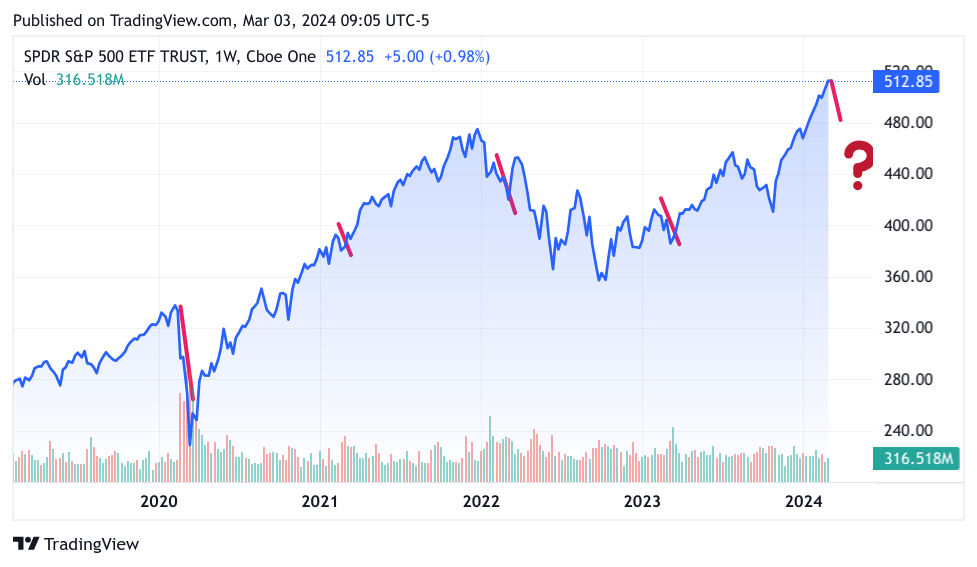

For the last several months, since about November of 2023, I have been focused on mid-February to mid-March as the likely time for a “normal” 7% to 10% correction. Mind you, such corrections happen in the normal course of stocks, at least once a year, often multiple times. I picked this window because as I’ve shown many times in previous articles, sell-offs happen often during this time frame, here let me trot the S&P 500 chart in the form of the S&P 500 ETF (SPY) out once again…

TradingView

I will be frank, the window for my prediction is closing, perhaps the correction will happen later in the year like in November, which is well-known for corrections. Right now, the slope from the start of the year is at about a 45% angle, which is just fine. If we start moving at a steeper ascent, stocks will be more vulnerable to a sell-off. Conditions are ripe for euphoria, and that tends to get individual traders to be more willing to take higher risks. Higher risks require that everything is just right and known. This sets up a situation where there is a surprise piece of negative data, which could cause a stampede to the exits. Or if we really get a mania going, the indexes could come tumbling down by their own weight like a “house of cards.” We are not there yet, though this week could bring some buying since we passed some tests on the economic data front. Yet, if you could employ a little bit of discipline now, you could become the gatekeeper at that exit and buy those shares at 20% to 25% discounts by panicked sellers.

This week, we got past economic numbers and a lot of “Fedspeak”

We did have moments, like the CPI & PPI, and when the 10-year bond was at 4.34% a high for 2024, it looked as if it was climbing to 4.5% and then on to 5%. Yet, while the rate hit that high for the year just days ago, it finished at 4.186%. Mind you, it could still happen, interest rate volatility is quite high. However, I am if anything an observer of price and the information it conveys, and right now, market participants are immune to negativity. Also, it seems that traders are fine with rate cuts in the latter half of the year. At least for now, that is. If we get to euphoric conditions, an errant comment by a Fed president about rate cuts starting in the last months of 2024, or the first quarter of 2025 could give us that 7% or even 10% correction. According to SOFI.com “Dating back to the mid-1900s, stock market corrections have typically happened three to four times every year. Although it’s nerve-wracking every time, these corrections are a normal part of the market cycle.” Also, according to Investopedia.com, a correction is a drop of 10%, and a bear market is defined as down 20%. So you can have a sell-off of 15% and it would still be considered a correction. Let’s bring back the fact that it is common for corrections to visit more than once or twice a year. In conclusion, if you take the rally from October, even including that divot the first week of January, we are overdue for a correction based on history.

Yet the market indexes are marching higher, which is great of course, but…

The SPX has had 16 out of the last 18 weeks on the plus side, which is the most since 1971. Our two major indexes are now at all-time highs, both indexes had their 7th positive week over the last eight. The Nasdaq was the last index to reach a record close for the year this past Thursday, even more importantly, it finally broke into a new high since 2021. Every rally that extends to new territory starts to sow seeds of its destruction. I acknowledge that technicians wait patiently for breakouts like this for new highs before they get aggressive. That’s great, and truly brand-new breakouts tend to produce further sharp rallies, which is perfect for “fast money” trading. So, of course, this is exciting…

New all-time highs and perfect economic conditions breed complacency

Yes, I said perfect economic conditions with Q4 now seen as producing 3.2% GDP growth, unemployment seemingly permanently cemented to under 4%. Rising wages, but paired with soaring productivity, and you have, I repeat, perfect conditions for business and our stocks. So it is only natural for the VIX to plummet below 13. It closed at 13.11 down 2.16%, and let’s face it, no one should be shocked if it goes below 12.50, perhaps we’ll see the 52-week low in the 11s again. I say that because expectations of volatility, especially fear of downside volatility, are evaporating. This offers a warning and an opportunity. We’ll touch on that when I talk about my trades.

Let’s talk about this notion of “Capital-at-Risk”

Part of what I do with my group is to use mental devices to manage our mental state. My primary approach is to find ways to elevate self-awareness when making investment decisions. Are we trading and investing because we are making rational decisions, or do we just enjoy the thrill of trading? There is nothing wrong with enjoying participating in the stock market. If you aren’t enjoying it, you are likely to make as many mistakes as trading purely for the thrill. As in all things moderation, the ancients cautioned us, and certainly when it comes to a market on the verge of euphoria. While I am at it, let me stress, that there is every reason to express optimism about jobs, the economy, and stocks. There is no reason right now to fear that Q1 will have disappointing earnings, let me state that positively, earnings and revenue will rise. So what’s the problem?

I am speaking from experience, let me speak by way of example. Let’s say you have set aside about 20% of your savings in a trading account, with 30K. You are taking balanced risks, so in the last 3 months you accumulated 15% of that in profit of about $4,500. Now you are trading with $34.5K, which is great when the getting is good. However, as I said earlier, the higher the market goes, the more risk becomes normalized. So “capital-at-risk” becomes very simple to explain, and it doesn’t take a fancy algorithm to make a decision. When buyers come rushing in, you should be reducing your “Captial-at-Risk” so that means setting aside that $4.5K. If you are making the same rational decisions, you don’t need more than 30K to create the same return for the next 3 months. That doesn’t sound like enough. Add those returns up, and you have a 60% return for the year! How many times when you find yourself up 15% to 20%, instead of reducing risk, we throw it all back at risk all over again? So let’s think about that for a moment. Let’s say we do get that 7% correction, most likely you are in high-beta names, which means they move more than more conservative stocks. If you are invested in NVIDIA (NVDA) Advanced Micro Devices (AMD), or Snowflake (SNOW) you are in a high beta name. So very likely these stocks will fall 20%, but let’s say they fall 15% now you are down for the year at $29.325K.

Now you are dealing with a destabilizing mental state

This does not engender a healthy mental state, you want to “win it back!” More often than not, that means going back to what worked before and getting risky trading for the upside. Momentum may have shifted to the downside, but you are emotionally closed to changing trading tactics, and in fairly quick order you might be down 20%. If this sounds familiar to you, start being conscious of your “capital-at-risk.” First, this bears repeating, set aside your winnings. When the market is soaring, you don’t need to risk as much to get the same returns. Second, before you put funds against a trade, ask yourself if the capital you are risking will hurt you if you lose 30% of it. If the answer is yes, reduce your capital at risk.

I don’t want to sound overly gloomy. The stock market could very well soar higher

There’s hardly anything to point your finger at and say this is going to crash the market. Yes, if interest rates of the 2-year and 10-year bonds move to 5% that could upset the market. Could the Fed start talking about raising, or holding rates? I guess so, though raising rates is not on the table. Though it is possible, the Fed says that the current rate is just fine and doesn’t need to be cut. At this point, I am unsure if the market would sell hard on that news; it could dip momentarily and keep moving. At least and until it gets hyperbolic, then anything will be able to be pushed over. This is what causes me to remind you that in trading, and in times like these, cash can become king. The very fact that we are dealing with perfect trading decisions pushes us to over-index because it’s so easy to make money, just buy NVDA, Super Micro Computer (SMCI), or even Dell (DELL), and the money is so easy!

In summary

As I said at the beginning of this article, a euphoric rally sows the seeds of its own destruction. Go ahead and trade, just keep your feet on the ground by at least keeping your capital-at-risk static, or even lowering it as the rally begins its manic rise. If you started the year at X, don’t trade with X + P where P is your accumulated profits. Keep pushing your profits to the side. Even consider reducing the original X because if we do have manic trading you don’t need the full X. I know this is hard, the more successful trades you have the greater the hubris.

My trades

Started Friday with a full 35% cash, fully in compliance with my Cash Management Discipline. Guess what, I fell for it myself, this whole article was me just confessing my sins. I ended the week at just 10% cash. DELL earnings blew up, so I gorged on DELL Call options, and I ended the day up 41%. I did put in a sell, but at 50%, but greed got the better of me. Normally, being up that level in one day and I would sell all day long. I hope I am right, and this rally has legs, but in hindsight, this was not good trading hygiene at all. I also got long Boeing (BA) again. I sold my calls this week when the stock jumped on the news that the FAA gave BA a deadline. I thought that was a negative, then rumors that BA is going to buy Spirit AeroSystems (SPR). I thought the FTC would frown on that, and that this would be a great opportunity for Larry Culp of GE to come in and acquire SOR. Then, I realised that these two events were connected. I now believe the FAA believes that the only way for BA to fix its quality problem is to recapture the Fuselage assembly function. So I got back in that. I got long SNOW, and Zscaler (ZS) Calls too. These are all high-priced Call options. Why? Why did I get so aggressive? For all the reasons I gave in this article. I stopped thinking about Capital-At-Risk, I had dollar signs in my eyes. It isn’t easy to maintain an even keel when you think you are on a winning streak. I am going to have to make some tough decisions, to cut down on risk. I may just cut all my positions in half. I am talking about trading, only. Stay in your investments even if the market falls 10%. If you mix your investments along with your trading, you are doing it wrong. More on that in the next article.

Read the full article here