The Dimensional Core Fixed Income ETF (NYSEARCA:DFCF) is a great way to play the global investment-grade bond market. Benchmarked against the Bloomberg Agg, or Bloomberg U.S. Aggregate Bond Index, DFCF offers exposure to long-duration bonds and other fixed-income securities that, in the aggregate, are expected to maximize the total return for investors. While the current high-interest-rate environment might not be ideal for investing in long-duration bonds, there are some advantages to this strategy. For now, though, this is a Hold for me. The analysis below will tell you why.

The Inverted Yield Curve and What It Means for Bond Investors

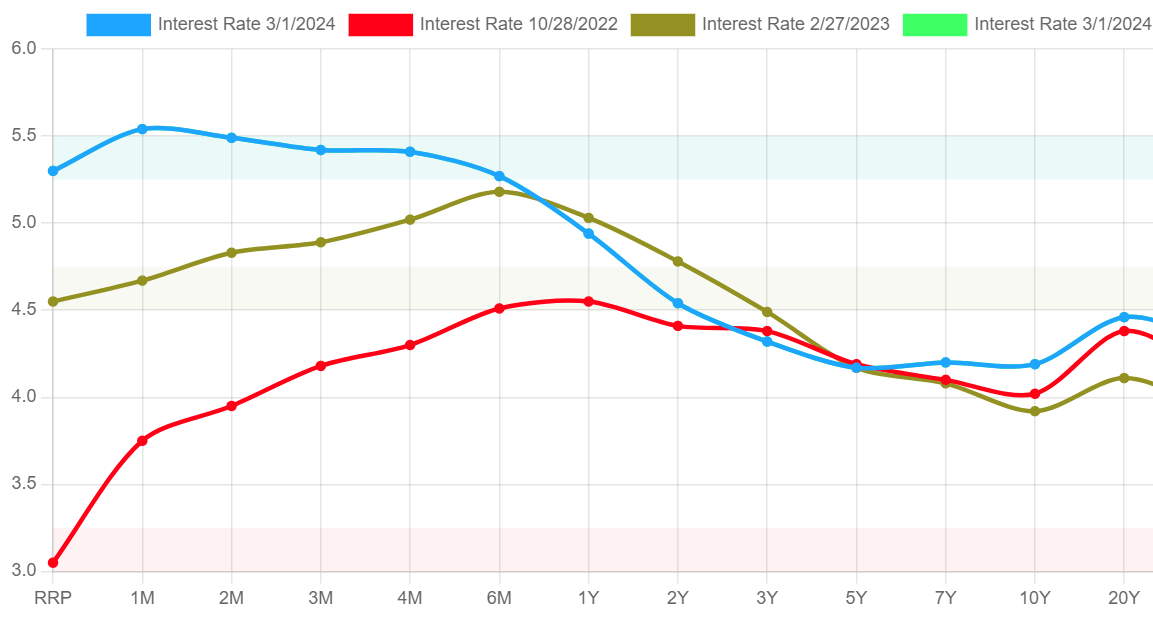

US Treasury Yield Curve

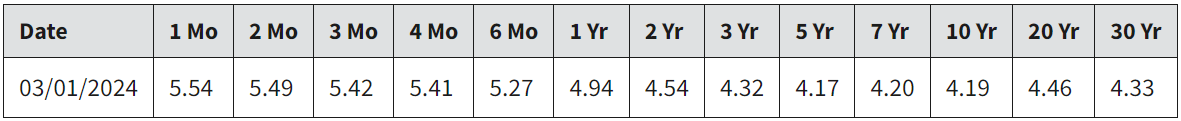

The current yield curve is inverted and has been for a while now. That means short-term bond yields are higher than those of longer-duration bonds, as you can see from the graph above (blue line) and this table below dated March 1, 2024.

Treasury.gov – U.S. Bond Yields By Duration – March 2024

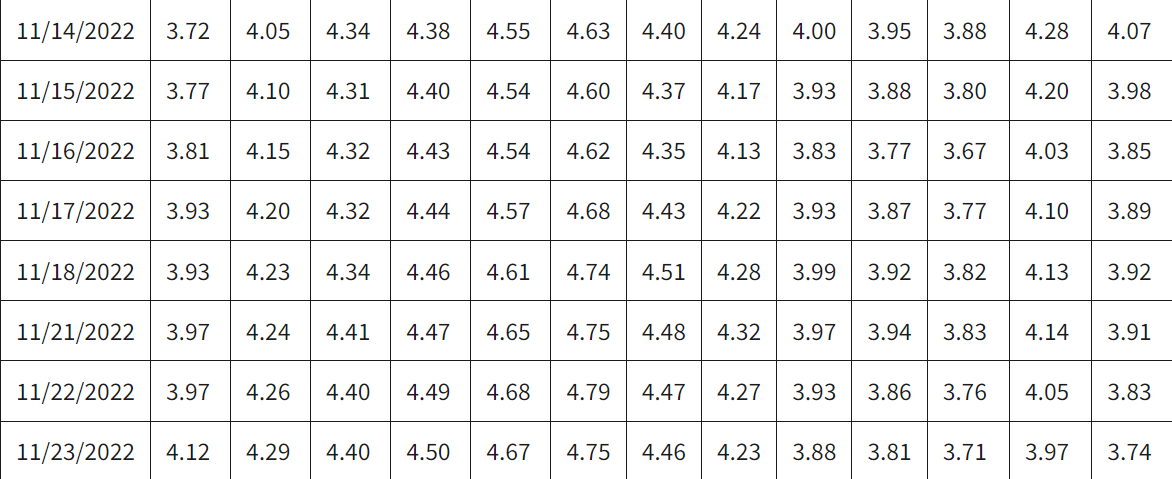

Treasury.gov – U.S. Bond Yields By Duration – November 2022

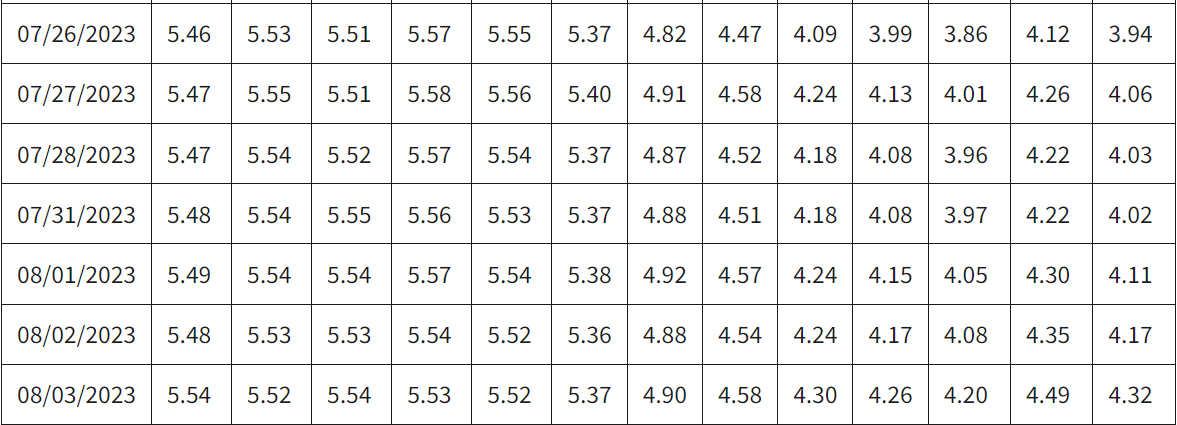

Treasury.gov – U.S. Bond Yields By Duration – July/August 2023

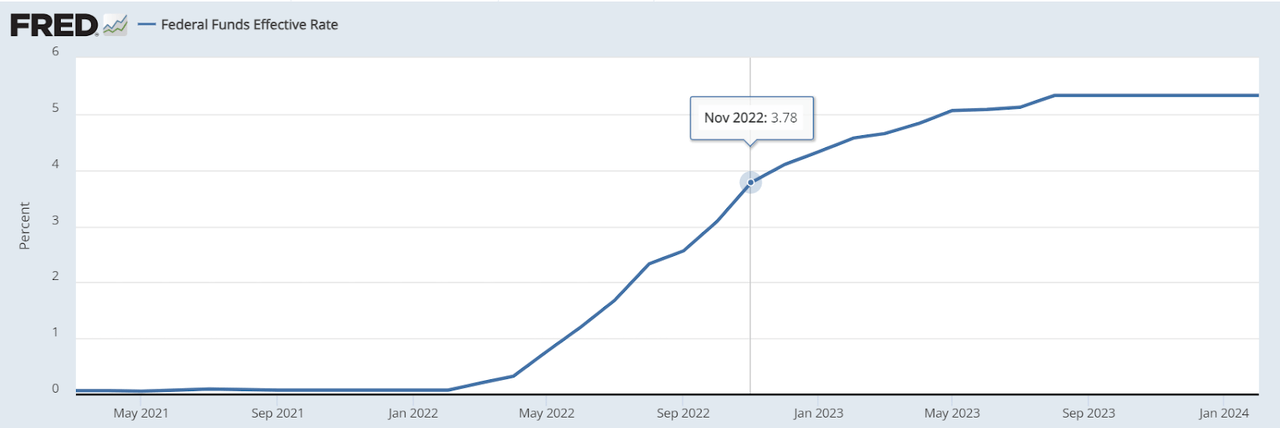

The current inversion has persisted for nearly a year and a half, from around the time Fed Funds Effective Rates were poised to breach the 4% mark (table below).

FRED – Fed Funds Effective Rate

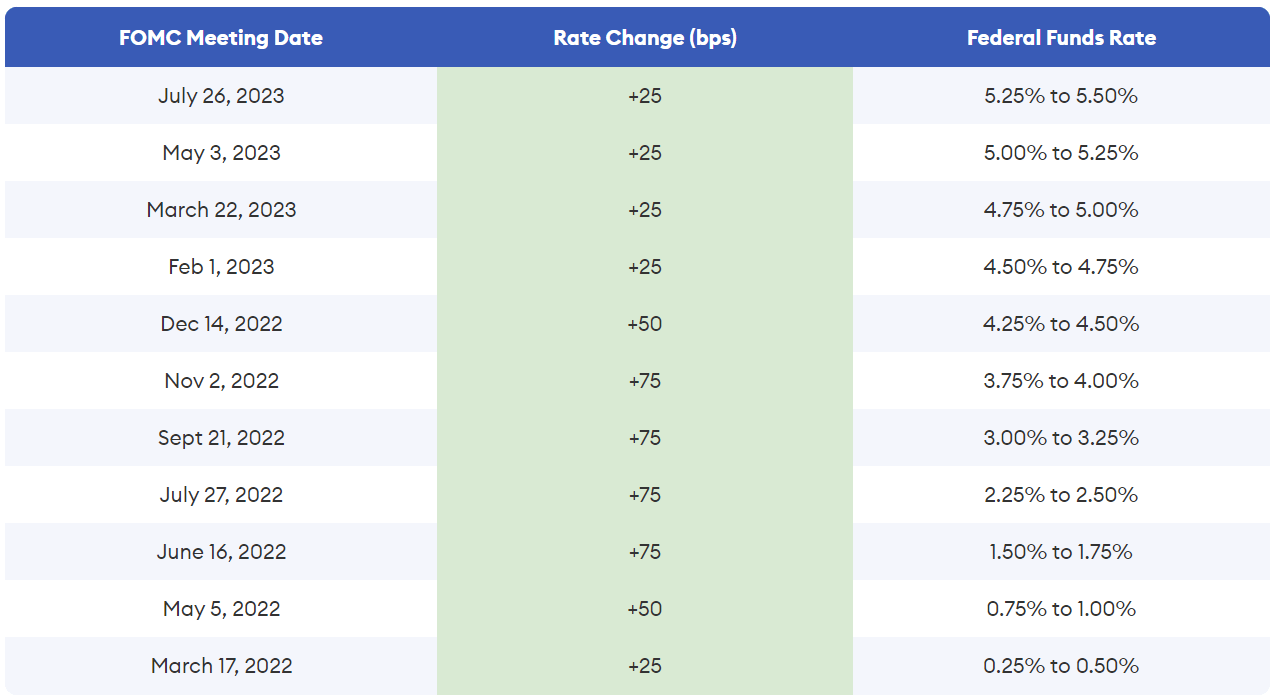

A closer look at the second table above (Nov 2022) shows that the flattening and subsequent inversion of the yield curve was swift and decisive, primarily due to the fact that the Fed had already ramped up its cadence of rate hikes to 75 basis points by then. Compare that table above to the one below and you’ll see why that inversion happened so rapidly.

Forbes – Fed Funds Effective Rates from March 2022 through July 2023

The Fed continued its interest rate hikes over the next couple of quarters, and by July 2023 when the last 25 basis point hike was implemented, short-term bond rates were already at above 5.4% – and in lockstep with Fed Funds rates (July/Aug 2023 bond yields table above.)

As of today, the Fed Funds rate is still elevated at 5.33%, with short-term bonds now yielding between 4.94% (1-year) and 5.54% (1-month), so why invest in an ETF that carries much longer durations with lower yields?

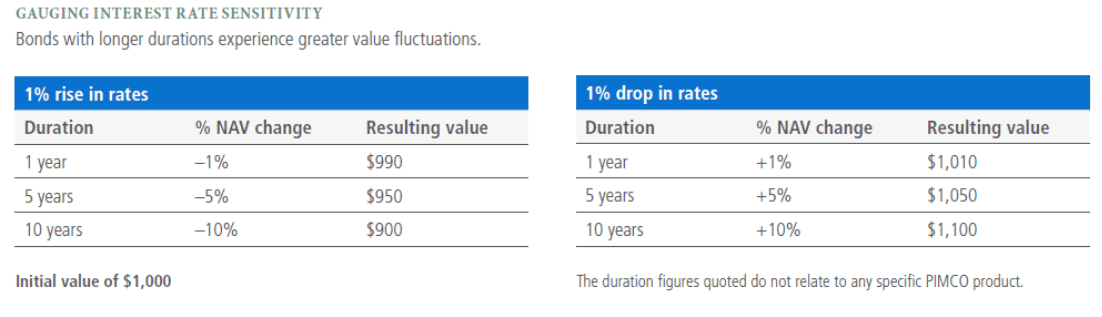

You’ll find the answer to that in the difference in sensitivities to interest rates between short- and long-term bond prices. Note that we’re not talking about bond yields here but bond prices. This sensitivity essentially means that longer-duration bonds are more sensitive to interest rate hikes as well as drops. This table from PIMCO below shows how long-term bond NAVs are exponentially affected by interest rate changes.

PIMCO

This could have made DFCF an attractive proposition at the moment, at least for investors who believe that interest rate declines are in the offing this year. However, I don’t see that happening anytime soon, as we’ll see in the following two sections.

DFCF in Context

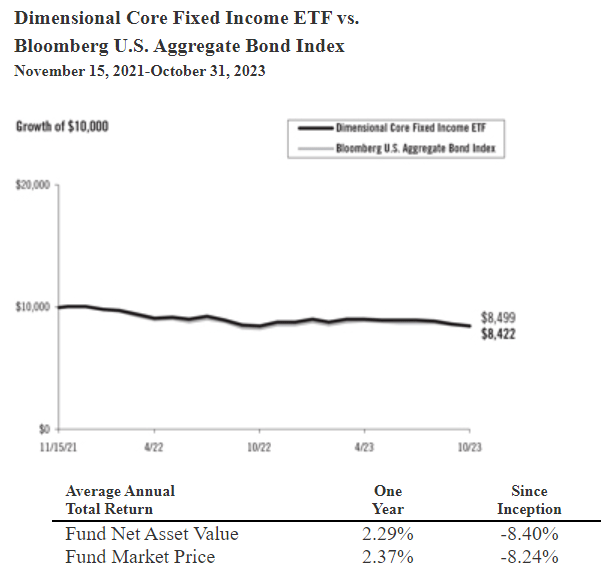

The value in this ETF lies in how the fund managers allocate funds across the breadth of their portfolio. As a rule, the fund invests in fixed income securities with a duration of under 20 years, and remains rangebound around the benchmark’s average duration on a weighted basis. As of the last annual report for the period ended 10/31/2023, the benchmark’s weighted average duration was 6.04 years compared to the year-ago duration of 6.63 years, and the range of the ETF should ideally be no more than a year less than the benchmark duration or one quarter over that. In actual duration terms, DFCF averaged a duration of 6.15 years, down from 6.63 in the year-ago period.

It’s important to note here that this period (Oct 31, 2022 through Oct 31, 2023) was marked by a flat to inverted yield curve that was skewed toward shorter- and intermediate-term bonds. Under normal yield curve conditions, the ETF would have invested more into longer-duration bonds, but the reality of the yield curve over the period meant completely divesting from anything longer than 20 years and increasing its position in shorter-term securities of one year or lower durations. If the fund managers hadn’t done that, the total return on a relative basis would have underperformed the benchmark; but, because of the fund’s dynamic allocation strategy, this was averted and the ETF performed relatively better than it would have otherwise.

In particular, the fund shifted its investments towards corporate bonds that carried A or BBB ratings because credit premia were higher on the back of wider spreads. Essentially, a credit spread in bond parlance is the yield differential between two different debt instruments with different credit quality but the same maturity or duration. So, when the spreads are wide, it’s prudent to allocate funds to high-quality securities but also dip into the lower-grade basket in order to gain more credit exposure.

This is what the fund managers did, and this move is validated by the ETF reporting positive realized credit premiums over the entire reported period due to this tactical shift. In contrast, the benchmark only returned 0.36%, thereby validating this tactical shift as being suitable in an inverted yield curve scenario.

Dimensional Annual Report for the Period Ended Oct 31, 2023

Moving Forward with DFCF

The key to the investment thesis here is whether or not you believe the Fed will start cutting interest rates this year, and by how much. As we saw, the current skew in the fund toward shorter-term fixed-income securities works in a ‘higher for longer’ interest rate environment, but only barely so against the benchmark. The fund’s strategy will only achieve its full potential when the yield curve is normal, which is why your view of the Fed’s actions this year matters so much.

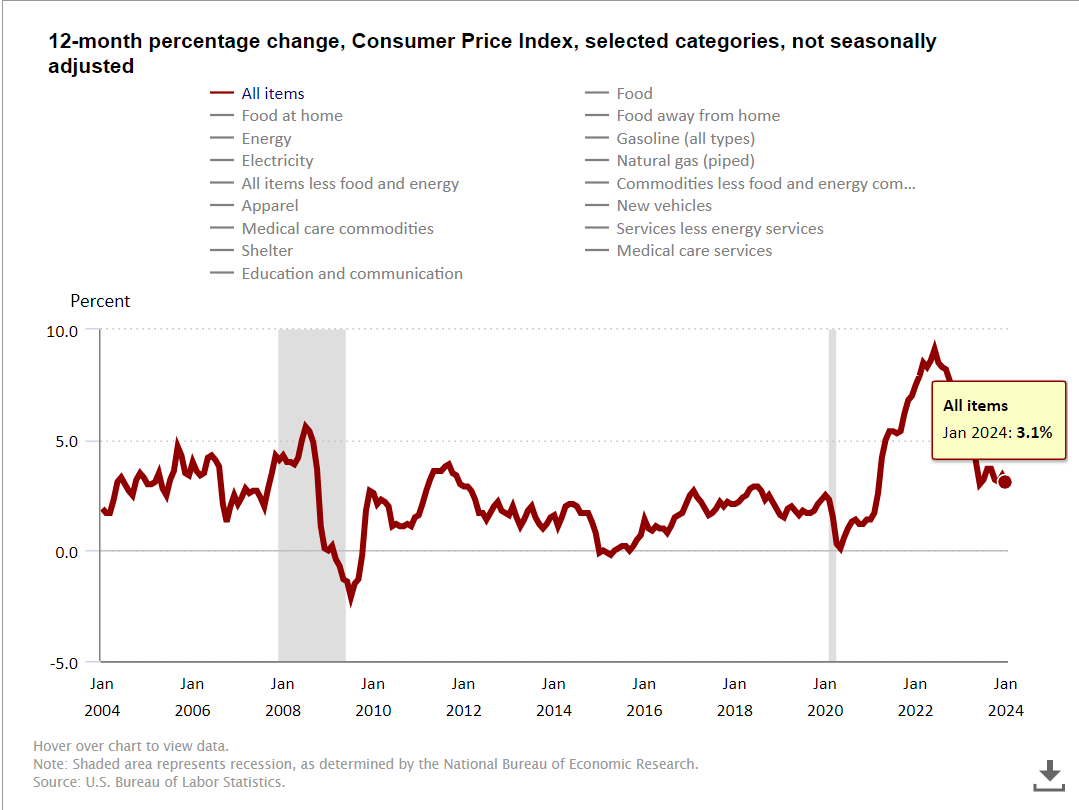

Looking at macro factors, particularly CPI, we see that this key metric continues to print above 3%; in other words, the consumer price index has been oscillating between 3% and 3.7% since June 2023 and doesn’t seem to want to cooperate with the market’s hope of the Fed reducing interest rates in 2024.

U.S. Bureau of Labor Statistics

As a matter of fact, just two days ago, Apollo Global Management’s Chief Economist, Torsten Sløk, made it amply clear what he thinks will happen:

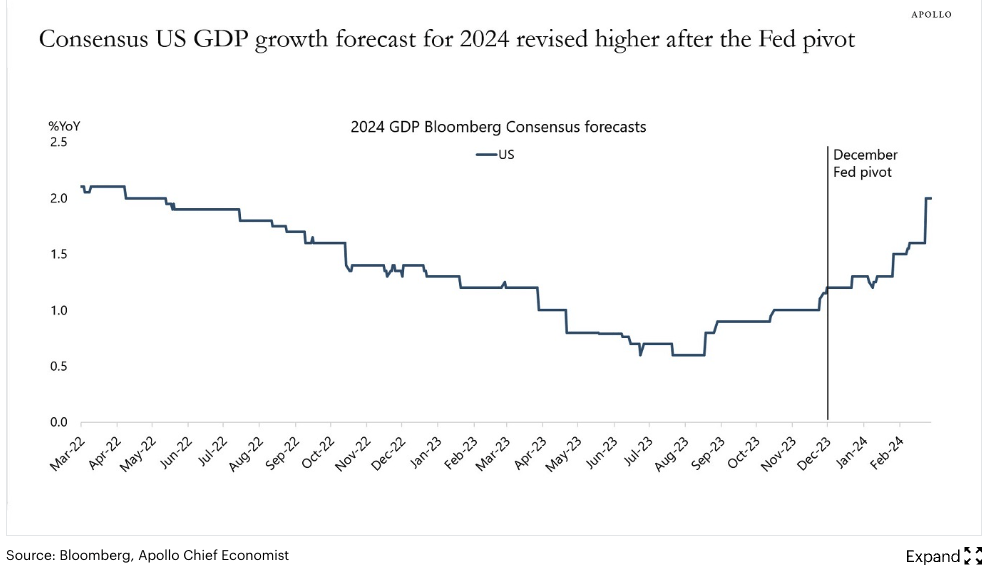

The reality is that the US economy is simply not slowing down, and the Fed pivot has provided a strong tailwind to growth since December. As a result, the Fed will not cut rates this year, and rates are going to stay higher for longer. Growth expectations for 2024 saw a big jump following the Fed pivot in December and the associated easing in financial conditions. Growth expectations for the U.S. continue to be revised higher. Financial conditions continue to ease following the Fed pivot in December with record-high IG issuance, high HY issuance, IPO activity rising, M&A activity rising, and tight credit spreads and the stock market reaching new all-time highs. With financial conditions easing significantly, it is not surprising that we saw strong nonfarm payrolls and inflation in January, and we should expect the strength to continue.

The gist of it is that the market’s expectations may not come to fruition this year because the economy is expected to keep growing stronger despite elevated interest rates.

Via Bloomberg

Coming back to the DFCF investment case, it doesn’t look like the fund will be able to return to its original strategy anytime soon. Their portfolio mix must necessarily weight its average duration at the lower end of the benchmark range, which has already moved lower over the reported period, as we saw.

In this type of situation, the fund would have to continue with its tactical strategy shift to shorter-duration securities. Unfortunately, although that might beat the benchmark, the objective of achieving superior total returns is very difficult to meet. As long as the yield is inverted, this must continue. That’s the major downside here.

Another risk at the moment is that the longer credit spreads stay wide, the more likely the fund is to gravitate toward lower-grade securities with higher yields – not an ideal scenario for investors looking for a secure investment vehicle for their fixed income needs because lower grades of securities equates to greater credit exposure. This could pose a serious problem in the event of a recession, which is not completely out of the question yet. There are mixed views on this, so it’s better to err on the side of caution, in my opinion.

At this point, nobody has a clue as to what the Fed might do this year. They seem to have pivoted at the end of last year, with a view to holding the rates steady, but when will a pivot to lowering the rates occur? Nobody knows for sure, and therein lies the risk of investing in DFCF.

On the contrary, if interest rate reductions are effected over the course of the next ten months, it could provide fertile soil for the fund’s strategy to work to its strengths. Right now, the market and the overall economy are both getting stronger even though inflation still sits stubbornly above 3%, which makes it very difficult for the Fed to cut rates. Inflation and economic activity should ideally slow down before the Fed shifts its focus back to a QE phase from its current QT efforts, and we don’t see that happening this year.

That makes the risk-reward profile of DFCF highly skewed toward risk over return, which is why I cannot recommend a Buy even though I like the core strategy here. However, I’m not rating it a Sell because if you’re already in it, you may want to grit your teeth and wait it out. Hopefully, your DFCF position is nowhere near being among your largest holdings; if it is, you may want to take some of those nominal benchmark-beating (not market-beating) gains off the table and reduce your exposure to this ETF. Moreover, if you’re really bullish on the Fed lowering interest rates in the next year or year and a half despite all signs to the contrary, even that won’t be necessary. As such, this intriguing play on the global investment-grade bond markets is a Hold for me at this time.

Read the full article here