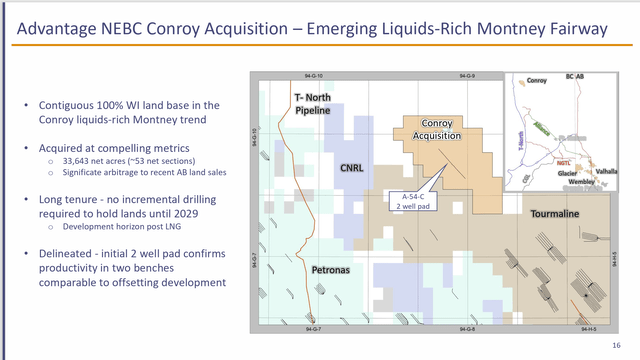

Advantage Energy (OTCPK:AAVVF) recently acquired about 33,643 acres of land known as the Conroy acquisition. This enables more liquids exposure should management desire that exposure. Management mentions that this set of leases has no more maintenance requirements until 2029. This gives management time to figure out how to develop this acreage as the export LNG business develops in Canada. In the meantime, the Entropy subsidiary is progressing along. Although Entropy has a lot of speculative future hopes. The main business though is plagued with low natural gas prices. That makes the transformation to more liquids production all the more important to the near future.

Conroy Acquisition

Management spent about C$10 million for about 53 sections that total a fair amount of acreage as noted before. Acreage in Canada in even good locations is dirt cheap when compared to the United States.

Advantage Energy Conroy Liquids -Rich Acquisition (Advantage Energy Fourth Quarter 2023, Earnings Conference Call Slides)

This acreage is located near the rest of the company acreage in Canada. The company has long been slowly building liquids production into the production mix to add value while holding costs to the low dry gas level where possible. In this way, management hopes to expand the production margin over time.

This management also intends to grow production about 10% a year. However, natural gas prices are so low right now that continuing weakness may revise that goal for the current fiscal year.

This management, like many, is well aware of the construction of a lot of LNG exporting ability that will come online over the next roughly two years or so. But as the saying goes, “you have to get there” and get there without breaking the company in the process. To that extent, liquids production has an outsized value to the company right now.

Entropy

This subsidiary received more funding from Canada’s Growth Fund in addition to previous funding from Brookfield. Details are in the annual Management Discussion and Analysis previously referenced.

Entropy does not have material results on the company reported results at the current time. Just getting this subsidiary to an initial public offering is a major undertaking that is probably years away, with a fair amount to accomplish before then. Many good ideas do not make it that far. But if this subsidiary does, then the company would at that point in the future likely make a profit on the public offering.

Probably the biggest risk is that a lot of people have the same idea. So, by the time this company goes public, there is likely to be a lot of competition or even an overcrowded market. Let’s see what happens. But the odds against any one idea succeeding first to an IPO and then further along are not good.

The Business

The business itself had a good year. Recently, management began stock repurchases. The chances of a dividend here are small and smaller. Therefore, income investors can look elsewhere.

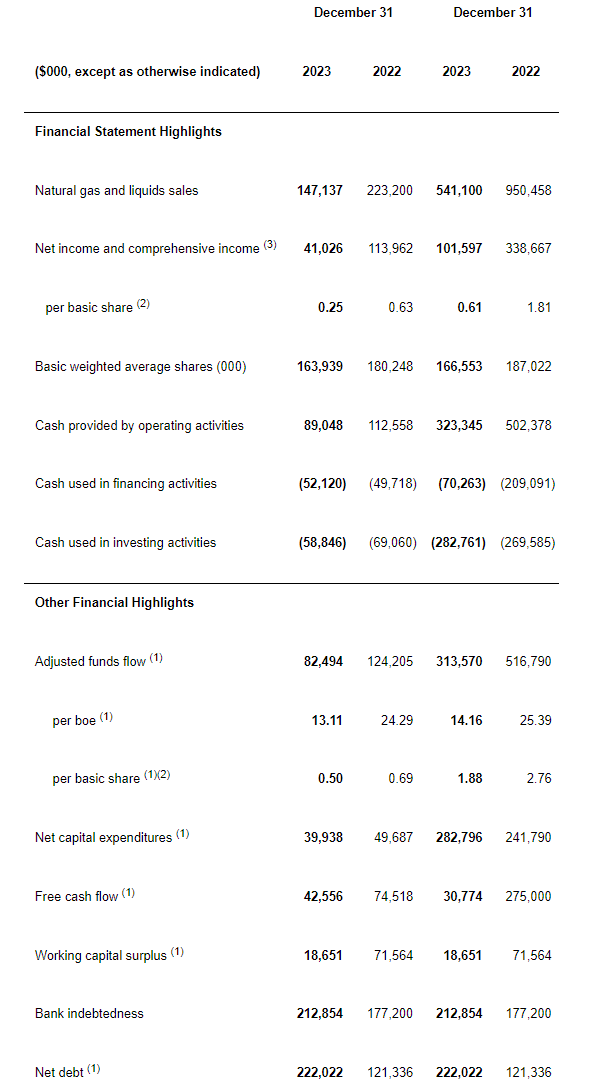

(Note: Advantage Energy Is A Canadian Company That Reports In Canadian Dollars Unless Otherwise Noted.)

Advantage Energy Summary Of 2023 Financial Results (Advantage Energy Fourth Quarter 2023, Earnings Press Release)

Obviously, the year was not as good as fiscal year 2022. But we have all seen worse when natural gas prices get where they are now. Management mentioned during the conference call that liquids are now 40% (roughly) of sales. When natural gas prices sag as much as they have lately, the more liquids produced, the better.

While the net debt is higher than it has been in the past, it is still fairly conservative when compared to the annual funds flow shown above. Either funds flow figure can be used. The key idea is that with depressed natural gas prices this company still has a conservative debt ratio. That is just what the debt market wants to see.

It Is All About Liquids

This management is clearly going the extra mile when it comes to liquids production.

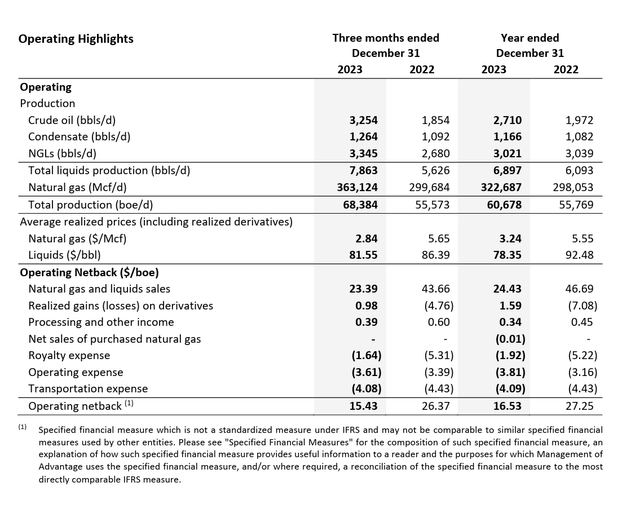

Advantage Energy Realized Pricing And Production Summary (Advantage Energy Management Discussion And Analysis Fourth Quarter 2023)

Notice that the average liquids production is quite valuable when compared to many other natural gas producers. This management has clearly made the choice to develop the more valuable liquids acreage in its possession. That makes the acquisition shown before even more interesting in light of the sales progress shown above of high valued liquids.

Management is getting that extra value without the expenses materially changing. The increasing percentage of liquids production somewhat offsets the decline in oil and related commodity prices throughout fiscal year 2023.

There are a lot of competitors that are shutting in dry gas production. The presence of liquids in the sales mix helps to avoid that outcome of negative cash flow.

Now management does have dry gas production. But that dry gas production is some of the lowest cost production in North America. Therefore, a lot of competitors will have negative cash flow from their production before this company does.

Through the acquisition and the expansion into liquids rich intervals on leases already owned, management is giving itself the choice of developing acreage for more liquids rich production when natural gas prices sag, as they have in the current fiscal year. This management can “milk” the dry gas production for cash flow while developing the more valuable rich gas acreage as market conditions indicate.

There is considerably more flexibility here than there is with strictly dry gas producers.

Summary

The conservative venture into liquids production is now proving to be a profit boost during a time of very weak natural gas prices. Management has managed to concentrate the natural gas production on the more profitable liquids production that includes light oil, condensate and even pentanes.

That shows some detail orientation on the part of management. There is also the aspect of attempting to keep the dry gas production costs where possible so that as much of the benefits of the more valuable liquids production heads to the bottom line.

That makes earnings growth from margin expansion as important as the management guided production growth. It also means that earnings are likely to grow in excess of production growth for some time into the future.

Now, of course there is risk of commodity prices being extremely volatile and not cooperating. But overall, the venture into liquids production appears to be very successful.

Note that this is a small company. Even though it is considered a strong buy, there is the risk of a loss of a material senior executive setting back the company. Still, this is one very well-run small company that should treat shareholders well over time as a capital gains vehicle. The compounded rate of return should average in the teens, even accounting for the volatility of the commodities in the industry.

It should also be noted that this is one very low visibility industry. Industry conditions can change very quickly. Therefore, this company is probably best suited as a consideration as part of a basket of stocks. Diversification when it comes to small stocks is essential, as small stocks have a tendency to “turn left” when you least expect it. But the overall basket, if chosen well should still outperform.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here