Summary

Kohl’s Corporation (NYSE:KSS) is a leading American department store retail chain, operating numerous stores across the U.S. KSS’s offers a wide variety of merchandise, including apparel, footwear, accessories, home goods, and beauty products. The company is known for its value-oriented approach, offering quality products at competitive prices, often accompanied by promotions and loyalty programs. Over the years, KSS’s has also embraced digital transformation, enhancing its online and mobile shopping platforms to cater to the evolving needs of its customers. Partnerships, like the one with Sephora, further exemplify KSS’s commitment to diversifying its offerings and enhancing the in-store shopping experience for its patrons.

KSS is navigating through a challenging phase marked by a declining revenue trend and persistent inflationary pressures. The retail giant’s second quarter 2023 financial performance underscores these challenges, with a notable year-over-year decrease in net sales and comparable sales and a contraction in retail gross profit margin. However, strategic initiatives, including a focus on enhancing the customer experience and a promising partnership with Sephora, offer a glimmer of hope. The valuation metrics, compared with its peers, indicate that KSS is underperforming across all metrics, leading to a hold recommendation for KSS. The future outlook for the company is intricately tied to the unfolding economic landscape and the efficacy of its strategic endeavors to counter the prevailing headwinds.

Financials

Over the last six years, KSS has experienced a downward trajectory in its revenue. In 2017, the company posted revenues close to $19 billion, which decreased to approximately $18 billion by 2022, marking a decline of around 5%. A significant factor contributing to this decline has been ongoing inflation, which has diminished consumers’ purchasing power and disposable income. Currently, inflation remains above the Federal Reserve’s target rate of 2%, although there has been some moderation since the onset of 2023.

Regarding EBITDA margins, the picture is not rosy either. The company’s margin stood at 13% in 2017, but by 2022, it had dwindled to 6%, signifying almost a 50% reduction. Inflation played a role here as well, leading to a rise in their cost of goods sold, which eroded their gross margin, which trickled down into net margins.

Valuation

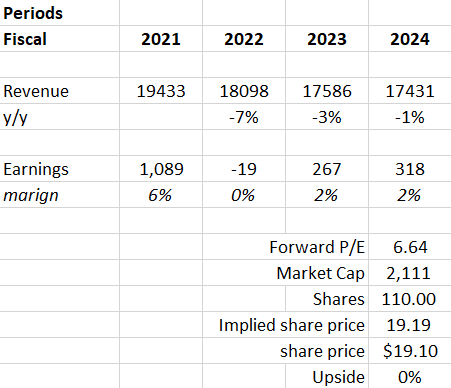

Based on my analysis of the company, I project a 3% decrease in KSS’s revenue for FY23 and a subsequent 1% drop for FY24. This forecast aligns with the broader market consensus. Several factors influence this outlook. Historically, KSS has shown a weak financial trajectory, with a 6-year revenue CAGR of approximately negative 1%. This downturn can be attributed to the adverse effects of inflation on KSS. Given that inflation remains persistent and exceeds the Federal Reserve’s target, KSS’s second quarter 2023 results reflected this challenge, with net sales continuing their decline. These combined elements contribute to my 3% negative growth projection, which mirrors market expectations. Looking ahead to FY24, while it is challenging to forecast inflation trends and how they are going to affect KSS, KSS’s strategic initiatives suggest a proactive approach towards future growth and resilience. Notably, their collaboration with Sephora has been a significant success. Capitalizing on this achievement, KSS is expanding its partnership with Sephora, which I believe could offset some of the revenue decline and offer a brighter outlook for the company.

Based on author’s own math

Currently, KSS’s forward price/earnings ratio is 6.8x, which is higher than its competitors like Macy’s (M) and Dillard’s (DDS), which have a median price/earnings ratio of 6.64x. When it comes to net margin, KSS lags with -0.1%, while its peers average a much healthier 8.63%. Regarding the debt-to-equity ratio, KSS stands at a high 213%, in contrast to its competitors’ average of 87.06%. Given these disparities, with KSS underperforming in all these metrics, I anticipate its price/earnings ratio to adjust downwards to align with its peers at 6.64x.

By applying this forward price/earnings ratio of 6.64x, my target price for KSS is $19.19, which almost matches its current share price. With no potential for capital growth, my recommendation for KSS is a hold. This stance is further reinforced by the prevailing uncertainties in the inflationary environment, which have taken a toll on KSS’s revenue.

Comments

KSS announced disappointing results for the second quarter 2023. There was a year-over-year decrease in net sales of 4.8%. Additionally, comparable sales dropped by 5.0%. The retail gross profit margin shrank to 39.0% year-over-year, influenced by increased product costs and higher shrinkage, though this was somewhat balanced by reduced freight and digital-related expenses. The company managed its SG&A expenses effectively, accounting for 33.5% of total sales, resulting in an operating margin of 4.2%.

KSS reiterated its cautious tone on the consumer macro, noting that the customer has less money to spend as a result of persistent inflation. As a result, the company is focused on delivering value to the customer. That said, they noted that trends improved in the quarter and that they are positive on the start they had in August, with comps trending above -5% Y/Y. As a result, management believes they can show incremental improvement in 2H, with even more benefits from strategic initiatives built into FY24 and beyond.

KSS has been actively focusing on a roadmap for its future growth and sustainability. One of the core pillars of this roadmap is the company’s strategic priorities for 2023. KSS’s aim is to provide a seamless shopping experience for its customers, whether they are shopping in-store, online, or through mobile platforms. This could involve revamping store layouts, investing in digital platforms, and offering personalized shopping recommendations.

In addition to enhancing the customer experience, KSS’s is keen on ensuring that customers perceive the value they receive, both in terms of product quality and price. This involves offering competitive pricing, frequent promotions, and ensuring that their private label products offer good quality at an attractive price point. Efficient inventory management is another area of focus for KSS. By using technology and data analytics, the company aims to forecast demand more accurately, reduce overstock situations, and quickly adapt to changing consumer preferences. On the financial front, KSS’s is working on strengthening its balance sheet to provide more financial stability and flexibility. This involves reducing debts, as evidenced by the reduction of revolver borrowings by $205 million and maintaining a good mix of debt and equity.

A significant highlight for KSS’s in recent times has been its collaboration with Sephora, a renowned global beauty retailer. Through this partnership, KSS’s has integrated Sephora shops within its stores, allowing customers to experience Sephora’s wide range of beauty products while shopping at KSS’s. The results have been promising, with beauty sales driven by this partnership increasing by nearly 90% year-over-year. This indicates a strong customer reception and the potential for this partnership to be a significant growth driver for KSS’s. The company has been aggressive in its expansion strategy, opening nearly 200 Sephora shops within its stores in a single quarter. This partnership not only benefits KSS’s through the premium brand association and increased foot traffic but also allows Sephora to expand its physical presence and tap into KSS’s diverse customer base.

In essence, KSS’s strategic initiatives and its partnership with Sephora reflect a comprehensive approach to address the challenges of the retail industry and capitalize on new opportunities.

Risk & conclusion

An upside risk to my hold recommendation is the possibility that the partnership with Sephora yields greater benefits than either the company or I have projected. If this collaboration, combined with an easing of inflation, propels KSS’s revenue growth into positive territory and enhances margins due to diminishing inflationary pressures, there is a likelihood that its share price will increase.

KSS’s latest results highlight challenges, with declines in sales and margins exacerbated by persistent inflation. However, positive trends in recent months and strategic initiatives, especially the successful Sephora partnership, offer optimism. Valuation metrics reveal KSS is underperforming its peers, and I expect its multiples to contract. Considering the aforementioned factors, along with the current economic uncertainties and the lack of capital growth potential, I recommend a hold rating for KSS. The trajectory of the company is closely tied to its strategic initiatives’ success and the overarching economic environment.

Read the full article here