity becomes needed. If U.S. Bancorp needs liquidity due to declining deposits and needs to sell its securities or residential mortgage loans, it will mark huge losses. Again, that is essentially what occurred in most of the 2023 bank failures, so investors should not write it off. Further, unrealized losses are not accounted for in equity ratios like CET1. Hence, many failed banks had “strong” CET1 ratios before failure, simply because investors and regulators overlooked this material factor.

U.S. Bancorp had a tangible book value of ~$30B at the end of Q4. Subtracting unrealized securities losses, that drop to $20B. Removing unrealized residential loan value losses (an estimated figure), its NAV estimate falls to ~$8B. Technically, I could go through its other loans and assets and discount the value of other fixed-rate loans. Realistically, I do not think its unrealized losses will be too notable in its different segments because most of its long-term maturity assets are residential loans. However, the other segments, particularly its $135B in CRE loans, have such a sharp rise in risk and nonperformance that I could easily foresee a scenario where USB would have negative tangible equity at fair value.

Further, its market cap is $68B, vastly above my NAV estimate and its tangible book value, indicating investors largely overlook its balance sheet risks. Of course, despite the relatively significant balance sheet risk, USB has maintained its net interest income because depositors have not reacted negatively to its meager savings account rates. That is one key area where my previous analysis was not yet correct, justifying its lack of tangible net equity value with high net income. However, as the monetary environment shifts, I believe U.S. Bancorp will unlikely maintain this benefit.

Large Banks “Free Money Era” Is Ending

Prior to 2022, the US (and Western) financial system was in a very cheap money era that lasted from the 2008 recession and was exacerbated by the 2020 stimulus programs. Since 2022, the direct cost of money has risen significantly, as all the 2020 stimulus programs resulted in a large inflation spike.

Smaller banks, with less stable depositors, felt the higher money costs very quickly as businesses and very wealthy individuals know better than to park money in a 0% APR bank. There is, to me, no benefit of a 0% APR bank over a 5% APR bank, considering both are FDIC insured. However, large banks like U.S. Bancorp have many retail customers that stick with it despite its lack of savings payments. Thus, the inflation cost for savers in USB is a considerable income driver for the bank, as customers essentially give away a 5% risk-free return.

This trend has been an enigma to many economists, who expect savers to be a bit wiser, but the long era of <1% APR rates has likely caused many retail savers to forget they should generally be paid for savings. Thus, I still believe it is unlikely that USB will continue to keep depositors without seeing its borrowing costs rise. Indeed, that may not be caused by smart choices for retail clients but instead by a Fed-driven liquidity decline.

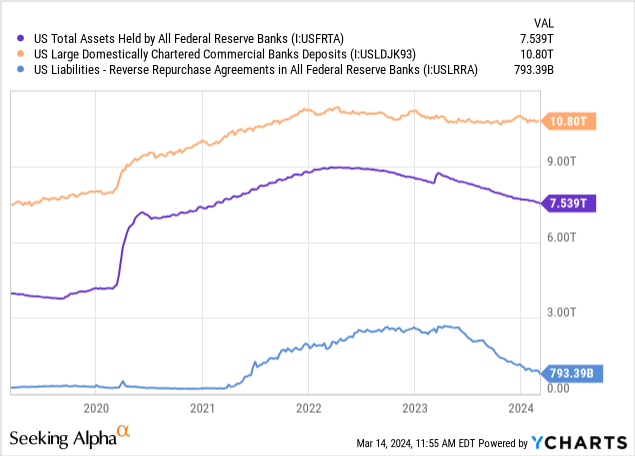

A significant portion of “cash” in large banks today was created during the stimulus program of 2020. Today, the Federal Reserve is slowly “deleting” that money by allowing its assets to mature, slowly pulling liquidity out of the economy. Around 2021, as QE continued, many large banks eventually had too much liquidity that they could not lend, causing them to lend back to the Federal Reserve via reverse repurchase agreements, which are a “liability” to the Fed and cash-like assets for banks. This has been a direct source of liquidity for large banks, offsetting negative broader economic liquidity trends.

In my view, as the Fed’s reverse repurchases “excess bank liquidity” figure falls toward zero, large banks will see their deposits decline as they can no longer draw on excess liquidity. Fundamentally, all banks are connected to the liquidity network, so a decline in broad excess liquidity will negatively impact the trend of all large banks. See these figures below:

The reverse repurchase agreement figure will reach zero around the mid-to-late summer of this year. Thus, I anticipate a decline in large bank liquidity by then, resulting in higher borrowing costs and/or lower deposits for large banks. In the case of U.S. Bancorp, I expect it may need to move more assets to be available for sale, causing the realization of its significant reported and estimated unrealized losses. If so, we could see its equity ratio plummeting to a precarious level. Add on the potential for higher CRE loan losses, and I do not see how USB’s risk profile is any better than that of regional banks today.

The Bottom Line

Overall, I remain very bearish on U.S. Bancorp. I believe it trades at a very excessive premium to its tangible equity value, mainly if its unrealized losses are accounted for. Additionally, both its tangible equity value and the “fair value adjusted” figure are very low compared to its total loans and assets, making its equity insecure in the event of a recession or a continued increase in CRE loan losses.

That said, I would not short-sell USB today. For one, my views regarding liquidity in the banking system remain speculative. U.S. Bancorp may continue to earn a high income if it can maintain free (or very low-cost) deposits. Again, that is an area where my outlook for large banks has been incorrect. Large banks may eventually face the same issues as small banks, but that depends on bank savings customers being wiser about looking for better savings yields. Thus far, many American savers appear uninterested in moving money for higher savings rates.

Lastly, I would not short-sell USB because it may receive either direct or indirect stimulus in the event of a significant financial issue. Though I expect it will face significant financial problems, I also know the US government, Fed, and other banks will tie themselves together to maintain general stability. That could create tremendous upside volatility, erasing potential gains from betting against USB. Still, among the large banks, I believe U.S. Bancorp is one of the riskiest, so it may be best to watch over the coming months as the reverse repurchase “excess liquidity” figure declines.

Read the full article here