MFA Financial, Inc. (NYSE:MFA) is an mREIT that invests in loans and mortgages by utilizing leverage to earn income. The company has been challenged by the restrictive rate policy of the Federal Reserve. Last year, I wrote about MFA’s convertible note that was offering a high-yield return. Since then, the company has issued a new baby bond (NYSE:MFAN) offering an 8.875% coupon maturing in 2029 that, I believe, is the best income investment between its common, preferred, and debt securities.

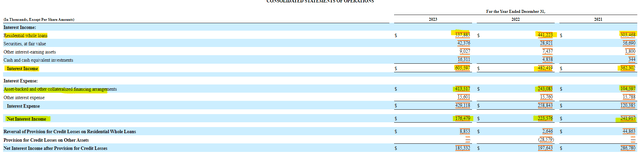

MFA Financial has seen its profitability erode in the face of higher interest rates over the last couple of years. While interest income has risen from $362 million in 2021 to $605 million in 2023, interest expenses have exploded by 3.5 times from $120 million to $429 million during the same period. The end result is that net interest income has gone from $242 million to $176 million from 2021 to 2023.

SEC 10-K

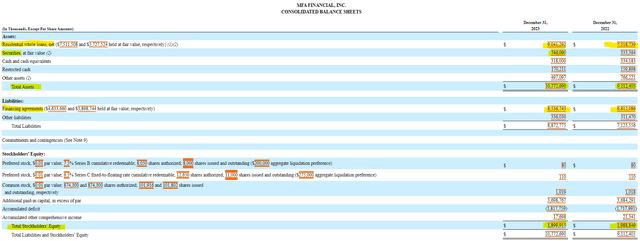

MFA Financial’s balance sheet shows a large growth in assets during 2023. The company increased its investments in residential whole loans and securities. The $1.6 billion increase in assets was primarily led by the increase in loans, which account for more than 80% of the company’s investments. MFA financed its entire asset growth in 2023 through debt (financing agreements), which increased by $1.7 billion. The decrease in the value of residential whole loans accounts for the decline in shareholder equity by $100 million to just under $1.9 billion.

SEC 10-K

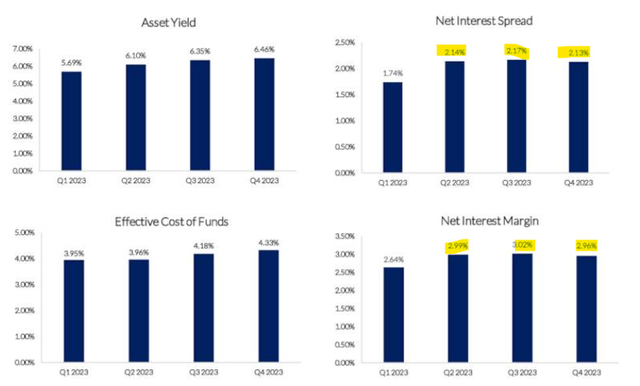

The increase in leverage to invest in more assets during a high-interest rate environment seems to be paying off for MFA Financial. The company’s asset yield has gone from 5.69% in the first quarter to 6.46% in the fourth quarter. The company’s cost of funds has grown by less than that. Effectively, this has led to increases in both net interest spread and net interest margin.

Earnings Presentation

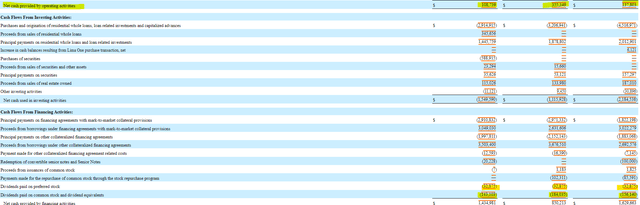

From a cash flow standpoint, I usually like to tie in free cash flow with the ability to fund dividends. In the case of MFA Financial, which has no capital expenditure, that task is difficult. The firm’s investing activities, which are composed of loan purchases and originations, are a part of the day-to-day operations. It is important to see the dividend obligations for both the preferred and common shares.

SEC 10-K

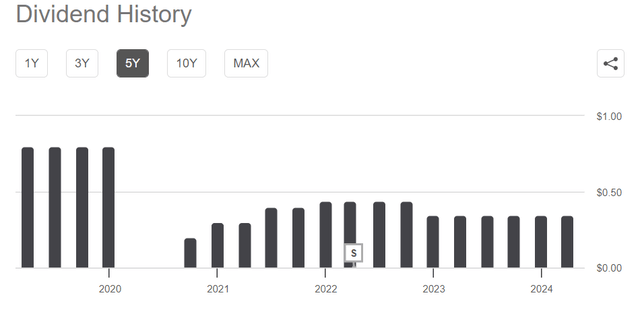

For dividend sustainability, MFA provides distributable earnings to compare whether or not the company is generating the earnings necessary to cover its dividends. While distributable earnings are growing, it was below the dividend threshold three quarters ago. This tightrope, combined with MFA’s dividend history having multiple cuts over the past five years, makes me uncomfortable with investing in the common shares.

Earnings Presentation Seeking Alpha

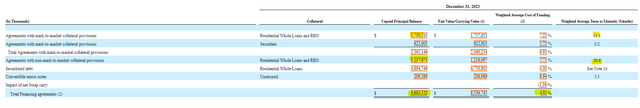

Interest rate levels represent a key risk to the financial performance of MFA Financial. The company appears to be betting big that we have reached the top of the rate hike cycle. If we have not, and loan rates are to rise, MFA will have to write down the value of its assets, which would push up its leverage ratio. It’s also important to note that while lower rates will help MFA Financial, the drop in interest expenses may not benefit the company as quickly as its peers. The two highest-interest loans on the liability side of the business have rates north of 7% and mature on average between 12 and 21 months out.

SEC 10-K

While I have nothing against MFA Financial’s preferred shares (MFA.PR.B) (MFA.PR.C), the Series B preferred share trades at a comparable yield to the baby bond, and the C Series trades at a yield of more than 100 basis points lower. While the C Series preferred share will float at a rate of three months LIBOR (or SOFR) plus 5.345%, that float does not occur until the end of next March. By then, rates could be low enough to where the float rate is also comparable to the current baby bond rate. The baby bond provides an attractive coupon of 8.875%, which will give the same income as the preferred shares with a little more safety.

MFA Financial is making big bets on interest rates either stabilizing or declining soon. The company has increased leverage to invest in additional loans, and a part of that capital raise has been to issue a new baby bond. Based on the safety level of each of the securities, I believe the 8.875% coupon baby bond is a great investment for debt and income investors alike.

Read the full article here