Overview

I previously gave a buy rating to ESAB Corp. (NYSE:ESAB) because I liked the tailwinds that the business was enjoying. I also expected valuations to rerate upwards as ESAB shows improvements in organic growth and margins. Indeed, the stock’s valuation re-rated nicely upward, yielding shareholders a gain of 16%. Fast forward to today. My recommendation for ESAB is to downgrade it to a hold rating as the valuation has gone up a lot faster than I expected, making the near-term upside less attractive than it was previously.

Recent results & updates

4Q net sales grew 6% compared to the prior year, reaching $650 million excluding Russia (vs. implied midpoint guidance of ~$629 million and consensus estimates of $647 million). This increase was driven by a combination of factors: 4% organic growth, 1% positive FX impact, and 1% contribution from inorganic drivers. By region, the Americas saw organic revenue of 9% y/y, while EMEA and APAC remained relatively flat. 4Q adjusted EBITDA increased 18% y/y to $126 million, implying a 19.4% margin, which was up 200 bps. This compares favorably to implied midpoint guidance of $113 million and consensus estimates of $115 million. Adjusted EPS came in at $1.13, which beat midpoint guidance of $1.02 and consensus estimates of $1.04.

ESAB end-market continued to show resilience as volume continued positive momentum in EMEA and APAC, while Americas was showing positive inflection. End-markets for ESAB’s products are holding their own thanks to energy transition projects and investments in global infrastructure, especially in the Middle East and India. Despite some weakness in retail, overall fabrication activity stayed strong. In the Americas, organic growth was strongly backed by pricing, even though volume was still slightly soft. This indicates that ESAB’s strategic investments in new product lines and solutions, like the light industrial line with Cobot and its advancements in automation and robotics, are paying off. I expect more growth opportunities in the region as the economy recovers. On the other hand, although pricing was down, the most important fact was the 2% increase in volume in EMEA and APAC. This performance has significant implications as it shows that ESAB is making progress in winning important projects related to hospital and lab expansion plans. This larger installed base would mean more potential for future maintenance and cross-selling of its equipment line and fully autonomous adaptive welding solutions.

I remain very positive about ESAB’s ability to grow as its product portfolio continues to get better. As an example, ESAB’s light industrial lineup was completed in 2023 with the introduction of the battery-powered welder Renegade VOLT, which has been met with overwhelmingly positive feedback from distributors. In addition, the heavy industrial product line was expanded with the launch of the new Warrior Edge, further penetrating the robotics and automation market. As the company keeps its focus on increasing equipment sales, management has emphasized that the Warrior Edge, in conjunction with ESAB’s digital solutions, gives it a competitive advantage. The fully autonomous adaptive welding solution for the renewable industry, enabled by an AI algorithm, is another product I’m excited about from ESAB. I expect the adoption rate to pick up as this product significantly improves productivity. Also, since this is the first AI-algorithm-enabled product, it has a first-mover advantage in capturing share. I also think it is great that management is concentrating on enhancing the company’s overall marketing plan in order to better distribute this product. In particular, a sales force incentive plan has been put in place to encourage the proactive sale of the new products.

Several compliments on our Renegade VOLT and our new Ruffian engine driven welder. The distributors are thrilled with the new ESAB products. Additionally, our Gas Control business continues to perform well in the region. From: 4Q2023 earnings call

Hence, while some might be worried about the incremental capex required for 2024 ($15 million of additional incremental investments), I am actually looking forward to these investments as it means more new products that can drive growth (so far the investments seem to be working well). There should be no problem with funding this balance sheet, as ESAB ended 2023 with a net leverage of less than 1.9x. Management has stressed that ESAB’s M&A pipeline is at an all-time high as the company keeps looking into bolt-on acquisitions, and with the balance sheet strong and the incremental CAPEX being relatively small, ESAB should have no trouble carrying out its M&A strategy.

Valuation and risk

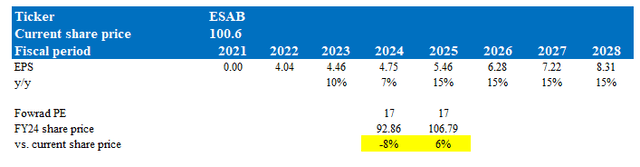

Author’s valuation model

According to my model, ESAB upside is no longer attractive in the near term because of the valuation that it is trading at today (20x forward PE). In the near term, I valued the share price at ~$93 to $106. I have updated my model to reflect ESAB’s FY23 EPS and management FY24 EPS, followed by my original expectation for mid-teens EPS growth (a discount to management high-teens EPS growth expectation because I remain conservative on contributions from M&As). The factor that is holding me back is that ESAB is trading at 20x forward PE, and if one were to look at the valuation chart, it has gone one way up, now trading way above its +1 standard deviation (17x). While I agree that the business has become a lot better, I think a lot has been priced in. As you can see from my model above, in the near-term (through FY26), if ESAB were to grow mid-teens in FY25/26 and valuation trades back to 17x (assuming this becomes the new mean for ESAB), there is only 6% upside. I would note here that inflecting mid- or high-teen EPS growth is still something that is a “show-me” story. So if ESAB were to miss expectations in the near term, this benefit of doubt that the market is willing to give today will go away, and valuation is likely to fall.

Summary

I downgraded my rating on ESAB to hold despite a positive business outlook. ESAB’s long-term prospects remain attractive as I think it is well-positioned for continued growth with its focus on new products like the Renegade VOLT and Warrior Edge, continued investment in automation and digital solutions, and a strong M&A pipeline. Additionally, ESAB’s healthy balance sheet supports further capital expenditures and strategic acquisitions. However, the market seems to have already priced in much of ESAB’s near-term growth potential. While the company exhibits strong fundamentals, a lower valuation might be a better entry point.

Read the full article here