Note: This article was first published to subscribers yesterday.

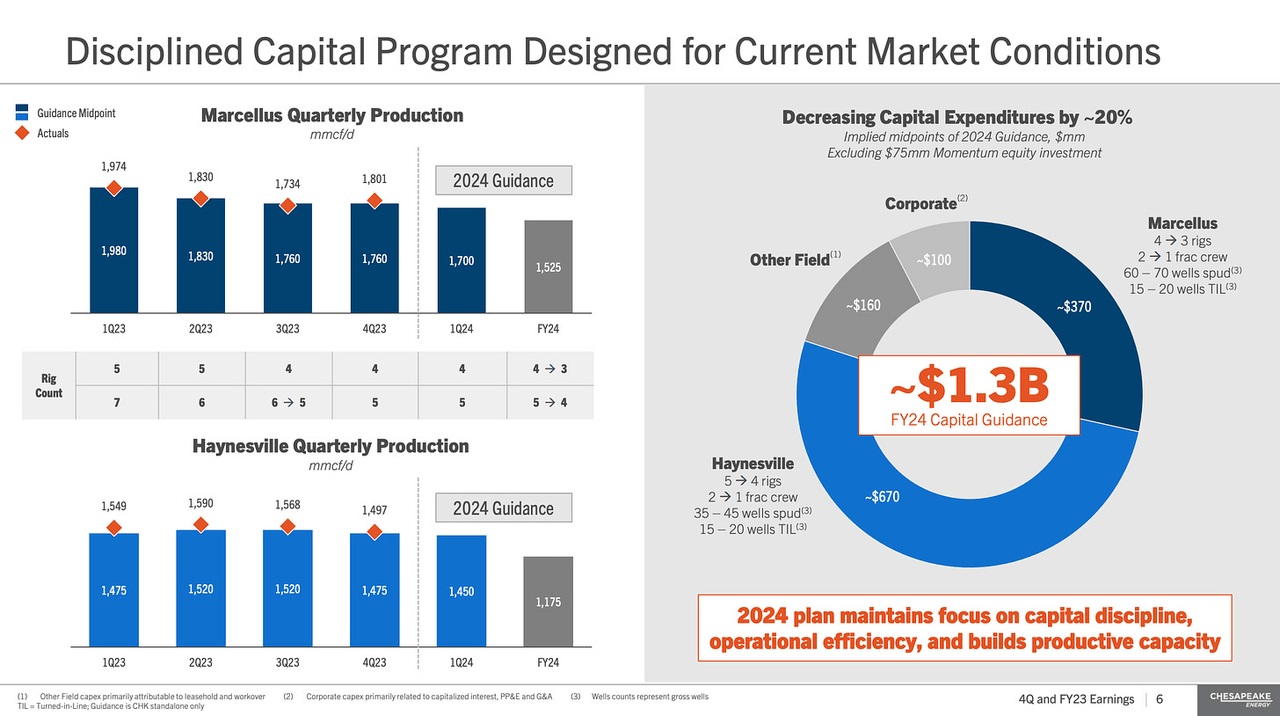

If you are staring at your screen wondering why natural gas prices are up ~11%, then look no further. Chesapeake Energy Corporation (CHK) announced a major reduction in capex and production (0.73 Bcf/d 2024 average vs. Q4 2023). And in turn, every natural gas producer we follow is up… a lot.

CHK

What’s interesting about this guidance is that if you look at what CHK is really doing, it’s following the playbook of Canadian natural gas producers. U.S. gas producers have had the benefit of increasing/ improving pipeline capacity as production expands. But in Canada, there were times back in 2017/2018 when AECO gas prices fell well below cash cost breakeven. During those periods, producers curtailed production dramatically and back-loaded the capex (during winter months).

CHK

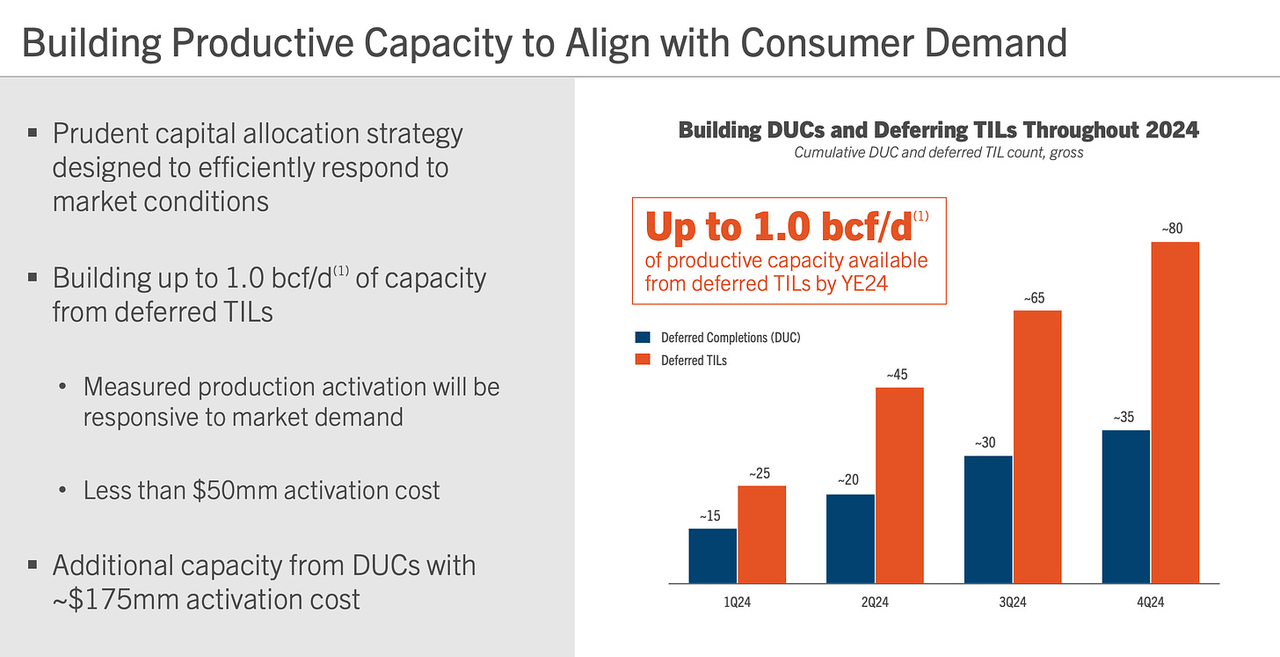

Similarly, CHK is doing the same by deferring TILs (turn-in-line, wells that can be turned into sales). By building up TILs, CHK is effectively holding “spare capacity,” or similar to what the Saudis do. So while it’s guiding down production, if the market environment turns (e.g., natural gas prices turn higher), it can increase production.

Now if you look at the timing of the production drop, CHK is guiding to lower and lower production quarter after quarter. Realistically, however, given the seasonality of natural gas prices (NG1:COM), Q2 should exhibit: 1) the lowest realized pricing; and 2) the lowest consumer demand (shoulder). Q3 will show a bump in consumer demand from cooling and if market balances tighten enough, CHK can increase production again in Q4.

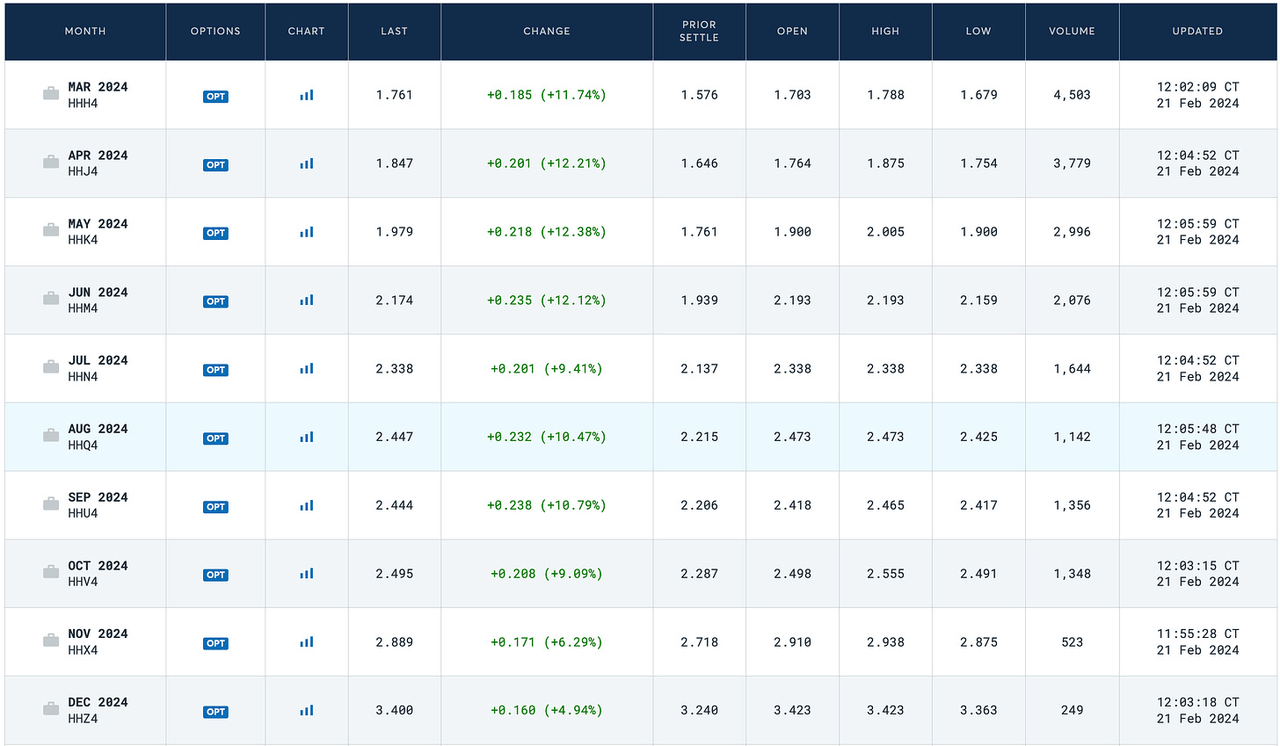

Our analysis of CHK production is predicated on the futures curve improving from where it is.

CME

As you can see, the market is in steep contango, with prices not surpassing $2.5/MMBtu until Nov. 2024. If the production curtailment boosts summer gas prices past $2.5/MMBtu, then we expect CHK’s production in Q3 to be higher than in Q2. If it remains at current prices or worsens, then we expect it to drop.

Is it enough?

The market is going to balance natural gas storage one way or another. By pummeling prices to the lows we’ve seen, it’s prompting a response from natural gas producers. It is evident now to the market that these prices are clearly unsustainable for natural gas-heavy producers.

But the issue we still have with the natural gas market today comes from these producers:

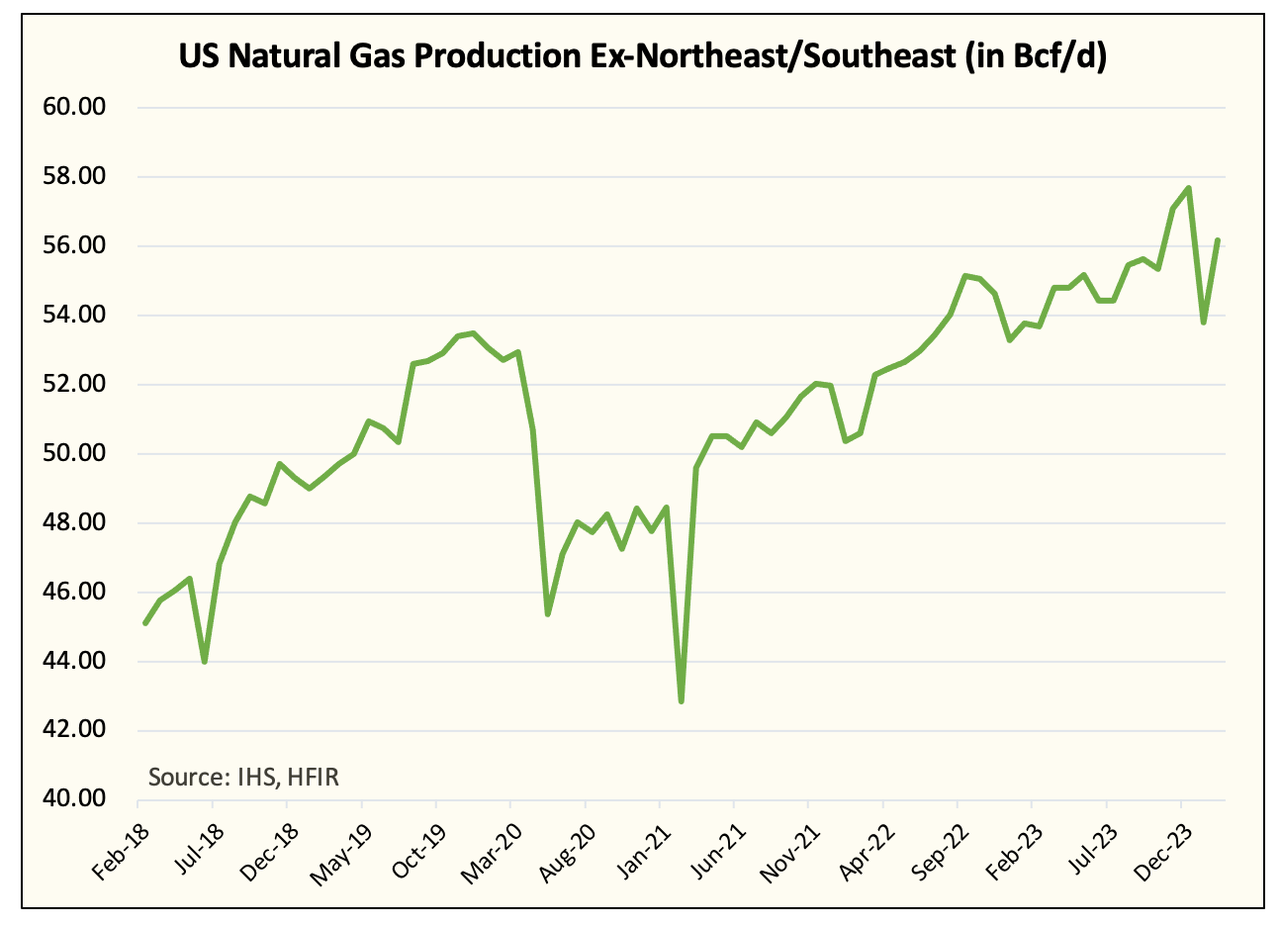

IHS, HFIR

Excluding the Northeast and Southeast, U.S. gas production out of the rest of the regions accounts for ~57 Bcf/d or over half of Lower 48 gas production.

IHS, HFIR

Marginally speaking, Northeast and Southeast gas producers can decrease production, but the other ~55% of producers are agnostic about natural gas prices.

In essence, natural gas-centric producers like Chesapeake have to play the role of OPEC. Given this being the case, how much production cut is needed?

Balance…

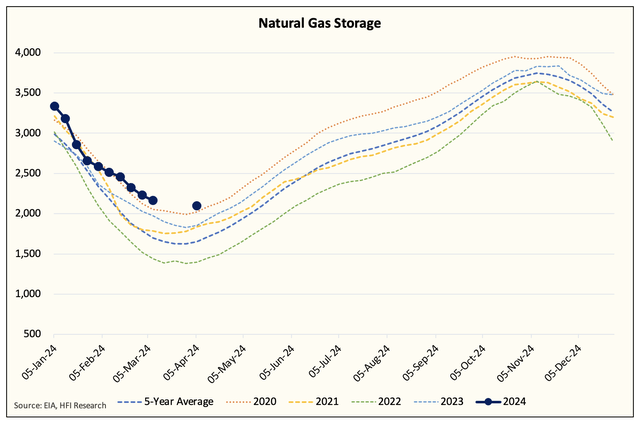

The 2023/2024 winter is one of the warmest on record. Despite that, natural gas storage managed to decrease from 3.833 Tcf to ~2.1 Tcf (our estimate for the beginning of April). This is a decrease of 1.733 Tcf or below the 5-year average decrease of 2.096 Tcf.

If you exclude the weather factor, this means that the U.S. gas market is still oversupplied, on balance, by ~1 Bcf/d. Relatively speaking, this is a bit tighter than what we initially expected (surplus of 1.5 Bcf/d).

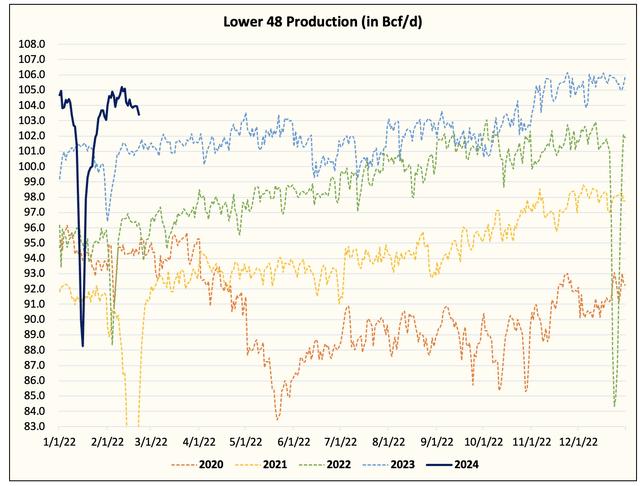

On balance, this means that Lower 48 gas production needs to decrease to ~102 Bcf/d to “balance” the market. Casting aside the fact that low prices are going to prompt a demand response (i.e., higher), at 102 Bcf/d, we can expect a normal seasonal injection season.

But now if we factor in demand responding to lower prices, we are estimating at least ~1.5 Bcf/d of power burn demand increase. This, combined with the likely production decrease we see, should push the U.S. gas market from +0.5 Bcf/d to -1 Bcf/d.

EIA, HFIR

However, readers must keep in mind that we are going to be exiting this winter at 5-year high storage. There are 30 weeks in the injection season, and the 5-year average injection total is 2.067 Tcf.

At -1 Bcf/d, that equates to a deficit of 210 Bcf. At this deficit, it implies storage to finish around ~3.957 Tcf. Now, this does not factor in a warmer-than-normal summer, so the storage level could finish below this level.

With the 5-year average at 3.746 Tcf, we will still be in surplus by ~211 Bcf.

A path to a balance…

I think the CHK announcement was a major signal the natural gas market needed today. Many in the market expected EQT to be the swing producer, but given its hedge book and low-cost profile, it was disappointed to find EQT increasing production y-o-y. CHK, on the other hand, delivered with a sizable decrease of 0.73 Bcf/d. Not only did the market need this, but it also signaled that other producers were likely going to do the same. Antero Resources Corporation (AR) has already guided to -0.1 Bcf/d, and other producers like Comstock Resources, Inc. (CRK) are guiding slightly lower as well.

If we had to ballpark the amount of production curtailment happening at these prices, we would say it’s closer to ~1.5 to ~2 Bcf/d. This means that Lower 48 gas production should decline to ~101.5 to ~102 Bcf/d during the summer months if prices stay below $2.5.

In essence, there is a path to a bottom here, and the market forces it out of the producers.

Rangebound, though, so don’t get too excited…

With all that being said, the U.S. gas market is still going to be rangebound. As we illustrated in the CHK slides, a lot of producers are going to be deferring TILs. This means excess capacity will be sidelined when prices improve, and since price is the determining factor here, we will see production respond to higher prices. As a result, and because the U.S. gas market is still in surplus (storage relative to the 5-year), natural gas price upside will be capped.

But the positive takeaway from all this is that there is a bottom now, and I think CHK’s announcement has told the market that $1.5/MMBtu is unsustainable. Now there’s no need for the market to “force” a shut-in price, so we can all rest easy knowing that.

From a trading perspective, we are still sitting on the sidelines. Our bias going forward will be towards the long side given the fundamental variables we laid out above. For now, we continue to favor oil equities over natural gas equities given the fundamentals of the two underlying markets.

Read the full article here