Major US-based Exchange Traded Fund (ETF) provider Proshares has just launched a new short Ether (ETH) product.

The new ETF, called the ProShares Short Ether Strategy ETF with the ticker $SETH, will allow investors to profit as the price of Ether declines.

Ether is the native currency that powers the smart-contract-enabled Ethereum blockchain, which remains by far the most widely used blockchain by the Decentralized Finance (DeFi), Non-fungible Token (NFT) and broader web3 industry.

$SETH will trade on the New York Stock Exchange and intends to achieve exactly the opposite of its underlying benchmark asset, which is Standard & Poor’s CME Ether Futures Index.

Moving ahead, traders would do well to keep an eye on how much in investor capital flows into ProShare’s new short ETH ETF product, as an increase in flows could indicate increased bearishness towards Ether.

However, its worth noting that a rise in capital inflows into short ETH ETF products might also be taken as a sign of institutional adoption of Ether.

That’s because investors won’t only buy short Ether products to express a bearish view on the cryptocurrency.

Rather, they might also buy it for hedging purposes, or to pursue delta-neutral investment strategies to take advantage of Ether’s inbuilt yield when used for staking.

Where Next for Ether (ETH)?

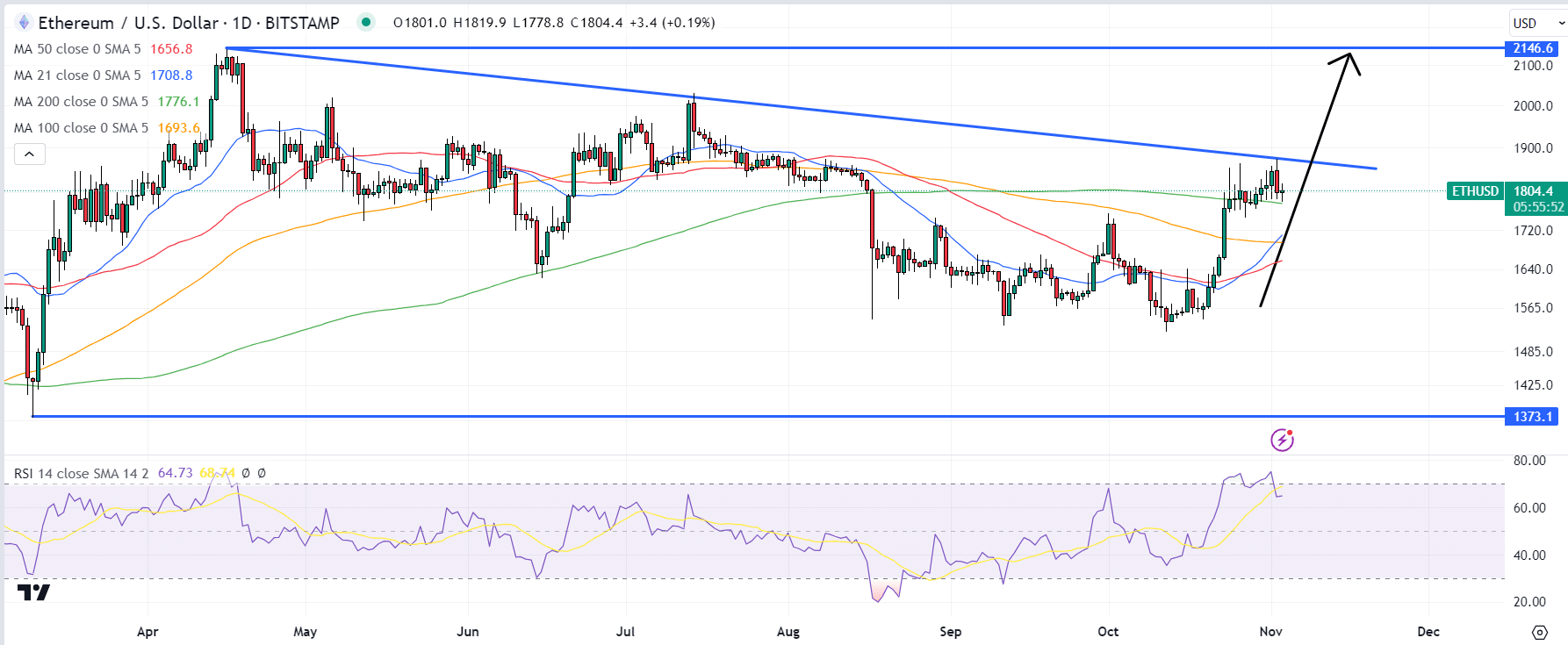

Ether (ETH) was last trading near flat on the day just above $1,800 per token, hovering above its 200DMA at $1,776 as traders digest the latest US jobs report, which was weaker across the board, supporting equity and bond prices.

While ETH is trading about 4% lower versus the multi-month highs it hit earlier in the week, it is trading nearly 20% higher versus its October lows just above $1,500, having pump in the latter part of October in tandem with the broader crypto market on optimism about potential near-term spot-Bitcoin ETF approvals.

Optimism surrounding institutional adoption is unlikely to fade anytime soon and the broader macro backdrop also seems to be acting as a tailwinds, with stocks rallying and US bond yields falling substantially this week as traders digest the latest updates from the Fed and on the US jobs market.

If Ether can break to the north of a downtrend linking this year’s highs, it’s in with a decent shot of rallying back to yearly highs above $2,000.

However, recent news that major web3 decentralized application Render Network is relocating to Solana from Ethereum, and the fact that on-chain activity has been weak as of late are headwinds for the ETH price.

Read the full article here