Many banks have enjoyed a three-year uptrend from the pandemic recession to sustained economic recovery. But recently, their upside potential has become toppish amid a challenging state of unprecedented interest rate cycle. Northern Trust Corporation (NASDAQ:NTRS) also reflects the impact of mounting inflationary headwinds. Interest income keeps increasing. However, the QoQ growth rate has decelerated in the past five quarters and was outpaced by the increase in interest expense.

These point to the downward trend of the stock price. Right now, it appears to be an excellent bargain as we compare it to the historical price metrics. Yet, the Fed’s hawkish stance may squeeze revenue and income further and put downward pressure on the stock price.

NTRS still showcases the resilience of its business model. It maintains an impeccable financial positioning, allowing it to withstand the risky market landscape. But right now, we are not keen on buying the stock.

Company Performance

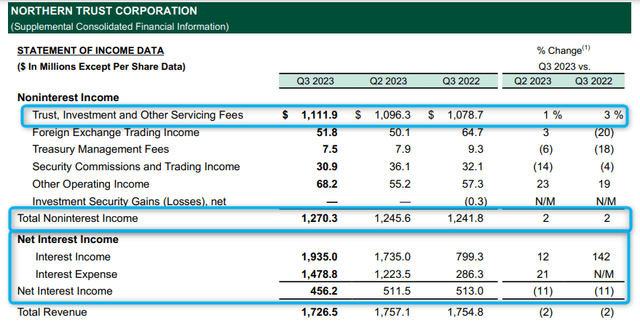

Northern Trust Corporation maintains a decent performance, albeit its toppish interest income growth this year. Interest income reached $1.94B, a 142% YoY growth. Yet, the sequential growth over the past year has been consistently decreasing. The QoQ growth in 4Q22 dropped to 46% before falling more to 24% in 1Q23. In 2Q23, the QoQ decreased further to 19%. Lastly, it landed on 12% in the most recent quarter.

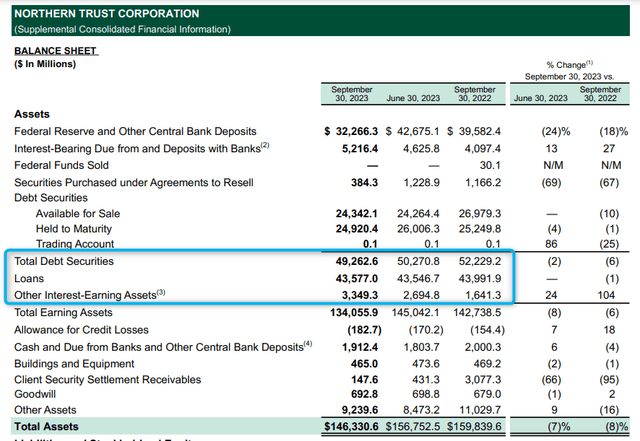

Debt securities and loans remained the top contributors and reflected the change in interest income. While their value decreased, their yields in the form of interest income rose. This shows that the Balance Sheet of NTRS remained interest-sensitive.

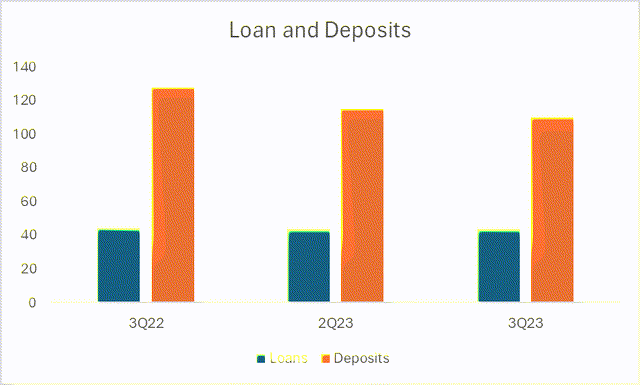

Additionally, the company does not maximize its lending capacity. We can see it by comparing loans and deposits in the Balance Sheet. We will delve into it in the next section.

Balance Sheet (NTRS 3Q23 Earnings Report)

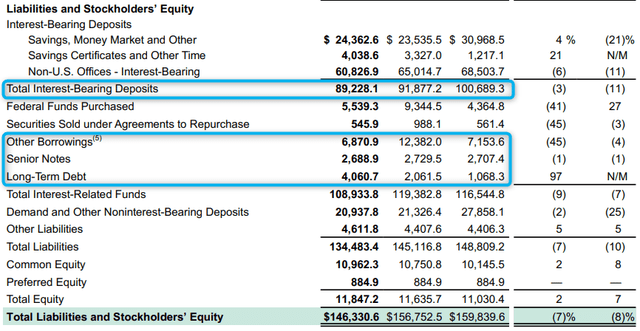

Likewise, interest expense increased consistently. But the growth rate has outpaced interest income, so net interest income plunged to $456M from $513M in 3Q22 and $512M in 2Q23. This could be attributed to elevated interest rates, since over 80% of its liabilities were interest-sensitive. Take deposits, for example. Interest-bearing deposits comprised 81% of the total deposits. Meanwhile, borrowings have risen by nearly 30% since 3Q22.

Balance Sheet (NTRS 3Q23 Earnings Report)

On the other hand, the non-interest segment remains stable with increasing trust and service fees. But like the other segment, its QoQ growth has contracted. Given this, the operating revenue was $1.73B, 2% lower than in 2Q23 and 3Q22. This was mainly driven by the substantial increase in interest expense.

Income Statement (NTRS 3Q23 Earnings Report)

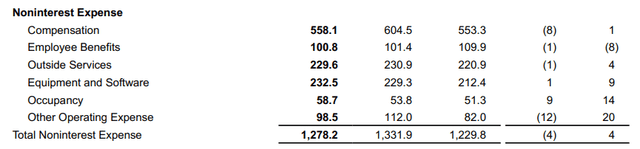

On a lighter note, its effort to expand its customer base while enhancing efficiency paid off. Labor-related and other operating expenses remained stable, which was impressive amid elevated prices. Note that inflation rebounded in August and September. This partially offset the decrease in operating revenue. Even so, it was still not enough to halt the decreasing net income.

Income Statement (NTRS 3Q23 Earnings Report)

With the hawkish stance of the Fed, interest rates may increase again in 4Q23. It will raise interest in loans, deposits, investment securities, and borrowings. While NTRS may remain stable and viable, its growth may remain toppish.

What’s Good About This Company?

Despite the slower growth, NTRS maintains stable positioning. It has enough risk mitigants to ensure it can withstand the blow of a potential economic downturn.

High Liquidity Through Effective Loan and Deposit Management

Northern Trust Corporation is one of the largest and oldest banking institutions in the US. In over a century, NTRS has witnessed numerous economic booms and bursts. Even so, it remains a sturdy company amid mounting inflationary headwinds and elevated interest rates.

One of its key attributes is its excess liquidity. NTRS is a large bank but maintains a conservative approach to growth. Its loans and deposits remain well-managed and well-diversified. Most importantly, its Loan-to-Deposit Ratio (LDR) remains below 40%.

Even better, its low LDR Ratio protects the bank from potential crises as recession woes remain. It has more than enough reserves to maintain high liquidity. This aspect will also allow the bank to withstand elevated interest rates that may lead to delinquent loans.

Loans and Deposits (NTRS 3Q23 Earnings Report)

Commercial Loan Exposure Increased

Historically, NTRS has low commercial loan exposure. Yet, it did not hamper NTRS’ growth and expansion. The events after the pandemic paved the way for the company to expand its client and borrower base. Moreover, its commercial loan exposure increased considerably. Currently, commercial loans are $22.4B, 56% higher than pre-pandemic levels. Also, they now comprise 51% of the total loans from 44% in 2019. So, the company has higher engagement with businesses.

Commercial loans are more sensitive to interest rates. These suit high-interest environments well. As such, increasing its exposure to commercial loans will help it generate higher interest income.

Low Real Estate Exposure

NTRS has low real estate exposure commercial and residential real estate loans only comprises 26% of the total loans. As such, NTRS is safer amid concerns about the real estate market. Although a crash is still a far cry from the events before the Great Recession, it is better to be safe than sorry. Its low exposure to mortgage loans may protect it from a potential crisis in the country.

Many Liquid Assets

It is typical to see high concentration on loans and investments. But NTRS appear quite different from many other banks. Its earning asset portfolio is well diversified. Most importantly, it has many liquid assets, such as its bank deposits and cash and cash equivalents. Their combined value of $43.3B comprises 30% of the total assets, making it a very liquid company. So NTRS has much resources to cover expansion, pay dividends, and sustain the business.

Enticing Returns With Manageable Risks

NTRS maintains a double-digit CET1 Ratio and ROAE, making it a bank offering high returns and manageable risks. This gives NTRS a strong capital position to adhere to Basel III requirements. Its Tier 1 Risk-Based Capital Ratio of 12.4% is much higher than the minimum of 6%. It is also higher than 2Q23 with 12.3% and 3Q22 with 11.1%. Even better, its Total Risk-Based Capital or Tier 2 Ratio of 14.5% exceeds the required 8% and 2Q23 with 14.4% and 3Q22 with 12.2%. Its CET1 Ratio is 11.4% while its ROAE is 11.6%. This makes NTRS well-capitalized amid macroeconomic headwinds.

What Will Hinder Its Income Rebound?

While Northern Trust remains a stable bank, investors must watch out for macroeconomic risks.

Interest Rate Hikes

The Fed left interest rates unchanged in its September board meeting, despite the slight inflation uptick. However, it hinted at its hawkish view of rate hikes this November. Inflation remains the main driver, surpassing the 3.6% consensus and reached 3.7%. Higher prices may be driven by the ongoing Russo-Ukrainian and Israel-Hamas Wars, as these may exacerbate OPEC oil cuts. Increased spending ahead of the Holiday season must also be anticipated.

Higher interest rates may lead to higher loan yields and deposit inflows. In turn, interest income and trust and other servicing fees will rise. It can also reprice loans or lend more since it has a very low LDR.

However, higher interest rates will also raise the interest expense and funding costs. We have already noticed that the increase in interest expense has already outpaced interest income increase. As such, interest rate hikes may squeeze net interest income further. Higher credit loss provisions will also affect the quality of loans. Hence, the company may have to be more careful of potential loan delinquencies.

Stock Price Valuation

NTRS had attractive returns after the banking industry recovered from the Global Financial Crisis. From 2011 to 2021, its stock price rose by 132% to $114 from $49. But after its steep drop in 2022, the stock price has remained at its lowest point since 2016. Currently, it is $63.55, 31% lower than in the same month in 2022 and 48% lower than its 2021 peak. This downtrend can be attributed to recession fears, exacerbated by the SVB collapse and hawkish stance of the Fed.

Meanwhile, price ratios show it is an excellent opportunity to buy stocks at a discount. Stocks are very cheap right now, which can be advantageous. Currently, the PE and PB Ratios are at their lowest. And if we use the five-year average, the target price using the PB Ratio and PE Ratio will be $98.15 and $84.41.

|

Year |

PB Ratio |

PE Ratio |

|

2017 |

2.00x |

18.38x |

|

2018 |

2.20x |

15.52x |

|

2019 |

1.84x |

14.19x |

|

2020 |

1.52x |

15.54x |

|

2021 |

1.94x |

15.50x |

|

2022 |

1.88x |

16.72x |

|

Average |

1.89x |

15.98x |

|

2023 (TTM) |

1.43x |

14.41x |

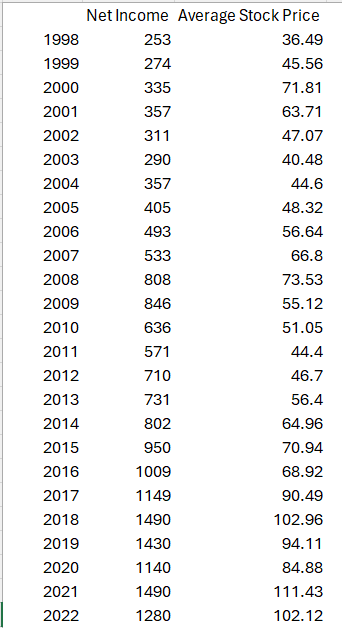

However, the macroeconomic changes make us apprehensive to buy its stocks right now. Since it is a banking stock, economic volatility may put more pressure on the stock price. Historically, NTRS’ stock has a high correlation with net income changes. So regardless of its affordability, the price moves along with net income as shown in the table below.

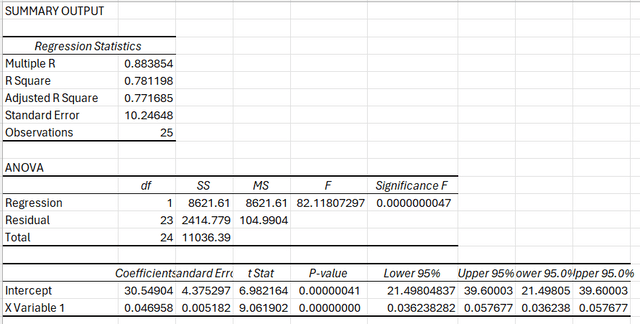

To prove my point, I made a 25-year statistical analysis using Regression to analyze the trend of Net Income (in USD Billions) as my X and stock price as my Y. The results show a high correlation of 88% using Multiple R between the two variables. Its R Square value of 78% shows good fitness of model because 78% of variance of Y or dispersion of the stock price can be explained by net income. Standard error is low, also showing low discrepancies between the two variables. Lastly, the p-value is less than 0.05, so the model is significant.

Net Income and Stock Price (SEC Filings of NTRS 10-K)

Regression Analysis (Data Ran by Analyst )

What do these figures say? If net income decreases again in 4Q, stock price may go below $60. Its YTD net income is 17% lower than in the same period in 2022. Given the current trend of company performance, raising Fed rates may squeeze net income further. This will translate into lower stock price. And while the stock price appears to be a good bargain, it may still go below $60.

Using the statistical analysis and net income pattern, I’m setting my target price at $52-55. I derive the range by getting the average net income change since 2022 which was 17%. The minimum of 14% is taken by multiplying 17% by the correlation coefficient of 0.88 or 88%.

Takeaways

Northern Trust Corporation remains a durable banking company. Its prudent portfolio diversification allows it to weather the stormy market environment. It has excess liquidity, which gives it a high capacity to expand its loan and client base and sustain dividend payments.

However, its performance has been toppish recently. Its high sensitivity to rate hikes is not helping it to sustain its growth. Interest expense has outpaced interest income, leading to lower revenue and net income. This translates into the stock price downtrend, as the correlation between the two has always been high. With a potential hike next month, its net income may decrease more. So it is logical to rate NTRS as a hold.

Read the full article here