Five9 (NASDAQ:FIVN) is a cloud contact center software (CCaaS) provider that empowers businesses to manage customer interactions through the cloud. They offer a suite of features including call center functionality, omnichannel communication, and customer analytics.

FIVN went public in 2014, with an initial share price of $7.6. Since its IPO, the stock has experienced significant volatility. I first covered FIVN in 2020, when I rated the stock a buy due to the seemingly strong profitable growth story. However, with the stock losing over 43% of its value from the time of my coverage, I was proven wrong today. As of today, it trades at $63, representing a 729% all-time return. However, the past year has been challenging, with the stock price down -7%. Looking further back, the total 5-year return is merely 18%, a rather below-average outlook.

I maintain my buy rating. My 1-year price target of $72 presents an 18% upside for the stock, highlighting an attractive buy opportunity.

Financial Reviews

While FIVN’s fundamentals are relatively decent, there are rooms for improvements, especially in profitability.

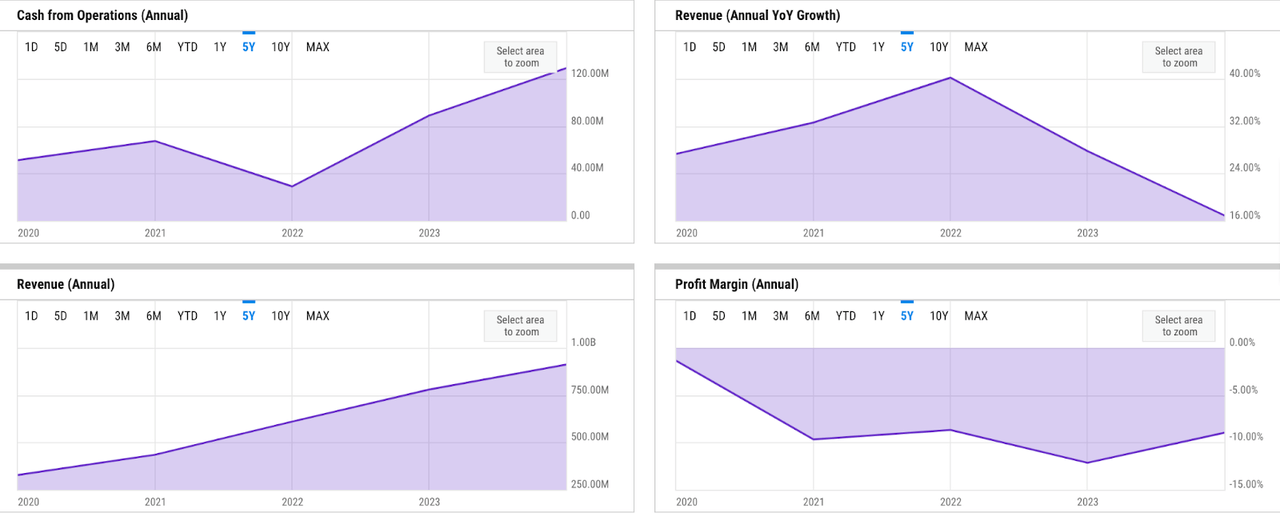

ycharts

FIVN has maintained a decent double-digit revenue growth over the past five years. However, it has struggled to maintain growth acceleration. FIVN saw its growth rapidly accelerate between 2020 and 2022, delivering an impressive 27% to 40% YoY revenue growth. In the process, it also enabled FIVN to almost double its revenue to over $600 million in just over two years. Though growth waned post 2022 onwards, FIVN still managed to deliver over $900 million of revenue in FY 2023, making it a hundred million away from a $1 billion revenue.

Meanwhile, FIVN’s cash flow generation has been strong. Since five years ago, it has never recorded a negative annual operating cash flow / OCF generation. OCF has even been trending up. In FY 2023, FIVN generated over $128 million of OCF, which means that FIVN was able to convert roughly 14% of its revenue into cash flows. By any standard, I believe a 14% OCF margin is a solid outlook.

GAAP losses, however, have widened in the same period, suggesting a potentially elevated share-based compensation / SBC at the operating level. The only positive thing I have noticed here is that FIVN appears to have its net losses under control. Net losses have widened since 2020, but it has more or less stayed in or around the negative 10% level.

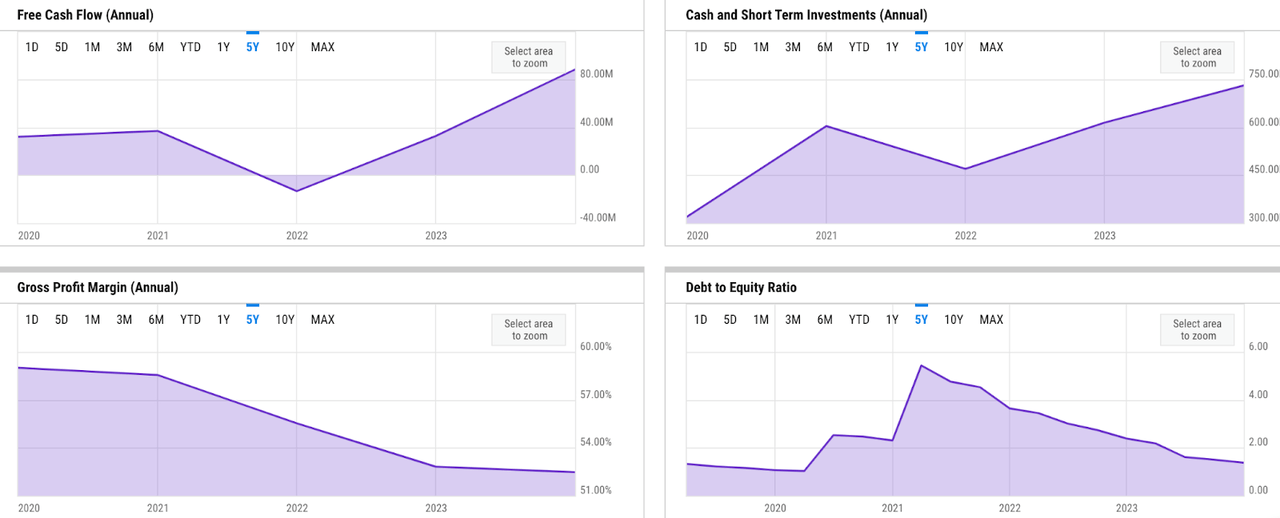

ycharts

Strong OCF translates well into strong FCF, and eventually a strong liquidity position in the balance sheet. Liquidity today stands at over $730 million. FIVN’s liquidity has also been on an uptrend. Over the past five years, it has relied on a mix of both OCF and debt issuance to bolster its liquidity. In 2021, for instance, a debt issuance pushed the debt-to-equity / DE ratio to above 4x, a barely ideal level, in my opinion. Nonetheless, FIVN’s strong cash flow generation has reduced its reliance on debt issuance over time. DE ratio has accordingly declined. In FY 2023, DE reached 1.3x.

Catalyst

I believe FIVN’s increasing traction in the enterprise segment, evidenced by record bookings and strategic RFPs, holds significant promise. In my view, stronger enterprise penetration signifies not only growing recognition of FIVN’s capabilities but also positions it for continued revenue growth. With the 25% YoY growth, enterprise subscription revenue growth even outpaced FIVN’s annual revenue growth in FY 2023.

As larger organizations prioritize digital transformation and customer experience, FIVN’s cloud-based solution, coupled with its AI and automation features, is likely to remain attractive. Therefore, FIVN’s continued advancements in AI are likely to further enhance its competitive edge through a deeper track record, particularly as the demand for automation and self-service solutions escalates in the customer service landscape.

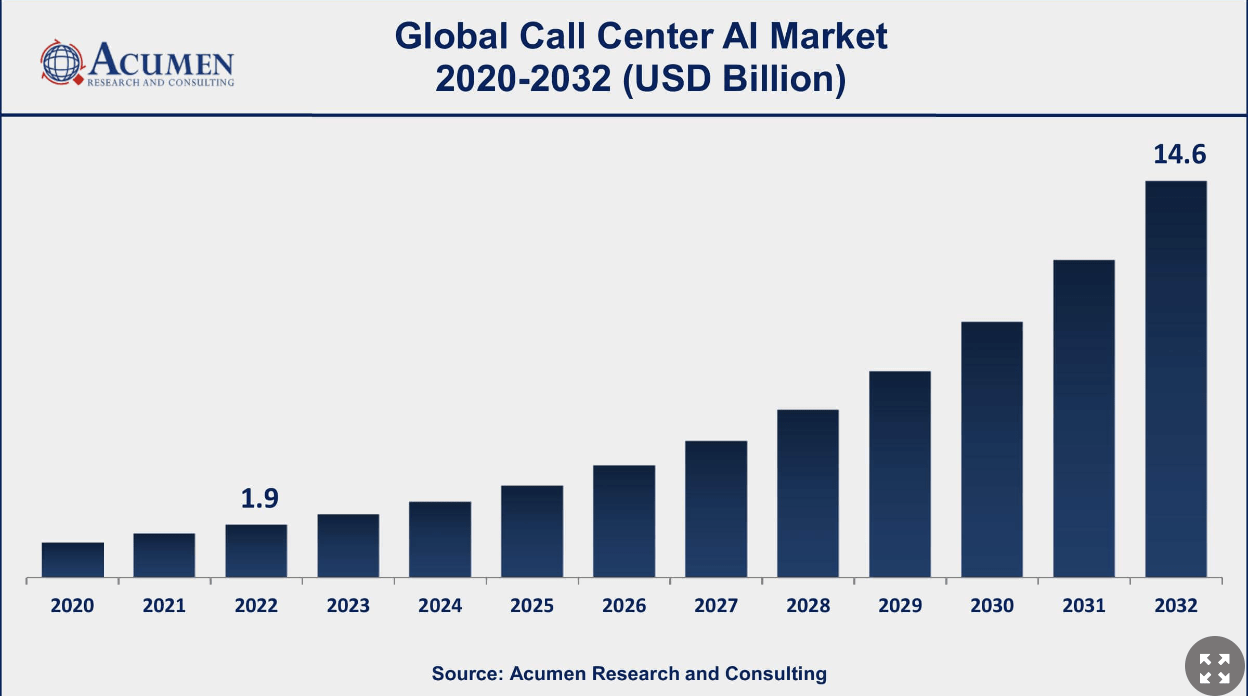

acumen

FIVN’s focus on AI-powered solutions for contact centers is also in line with the emerging adoption trends in AI CCaaS. According to a report, the AI contact center market alone is projected to be a $14.6 billion market in 2032. This should position FIVN for significant future growth.

Furthermore, FIVN’s focus on expanding and strengthening its channel partnerships in Q4 is a noteworthy development that serves as a leading indicator for future revenue growth, in my opinion. These partnerships, particularly with established industry leaders, act as force multipliers for FIVN’s reach and customer acquisition efforts. In my opinion, FIVN’s recent partnerships with industry leaders like BT, TELUS International, IBM, and Deloitte in Q4 also create better access to more enterprise clients.

Channel partners play a crucial role in recommending FIVN’s offerings to their own client base and facilitating the acquisition of new clients, especially in the enterprise segment, where FIVN is experiencing growing traction.

Risk

I believe risk remains minimal to moderate. In my view, an overall market slowdown could dampen technology spending and potentially hinder FIVN’s growth prospects. This is because FIVN’s enterprise customers may also face dampened consumer sentiment, leading them to delay or reduce technology investments, including CCaaS. This risk is particularly concerning for FIVN, given their historical pattern of stronger revenue growth in the second half of the year.

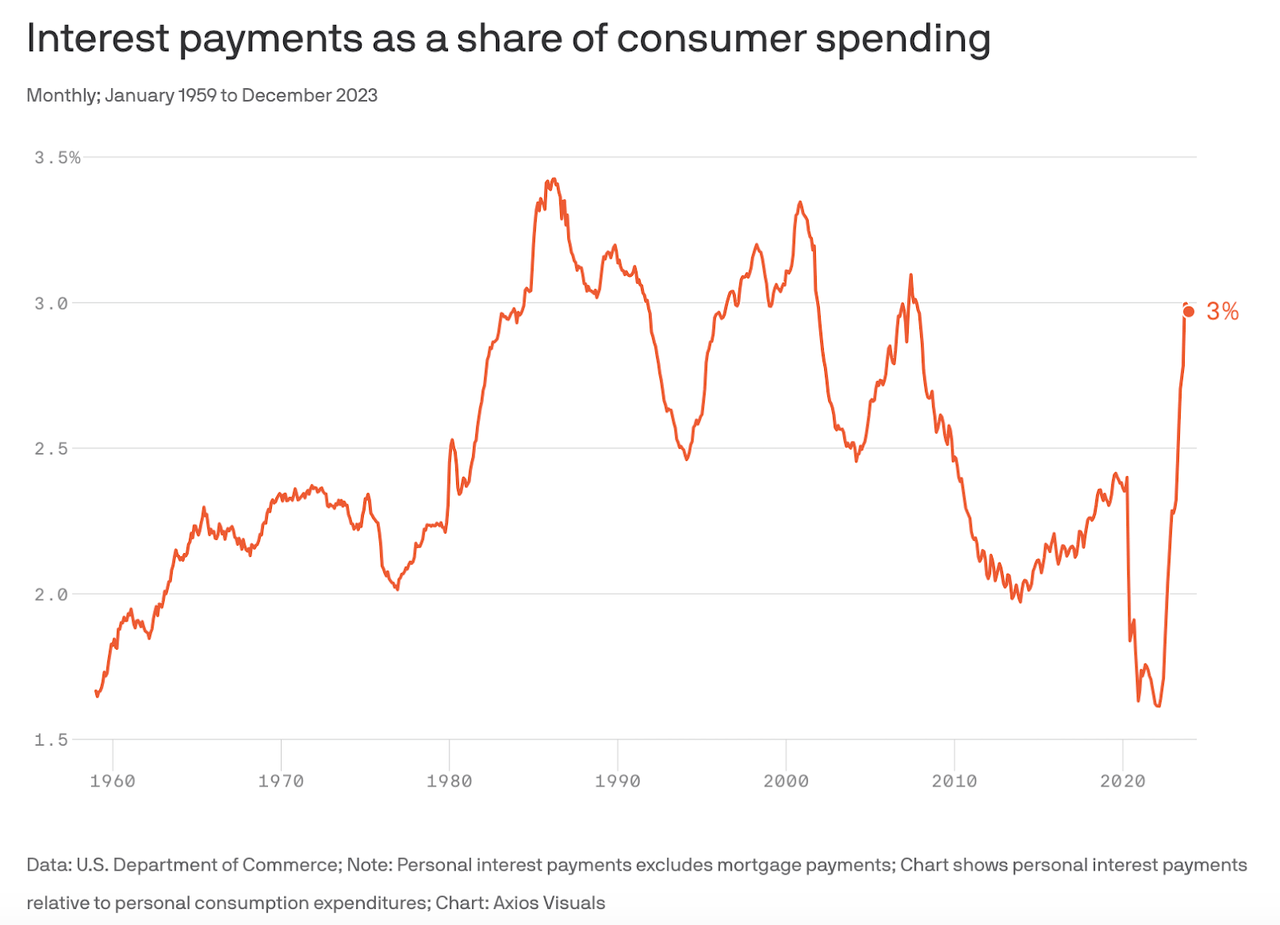

axios

With still elevated inflation as of late, there has been news about the Fed reconsidering rate cuts in 2024, suggesting the possibility of an unimproved outlook in 2024. For companies delivering CCaaS solutions like FIVN, this has not been good news. FIVN’s clients use CCaaS solutions to communicate with their customers to improve their sales and customer experience. With weak consumer demand, then there would be lower demand for CCaaS platform.

Additionally, the CCaaS space is becoming increasingly competitive. I believe new entrants or existing players with substantial resources could pose a significant challenge to FIVN’s market share:

The market for contact center solutions is highly competitive. Generally, we do not have long-term contracts with our clients and our clients can terminate our service and switch to competitors’ offerings on short notice. We currently compete with large legacy technology vendors that offer on-premise contact center systems, such as Avaya and Cisco. These legacy technology and software companies are increasingly supplementing their traditional on-premise contact center systems with competing cloud offerings, through a combination of acquisitions, partnerships and in-house development.

Source: 10K.

Beyond external factors, FIVN faces company-specific risks that require careful management. Execution remains key, as their success hinges on the ability to effectively execute expansion plans, strategic partnerships, and product development initiatives. For instance, FIVN’s larger customers prefer annual contracts, yet usually require implementation work of FIVN’s solution. Considering that FIVN would only be able to recognize the revenues upon completion of work, then there is execution risk here. In my opinion, any missteps in these areas could derail their growth trajectory.

Valuation / Pricing

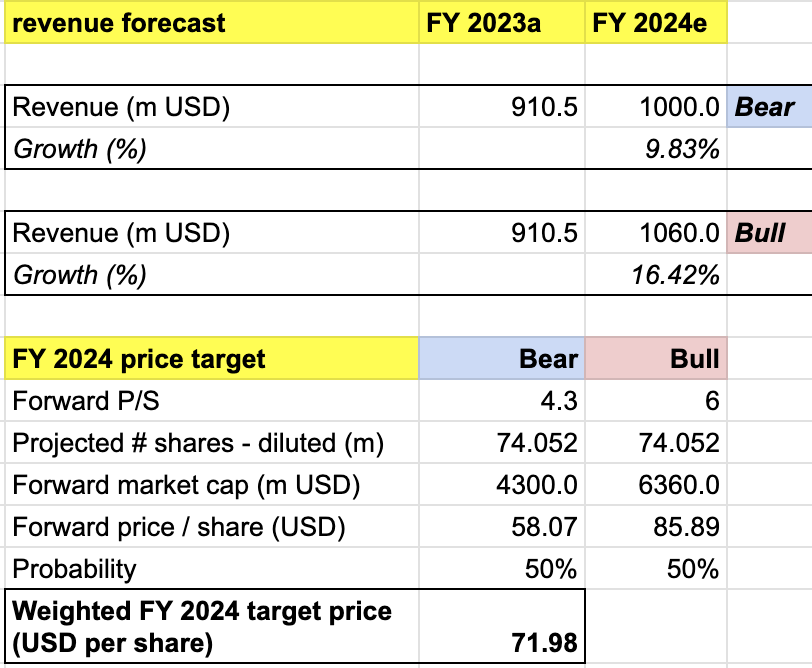

My target price for FIVN is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (50% probability) assumptions – FIVN to achieve FY 2024 revenue of $1.06 billion, a 16.42% growth, at the high end of analyst’s guidance. I assign FIVN a forward P/S of 6x, an expansion from the current level. In this scenario, I expect FIVN to see stronger enterprise uptake with minimal execution issues.

-

Bear scenario (50% probability) assumptions – FIVN to deliver FY 2024 revenue of $1 billion, a 9.8% growth, missing the low end of the analyst’s estimate. In this scenario, I would expect FIVN’s top line estimates to face pressures from unexpected longer sales cycles and even overall demand, due to worsening macro headwinds. I expect its P/S to contract to 4.3x, implying a major correction to $58 level.

price target (own analysis)

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $72 per share. I maintain my buy rating for the stock. While my previous buy rating at $100 level in 2020 is proven to be a wrong call at the time, the broader valuation adjustment across the tech sector post-pandemic has suggested that FIVN’s valuation today has normalized to a more reasonable level.

Trading at $61 today, my 1-year price target model implies an 18% upside for FIVN. I would also note that my price target model is relatively conservative due to a few things. First, I assigned FIVN a considerably lower bear-case revenue of $1 billion despite the relatively decent pipeline visibility. As such, my 50% probability for a bull case scenario is also conservative.

Conclusion

FIVN’s volatile journey since its 2014 IPO highlights the challenges of predicting market performance. While my initial “buy” call in 2020 missed the mark, the stock’s long-term return remains impressive. Despite recent headwinds, FIVN’s solid foundation in the booming cloud contact center market, combined with its focus on upmarket expansion and strategic partnerships, positions it for future growth. Therefore, I reiterate my buy rating with a 1-year price target of $72, offering an attractive 18% upside potential.

Read the full article here