In January, Aeva (NYSE:AEVA) announced a win with Torc and Daimler Truck for its newest sensor, Atlas, and the development of autonomous technology. The win has a two-pronged approach, as per the news release:

“Aeva will supply its latest Aeva Atlas™ automotive grade 4D LiDAR technology to Daimler Truck and collaborate with Torc Robotics, an independent subsidiary of Daimler Truck, to enable SAE Level 4 autonomous vehicle capabilities beginning with the Class 8 Freightliner Cascadia truck platform. Daimler Truck intends to integrate the LiDAR sensors directly into its production process, making it easy for customers to buy autonomous ready trucks directly out of its manufacturing plants without the need for sensors to be retrofitted. Torc in turn will sell its virtual driver technology and supporting Mission Control services as a subscription to customers. Its driving software will use Aeva’s perception software, built around Aeva’s instant velocity data, to detect objects faster, further away, and with higher accuracy. The multi-year collaboration begins in the first quarter of 2024 with Aeva’s start of production by 2026 and Daimler Truck production ramp by 2027.”

Shown to increase market capitalization for others, a production win was first mentioned in August 2023 as a collaboration awaiting a decision. During the Q3 2023 results, the company announced the sale of the equity at $0.53 per share for some $21M in cash and established a $125M preferred share facility, hinting that money was required to support the OEM win. When the announcement was made in January, the equity sales were forgotten to have negative implications. The Q4 call narrative helped increase the price, focusing solely on the win and additional opportunities with the Atlas sensor.

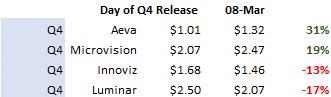

The market reaction to the win resembles the reactions offered to other companies, winning production deals. However, Luminar (LAZR) and Innoviz (INVZ), whose wins have yet to produce revenues and whose Q4 estimates for 2024 have seen downward adjustments, have seen a drop in share price. That trend proves that the market eventually catches up with reality.

Upon closer examination of the deal, Atlas emerges as a size-down iteration of Aeries II. Its specifications mirror those of Aeries II with a notable distinction in form factor and power consumption. The company has labeled Atlas as 70% smaller than its predecessor, requiring around four times less power.

Developing Atlas into a production-ready sensor will remain a time-consuming and challenging endeavor. Despite its past narrative of participating in securing deals, Aeries II has never clinched any significant wins. While winning contracts with May Mobility in the automotive sector and Nikon for industrial metrology are notable, they pale compared to the magnitude of the Daimler deal. A smaller form factor represents a strategic pivot that enables Aeva to pursue more opportunities, including those in the passenger car market, which the bulky form factor of Aeries II could not accommodate. The journey thus far has incurred an annual cost of $119M, and the company will continue to spend similar amounts until planned production starts in late 2026.

Aeva wrote that the deal is worth $1B. Freightliner, which will fit the sensors into its trucks and use systems developed by Aeva and Torc, makes around 80K trucks yearly. Aeva will supply Freightliner with the sensors for the ramp-up in 2027.

Realistically, how many trucks will operate at Level 4 autonomy on highways by 2027? At Level 4, human intervention is no longer required. Some descriptions suggest drivers can watch movies and even sleep; ultimately, the vehicle can operate without occupants. Therefore, it may be overly optimistic to expect full adoption of that production capacity. Consequently, realizing a value of $1B may take many years, longer if adoption follows the trajectory of robotaxis in cities.

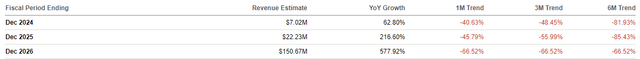

The observation above aligns with Aeva’s revenue expectations for the next three years.

I have compiled revenue forecasts provided by SA for the next three years and the trend of the revisions made to them. Every company has seen a reduction in revenue expectations, including the two expected to capitalize on the production deals this year: Luminar and Innoviz. However, the 2026 forecast for Aeva sees a 66% reduction, indicating that the company’s Torc deal has not tipped the scale or has been seen less now than whatever was predicted six months ago.

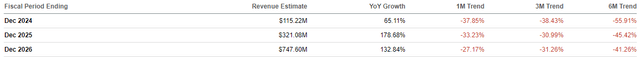

Luminar:

Revenue Forecasts and Revisions Luminar (SA)

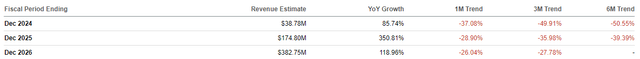

Innoviz:

Revenue Forecasts and Revisions Innoviz (SA)

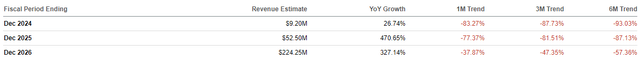

MicroVision:

Revenue Forecasts and Revisions MicroVision (SA)

Aeva:

Revenue Forecasts and Revisions (SA)

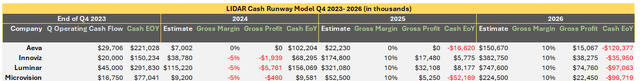

To further illustrate the consequences of revenue reductions, I have put forecasts into a table and compared them to cash levels, operating cash flows, and the assumed gross margins.

Cash Runway Model 2024- 2026 Lidar Companies (Author, SA)

The result? All companies must sell equity as there is no contribution from revenue to sustain them.

With the highest revenue expectations, Luminar has delivered a disappointing forecast, a topic I cover in another article. Due to its increasingly desperate financial situation, I have rated the company as a sell. However, contrary to my views, I have encountered an opinion suggesting that the question is not whether Luminar will run out of cash but how much equity it needs to sell.

While this approach may secure the company’s survivability, selling equity without aiming for profitability should raise concerns about long-term viability among investors. Depreciating value through equity dilution is one of the worst outcomes of investing in any stock. Furthermore, what if the projections, as the Q4 results suggest, are adjusted with 50% or even 90% reductions for 2025 and 2026? What if there is no longer an appetite for buying equity in the market?

Unfazed, MicroVision (MVIS) and Aeva acted with the obvious point that cash is needed. MicroVision announced a new $150M ATM, and Aeva, as mentioned, sold equity and added a preferred facility of $125M in Q4. However, both solutions, ATM and preferred facility avoid the hassle of secondary offerings and price setting to eliminate a lower share price outcome. Innoviz’s dramatic selloff after it set low pricing for its equity sale in 2023 provided a valuable lesson to the group, prompting them to avoid such a strategy. Even Luminar will add $50M LOC to prop its balance sheet while it still has $24M left in the equity sale program, confirming that the system is likely reluctant to send more good money while seeing poor results.

As shown in the table, the funding from Aeva and MicroVision will only last until the end of 2026, a fact yet to be apparent to the market. I also believe valuation increases driven by narratives such as MicroVision’s participation in 9 RFQs or Aeva’s goal to earn $1B will run out of momentum. MicroVision may face a setback as early as the end of March if a win is not announced.

I suspect that what happened to Luminar and Innoviz after their Q4 results will also eventually occur to Aeva. An extended timetable to reach revenues and uncertainty about the success of expensive development that will continue for the next three years may make Aeva’s recent surge temporary. However, I acknowledge that another win, around 6 to 9 months from now, the timeline for OEMs’ decisions, according to the company, may renew current sentiment. Hence, based on my views, I rate Aeva as a hold.

Share prices On the Day of Q4 and Today (Yahoo Finance, Author)

I rate Innoviz as a hold until the company updates on its revenue potential. A positive, improved operating cash level in Q4, which could extend the cash runway if proven more than a one-time outcome, further supports my take.

I confirm my rating for Luminar and MicroVision as a sell, as I see both MicroVision and Luminar as overvalued. I have not seen MicroVision in any improved light since my article from March 2023. I am also not confident about the company’s ability to win a design or a production deal.

Finally, in my opinion, all Western companies’ expectations for the Chinese market are curtailed with the Department of Commerce’s review of the connected vehicles, naming China as a data collector and including LIDAR as a means of such a collection. With Hesai (HSAI) already on the list from the Department of Defense, identified as connected to the Chinese military, I see China approaching Western companies with a similar conclusion, ending the possibility of Western LIDAR in China. That condition benefits Western companies, leaving ex-China open to them. Still, in the immediate term, I see the plans for companies like Luminar being negatively impacted since its business model has a presence in China, followed by Innoviz, despite the statement that, as an Israeli company, Innoviz is considered neutral in this conflict. The review results are expected by the end of April, where the most expected outcome is the ban on Chinese LIDAR sensors in the US.

Read the full article here