Much ink has been spilled over the last several years regarding whether to employ a traditional market cap-weighted portfolio or to opt for an equal-weight construct. The difference is important, as the latter version generally offers a tilt toward more cyclical and value-oriented small and mid-sized companies, away from the U.S. mega caps. There are other approaches, though.

Few investors talk about strategically allocating capital based on actual company earnings metrics. The WisdomTree U.S. Earnings 500 Fund ETF (NYSEARCA:EPS) does just that. EPS uses a rules-based approach, focusing on core earnings to offer investors exposure to the domestic stock market. The fund provides effective diversification, modest fees compared to active strategies, tax efficiency, and transparency.

I reiterate my buy rating on the EPS exchange-traded fund or ETF. I see its stock-selection rules, valuation, and long-term performance trends as positive, but I am careful to note some issues on the chart and with EPS’s seasonal performance as we approach the final month of Q1.

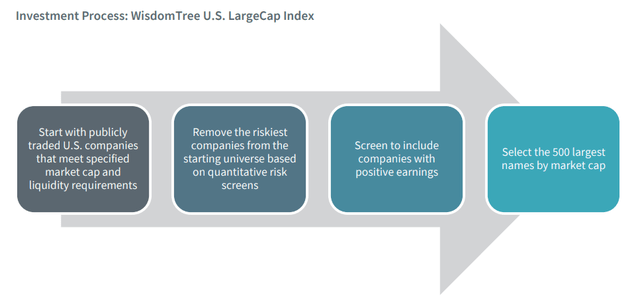

With an earnings-weighted methodology, the screening process begins with analyzing U.S. firms that meet certain size criteria and liquidity requirements. It then filters out highly risky stocks before applying the positive earnings screen. EPS then selects the 500 largest company shares by market cap.

EPS Investment Process

WisdomTree

Among the fund’s goals in utilizing this stock-selection process is to choose companies based on positive earnings growth while avoiding overexposure to expensive and unprofitable niches of the US large-cap universe. EPS’s beta and correlation to the market are close to one, so don’t expect much deviation from the SPX, but over several market cycles, the fund’s objective is to outperform the S&P 500 while reducing risk, with an emphasis on healthy risk-adjusted returns.

EPS is a solid fund to own for the long haul, in my view. Its annual expense ratio is extremely low at just 0.08% and it pays a yield that is slightly higher than that of the S&P 500 at 1.62% on a trailing 12-month basis. Share-price momentum is very strong as the ETF notches fresh all-time highs in recent days – I will highlight key price levels to monitor later in the article.

Risk metrics are also sublime given its proven diversification and steadily rising share price. Finally, EPS’s liquidity profile is not bad, but with a 30-day median bid/ask spread of eight basis points, I encourage investors to employ limit orders during less liquid periods of the trading day.

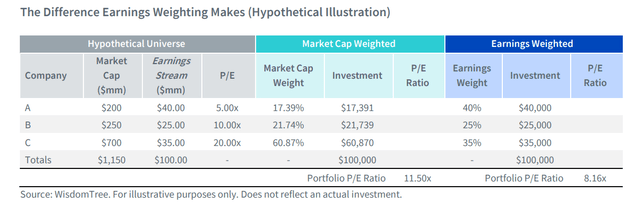

As WisdomTree points out, forming a portfolio based on earnings is not all that complicated, and it makes intuitive sense. Rather than simply owning the biggest stocks in proportion to size, running straightforward screens to overweight highly profitable companies might be more effective in limiting drawdowns. The result is often owning a portfolio with a lower P/E compared to the traditional cap-weighted approach.

EPS: The Earnings Difference

WisdomTree

The 3-star, Silver-rated portfolio by Morningstar plots along the top tier of the style box, indicating that it holds primarily large caps, but there is a significant 21% exposure to what Morningstar considers to be mid-cap stocks.

The fund’s price-to-earnings ratio is just 17.2 using forward estimates as of February 22, 2024, according to the issuer. That is a full three turns cheaper than the S&P 500 Index. EPS features a 2.1% net buyback yield, too.

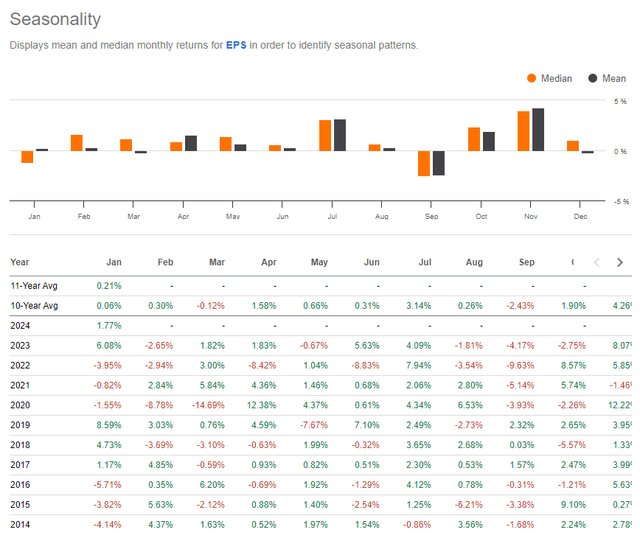

Seasonally, the fund tends to trade about sideways in March before the historically strong stretch from April through August ensues.

EPS: March Has Been A Weak Month, But Q2 and Early Q3 Have Been Strong

Seeking Alpha

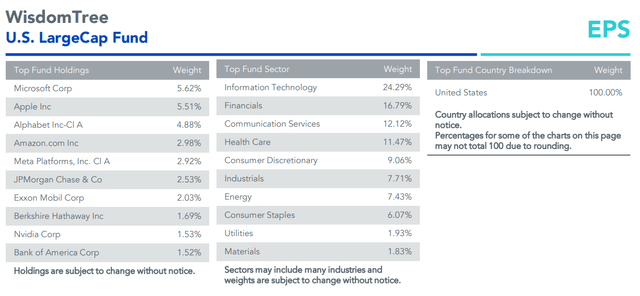

As for the portfolio’s current holdings, EPS owns many of the familiar names, including the Magnificent Seven stocks among its top positions. Apple Inc. (AAPL), Microsoft Corporation (MSFT), NVIDIA Corporation (NVDA), Alphabet Inc. (GOOG, GOOGL), Amazon.com, Inc. (AMZN), and Meta Platforms, Inc. (META) are all in the top 10 positions, with just the embattled Tesla (TSLA) not included.

Information Technology is, unsurprisingly, the biggest weight with the more value-oriented Financials sector being the next largest. Income investors might not choose EPS as a high-yield fund, but the ETF has six years running of dividend growth.

EPS: Top Holdings, Sector Weights

WisdomTree

The Technical Take

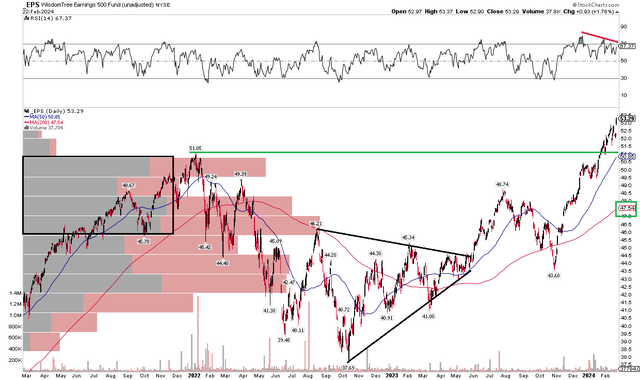

EPS has been printing new all-time highs through February, but there is a bearish risk to consider on this high-quality, earnings-focused fund. Notice in the chart below that shares are indeed on the rise, but the RSI momentum oscillator at the top of the graph has been posting a series of lower highs, which technicians would deem a bearish divergence between price and momentum. I would like to see the RSI trend improve, but a mere consolidation in price during what has historically been a soft seasonal patch would certainly make sense here.

Still, with a rising long-term 200-day moving average, the broader trend clearly favors the bulls. EPS endured a material correction from late July last year through the middle of October – that 10.5% pullback found support right at the apex of a triangle consolidation zone from August 2022 through May of last year. I do not see a full-blown 10% correction in the cards, but key support is seen at the previous all-time high of $51 – that would be an opportunity to get long the fund, in my opinion.

Overall, EPS sports a solid uptrend, but recent momentum readings are not particularly impressive. Buying on a dip to $51 appears to be a reasonable investment strategy.

EPS: All-Time Highs, Some Bearish RSI Divergence

StockCharts.com

The Bottom Line

I have a buy rating on WisdomTree U.S. Earnings 500 Fund ETF. I like its sound construction and portfolio management methodology. What’s more, the EPS ETF comes at a very inexpensive price while its technical picture is generally favorable heading into a tough part of the calendar.

Read the full article here