Investment Thesis

Company Overview

Dorian LPG (NYSE:LPG), incorporated in 2013 under the laws of the Republic of the Marshall Islands and headquarters in Stamford, Connecticut, is a liquefied petroleum gas transportation company that owns and operates VLGCs (“Very Large Gas Carriers”) worldwide.

Strengths and Weaknesses

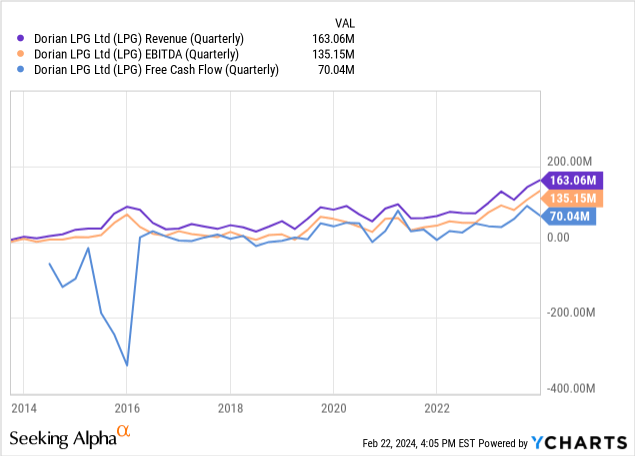

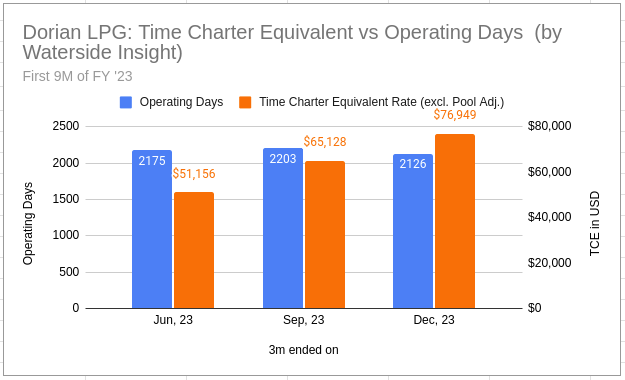

Dorian was having its best quarter yet in terms of revenue and earnings for Q3. The company’s record revenue of $163.1 million and adjusted EBITDA of $133 million were achieved through its highest Time Charter Equivalent (“TCT”) rate per operating day at $76,377. We will have more analysis on this later. The strong financial position was also reflected in its irregular cash dividend paid during the quarter of totaling $40.6 million, and entering the 2023 A&R debt facility, which we will also delve into later. On the cost side, its fleet’s operating expenses per day was $9,936, staying in the ball park with the same period last year of $9,739.

The recent taking off for Dorian LPG’s stock price has long been in the making. The principals of the company from Greece represent more than a century of shipping experience and entered the LPG market in 2002 through the acquisition of two pressurized vessels. Its offices have a global representation in Stamford, CT in the North America, Copenhagen and Athens in Europe and Singapore in Asia. The majority of its current fleet was purchased in 2014 and 2015, exactly eyeing at taking advantage of the US shale boom. The slump of the energy exploration and production sector in 2017-20 did not have large adverse impact on its revenue and earnings.

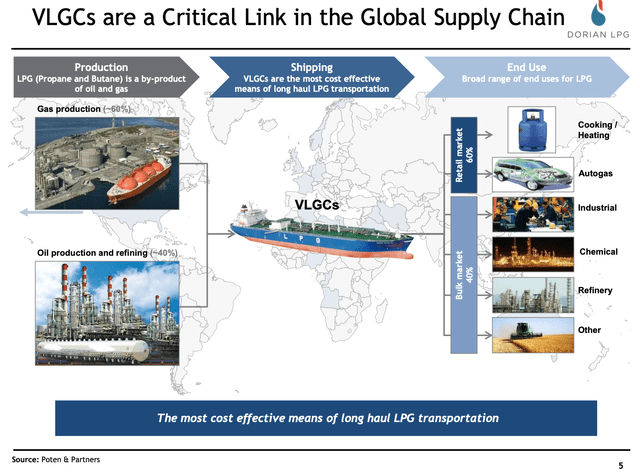

The reason of its resilience is mostly lying in the fact that VLGCs are a critical part of global supply chain, which increasingly relying on seaborne shipment to move products and raw materials around.

Dorian: VLGC’s Role in Global Supply Chain (Company Presentation in Sep 2015)

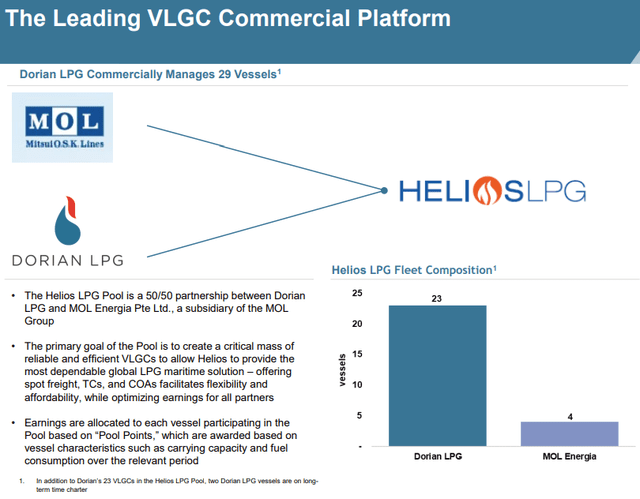

For the past three FYs, Helios Pool accounted for over 90% of Dorian’s revenue. Helios Pool is a joint adventure 50% owned by Dorian and 50% owned by Phoenix Tankers Pte. Ltd. The Pool currently comprises 27 vessels, 23 of which are from Dorian. It operates its vessels in the Pool with in-house commercial and technical management services. Revenue by source including net pool revenue and time charter.

Dorian LPG: Helios Pool (Company Presentation)

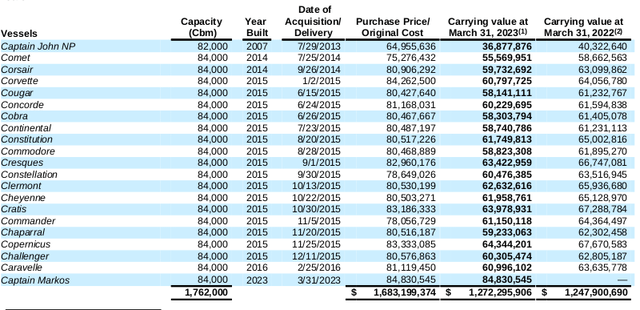

Dorian’s fleet is currently valued at about $1.3 billion, with 21 vessels mostly built or acquired in 2015 and the newest one from 2023. The original purchase cost was $1.68 billion and the YoY decline of carrying value for FY 23 was about $25 million.

Dorian LPG: Fleet portfolio (Company 2023 10K)

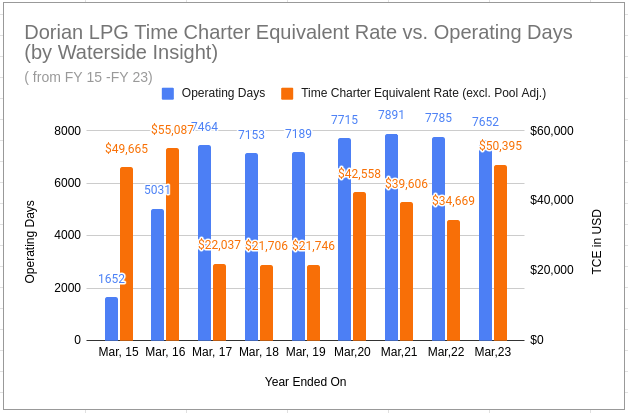

A way to look at its revenue is to calculate operating days for each vessel within the Helios Pool as a variable rate time charter, then it will yield something called “Time Charter Equivalent Rate” (“TCE”) for the pool. The company’s own methodology uses revenue net of voyage expenses being divided by operating days (There is an alternate methodology for such calculation. Interested investors can look at its 10Q). Historically, such a rate has been volatile. The TCE rate was half of where it was from ’17 to ’19 compared to when the company first started operating its new fleet in ’15 and ’16. Since 2020, it has continued to recovered, back to almost its ’15 rate level at $50,395 per day.

Dorian LPG: Time Charter Equivalent Rate vs Operating Days from FY ’15 to ’23 (Calculated and Charted by Waterside Insight with data from the company)

The full year time charter rates tend to smooth out these short-term fluctuations. But as explained in its 10K, Dorian’s business flow is highly seasonal due to the VLGC spot market cycles. It typically has stronger second and third calendar quarters as suppliers build inventory for high consumption season for the northern hemisphere winter. So far for FY ’24, the first 3 quarters have been exceeding the average level of past nine years. The latest holiday season’s revenue is the strongest yet.

Dorian LPG: Time Charter Equivalent Rate vs Operating Days from First 9M of FY ’23 (Calculated and Charted by Waterside Insight with data from the company)

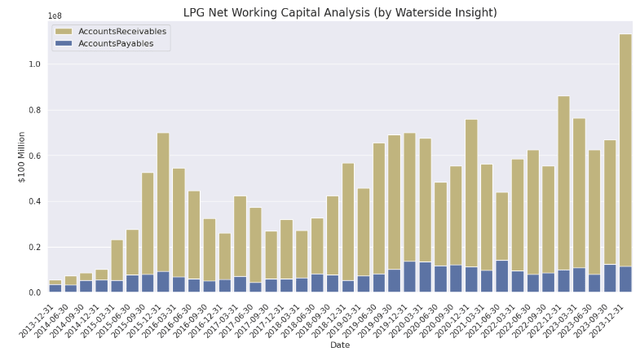

During FY ’23, which ended in March 31, Dorian has increasingly using credits for its business. It extended 4x more YoY credits to its customer accounts to pay for using its services, while using 6x more YoY credit to pay its suppliers.

Dorian LPG: Net Working Capital Analysis (Calculated and Charted by Waterside Insight with data from Company)

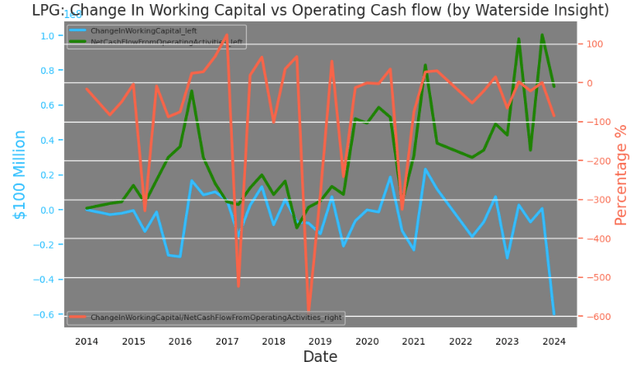

Its operating cash flow has remained strong at a historical high level, but by comparison, the working capital has been reduced by almost $60 million in the latest quarter alone. We charted this net change of working capital as a percentage of its operating cash flow, and the ratio was still at its average level for the past ten years. Perhaps it is not a bad thing to leverage up its strong operating cash flow to generate better top line growth, and the reduction of accounts receivable in the future will give its free cash flow a good support for at least the next few quarters. But the management needs to closely balance this credit extension, and make sure the customers have the ability to pay back on time.

Dorian LPG: Change of Working Capital Vs Operating Cash Flow (Calculated and Charted by Waterside Insight)

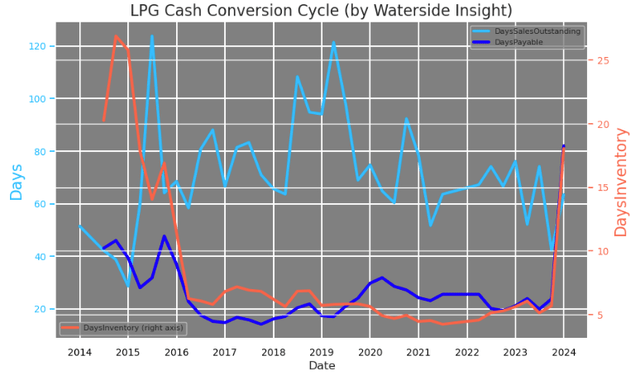

On the other hand, by looking at its cash conversion cycle, it shows its Days of Inventory has risen up from merely five days to about 18 days. It is high compared to the company’s average, but when Days of Payable rose from 20 days to about 80 days, it was more than enough to compensate for it.

Dorian LPG: Cash Conversion Cycle Breakdown (Calculated and Charted by Waterside Insight)

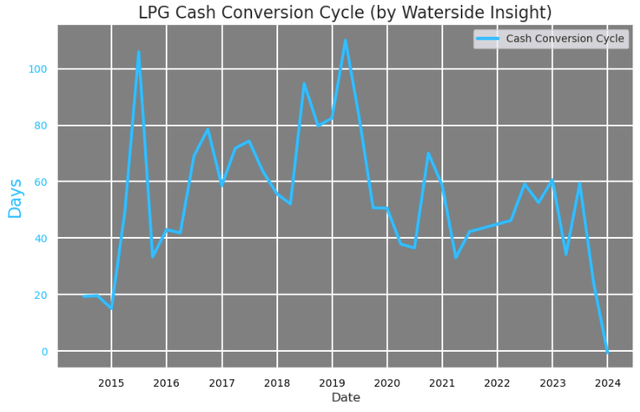

In the end, Dorian is having its shortest cash conversion cycle ever, almost cutting to zero day. And the rise of inventory was not any problem either, as the inventory-to-revenue ratio remained at all time low at around 2.5%.

Dorian LPG: Cash Conversion Cycle (Calculated and Charted by Waterside Insight with data from company)

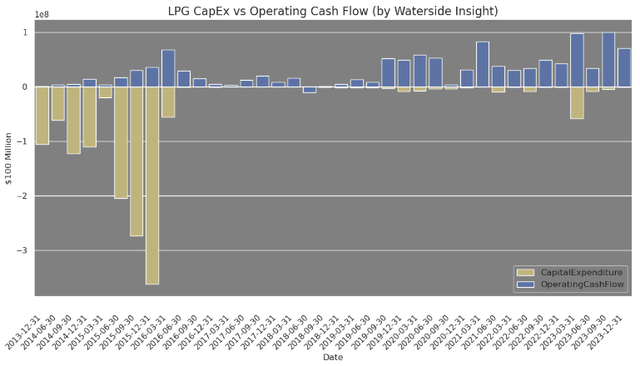

Dorian had experienced negative free cash flow during ’16-’17, and negative net income from ’16-’19. On top of its once-every-5-year drydocking expenses, the company typically spends its CapEx on building up or acquiring new vessels, which is the reason behind the large CapEx spending in ’15-’16. It entered an agreement for a newbuilding VLGC/AC with a cargo carrying capacity of 93,000 cbm that can transport LPG or ammonia. The latter is a more efficient hydrogen carrier. This newbuild is expected to be delivered by Hanwha Ocean Co. in Q3 of 2026 and with $119 million committed to settle upon milestone of expected delivery. The incremental CapEx spending has to do with the scrubber-fitting efforts it has been making. Scrubbers are commonly referring to the exhaust gas cleaning systems in recent years fitted to the vessels to meet the low-sulfur requirements. Such vessels can usually command higher rates compared to the ones without the capacity. It currently has 14 vessels with scrubbers and one chartered-in scrubber-equipped vessel that can burn heavy fuel oil. On the other hand, it only has one newbuilding dual-fuel VLGC and three chartered-in dual-fuel vessels that can burn LPG as fuel. This upgrade and conversion process is expected to accelerate as the trend becoming dominant in the shipping industry.

Dorian LPG: CapEx vs Operating Cash Flow (Calculated and Charted by Waterside Insight with data from company)

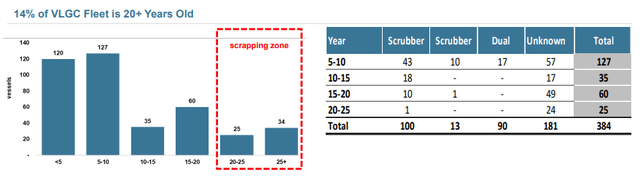

In two years, this patch of Dorian’s vessels will be about ten years old. Majority of the VLGC’s fleets in the world is in the 5-10 year old zone, with about 15% in the 10-15 year old zone and a quarter in the 10-20 year. The company will have about seven years to start introducing new upgrade to its fleet by rebuilding or commissioning new construction. It typically can take up about one to two years to deliver a new VLGC’s.

Dorian LPG: World VLGC Age Range (Company Presentation Feb 2024)

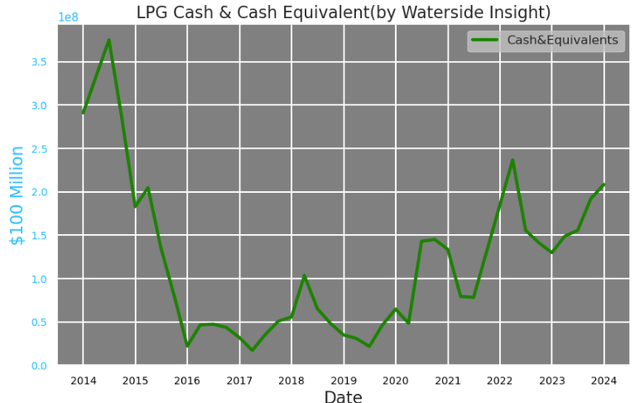

Currently, it has about $4 billion invested in securities as in investing activities, also $200 million in cash and its equivalent, which it has been building up after strong earnings as cash helps to weather the seasonality. We expect the company to use some of the investment capacity and cash to invest in new vessels in the near term. It would be easier if it will gradually upgrading new VLGC’s to its fleet than doing it in bulk. This means maybe starting the construction of another modern ECO vessel within the next 18 months, in addition to the current one under construction. Last time in ’15-’16, Dorian committed a debt facility of around $758 million over a weighted average profile of 14 years through a consortium of banks to finance the purchase of the majority of its current fleet. In December of 2023, the company entered into an amended and restated (“A&R”) debt financing facility with about $240 remaining debt from the 2015 debt facility and with additional credit facility. This A&R facility was reported to be $210 million in the latest earnings release. It has no refinancing needs until 2026. Currently, the company has $623.8 million in long-term debt with a total debt-to-equity ratio of about 78%, while in ’14 it was only about 20%. Getting back to the timing of upgrading Dorian’s fleet, to enter a large debt facility may not be as easy this time around, but the company has the capacity to not needing large external financing, depending on how it plans it strategically and financially.

Dorian LPG: Cash & Cash Equivalent (Calculated and Charted by Waterside Insight with data from company)

Macro Picture

Dorian’s business are greatly influenced by two factors, LPG commodity market and VLCG spot market that reflects the vessels’ supply and demand. We will take a look at both respectively.

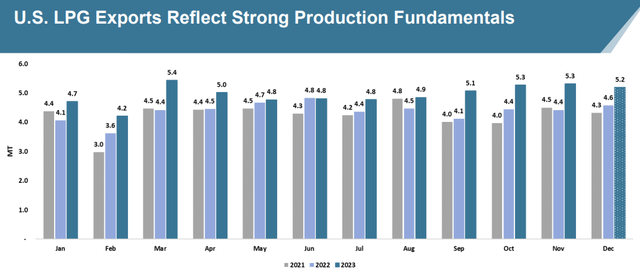

The US shale boom and the rise of the Asia, including China and India, have created an East-West arbitrage of LPG demand and supply. Since the Russia invasion to Ukraine, the demand to Europe has also increased. As a result, the US LPG exports in the past three years have seen continuous growth. The infrastructure in the US ports have also been improving to support this export boom.

Dorian LPG: US LPG Export Volume (Company Presentation Feb 2024)

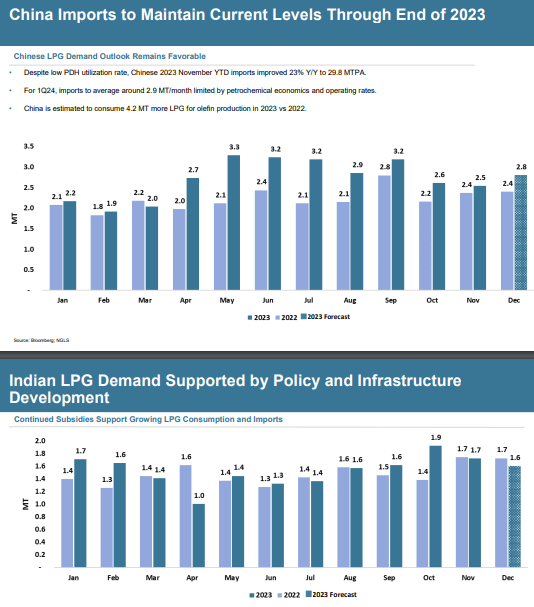

The demand from both China and India are expected to be maintained at the current level.

Dorian LPG: China and India LPG Imports (Company Presentation Feb 2024)

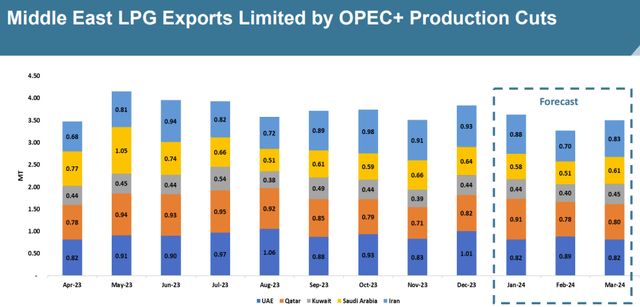

The supply competition mostly came from the Middle East oil producers. But due to the recent OPEC+ production cuts, the LPG exports from Middle East will decrease to an average 3.5 MT/month in Q1 of 2024, dialing back down from their surge in the large part of 2023. Some OPEC watchers even predicted cuts will extend into the next quarter.

Dorian LPG: Middle East LPG Exports (Company Presentation Feb 2024)

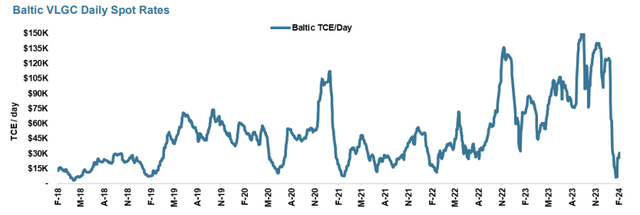

On the VLGC spot market front, the current Baltic TCE rate per day has been hitting some of the low points since 1990. The average of such rate since the 1990 is about $40K, and the lowest point was just above $10K. There is definitely a lot of room to recover from the current level.

Dorian LPG: Baltic VLGC TCE/Day (Company Presentation Feb 2024)

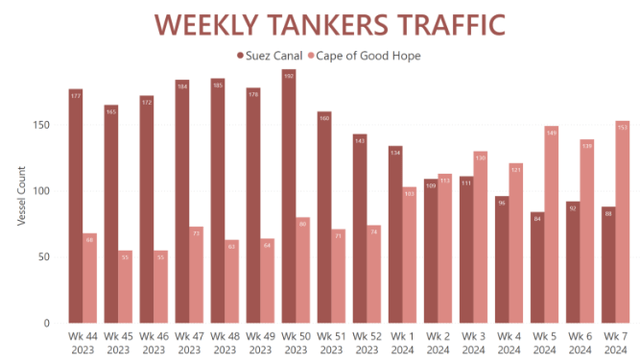

Given the tension currently ongoing in the Red Sea has also been creating a two tier market. Although the Baltic standard rates have been dropping, Panamax rates have seen increases. Since the conflict broke out last fall, the tankers and LPG carriers increasingly to avoid the Suez canal and increasing the Cape of Good Hope, reversing the increase in the aftermath of Russia invasion of Ukraine. As a result, the added miles gave the freight market a strong support. This has also been reported by the management in the latest earnings call.

Weekly Tanker Traffic: Suez Canal vs Cape of Good Hope (AlphaLiner)

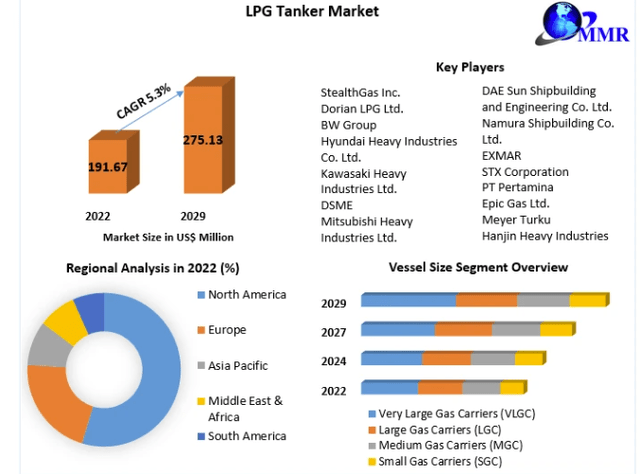

Dorian LPG is one of the key players in the LPG tanker market. It is expected that this market will grow 5.2% CAGR through 2029 with North America taking the lion share of over 50% of the global market. VLGC is the largest segment among all vessel size in this market as well. Since 2015, Dorian’s revenue grew at 15.9% CAGR.

LPG Tanker Market (MaximizeMarketResearch)

Overall, Dorian’s ride on the US Shale boom and the demand arbitrage elsewhere in the world is well supported with long-term potential. The company’s own revenue and earnings are at its strongest since its current fleet was built in 2015. The cash flow and cash conversion efficiency are both reaching their best levels. We expect the upgrade of its fleet to be manageable if the company starts early and manage it with discipline strategically. It will need to continue maintaining its strong financials to secure easier financing terms in the medium term and keep building its cash pile.

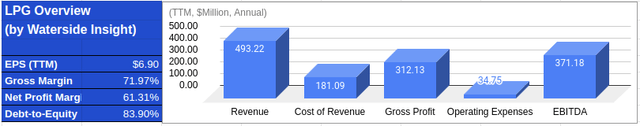

Financial Overview & Valuation

Dorian LPG: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

There are macro and company-specific moving parts for Dorian’s business and growth. Macro picture is mostly exogenous factors. Due to the key function of LPG in the global supply chain, current geopolitical risks are not likely to upend the company’s profitable transportation business. If anything, they add to the fuel of lower supply against inelastic demand. Higher US natural gas price or lower overseas demand alone will not completely change the arbitrage opportunity either, as they are most likely to be short-term adjustments. It will have to be a deep recession that knock off the spot rates to the point that it is unprofitable to ship LPG around the globe, or higher US supply costs coincide with subdue overseas demand, that will remove the profits in this. They are, however, not our base case scenarios. On the other hand, if the company forgo capital allocation discipline and efficiency, it could very likely face a steep hill to climb when the time comes to have to replace its fleet. And come it will. In general, the base case we value the company shows its stock price still has room to rise further and it is not expensive.

Conclusion

With the risk of overly simplifying, we say the foundation Dorian’s business built on is the opportunity provided by the US shale boom. When opportunity met with a generational geo-economical shift globally, the arbitrage from the supply and demand dynamics becomes a long term trend. With the management increasingly skillful in navigating the financing facilities and capital allocation efficiency, the company has been building wealth for its principals and stockholders for almost a decade. We think its best day is still ahead with upside likely. Interested investors can buy at or below the current levels.

Read the full article here